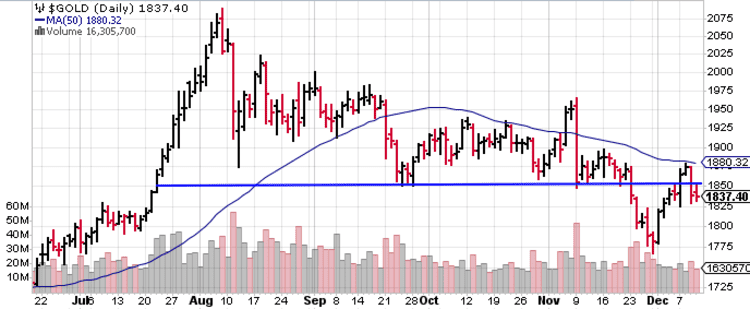

It would appear that $1,850 is turning into a front line in the brawl between gold bulls and bears.

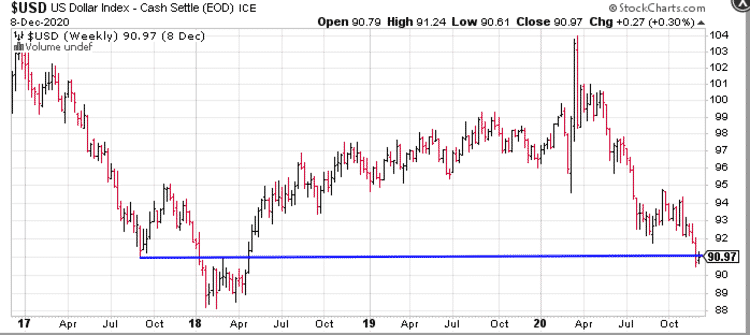

After breaking through key support ($1,850) earlier in the week, the snap-back from the $1,767 level, anchored by a surfeit of compelling fundamentals, coincided with the U.S Dollar printing 2.5 year lows.

After breaking through key support ($1,850) earlier in the week, the snap-back from the $1,767 level, anchored by a surfeit of compelling fundamentals, coincided with the U.S Dollar printing 2.5 year lows.

Short term, the market is eyeing the potential of a fat stimulus package courtesy of U.S. policymakers.

The lack of any real progress on that front is the reason for the recent breakdown and volatility. Short term see-saw swings aside, the medium to long term fundamentals underpinning gold remain intact.

On the upside, the $1,881 level—the 50 period SMA—is likely being surveilled by a whole universe of traders.

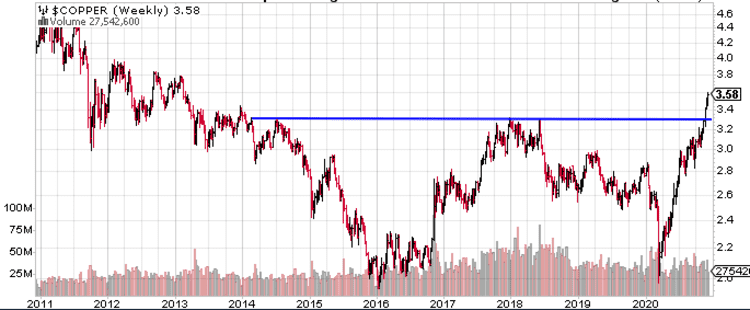

The recent price strength in base metals, particularly copper, is also being watched closely.

The reddish, ductile, and superior conductor of electricity and heat is on a tear, taking out multi-year highs.

A host of fundamental factors—tight supplies (low above-ground inventories), policy-driven demand (the EV revolution), and a falling dollar—are conspiring to push prices higher.

