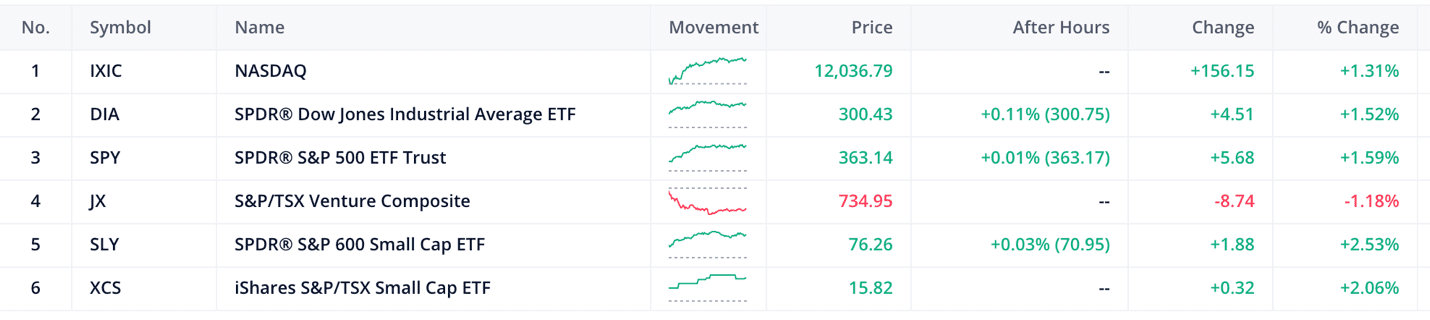

- The S&P 600 & TSX20 are up by 2.53% and 2.06% respectively

- The Canadian 10-year bond up by 0.03% and the US 10-year bond up by 0.02%

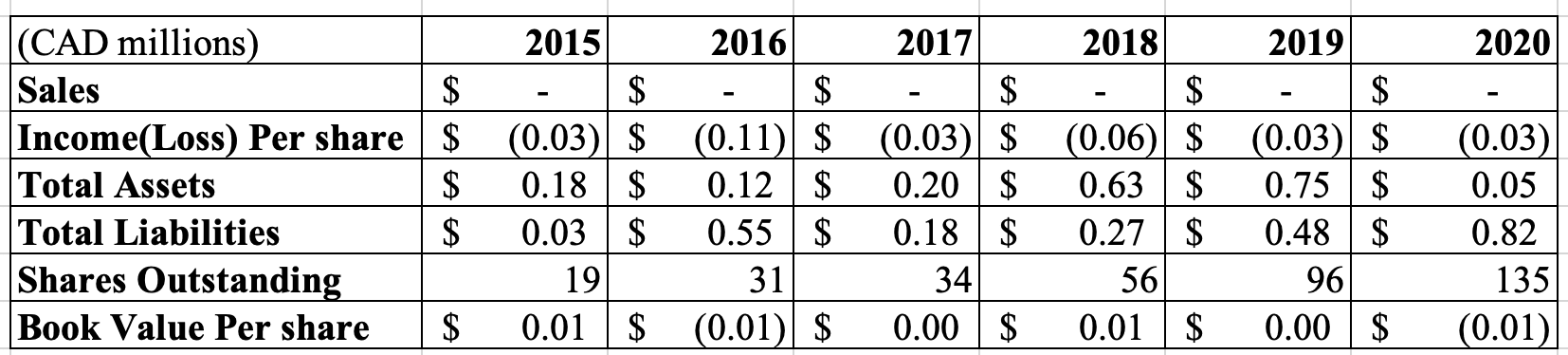

Today’s stock pick of the day is LeanLife (LLP.C) formally know as SPT Sulphur Polymer Technologies a Vancouver-based firm that produces and sells omega-3 fatty acid products worldwide. As of June 30, 2020, Leanlife was able to generate a grand total of $0 in revenues utilizing negative $771,000 in net tangible assets.

The business is now worth $7 million dollars but has not been able to generate any sales as of the last financial reports. How have they been able to continue running and raising money if they seem to be running at a loss?

There are two basic sources of capital funds that are available to corporations. Capital funds may be (1) generated internally or (2) acquired from outside sources. When capital is generated internally, a portion of a corporation’s cash flows must be retained. When capital is acquired from external sources, a corporation may choose among alternatives.

- by borrowing or

- the sale of equity issues

Internally generated cash flows

The internally generated cash flows are usually the cheapest form of capital raising. This is because the business is utilizing assets and projects that it has already deployed in the past and is merely profiting from the efficient use of these assets.

Being able to raise money by merely selling products is a very good sign of an efficiently run business that doesn’t need outside financing to continue operations as a going concern. The most common businesses that do this are in the maturity or early maturity stage. Having said that it doesn’t mean businesses in the growth or early development stage cannot reach this potential, it is just more common for them to use other methods of financing.

Usually, a business will be able to generate cash flow if the revenue generated from selling its product exceeds its cost to run the business. In the case of LeanLife, they have of this moment not been able to generate any sales.

