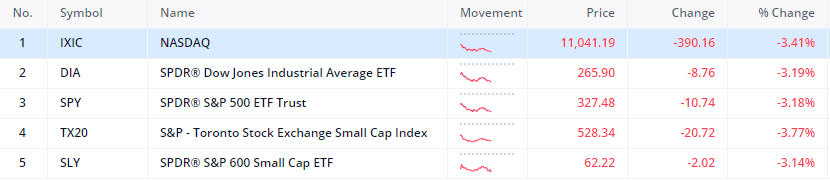

For some time now stocks have been rising at rather rapid rates, as opposed to the lag or decrease in business profits and dividend distributions.

It is not to be unexpected that a correction on the downside would occur as the market comes to terms with the economic reality of COVID19.

Economists believe that the stock market is a forward-looking market as it discounts the earnings of various corporations to come to a marginal consensus about economic prosperity and sometimes economic hardships. This is true but we must not forget that any market in the short-term is driven by human emotion.

The stock market has been a good forecaster at times but does tend to overreact to information, usually on the downside.

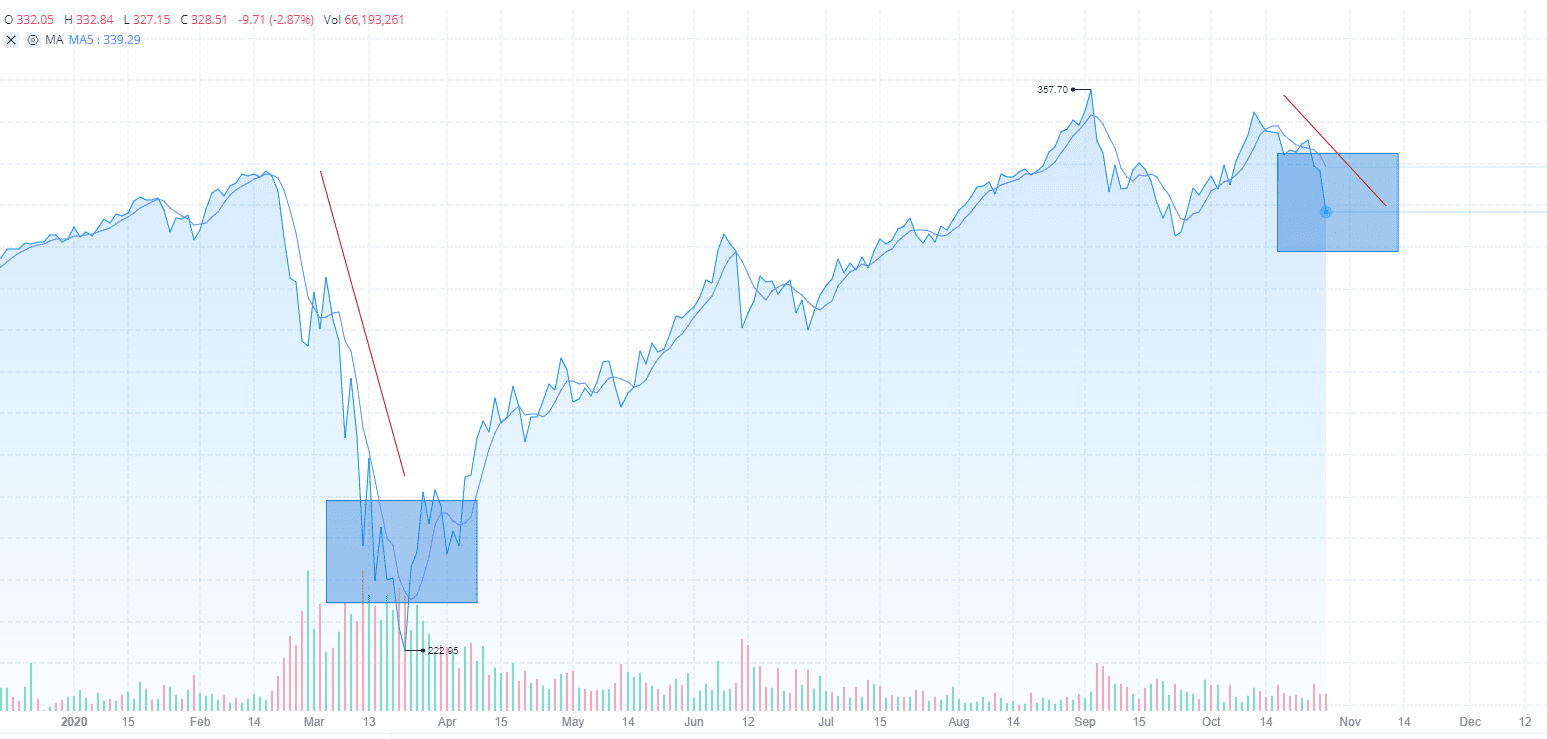

As seen above the market readjusts rapidly when brokers put out margin calls on individuals & institutions who have bought leveraged products to capitalize on the markets’ recent run.