Two ExplorerCos on our shortlist with copper and gold in their crosshairs

Yesterday, on December 10th, Arizona Metals (AMC.V) dropped the following headline:

Arizona Metals Corp Identifies New High-Priority Kay Mine Targets; Drilling to Commence January 2021

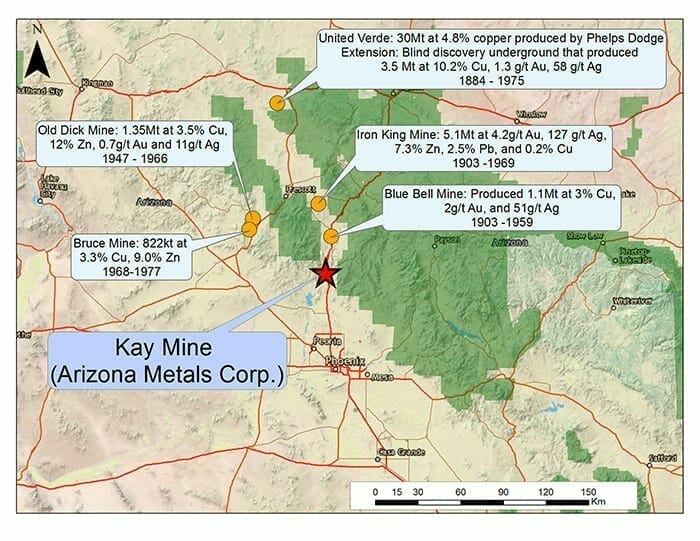

For those new to the AMC story, the Kay Mine project is located in a prolific volcanogenic massive sulphide (VMS) district—a region host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of this highly prospective asset.

How prolific? With grades in the neighborhood of 3.5%, this VMS district is credited with roughly 4 billion pounds of copper production over its century-long run.

As you likely divined by the name, we’re talking about Arizona here—a jurisdiction ranked in the Top Ten according to the Fraser Institute’s most recent investment attractiveness survey.

As you likely divined by the name, we’re talking about Arizona here—a jurisdiction ranked in the Top Ten according to the Fraser Institute’s most recent investment attractiveness survey.

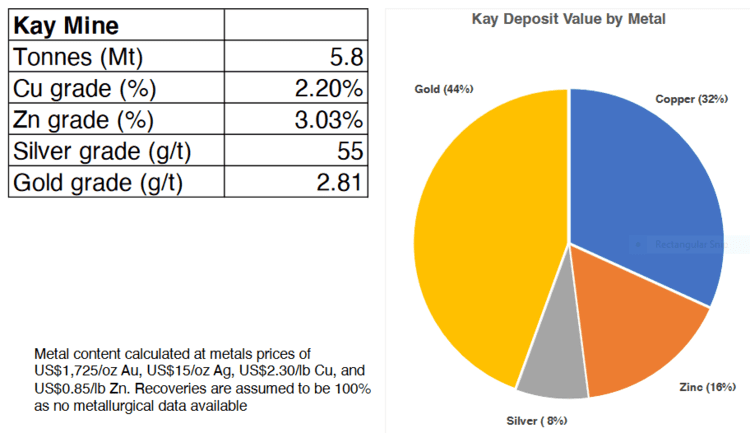

In the early 1980s, Exxon Minerals worked the Kay project delineating 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and 2.8 g/t Au for a CuEq grade of 5.8% ***.

Without taking into account recovery rates, the precious metals component of this historic resource represents 52% of the total contained metals.

As the Company prepares to launch an aggressive drilling campaign at Kay, the following excerpt from our maiden AMC piece—Arizona Metals (AMC.V) homes in on gold-copper-rich VMS targets in mining-friendly Arizona—is an important consideration when conducting your due diligence…

The geological model at Kay is that of an isoclinal folded VMS deposit.

The analog here might be the uber-rich VMS deposits that straddle the provinces of Ontario and Quebec, along the prolific Abitibi Greenstone Belt. The world-class Kidd Creek mine in the Timmins Camp and the Horne mine in Rouyn-Noranda (Quebec), come to mind.

Previous Kay operator, Exxon Minerals, reported 18 vertically stacked lenses that range from 5 meters to 25 meters in thickness.

Exxon reported that Kay’s tightly folded hinges within these lenses demonstrate superior grades and widths (the video linked further down the page demonstrates this folding sequence).

One of the objectives of currently drilling is to delineate these unique (high-grade) geological features and grow Kay beyond its current 5.8M tonnes.

The Kay deposit starts at a depth of 120 meters. The company believes mineralization extends to depths greater than one kilometer.

