It might not be a popular trade, but I trade the markets that I see rather than the markets I want to see. Even though I am very bullish on both Gold and Silver for the longer term, I do think we make one more larger pullback before we continue the uptrend. If you recall, I posted a short trade set up on both metals with a Gold target at 1800 and a Silver target at 20.50. These targets still remain the target, and I believe we are in the process of making our first lower high swing on the daily chart currently.

In a previous silver post, I spoke about the monthly chart and what I expect price to do…it is doing just as I predicted. I can see Silver hit our target this month along with Gold, and then the catalyst to take them higher could come in November. I am of course speaking about the US election. If we see some drama and contesting on who won the election, with the possibility of it dragging on for months, the metals will rise. Remember, Gold is the confidence crisis asset. People buy Gold when they begin to lose confidence in government, central banks and the fiat money. The central banks and fiat money crisis is already unfolding, the next big plot line will be negative interest rates. So far the Bank of England has admitted that they are seriously considering it, but do expect all other western central banks to do the same. With more fiscal policy to try to keep people afloat, negative rates will help governments service the debt.

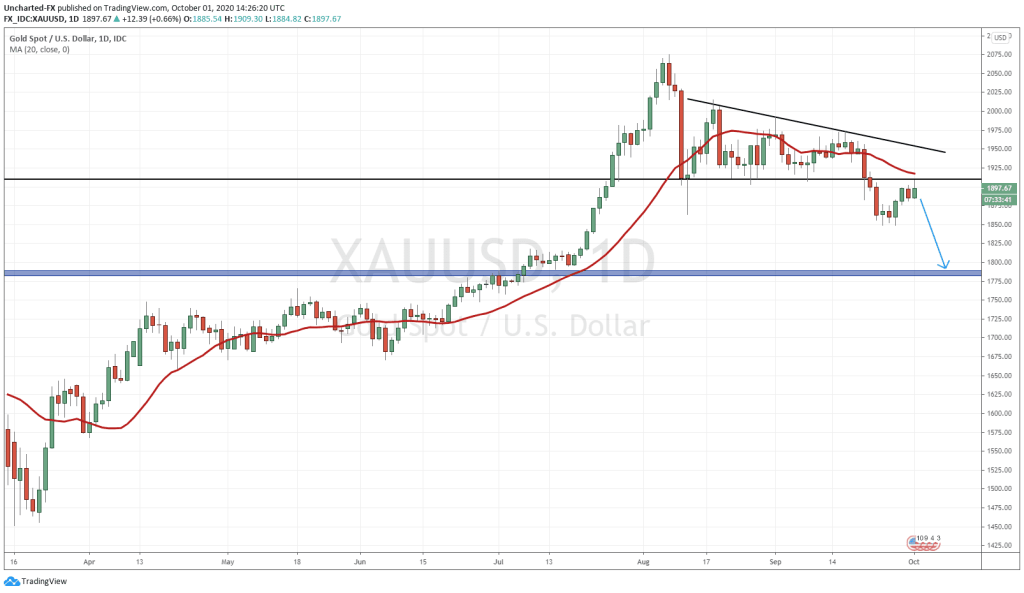

