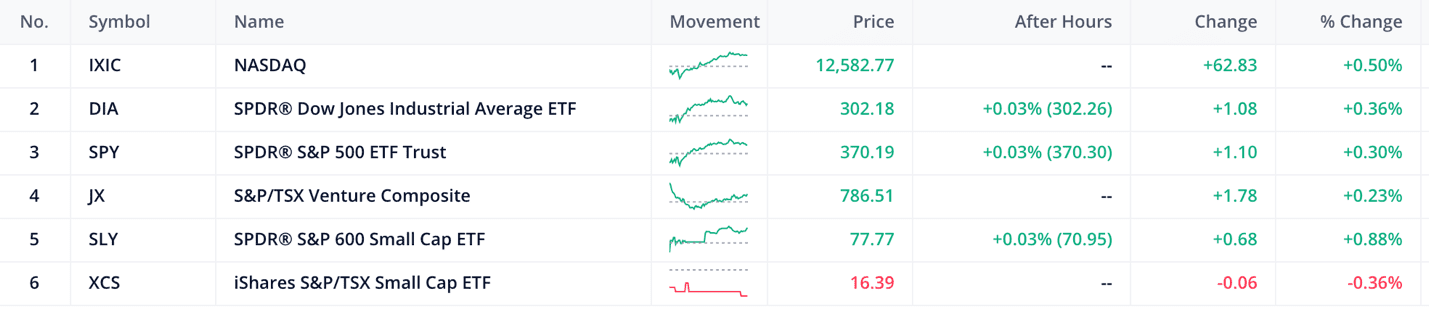

- The S&P 600 is up by 0.88% and the TSX20 is down by 0.36%

- The Canadian 10-year bond down by 0.02% and the US 10-year bond up by 0.01%

Today’s stock pick of the day is Gravitas Financial (GFI.C) a Toronto – based capital markets firm. “It is a platform company that creates businesses in key traditional and emerging sectors with strong industry partners.” Their industry focus includes financial services and fintech.

As of the nine months ended September 30, 2020, Gravitas was able to generate a grand total of $108 thousand in revenue utilizing an average of $(9754) in net tangible assets. They have negative cash flows from operations and a large amount of debt ahead of the common shares.

These conditions raise a material uncertainty that causes significant doubt about the Company’s ability to continue as a going concern a standard cautionary phrase in interim financial statements for smallcap stocks subject to market fluctuations.

However, Gravitas has been blessed by the market with a new valuation of $4 million today, as the market reacts enthusiastically to … absolutely no news at all.

While Gravitas might want to stay mute on the arrival of their sudden gift horse, as potential investors we have the job of doing our own research into what is pushing the value of this stock. And the best place to start is by trying to understand what the company actually does because their own self-description is so ambiguous.

Gravitas is an investment holding and merchant banking firm with a focus on financial services, financial technology, and mining verticals. It has an active presence in North America, as well as in the fast-growing international regions including China, India, and the Middle East.

In May 2019, the Company executed a sales and investment solicitation process (“SISP”) with the major debenture holder to facilitate the sale of substantially all of the assets of the Company. In July 2019, the Company estimated that it will obtain the majority votes from shareholders in order to dispose of the following subsidiaries and assets of the Company. Shareholders subsequently voted in the majority to sell all or substantially all of the subsidiaries and assets of the company in the annual general and special meeting held on October 29, 2019.

- On April 28, 2020, the Company closed the transaction relating to the sale of all of its interests in Gravitas Ilium Corporation. The Company reported a gain on disposal of the subsidiary of $3,450,017 for the transaction.

- On September 26, 2019, the Company entered into an agreement to dispose of the common shares in The Mint Corporation registered and beneficially owned by the Company and settle certain outstanding loans and other indebtedness owed to the Company by Mint and certain of its affiliates. The transaction was closed on December 31, 2019, for aggregate cash considerations of $1,098,099 and again on disposal of $36,377,915

- In June 2019, the Company entered into a sale and purchase agreement with Yuhua International Capital Inc. (“Yuhua”) whereby Yuhua will acquire the Company’s shares of PCPC as well as certain receivables for cash consideration for a total cash consideration of $1,150,000. The Company noted cash proceeds of $810,594 of its 64.6% interest in PCPC and recorded a loss on disposal of $1,893,923

- On July 13, 2019, as part of the SISP, the Company entered into an accommodation agreement and closed the sale of the associate investment in GICMB for cash consideration of $225,000 and reported a loss on disposal of $494,600.

- As of December 31, 2019, investment in Portfolio Analysts Inc. (PAI) has been disposed of for a cash consideration of $2,480,000 resulting in a loss on disposal of $1,063,561. The Company had owned a 40% interest in PAI.