Back to the Dec. 10th press release

Here, the Company announced that a recently completed review of structural and spectral alteration data from the phase-1 drill program conducted earlier this year—a program that tagged massive sulphides in 19 of the 20 holes drilled—has “further improved the understanding of the geological model of the Kay Deposit, and has identified a number of new high-priority drill targets.”

SRK Consulting (Canada) Inc. was engaged to further these studies.

This data review and interpretation from phase-1 drilling included 1,202 spectral alteration measurements combined with digitized historical data and structural mapping to “undertake sulphide lens modelling and fold modelling to identify new drill targets.”

“Arizona Metals completed spectral analyses to map alteration within and away from the mineralized zones. These data were used by SRK to define five alteration types, which can be used as vectors towards mineralization.”

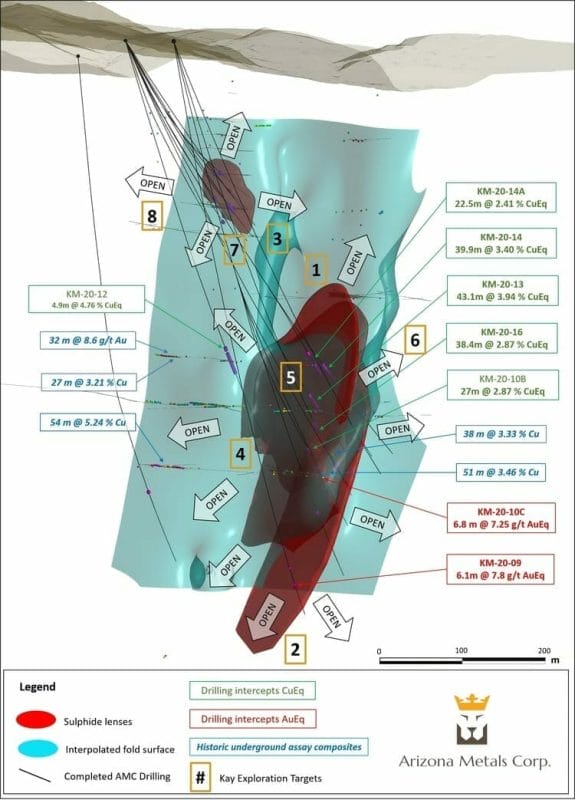

SRK determined that the thickest and most continuous sulphide lenses are located in the anticlinal hinges (referenced above). These anticlinal hinges represent the highest priority drill targets (numbered 1 through 8, map below)…

These sulphide lenses appear to have a strong down-dip continuity.

The extension of hanging-wall and footwall contacts will be investigated to the south and north for additional sulphide lenses.

Kay Mine Deposit Proposed Exploration Targets Defined (map above):

- Targets 1 and 2: up-plunge and down-plunge along the South Zone anticline hinge;

- Targets 3 and 4: up-plunge and down-plunge along North Zone anticline hinge;

- Targets 5: on the fold limb and synclinal hinge between the North and South zones;

- Target 6: on the southern continuation of hanging wall-footwall horizon;

- Target 7: on the western limb of the North Zone Anticline;