This shows that they might need to find other ways to raise money to invest in capital projects, research and development, depreciation and amortization reserves, and working capital needs. This leads us to our next form of capital raising borrowing from the secondary or primary market.

Borrowing to raise capital

When companies fail to raise capital through their day-to-day operations from running the business, they dip their toes into the fixed income market. There are many ways to do this and we will list just a few :

1. Revolving line of credit or any similar borrowing from a bank

2. Account payables with suppliers

3. Issuing different tranches of Bonds with collateral or debentures.

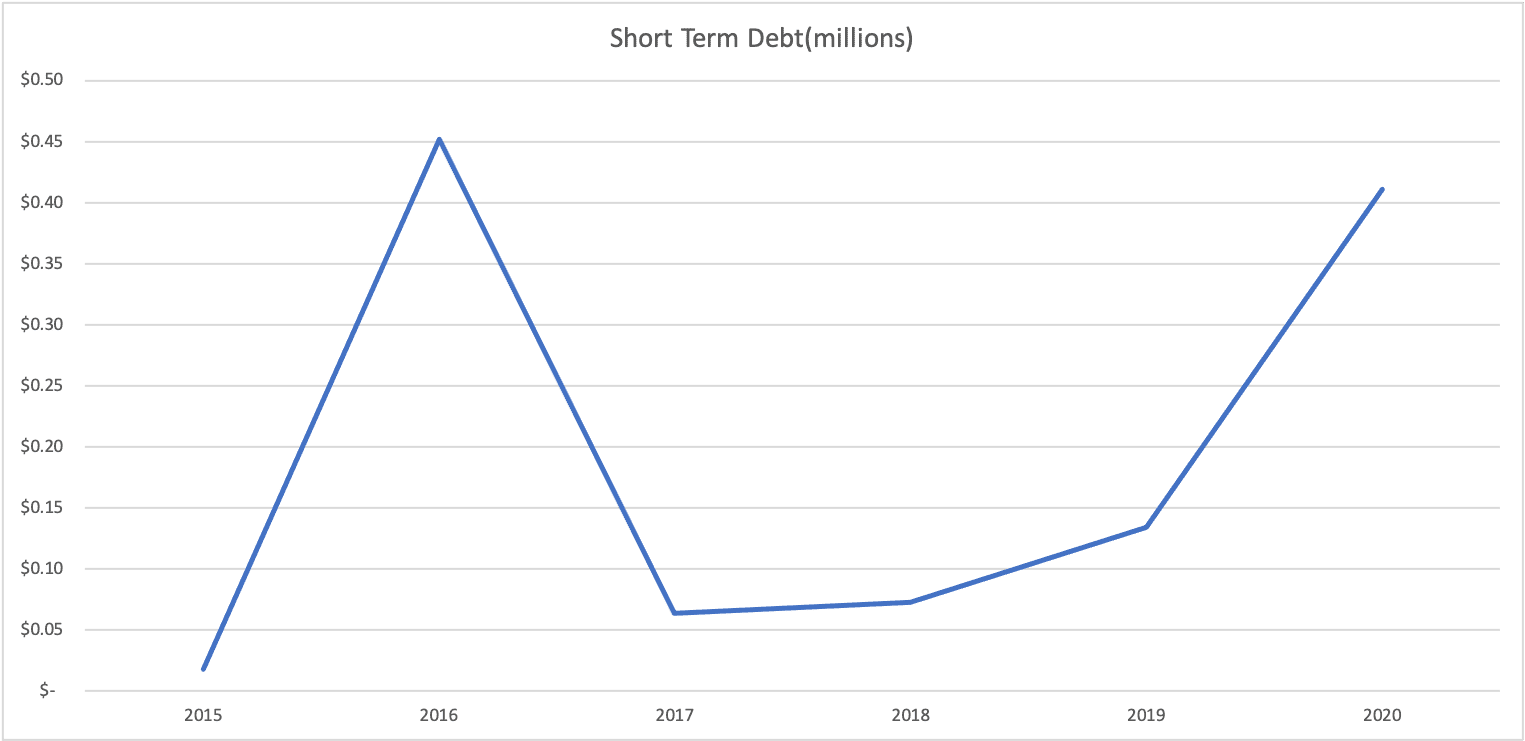

All these different forms of borrowing can be short-term or long-term depending on the working capital needs of the business. LeanLife is a net issuer of short-term borrowing in the form of bank loans and the issuance of bonds to the market. They also have an account payable position with their suppliers and strategic partners.

Borrowing capital is usually cheaper than equity financing but more expensive than raising capital from business sales. Borrowing is an expensive funding technique because of the need to put up collateral with financial institutions to get the needed financing. Not only is the collateral need using the business’s assets, bonds usually come with indentures and covenants that limit the company’s ability to change its balance sheet. This might not be an explicit cost like the interest payments but implicitly affects how the business and management is operated.