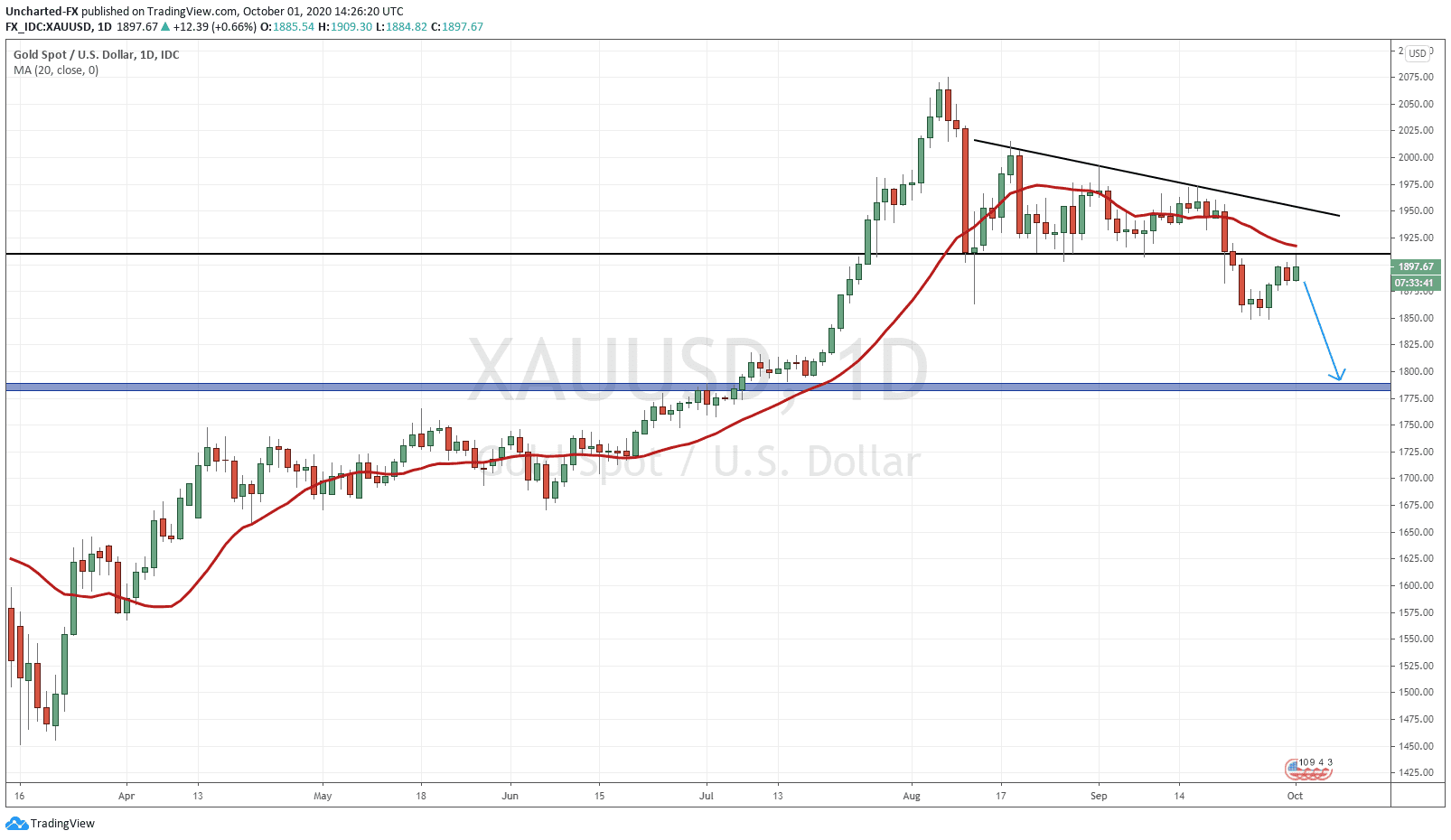

When I wrote about my Gold and Silver pullback trades, both metals had been ranging for more than a month. Was just a sign that the uptrend was exhausting, and a pullback was imminent. As you can see from the chart above, Gold was forming a wedge/triangle pattern. It kept the bulls hopeful as a break above the wedge trend line would mean further upside. Yes, this was possible, but not probably in my opinion. Gold had made multiple higher lows already, and all trends do not last forever. Just using probabilities, it was a higher chance of price pulling back before continuing much higher. This means we need to make lower high swings to the downside.

That can be occurring right now, and by the end of today’s candle close, we can have a candle to work with. Price broke below the 1900 support, and we are now retesting this zone. A nice wick or a large engulfing candle here, will bring in many sellers. Of course, price can continue to be indecisive here as the bulls and the bears battle it out.

If we do get that bearish signal today (our discord trading room members will be notified) we can take a short with a stop loss above today’s daily highs and a take profit at our 1800 zone. Incredible risk vs reward ratio.

The second way is to wait for new lower lows, which would be a break and close below 1850, before entering and targeting 1800. Yes, you miss out on a lot of the move, but the break below recent lows increases your probability of the trade. So that is the trade off.