- Target 8: on the northern continuation of the hanging wall-footwall horizon

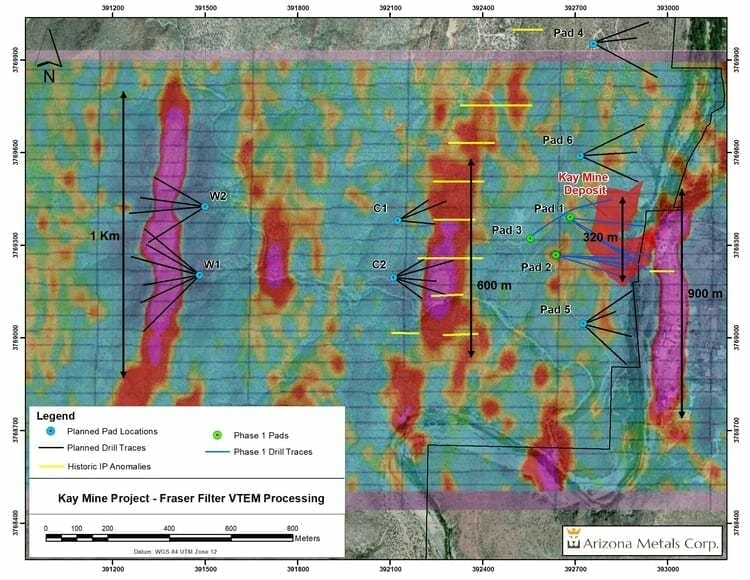

The combination of good science—soil sampling with structural maps, historical geological maps, and VTEM results—led to the definition of additional high-priority targets to the west of Kay.

This is virgin ground.

These compelling targets—the undrilled Central and Western anomalies—will be tested via pads C1, C2, W1, and W2 (map below).

Permitting is currently underway as the first step in unlocking the latent potential of these highly prospective targets.

The Company will be mobilizing the first drill rig to the project on January 4th, 2021 (that’s only a few weeks away). This fully-funded drilling campaign will consist of up to 11,000 meters in 29 holes.

Drilling will start at the Kay Mine deposit to test for new VMS lenses in anticlinal hinge zones identified to the north and south of recent drilling, as well as the up-plunge and down-plunge extensions of the known hinges.

The drill will then be moved to the Central and Western targets as permits fall into place. According to the Company, “permitting is currently underway for these targets and is progressing well.”

Marc Pais, Arizona Metals’ CEO:

“We were very pleased with our successful Phase 1 drill program, which has greatly increased our confidence in the model outlined by the Exxon Minerals’ historic estimate* of 1982. Drilling encountered massive sulphides in 19 of 20 holes. Recently completed spectral alteration analyses of the Kay Mine Phase 1 program drill core, along with downhole EM geophysical surveying, has given us an even stronger understanding of the folding of the Kay deposit at depth. This work has identified a number of high priority drill targets, which we believe have the potential to host additional VMS lenses, as well as wide mineralized hinge zones, similar to the 43 m of 3.9% CuEq (incl. 15 m of 6.7% CuEq) encountered in hole 13. The Phase 2 program, which will commence in early January, has the potential to significantly expand the scope and scale of the Kay project, well beyond the boundaries of the 5.8 million tonne historic estimate.”

On December 10th, Delta Resources (DLTA.V) dropped the following headline:

Delta Receives Permit to Drill Its Trans Canada Target Thunder Bay, Ontario

A quick review of what Delta’s project portfolio

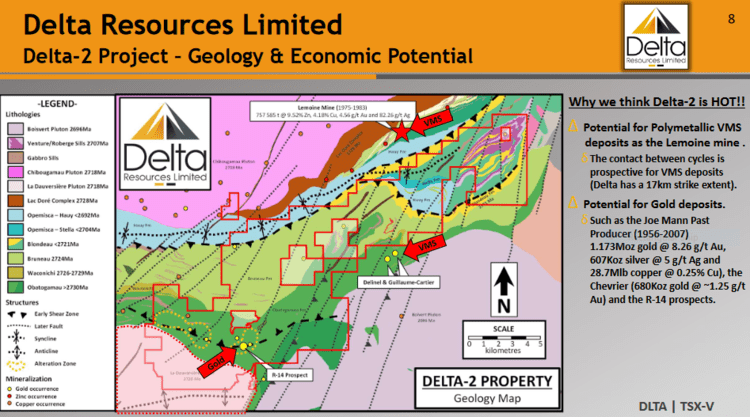

Delta is also on the hunt for VMS.

The Company’s 16,400-hectare Delta-2 project is located along the northeast end of the Abitibi Volcanic Belt, just to the southeast of Chibougamau.

The Company is targeting two deposit types at Delta-1—VMS deposits, like the past-producing Lemoine deposit (757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag), and Magmatic-hydrothermal Au deposits, like the Chevrier Zone (43-101 Resource of 10.8Mt @ 1.22 g/t Indicated and 6.3Mt @ 1.27 g/t Au Inferred).

