Unless you’ve been living under a rock, you know that Covid-19 took a sledgehammer to corporate profits this summer. So, what the hell did you expect from Valeo Pharma’s (VPH.C) latest quarterly results?

The Canadian biotech firm reported fiscal third-quarter results after the bell on Tuesday. The numbers showed a decline in year-over-year revenue and a net loss of $1.6 million for the period ending July 31. Revenues were actually higher than the second quarter but losses mounted due to pandemic and other accounting adjustments.

While the numbers don’t look too appealing at the surface, they skew an otherwise remarkable growth story for one of Canada’s emerging healthcare innovators. A focus on increasing cash flow, bringing to market new specialty pharma products, and unleashing the therapeutic potential of natural remedies are putting Valeo on the map at a critical time in our fight against Covid-19.

The real story behind Valeo

Valeo CEO Steve Saviuk didn’t mince words when discussing his company’s third-quarter earnings report:

Setting aside the obvious Covid-related hiccups, it’s almost useless to compare quarter-over-quarter changes of an emerging company like Valeo. The annualized revenue drop was also skewed by the successful launch of Onstryv in the third quarter of 2019. Onstryv–the first oral treatment for Parkinson’s disease to be approved in Canada in over a decade–received strong initial uptake. (Sales have moderated, but are expected to grow because of the sharp rise in Parkinson’s disease among aging boomers.)

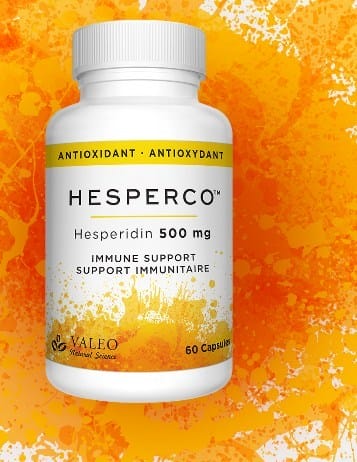

Valeo also received ‘quick government approval’ for Hesperco Natural, an immune system booster that contains hesperidin–a natural remedy that is believed to reduce complications of Covid-19. (There’s no “woo” here; several studies have listed hesperidin as a promising treatment for the virus. Here, here, here and here.)

Valeo’s business model, patents, and leadership transcend the corona-hype, so you can expect the company to be around for a long time. (In fact, it has already been in operation since 2003.)

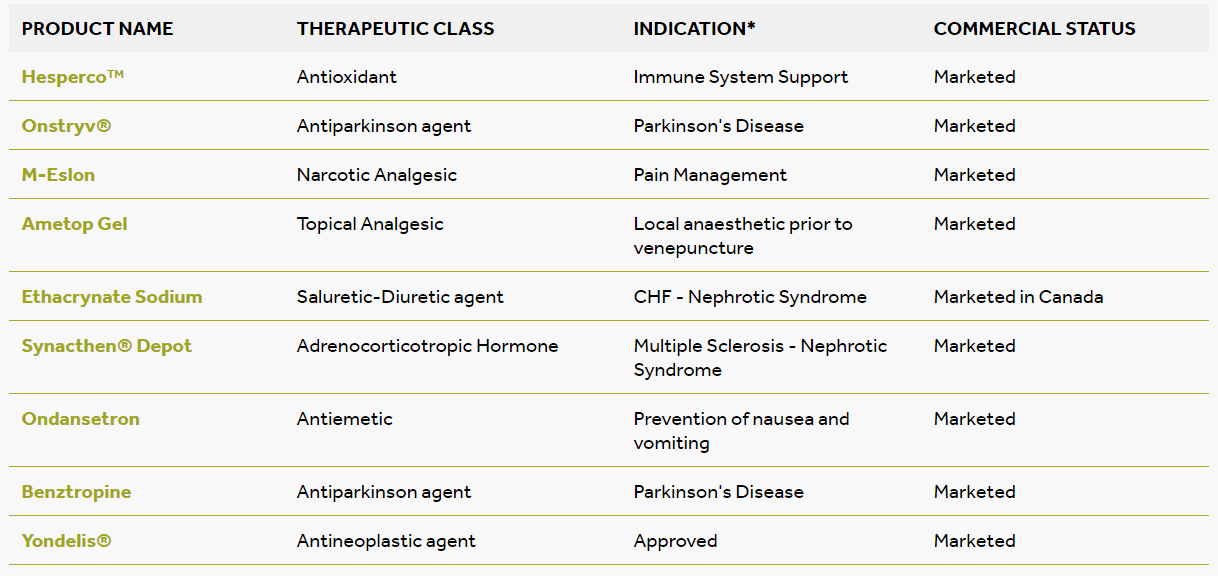

The company isn’t selling hype, either. For all the innovations underway in therapeutic solutions, Valeo’s business model is remarkably simple and risk-averse. Valeo finds companies in established drug markets outside of Canada, develops an in-license partnership with them, and commercializes and sells the product in Canada. Along the way, it avoids spending countless billions on R&D, clinical trials, and regulatory approval.

Specialty pharma is a huge market

Valeo’s growth story is more believable when you look at the size and trajectory of the specialty pharmaceutical market.

Pre-pandemic data collection from Research and Markets projected market size of $568 billion by 2026. The industry is growing exponentially due to the plateauing of the generic dispensing ratio (GDR), the fast-tracking of new developments in pharma science, and improvements in healthcare plans. (FYI: GDR is the number of generic fills divided by the total number of prescriptions; high GDR tends to produce lower prescription drug costs.)

With a focus on commercialization, Valeo has the chops to capitalize on this expanding market. And for all the talk about immune-boosting treatments, Valeo’s primary focus remains neurodegenerative disease, oncology, and specialty products for hospitals.

