Regardless of who wins the election, the real winner this week has been bitcoin hodlers.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

Bitcoin

market cap $287,557,781,498

In time for the election, the United States government liquidated one of the silk-road era Bitcoin wallets for roughly $1 billion. The justice department announced that it had seized the contents of the wallet as part of a civil forfeiture case involving the Silk Road. The wallet retrieved roughly 70,000 bitcoins with the help of an unnamed hacker.

Must be nice to just have random wallets of billions of dollars hanging out the evidence locker. Do you think maybe the fed can slow the QE machine down now? Yeah. I didn’t think so either.

Ethereum

market cap $50,582,625,735

The deposit contract of Ethereum 2.0 launched without fanfare this week. This is the first implementation of the upgrade, and effectively goes live as of December 1, 2020. Vitalik Buterin, Ethereum’s creator, tweeted about it, stating that the contract was released but offered nothing.

The deposit contract is the key to the upcoming Proof of Stake consensus mechanism.

ETH2 deposit contract released:https://t.co/bDrtf9vRpJ

—

vitalik.eth (@VitalikButerin) November

4, 2020

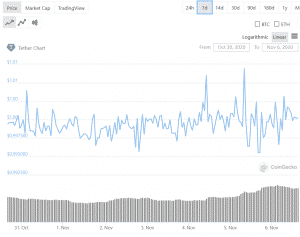

Tether

market cap $16,993,723,396

Tether printed another batch of $10 million new coins onto the market earlier this week. Some folks out there think this caused the Bitcoin spike from $15,501 to $15,869.

Here’s what this really means in a tweet:

#crypto

$btc

differences 2017 and now2017; Check if tether

issued and send coins, moon incomming2020; Checks

chart, oh well, @paoloardoino

did his thing again.. lets check @whale_alert

for mints.. ah yes, there it is.. another few hundred million out of

thin air #tether

#USDT—

Gman (@thacryp) November

6, 2020

The third place coin by market cap is a load

of hot air with the ability to print as many coins as required. But

as I’ve been saying, there’s no way they can back those billions of

dollars up with actual cash and the time’s running short.

Eventually, someone’s going to call their bluff and it won’t be

pretty.

XRP/Ripple

market cap $11,546,802,644

Bitcoin spiked beyond the USD$15,000 mark, nearly bouncing into the $16,000 range. That’s north of CAD$20,000, and while most of the altcoins went along for the ride as altcoins tend to do, XRP did not.

Instead, one crypto trader has stated that Bitcoin’s rally may ultimately force XRP holders to surrender.

This here doesn’t surprise me. Most of the trading types I know usually bounce between coins, looking for the top performers to make the most money from their bull runs while going to hide during bear markets. If XRP is performing well, that’s where the smart money is. If XRP flags behind BTC like it did this week, find an exchange with minimal cost for shapeshifting and hop on the wave.

Ultimately, though, doing this a lot usually means the only people making money are the exchanges. But it’d be silly not to put your weakly performing XRP into Bitcoin as it starts to run.

Bitcoin Cash

market cap $4,738,693,665

In the past few years, we’ve seen a lot of big tech companies circling the wagon against unpopular opinions. This has gone further in many cases than just attacks on hate speech and the like – and alternative social media sites have started to make an appearance.

Two years ago, a social network site called memo.cash specifically on the Bitcoin Cash blockchain, was fired up and it’s enjoyed some development since then. Earlier this week, the team behind Memo dropped that the platform’s now available for iOS phones through their App store. Now Apple users can connect to the social network that saves a users content to the Bitcoin Cash blockchain.

I’m not particularly fond of Bitcoin Cash, but even I have to admit that this is fairly cool.

Chainlink

market cap $4,706,375,936

The zenlink exchange intends to integrate chainlink oracles on polkadot. Zenlink is a native Polkadot parachain decentralized exchange (DEX), allowing users to securely swap any asset among parachains.

As a reminder:

A blockchain oracle is any device or entity that connects a deterministic blockchain with off-chain data.

