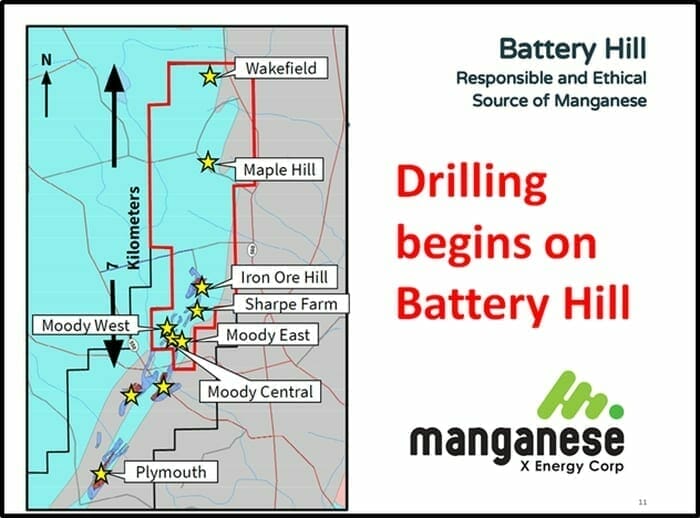

On October 1, 2020 Manganese X (MN.V) announced that drilling activity has started on its 100%-owned Battery Hill property in New Brunswick, Canada.

Previous holes on that property intercepted significant grades and widths of manganese such as 10.75% Mn over 52.6 meters (core length), 12.96% Mn over 32.85 meters (core length) and 9.39% Mn over 74.0 meters.

“Manganese is beginning to play a critical role in the evolution of new off-grid power storage systems, and cutting edge solar energy (storage) technologies,” reported Equity Guru’s Greg Nolan a month ago when MN stock could be purchased for .20 (it’s double that now).

Editor’s Note: By market close October 1, 2020 – the MN stock price is up another .11 (25%) to .56 on 3.3 million shares traded.

MN will drill about 25 holes totaling a minimum of 3,200 meters.

The average depth per hole ranges between 100 to 250 meters.

The objective of the drill program is to significantly expand and upgrade the current classification of mineralization to inferred or higher resource status.

The program will focus on near surface, higher grade areas of the deposit such as the Moody Hill zones, a potential “low-cost open-pit mine” location.

Higher grade areas such as Moody Hill may represent candidate “starter pit” locations.

Manganese has the following demand drivers.

- A critical component of the cathode material in modern alkaline, lithium, and sodium batteries

- Green/clean energy credentials – weening off fossil fuels.

- Likely to remain the preferred energy material for the future.

- Well suited for cathode mix in bulk energy storage & energy management.

- Ideal for portable power

- Key material for integrating solar and wind renewable energy.

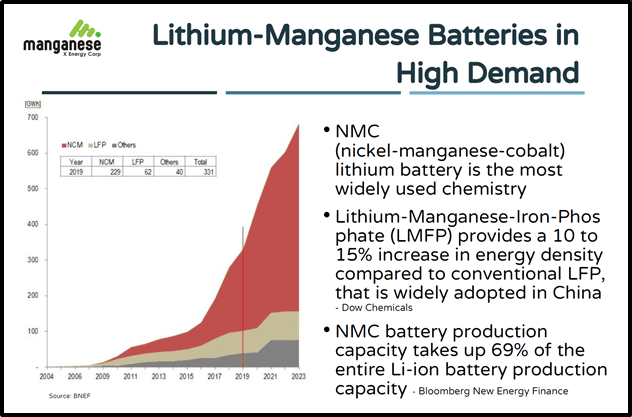

Modern Li-ion battery systems feature a cathode combination of nickel-manganese-cobalt (NMC).

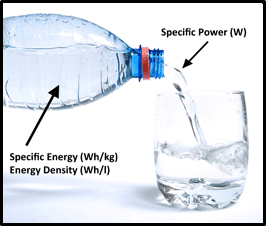

NMC batteries can have either a high specific energy or high specific power. They cannot have both properties.