To be able to raise capital using bonds a business needs to be backed by healthy tangible assets. Its assets need to be growing overtime to give assurance to bondholders and lenders that the business is in good financial standing. Leanlife seems to be heading in the opposite direction and has resorted to issuing shares to raise needed financing.

Selling equity issues to raise capital

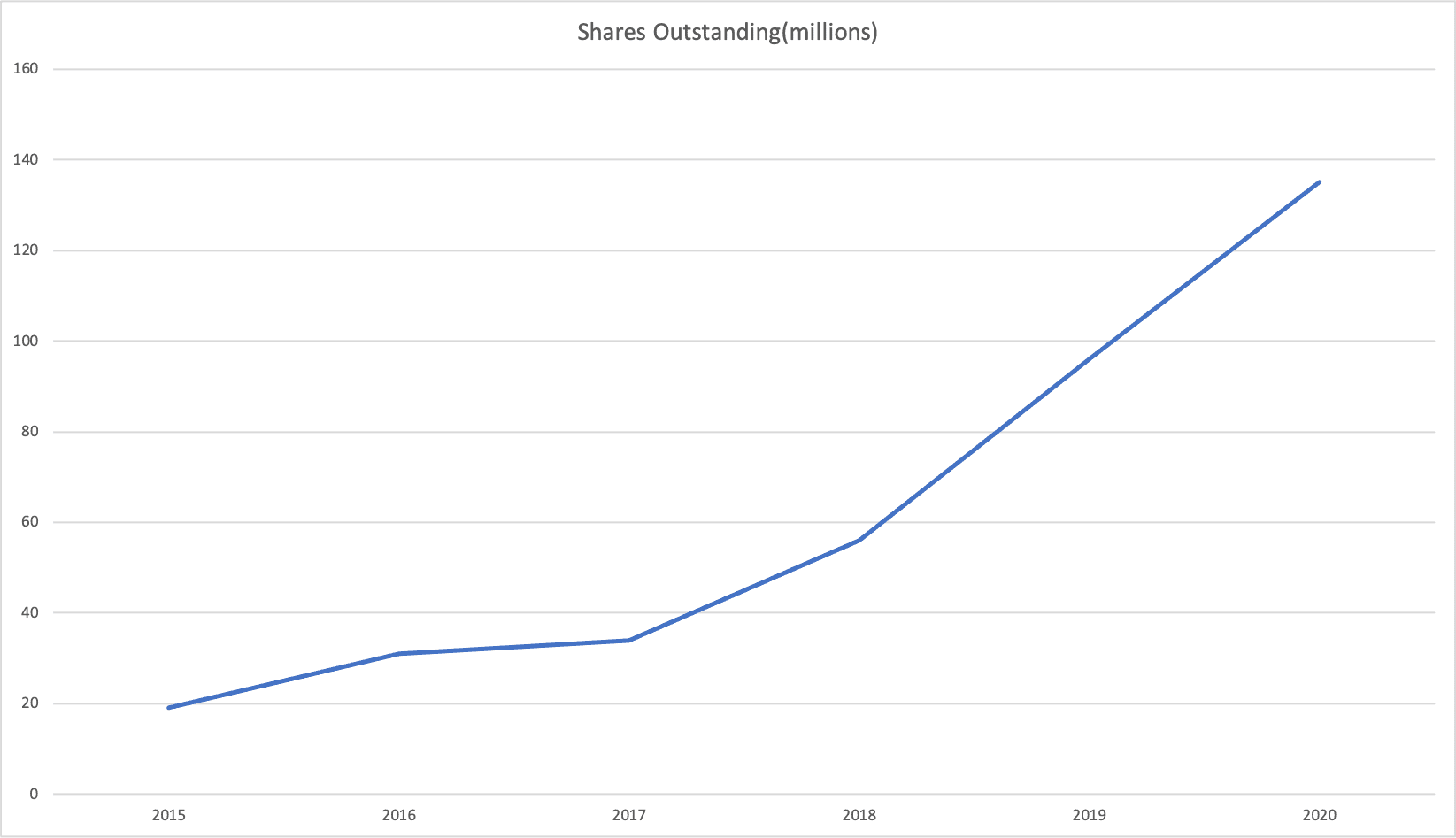

From the chart above it is pretty evident that lean life uses equity capital financing as its main means of raising money to invest in capital projects. To be frank this is a double-edged sword as it does inject needed capital into the business but at the expense of current shareholders being diluted over time.

Since 2015 the Leanlifes total shares outstanding have grown at a compounded rate of 48%, whilst book value has decreased by 100% and the stock price in the same period has gone down by 93%. (Pause for dramatic effect)

Leanlife Management Teams reaction to that last sentence.

This is one of the clear signs of a management team that has been failing to make use of shareholders’ money to create value, it has actually done the opposite and destroyed value. But complete blame cannot go to the management team, maybe the current economic climate is unconducive for the line of business they are in or maybe the market hasn’t realized the potential of the business.

Today’s market valuation of $7 million can be seen as absurd once all of this information has been accommodated for…

…But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.