Margin is collateral that the holder of a financial instrument must deposit with a counterparty (most often their broker or an exchange) to cover some or all the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following:

- Borrowed cash from the counterparty to buy financial instruments,

- Borrowed financial instruments to sell them short,

- Entered a derivative contract.

Once this downside trend is reinforced by margin calls those who hold the common stock sell with the hope to be locking in a profit before all their short-term gains have been eaten up by the market.

To make matters worse savvy traders will purchase put option contracts to benefit from the fall in stock prices increasing the downside pressure on the securities market and increasing the derivative exposure by taking advantage of leverage.

Whilst all this is happening, we are now living in a market environment that is mainly algorithmic trading or Algo trading. This is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume.

This type of trading was developed to make use of the speed and data processing advantages that computers have over human traders. Algo traders can make millions of transactions per second to benefit from minuscule bid and ask spreads to earn a profit.

In the spirit of simplicity, we can assume that all Algo trades work on a simplified “if x then y” function. Meaning if the stock market is to drop by 1% within a certain price range, volume, and time range the financial programmer will instruct the computer system to short or buy put options at a rapid rate to profit from this sudden influx of volatility. This rapid buying and selling by the computers will also add extra pressure on the market and will reinforce the downside pressure.

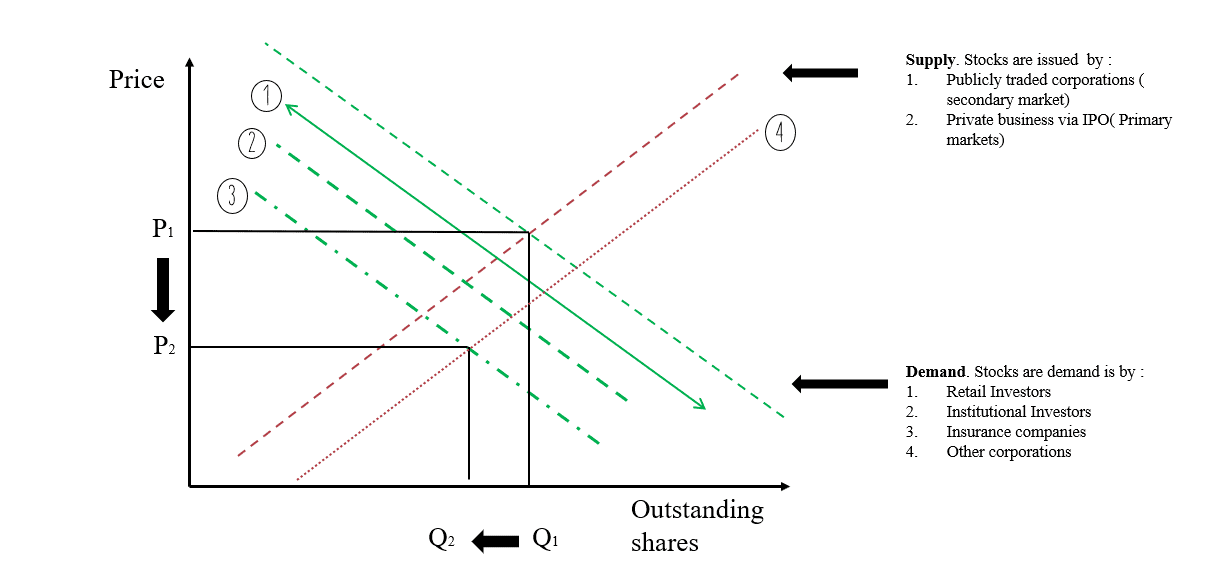

This next part of this article can be skipped as it goes into basic economic concepts that might offend the sophisticated reader. But we feel it is best to illustrate this theory with a demand and supply diagram. Studies show we are better visual learners.

When the market is in consensus and everybody is happy with what they own we are in a steady-state. In this steady-state the market will trade at P1 and the shares available would be at Q1. Once the headline U.S. coronavirus deaths rise again in the majority of states as new wave grows, the self-generating mechanism on the downside begins.

- The initial reaction by the demanders taking profits on their speculative investments will push down prices. To reinforce this the headline of the day is Dow slides more than 800 points as rising coronavirus counts threaten the fragile recovery

- The savvy investors getting word of this downtrend and news would execute put option contracts or open short positions putting pressure on the market even more. This is also when the Algo traders notice the increase in volume and try to profit on small bid-ask spreads putting even more pressure on the market.

- Once this starts fear kicks in and the investors who had borrowed to buy the stock need to put up collateral as the brokers initiate margin calls, or they sell back the stock at a loss.

- Increasing the supply of shares in the market happens as no new buyers demand the lower valued shares that have just been sold adding that extra final push back on the price.

We end up in a new steady-state where the new depressed price is P2 and the number of common stocks demanded is lower at Q2.

So, maybe the stock market now is correcting a previously incorrect forecast rather than a new correct one. This self-generating mechanism on the downside from marginal loans from brokers and rapid trading and pessimism is a by-product of a market with “too many geniuses chasing a small number of great investments”.

HAPPY HUNTING!