Our maiden piece on this company—Delta Resources (DLTA.V) – a tightly run ExplorerCo with significant discovery potential in mining-friendly Ontario and Quebec—brings Delta-2 into greater focus.

Our maiden piece on this company—Delta Resources (DLTA.V) – a tightly run ExplorerCo with significant discovery potential in mining-friendly Ontario and Quebec—brings Delta-2 into greater focus.

There’s also this (Delta management is doing a fine job of keeping its shareholder base in-the-loop)…

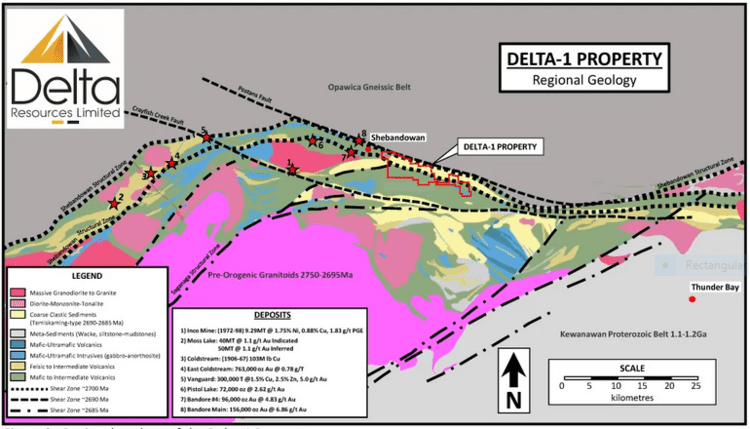

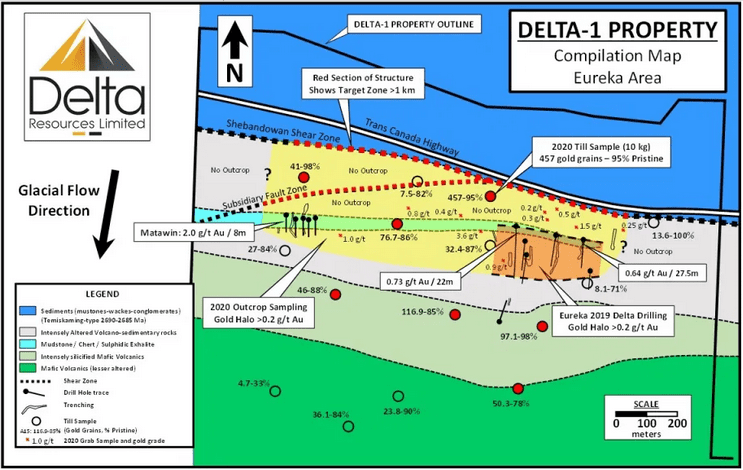

This December 10th press release concerns the Company’s Delta-1 property, an equally compelling project located along the north-central portion of the Shebandowan greenstone belt, in the Superior structural province of the Canadian Shield.

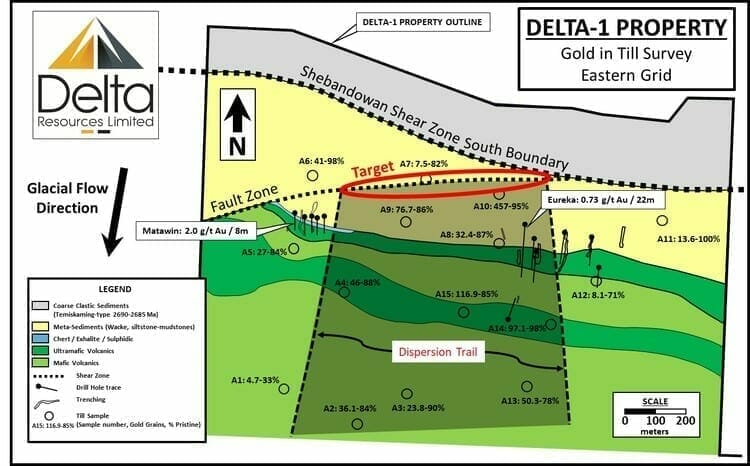

The property straddles the Shebandowan Structural Zone (black dotted lines, map below), and like the Cadillac Break in the Abitibi, it’s a structure that separates large geological domains—a deep-seated structure where large volumes of fluid were channeled from great depths.