None of the proceeds from the transactions shall be distributed to the Shareholders. The management instead used the proceeds to retire all the debentures and accrued interest payable ($83,569,333 principal and $2,684,557 interest payable as of March 31, 2020)

In other words, while the financial statements are going to look a lot cleaner moving forward, the reduced liabilities came at the major cost of the loss of many assets originally held by Gravitas. Shareholders are therefore holding shares in a company, whose job is to invest their funds into other companies to return value, only to flip that money back into their debts.

This is an excellent example as to why it is believed that running a financial services business that is heavily dependent on the securities market is a difficult endeavor. Shareholders put their trust in the management team to pick great businesses that create positive cash flows overtime increasing the intrinsic value of the financial services business.

Sadly, this is not the case here and management has found a way to destroy value. It will be interesting to watch the business over time and see if they are able to ‘turn around’, and how a recovery which is not easy to do in the financial market.

With that breakdown of recent financial moves by Gravitas, the question at the top of your mind should be where is this $4,000,000 valuation coming from? The business has a negative net worth, is producing negative cashflows after disposing of investments and subsidiaries in order to pay off its debentures, and not generating any significant revenue to keep the working capital positive: is the market really reacting appropriately with its new million-dollar valuation?

The sheer uncertainty about this business causes me to be very conservative with my calculation of the intrinsic business value. Having said this there is no point in continuing the valuation as an evaluation posed by any investor at this point would be highly speculative.

Is that a bit of a cop-out from building a full and incredibly hypothetical DCF? Yes. If you’re truly interested in finding a valuation, this author suggests a sum of all parts valuation. In this situation, this would be the sum of all parts that are left off valuation. The value of each business unit or segment is derived separately and can be determined by any number of analysis methods.

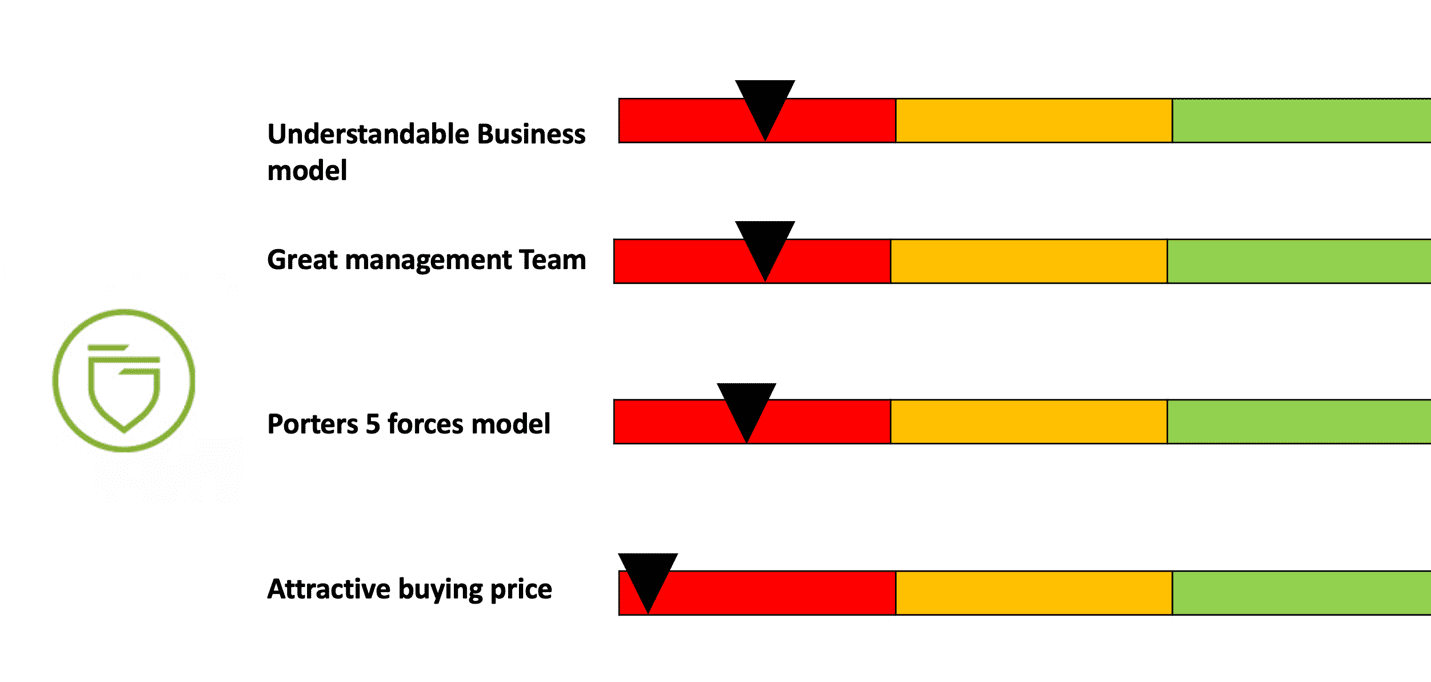

Below is a great visual summary of our analysis and shows how subjective the investment analysis process can be.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.