Specific energy defines battery capacity in weight (Wh/kg); energy density, or volumetric energy density, reflects volume in liters (Wh/l). Products requiring long runtimes at moderate load are optimized for high specific energy.

Specific power indicates loading capability. Batteries for power tools are made for high specific power and come with reduced specific energy (capacity).

The NMC battery is common in power tools and in powertrains for vehicles.

The chemical subsidiary of LG Electronics, LG Chem and 3M, are using NMC cathode materials in lithium-ion batteries. LG Chem supplies NMC-based Li-ion batteries to plug-in vehicles, including the Chevy Volt and Nissan Leaf.

Cobalt is the most expensive material used in batteries, so eliminating it will make Electric Vehicles (EVs) cheaper. Tesla says it will be able to make a $25,000 EV — $10,000 less than its cheapest 2020 model — partly because it is reducing cobalt and increasing manganese.

“It’s absolutely critical that we make cars that people can people can actually afford,” stated Tesla CEO Elon Musk on September 22, 2020, “Affordability is key to how we scale.”

As well as the cost factor, there are political issues.

“Cobalt has also been called the ‘blood diamond of batteries’” states The Verge, “That’s because it’s been mined in a way that’s endangered child workers and wrecked the environment in the Democratic Republic of Congo.

“We are accelerating our drilling agenda to take advantage of the current attention and demand on manganese as a key cathode component in battery chemistry,” confirmed Martin Kepman, CEO of Manganese X, “Tesla Battery Day was a call to action for companies in the energy metals sector.”

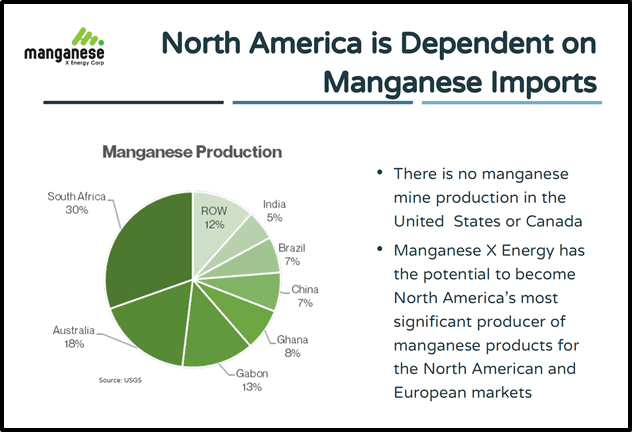

“Elon Musk is looking to source battery grade manganese which we have dubbed ‘electric gold’ from the North American chain,” continued Kepman, “We feel our property, being 12 miles from the US border gives us a decided advantage. We are the only manganese property in North America on a fast track to commercialization.”

Upon successful completion of the drill program and ongoing metallurgical studies recommended in the June 2020 NI 43-101 technical report, work will be initiated toward the completion of a Preliminary Economic Assessment (PEA).

A PEA answers the question, “How best can this deposit be exploited to maximize its profits for investors?” Unlike more advanced studies, a PEA can use inferred resources for its operational and financial modeling.

A PEA will not trigger a production green light because of the relatively high degree of unknown risks.

A positive PEA will typically create an upward re-valuation of the company, unless the spot price of the targeted mineral is plummeting – which is unlikely given the demand/supply ratio for Manganese.

Here’s Tesla’s Elon Musk talking about Manganese:

“This brittle, silvery-gray metal was recently added to a list of 23 elements critical to the US economy,” continued Greg Nolan, “Manganese X appears to hold significant tonnage potential in the subsurface layers of its 1,228-hectare flagship Battery Hill Project in mining-friendly New Brunswick.”

In the October 1, 2020 press release, MN confirmed it has enough cash to execute on all corporate activities in the next 18-20 months.

BONUS VIDEO: CEO Martin Kepman talks about last week’s unfortunate insider sales, and explains why the future is sold.

- Lukas Kane

Full disclosure: Manganese X is an Equity Guru marketing client.