Delta-1 covers 17 kilometers of strike along the Shebandowan Structural Zone.

A limited 2019 drilling campaign at the Eureka zone tagged broad, highly anomalous values—141 meters of .17 g/t Au (including 27.5 meters of .64 g/t Au) and 137 meters of .20 g/t Au (including 22 meters of .73 g/t Au). This first pass with the drill bit was mere foreplay.

A limited 2019 drilling campaign at the Eureka zone tagged broad, highly anomalous values—141 meters of .17 g/t Au (including 27.5 meters of .64 g/t Au) and 137 meters of .20 g/t Au (including 22 meters of .73 g/t Au). This first pass with the drill bit was mere foreplay.

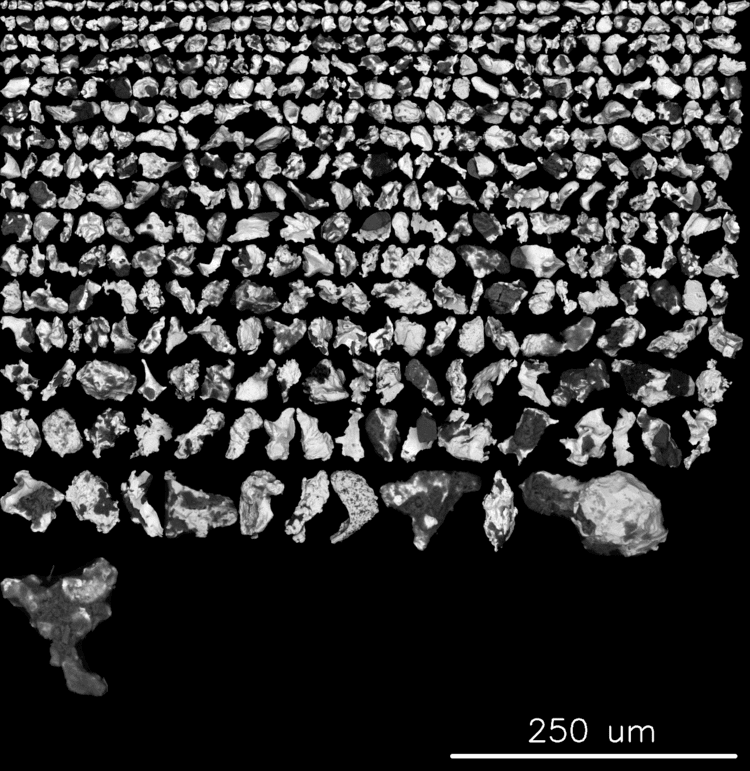

Results from a till sampling campaign announced earlier this summer produced some exceptional values.

Gold grains were recovered from all samples collected.

Eight of the (10kg) samples returned between 41 and 457 gold grains, with pristine grains accounting for 78% to 99% of the total gold grains encountered.

Eight of the (10kg) samples returned between 41 and 457 gold grains, with pristine grains accounting for 78% to 99% of the total gold grains encountered.

95% of the sample that produced 457 gold grains were pristine in nature.

“The pristine character of the gold grains indicates that there has been very little transport and hence these samples are interpreted to be proximal to a bedrock source for the gold.“

Stated another way, the angular and fragile character of these gold grains suggests that the source is within a stones throw.

The red oval outline (map below) represents an intriguing ~800-meter long target, one worthy of a proper probe with the drill bit.

Speaking of probe, the following is a quote from my Dec. 3rd Delta piece (on the subject of pristine gold grains)…

Speaking of probe, the following is a quote from my Dec. 3rd Delta piece (on the subject of pristine gold grains)…

These gold grain counts remind me of the Borden Gold project (Probe Mines), a project that ultimately provoked a $526M takeover bid from Goldcorp back in 2015.

Back to the December 109th headline

Here, the Company announced receipt of an encroachment permit to probe the subsurface stratum at its Trans Canada Gold target at Delta-1.

This initial permit will allow Delta to drill up to 14 drill holes for a total of 4,200 meters at any time between January and November 18, 2021.

