From the ashes, a fire shall be woken, A light from the shadows shall spring…

– J.R.R. Tolkien, The Fellowship of the Ring

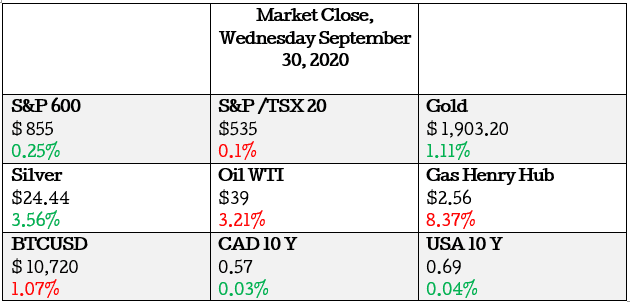

- S&P 600 (USA Small Caps) up by 0.25% and S&P 500(USA Large Caps) by 0.83% for the day

- S&P/TSX 20(CAD Small Cap) down by 0.1% and the S&P/TSX 60 (CAD Large Cap) down by 0.67% intraday

- Bitcoin down by 1.07%

Market Movers

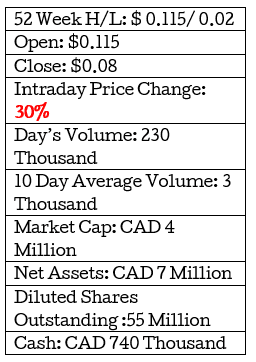

Today we the judges have picked: Zedcor Inc. (ZDC.V) as the “most unattractive common stock”

Business Summary: Zedcor Inc. engages in the rental of oilfield surface equipment and portable oilfield accommodations in Canada. The company operates through two segments, Energy Services, and Security & Surveillance.

The Rentals ( Formally Energy Services )segment provides surface equipment rentals and wellsite accommodation rentals to support the drilling and completions operations of energy and production companies operating in the Western Canada Sedimentary Basin, as well as rental equipment to support construction and infrastructure projects.

They believe that this segment of their business is more capital intensive, and this is true it requires heavy investment to maintain the property plant and equipment need to run the segment.

The three main products for lease are :

- Generators

2.Light towers

3. Surface Rentals

This equipment is very difficult to maintain and requires a lot of man-hours and expensive labor to install and set up. To stay competitive in the industry they will need to invest millions of dollars of cash to buy newer equipment as some of their assets get older which can burn cash needed for other business operations. The Management believes slowly they will move into the less costly and “more” profitable business segment.

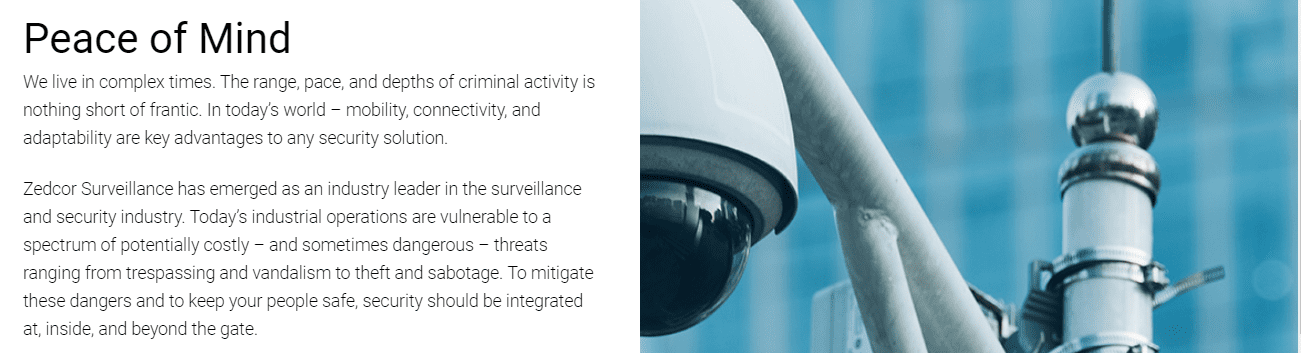

The Security & Surveillance segment offers various services through a fleet of hybrid solar light towers equipped with high-resolution security cameras for the pipeline, energy, and construction industries.

They have slowly pivoted their resources into this segment as they feel it is more profitable and will bring greater revenues over time. They have recently rebranded their business name to match this new direction :

Zedcor Energy Inc. Announces Corporate Name Change to Zedcor Inc.

CALGARY, ALBERTA – September 17, 2020, Zedcor Energy Inc. (the “Company”) (TSX VENTURE: ZDC) is pleased to announce that at the Annual and Special Meeting of the shareholders of the Company held on

September 17, 2020, the proposed name change of the Company to Zedcor Inc. was approved.