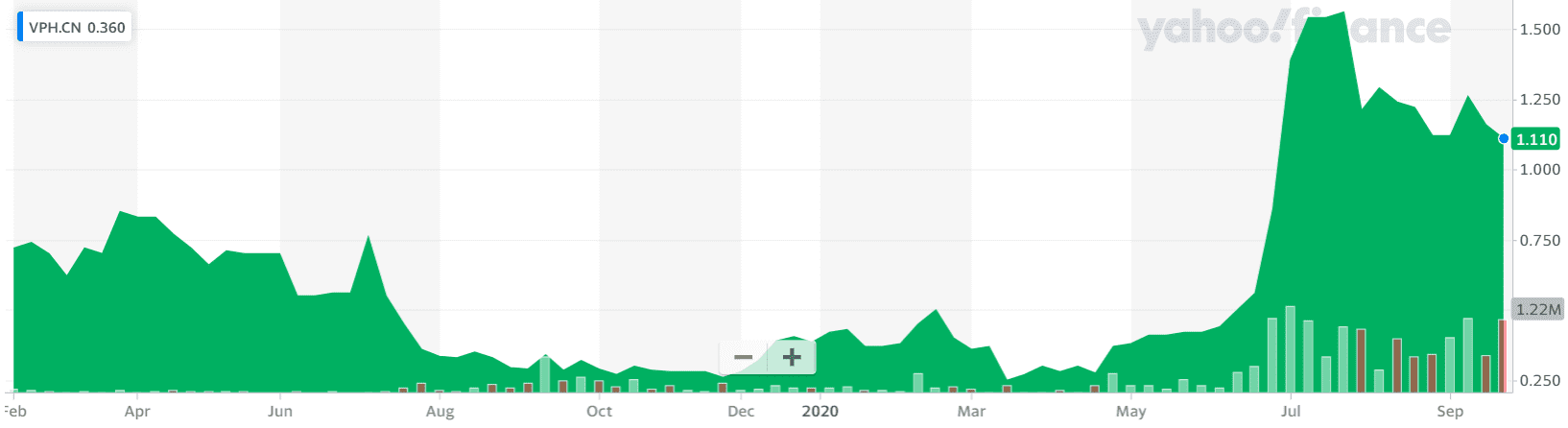

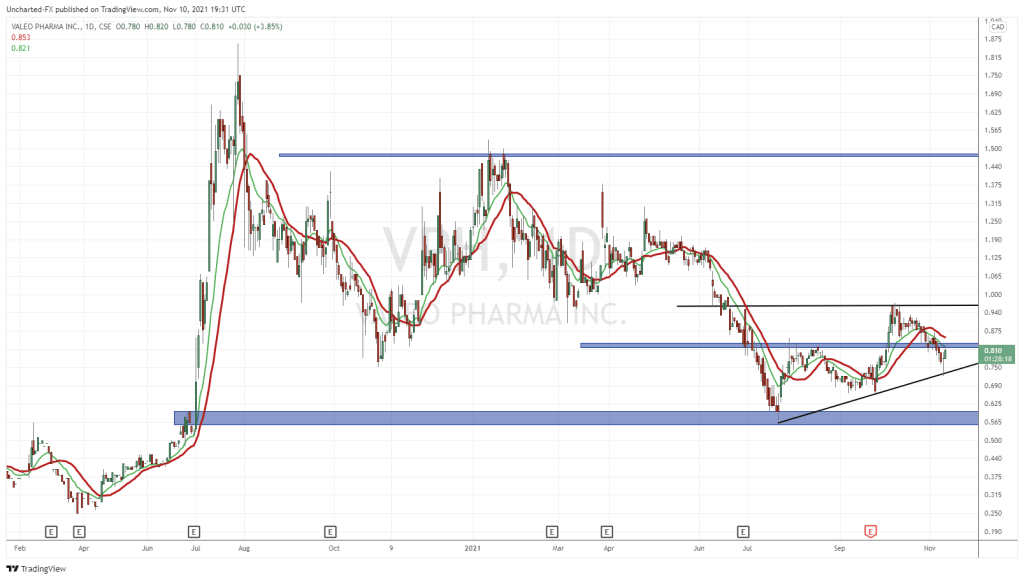

Valeo stock is trading well below its peak

Being a Valeo shareholder isn’t for the faint of heart. VPH.C received a massive tailwind in June, and at one point gained over 50% in a week. The stock eventually peaked at $1.86 in July before nosediving the following month. It closed down 3.5% at $1.11 on Oct. 2. At current values, Valeo has a market cap of $64.5 million with a daily turnover of around 200,000 shares.

Although VPH.C is down 40% from its July 26 intraday peak, the loss is a less gut-wrenching 28% from its closing high of $1.56.

Biotech as a whole has been under intense selling pressure since July. The Nasdaq Biotechnology Index declined by as much as 13.3% over six weeks.

When it comes to evaluating Valeo, you have to look past the short-term volatility and focus on the big picture. Does the company have a viable growth strategy? Is there a path to profitability? Are their competent people at the top?

We can answer “yes” to all of the above.

If we weed out the corona-induced volatility, Valeo is a solid revenue generator (sales grew 112% between Q2 2019 and Q2 2020; net losses and EBITDA losses improved considerably over the same period).

Investor interest is alive and well. The company just raised $6.9 million in a bought deal, so there’s reason to be optimistic about expansion. Concerns about shareholder dilution may be warranted, but a simple look at corporate headlines sends a clear signal that the growth story is far from over.

Keep Valeo on your radar. It has been around for a while and is gaining momentum as a publicly-traded company.

—Sam Bourgi

Full disclosure: Valeo Pharma is an equity.guru marketing client.