The first holes of this program will test the Trans Canada target over a (minimum) strike length of 700 meters… underneath and south of the highway.

Since Delta acquired the Delta-1 property in October 2019, the Company has focussed its exploration efforts on the Eureka Gold occurrence area in the central-east portion of the property. This work includes Delta’s maiden drilling program in November 2019 (six drill holes totaling 1000 metres), a reconnaissance basal till survey during the summer of 2020 and a geological mapping and sampling program in October 2020. All exploration work to date provide a convergence of evidence that points to the Shebandowan Structural zone and a possible subsidiary structure that lie immediately adjacent or underneath the Trans Canada Highway.

How’s that for easy road access?

As per this press release…

To date, these geological indicators include (also refer to map below):

- A gold halo grading approximately 0.2 g/t Au, extending south of the structure for at least 150 metres and for a minimum strike length of one kilometre (open to the east and west). This gold halo was defined by Delta’s 2019 drill program and by grab samples that returned assays ranging from 0.2 g/t to 3.6 g/t gold collected in October 2020. Additional near-surface drill intercepts from Delta’s 2029 drill program also include: 0.73 g/t Au over 22 meters and 0.64 g/t Au over 27.5 meters.

- A halo of intensely altered volcano-sedimentary rocks of similar strike length as the gold halo (also open to the east and west) but extending 400 to 600 metres south of the Shebandowan structural zone.

- Very high gold grain counts in till samples (between 41 and 457 gold grains with 78% to 99% pristine) from Delta’s summer 2020 till program, located within 60 metres south of the Shebandowan structural zone.

- Geological mapping which shows the juxtaposition of the intensely altered and mineralized volcano-sedimentary rocks south of the highway with younger, non mineralized rocks north of the Trans Canada Highway. At that locality, the structure also corresponds with a 30-metre drop of topographic elevation.

Referring back to the gold grain counts highlighted above, a follow-up property-scale till survey was carried out last September and October and are expected to produce results before the year is out. I view this pending news as a catalyst, one that’ll further set the stage for a highly anticipated drilling campaign scheduled for February of 2021.

Final thoughts

If I were to rate these Cos A to D—the A’s being top shelf and the D’s being purely spurious—I’d rank them as A-listers. Both companies check all of my boxes, from cap structure to management’s rock-kicking prowess.

Delta Resources (DLTA.V)

- 35.35 million shares outstanding

- $13.96M market cap based on its last trade (mid session Dec. 11th) at $0.395

Investor presentation (December 2020)

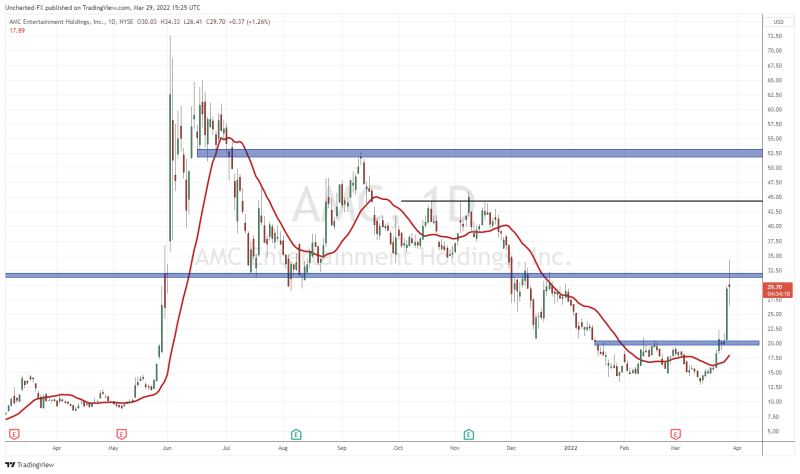

Arizona Metals (AMC.V)

- 64.81 million shares outstanding

- $59.62M market cap based on its last trade (mid session Dec. 11th) at $0.92

Investor presentation (November 2020)

END

Greg Nolan

*** The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Full disclosure: Both Arizona Metals and Delta Resources are Equity Guru marketing clients.