Every company goes through growing pains. These are generally small bumps on the road that get in the way of stiff, steady growth, and the way the company meets these challenges is really the difference between a flash in the pan and a company that maintains a steady burn that cuts through the generations. It also helps when there’s a pressing issue that desperately requires a solution and PredictMedix (PMED.C) is working to get that covered. Their issue is COVID detection, as is ours and everyone elses, and how to mitigate its effects without the need to shut down the economy like we did last year.

For example, if we had a definitive way to stem the rate of contagion by determining who is and who is not infected last year, we wouldn’t be in the mess we’re in right now with closed borders, limitations on social gathering, mandatory masks, and over 300 infected people in one weekend. Not to mention the millions of infected in the United States and the seven figure global death-toll.

Their solution looks like an airport metal detector, but instead of picking up your belt buckle, it determines if you’re sick.

Deployment

The technology is deployed in two stages:

The first stage involves a technical team putting together the parts in the gateway unit and working with their engineering team to ensure that the product meets set standards for live deployment. The second stage involves physically taking and installing the gateway, as well as running it through a series of tests to make sure the system works.

These units involve an array of cameras and sensors capable of seeing in multiple different wavelengths of the electromagnetic spectrum capturing and analyzing heat signatures to determine if the person is ill or otherwise compromised. These devices send that information to the artificial intelligence model in the cloud, which triggers a response, activating a red or a green light indicating if someone is exhibiting symptoms of infectious disease, like COVID-19.

The only problem is that COVID’s disruptions to the global supply chain have curtailed the fabrication process affecting the timely rollout and deployment of these gateway units. But necessity is the mother of innovation, as they say, and PMED has been busy working with suppliers and manufacturers to find a work-around for this problem, testing alternative components to widen their supply-chain options. They’re also working with resellers to build an assembled inventory of gateway units that can be repurposed and redeployed as orders require. All of this ensures that the supply issue is a bump and not a wall.

A net positive is that in the unlikely event that COVID-19 wave-2 does temporarily stall production, PredictMedix actually owns the hardware configuration for the gateway in addition to the artificial intelligence algorithms that run it. Even if they run into some issues with sourcing the hardware components or for whatever reason can’t build their gateway, they can still take advantage of the IP. That’s really a worst case scenario, though.

The good news for investors is the company already has machines in the marketplace. Before that happens there’s a certain amount of uncertainty about whether or not a company is going to deliver on its promises, but PMED already has and there’s no longer any doubts there. The question is whether or not they’re going to keep hitting their milestones and that depends on whether or not they can find the work-around in time.

The company has deployed their technology at Flow Water, in Aurora, Ontario, a premium water brand offering alkaline spring water with flavouring options. Its reach is approximately 20,000 retailers across the United States, Canada and Europe. The units are now live and completely operational, and the first incidences where the company ran into some supply chain issues for the components which may cause some issues in the future.

COVID and Telehealth

But there’s a whole other angle to look at with this company. The gateways are only one of their offerings, and the other offering, the Mobile Wellbeing remote patient monitoring platform is doing fine. The company’s acquisition of Mobile Wellbeing has given them the leverage they need to enter the growing telehealth and clinical trial marketplace.

Clinical trials generally require on-site monitoring to protect human subjects, data integrity and quality, but the pandemic has put a bit of a crimp in that, forcing clinical research sites to reduce and restrict on-site monitoring. There’s also the issues raised by travel restrictions and other safety issues which further add to the challenges of on-site monitoring. The guidance from the FDA for properly conducting clinical trials during COVID-19 r estrictions supports monitoring remotely for oversight of these particular sites. Often these patients are already immunocompromised and may be put at further risk by potential COVID-19 contamination.

estrictions supports monitoring remotely for oversight of these particular sites. Often these patients are already immunocompromised and may be put at further risk by potential COVID-19 contamination.

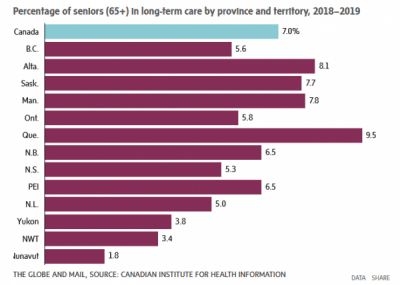

The company sees Long Term Care (LTC) and retirement residences as potential places where Mobile Wellbeing could theoretically make a difference. Especially given the scrutiny that retirement homes have come under due to the high incidence of deaths when COVID-19 gets into these facilities.

They’re definitely onto something. The Globe and Mail reported that 81% of COVID-19 deaths were from LTC facilities, which is nearly double the average for countries in the Organization for Economic Co-operation and Development (OECD).

Their focuses right now are North America for LTC, and Asia for clinical trials and hospitals. But they’ve also developing new wearables to monitor for vitals like heart rate, respiratory rate, blood pressure and temperature, which would help considerably with physiological tracking for clinical trials and LTC.

In terms of price, charts and market cap, the company is presently trending downwards owing likely to their supply chain issues, but as they come up with solutions and demand for their COVID-19 detectors scales with the severity of the issue during phase 2 of the pandemic, there’s a strong probability that this won’t last.

After all, a company with working and distributed tech and a gameplan going forward, and a respectable amount of paper in circulation, is still an absolute steal at a $45 million market cap.

—Joseph Morton

Full disclosure: Predictmedix is an equity.guru marketing client.