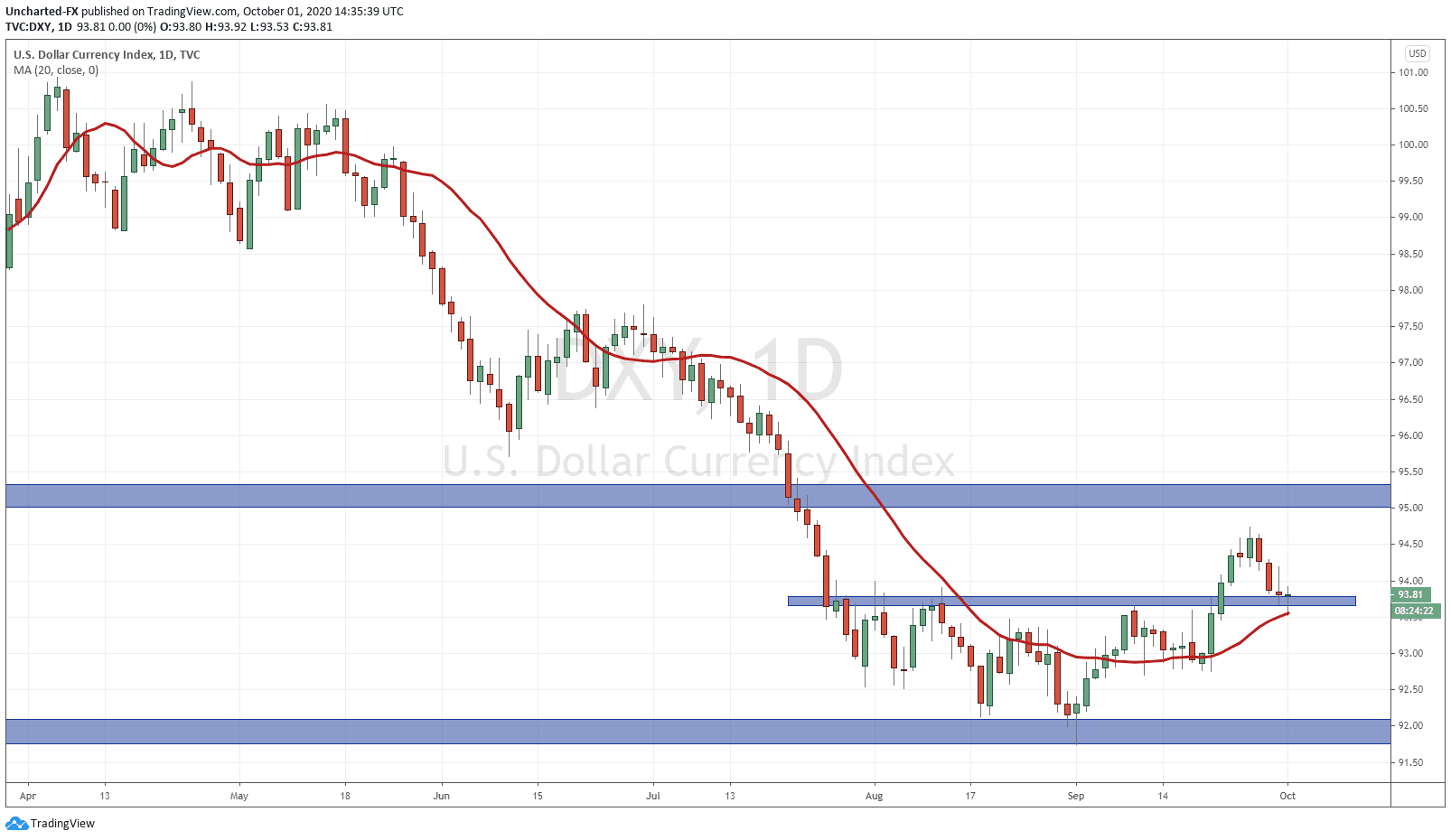

There is another daily candle close that you MUST keep your eye on…and I have said in the past that this is what will weigh in on the metals.

The Dollar has also been one of my other contrarian plays. Just cannot ignore the head and shoulder bottoming pattern with the trigger on the breakout. Price has now retested, which is normal, and the battle starts here. If we hold this support, another move higher with a higher low is on tap. If we do break and close below support…the Dollar continues its decline.

Not only will this Dollar chart weigh in on metals, but also the equities. This is a very important chart and will impact financial markets and geopolitics. I do believe that a lot that is occurring with Turkey and Erdogan is due to the fact that the Turkish central bank cannot control the decline of the Turkish Lira. To distract from this and domestic issues, Erdogan is looking at external enemies such as Greece and now Armenia.