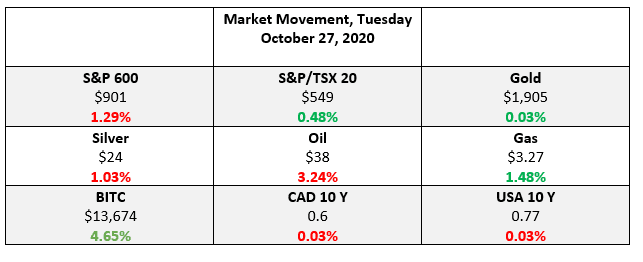

As the general stock market attempts to consolidate all current information pertaining to the results of the US election, the stimulus package proposal, and the global pandemic, investors of today are faced with many challenges when it comes to asset allocation.

Despite all this market volatility and uncertainty there is always hope in the markets for those who do the work and understand what they are purchasing, be it speculators or investors.

Staying on the optimistic side today we will look at the “market winner”. For most of these articles, this has usually been the company that has gone up the most, or the company that piques the interest of the author. The companies are usually randomly selected by market participants and the challenge is constructing an article around this company with a key idea or takeaway that resonates with the reader. Today we will be looking at the depressed apparel and retail space which is being affected by the reduction in consumer spending caused by social distancing stipulations and the extra costs associated with these requirements.

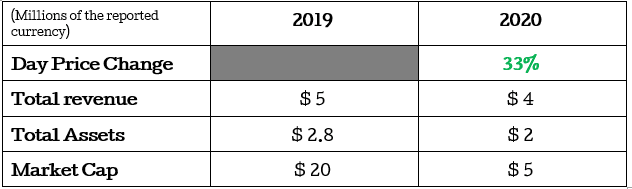

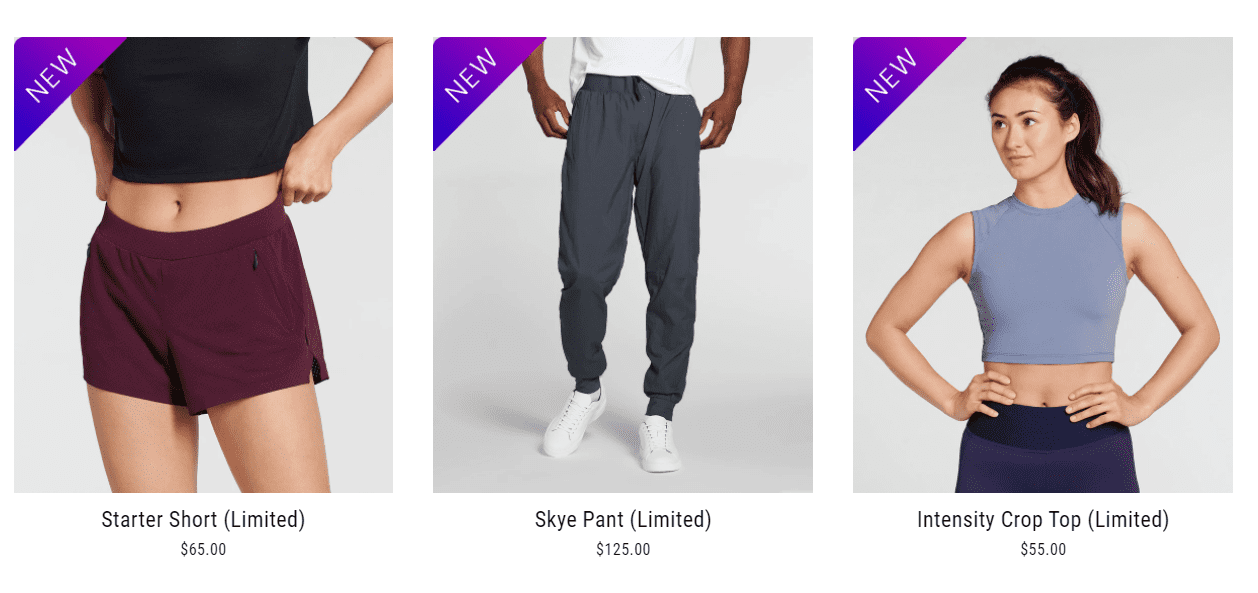

Today’s big market winner was RYU Apparel (RYU.V) a Vancouver-based apparel company founded in 2008. The business is described as one that develops, markets, and distributes athletic apparel, bags, and accessories under the RYU brand for men and women.

It offers men’s and women’s apparel; bags; and accessories for fitness, training, and performance and lifestyle of athletically minded individuals. The company sells its products through its retail stores and wholesale accounts, as well as ryu.com, an e-commerce site.

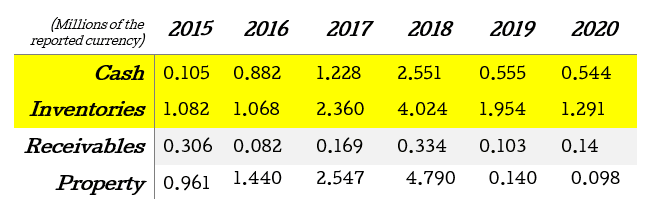

As of their most recent reports, this $6 million business has been able to generate $4 million in revenue utilizing $2 Billion in assets.

The majority of their assets consist of the inventory (the athletic gear and apparel) they sell and cash in the bank usually held in short term securities and other liquid financial instruments.