This name change better reflects the Company’s overall service offering and diversification of its revenue streams away from traditional energy services markets. Zedcor Inc., with its operating subsidiary Zedcor Security Solutions Corp., has an excellent reputation for providing security and surveillance solutions and equipment rental services for pipeline contractors, general construction contractors and industrial, commercial and oil & gas customers.

The Company’s common shares will continue to trade on the TSX Venture Exchange under the ticker

symbol “ZDC”.

turn·a·round

/ˈtərnəˌround/

noun

plural noun: turnarounds

- an abrupt or unexpected change, especially one that results in a more favorable situation.

“it was a remarkable turnaround in his fortunes”

This is a classic business turnaround and is done to either

- leave unprofitable industries

- restructure and reorganize a brand

- or come back from some bad financial decisions by the management team.

The most recent example of the type 1 turnaround would be from Kodak (KODK.NY) who went from being a really profitable photography business a while back, and then the economics and technology of this sector changed dramatically and they could not keep up. They are now turning to the pharmaceutical industry to achieve financial success.

Zedcor is unique in that its turnaround mixes all the variables as will be noted from their most recent financial reports :

Zedcor is actively managing risks related to the volatility in the oil and gas sector by continuing to diversify its revenues and market its fleet of assets to other industries. This is in addition to the Company’s focus on expanding its S&S segment.

- Leaving an unprofitable business – “This is in addition to the Company’s focus on expanding its S&S segment”

It is trying to diversify its revenue by going into more profitable segments but not completely running down the operations of its rentals.

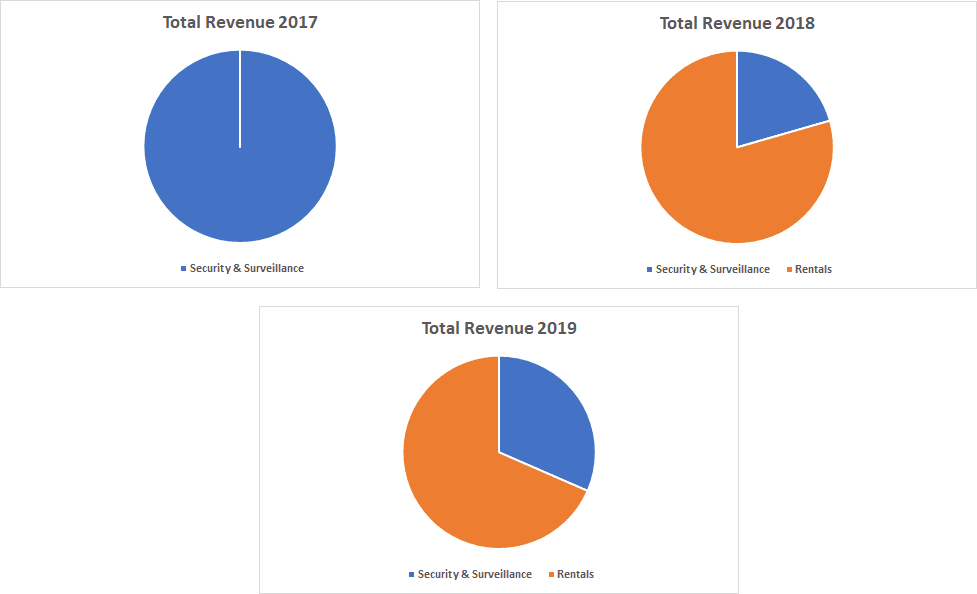

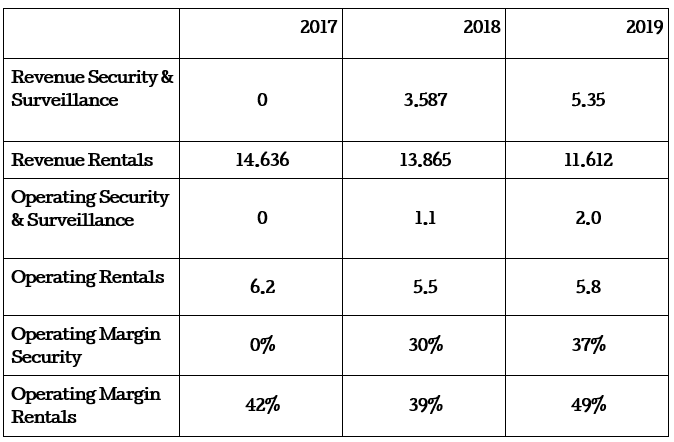

As can be seen in 2017 100% of their revenues came from the rentals business but in 2018 this number was cut as they introduced their surveillance and security sector. This progress only ramped up as they made more strides in improving this “new” business. To put that into perspective their surveillance and security revenues grew by 14% since 2017 and their renting business grew by -7.72%, a net loss.