Zenlink is a cross-chain network based on Polkadot. It will use Chainlink’s price feeds to access reliable valuations for assets secured on the Polkadot blockchain. Chainlink’s price oracles will be used on financial applications, such as lending applications, automated trading strategies and various other decentralized finance products, built on top of the Zenlink token’s blockchain.

It’s a series of linkages allowing for these three blockchains and a decentralized exchange to interoperate, and allow for certain aspects of decentralized finance to interact.

Binance Coin

market cap $4,258,506,311

One of the problems with DeFi is the same as those with all of crypto, and that’s when scammers arrive and successfully bilk people out of their money, there’s almost no way for individuals to get their money back. That’s why it’s noteworthy when Binance, the exchange, managed to recover all of their stolen funds from a time earlier in the year when they were the subject of a scam DeFi project.

Earlier this week, they gained customer of 99% of the $345,000 worth of cryptocurrency stolen by an automated market maker Wine Swap in October. Having raised the funds at launch on the Binance Smart Chain in October, the operator disappeared with the users’ crptocurrency within the hour, according to the exchange.

“Analysis of the transfers to and from Wine Swap allowed us to identify which addresses fell victim to the scam and calculate exactly how much was owed to them,” the exchange said.

Polkadot

market cap $4,187,473,841

There’s a lot of speculation going on around about DeFi and its potential. One of these voices, Peter Mauric, head of public affairs at Parity Technologies, thinks there’s vast potential to expand the DeFi ecosystem beyond its present capabilities.

It’s hard to determine whether or not decentralized finance is going to be the next generation of cryptocurrency and blockchain events, or if it’s going to fizzle. That largely depends right now on Vitalik Buterin and his rollout of Ethereum 2.0. if he can’t solve Ethereum’s scaling issue, then DeFi isn’t going anywhere.

Still, if it does, then there’s a chance that coins like Polkadot and Chainlink could be here to stay.

“Once we have these turbo-charged DeFi primitives, the potential for new innovation is greatly expanded, and we see interesting new possibilities like decentralized Sovereign Wealth Funds and cross-chain money markets providing the basis for the next generation of DeFi protocols,” said Mauric

We’ll see.

Litecoin

market cap: $4,031,787,256

Building on the story from last week, the Venezuelan government has produced their own cryptocurrency exchange with support for the petro token as well as BTC, LTC and private coin, Dash. These will be paired with their fiat currency, the bolivar, according to an official announcement from the National Superintendency of Crypto Assets and Related Activities.

Honestly, the fact that this country actually has a ministry designated for cryptocurrency suggests how deeply the asset class has penetrated into the country. The exchange will be called the Venezuela Exchange.

Cardano

market cap $3,360,791,074

It’s November 6th, three days after Americans went to the polls and as of right now, three states are going blue, and one red. When and if the states finally go blue, it will send a signal to the republican party that their time in office is over. Except it totally won’t. It’ll kick off a month or two of recounts, violent skirmishes, accusations of voter fraud, corruption and more violence.

It’s because there’s absolutely zero trust in the United States for politicians and ever widening gulf between red and blue states.

Yeah. It’s a mess.

But it needn’t be that way. Charles Hoskinson, the inventor of Cardano, took to twitter to suggest that President Trump take advantage of blockchain technology’s trustless immutability function to handle elections without any of the abiding nonsense we’re going to be dealing with in the next month.

Besides, Trump has repeatedly criticized that postal votes could lead to fraud and manipulation. But there’s no manipulating a blockchain once you put information in. He may have a point.

Regardless, here’s his tweet:

Hey Don, I can solve this for you. Call anytime ? https://t.co/fnWkXhZYN3

— Charles Hoskinson (@IOHK_Charles) October 31, 2020

An important application of the blockchain technology is, among other things, the execution of elections of any kind. All information can be stored transparently and forgery-proof. For this reason, Hoskinson has offered President Trump his immediate assistance in conducting the US elections on Cardano blockchain.

Naturally, he won’t, though. Because it would take away his ability to cast doubt on the process and that’s been his bread and butter throughout his entire life.

—Joseph Morton