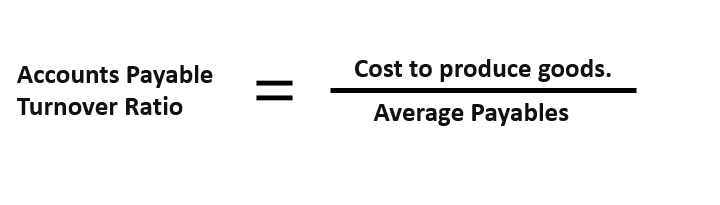

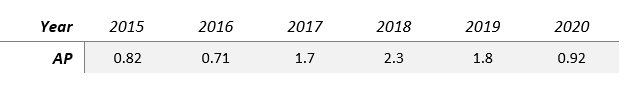

The company has been able to achieve these ‘returns’ whilst utilizing little to no debt and mainly equity capital. They have also leveraged their negotiation skills by accruing accounts payables that are due in the short-term. With these contracts, they need to pay suppliers and other creditors. They have set up these contracts in a favorable way for the business. The leading indicator of payables efficiency would be the Accounts Payable Turnover Ratio.

A decreasing turnover ratio indicates that RYU could be taking longer to pay off its suppliers than in previous periods. The rate at which they pay off their debts could provide an indication of the company’s financial condition. A decreasing ratio could in some situations signal that a company is in financial distress. On the other hand, a decreasing ratio could also mean the company has negotiated different payment arrangements with its suppliers.

It is difficult to know if RYU is in financial distress or is renegotiating aggressively with its creditors. But the financial reports mention a few of the key strategic partners that could aid this analysis in the right direction.

These are :

- Naturo Group Investments Inc produces nutritional beverages and foods. The company is based in the United States. The company is both a landlord and supplier of products to RYU.

- Polygiene AB develops, manufactures, and sells odor control solutions for clothes, sports equipment, textiles, and other materials in Asia, Europe, North America, and internationally. It is also a supplier under the Polygiene brand.

- Pure Freedom YYOGA Wellness Inc. provides yoga classes and is recognized as a supplier by RYU.

For simplicity, we will assume it is a mixture of lease payments that have become difficult for RYU to pay as their operating earnings compress, and Naturo Group Investments Inc has either accelerated the lease payments or has renegotiated with RYU on better terms to delay payments.

On the supplier side, it would be the same situation as above for both Polygiene AB and Pure Freedom YYOGA Wellness Inc. This being that they have negotiated contracts to something that factors in the current economic climate and is more favorable for all parties involved.

Outside of selling through its retail brands and stores through Nordstrom (JWN.NY) its main distributor. The business is a wholesaler as well. Wikipedia defines a wholesaler as :

“Wholesaling or distributing is the sale of goods or merchandise to retailers; to industrial, commercial, institutional or other professional business users; or to other wholesalers (wholesale businesses) and related subordinated services. In general, it is the sale of goods to anyone other than a standard consumer.”

RYU has three main customers in the wholesale industry:

- Naturo Group Investments Inc

- Steve Nash Fitness World, Inc. – currently going through financial difficulty and bankruptcy proceedings

- The We Company – currently going through financial difficulty

When two of your biggest clients are in financial distress and your landlord is demanding their rent payments you can only assume there is trouble in paradise. Especially with a two-tier business structure that is struggling in both tranches.

Can Wholesalers Sell Retail and Vice Versa?

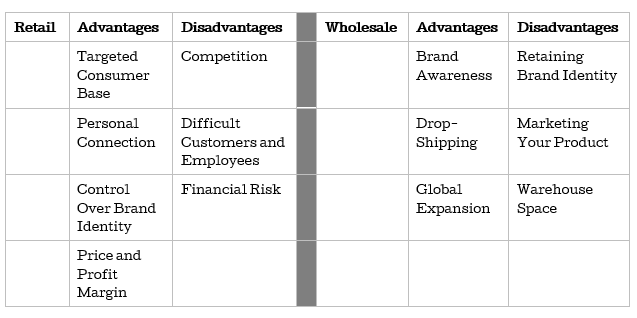

The simple answer is yes, but it is operationally exceedingly difficult to do. The two businesses on their own have many pros and cons. (see table below)

But a combination of these two forms has two main issues.

Issue one is the fact that you are your own worst enemy. By being both retailer and wholesaler, RYU is at risk of directly competing against their own resellers, therefore they are competing against their own product. Over time this would damage their wholesale relationships with the resellers, and retailers would be reluctant to take your inventory in the future.

Finally the profit margins. If choosing to sell via wholesale as well as retail, they need to be sure that their wholesale prices cover your costs and still make a profit. This is where understanding the true inventory costs comes in.

Having a grip on all these inventory costs before pricing their products will ensure they are making the most profit, in line with the items they sell.

Having gone through this simplified process of due diligence we can comfortably come to the conclusion that the apparel and retail space :

- Is very competitive and there are many firms chasing profitability

- This heavy competition means that profit margins are low, and most firms are not profitable

- And the only way to be competitive is to be the lowest-cost producer in a broad target market

- Inventory management is key to business success and an efficient working capital position is key

- And finally, the long term economics of the industry are very difficult at this moment to predict with any amount of certainty.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebodies favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments

HAPPY HUNTING!