2. Restructure and reorganize a brand – “managing risks related to the volatility in the oil and gas sector by continuing to diversify its revenues”

The surveillance and security sector has not only grown rapidly but has been great as a brand boost operationally for Zedcor. To see this we can look at the table below and one thing that stands out is how consistent the Operating Margins have been for the segment. As of June 2020, they are now up to 46%.

Why is this significant? The Operating Margins show after direct costs how efficient the operations of a business or business segment are. The higher the number the better the operations of the business. It shows how effectively management is controlling the costs such as marketing, insurance, and sales expenses, and the ability to turn human capital into business profits before taking taxes and debt expenses.

Zedcor management team might be onto something with its surveillance and security brand as it is growing rapidly and operationally efficient. This is not to say the Rentals business is not efficient, it simply costs more to run the departments needed and can be a drain on resources.

3. or come back from some bad financial decisions by the management team. – Looking Forward

Looking forward by looking in the past we can see how slowly these business choices are leading to a better financial position for Zedcor and could lead to potential growth in the future.

The primary uses of funds are operating expenses, maintenance and growth capital spending, interest, and principal payments on debt facilities. The Company has a variety of sources available to meet these liquidity needs, including cash generated from operations. In general, the Company funds its operations with cash flow generated from operations, while growth capital and acquisitions are typically funded by issuing new equity or debt.

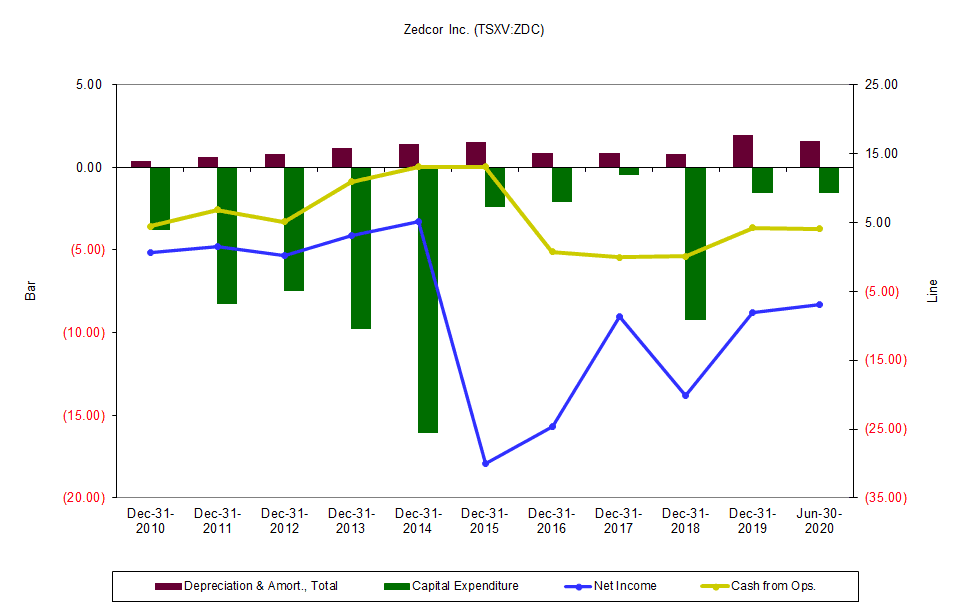

The above statement by the company aids us in our analysis of Zedcors financial choices. Assuming 2017 was the first year they pivoted into the new structure the chart above clearly shows us how things have panned out.

The yellow line is the cash the business generates from operations, and the blue line is the earnings reported by the financial media. The cash they generate has trended up and actually been positive in recent years since 2017 and the earnings have followed the same pattern but have yet to break into the positive side. Due to the impacts of COVID19, their growth has slowed down but they still produced cash helping them achieve the goals they laid out in the above statement. This is great news and although times are tough currently their surveillance business is working at 90% capacity growing as the economic realities of COVID sink in.

The green and purple bars are capital expenditures and depreciation, respectively. Like we discussed before the pivot into the new segment reduces the need to invest in heavy machinery that costs millions and depreciates rapidly. They have been able to cut their capital investments by 80% (except for 2018) and have way more cash left over to pay off debt, grow the business, and build value for shareholders.

This goes to show you that just because a stock has gone down it does not make it riskier, on the contrary, it probably makes it less risky.

By this I mean if the investor is to buy assets of a wonderful business as they go on a discount, the risk reduces as you pay less for each share in the business. The key thing here is to remember this only holds true when buying wonderful businesses at discounted prices, turnarounds are difficult to predict but can be wonderful investments for the careful investor.

HAPPY HUNTING!