This week has been a curious mess. One of the most prominent exchanges has a mysterious power outage and during it people try to run off with more money than they’re entitled too, but it’s totally not a hack. Oh no. Never a hack. Insecurity bubbles over into another potential fork, and Jack Dorsey talks about the need for security and trustlessness.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

Bitcoin

market cap $197,396,813,768

Jack Dorsey, the CEO of Twitter (TWTR.Q) and Square (SQ.Z) has long been a proponent of cryptocurrency and bitcoin in particular. The Oslo Freedom Forum, which runs events under the Human Rights Foundation, had Dorsey in for an interview on YouTube earlier this week. Dorsey naturally spoke kindly about Bitcoin:

“The whole spirit of Bitcoin, for instance, is to provide a trusted system in a distrusted environment, which is the internet,” Dorsey told host and HRF president Thor Halvorssen in an interview, published on Sept. 25.

The quote is one segment of a lengthy discussion on the topic of security and protection methods guarding against various nefarious parties.

“I fundamentally believe that security is not something that can ever be perfected. It’s a constant push to be 10 steps ahead of your attackers,” he said.

He would know. He’s been failing at this particular job with Twitter over the past few months, having endured a high value hack in which stumpers for Bitcoin bilked the unwary out of their stake via a series of phishing schemes involving hijacked high profile celebrity handles. Still, Dorsey spoke about Bitcoin as an example of a technological innovation that could ultimate assist in blazing a path towards greater security, and specifically by making trust a less crucial component.

Ethereum

market cap $39,688,862,889

For some, the wait for Ethereum 2.0’s rollout is taking too long. Over the past few months, the Ethereum network’s been having some heavy loads, and growth of decentralized finance (DeFi) has meant long queues, and elevated gas prices.

Some people are fed up of waiting to do business and paying the price of gas to work on a constantly overloaded and bogged down blockchain and they’re taking their ball and going home. Still, others are hoping the addition of sharding fulfills its promises, but nobody’s holding their breath waiting for a miracle to come.

Tether

market cap $15,201,416,372

Here’s a funny quote from Ethereumworldnews.com:

“The team at Weiss Ratings has provided a hard-hitting recommendation to crypto-traders by suggesting that they should avoid exposure to the stablecoin of Tether (USDT). The team at Wiess shared this insight via Twitter and explained that USDT is not 100% backed by fiat as the parent company claims. Furthermore, Tether is run like a fractional reserve bank and its balances are held in private back accounts that are not publicly auditable.”

Haven’t I been saying that all along?

XRP/Ripple

market cap $10,891,325,931

Sometimes it’s to defend themselves, and sometimes they go on the attack. One of their lesser known court cases was circa April 2020, when they took action against YouTube for allowing multiple videos that used the logo and likeness of Ripple’s CEO Brad Garlinghouse to promote Spanish Prisoner style scams.

YouTube’s lawyers probably got a good chuckle out of that as they filed a motion to dismiss, because of course, YouTube and every other social media outlet doesn’t really need to take accountability regarding what their people use them for. No more than Ripple does when someone buys drugs on the Deep Web using XRP. Ripple contested the claim, because they lack self-awareness, and argued that the 350 takedown notices it sent to YouTube meant it had full knowledge of the scams but instead chose not to act.

But seriously, social media companies would all be bankrupt if they had to respond, or add additional security measures, every time some asshole used their platform to rob someone else. Multiple giveaway scams are uploaded to YouTube and every other social media platform every day, and some get tens of thousands of views in hours. Ripple claims that users were defrauded of millions of XRP, worth hundreds of thousands of dollars, and the company took a reputation hit because of YouTube supposed negligence.

Not really.

This really only reinforces two self-evident things:

1. People who get into crypto are still occasionally fairly gullible.

2. Ripple loves to go to court.

Chainlink

market cap $4,134,293,276

Normally, when we hear about some third-party retailer accepting cryptocurrency, it’s usually Bitcoin, Ethereum or Bitcoin Cash. Maybe it’s because ChainLink is such a new coin, having jumped onto the scene only in the past few months, that it comes as a surprise that Travala.com, which is apparently a travel oriented firm involved in bookings and other travel arrangements, will be accepting Link.

Sure.

This is the first time Travala has ever come across my desk, but they apparently are now allowing ChainkLink holders to pay using the crypto for their bookings in over 2.2 million global hotels and homes.

Admittedly, though, Link’s considerable leap into the upper echelons of cryptocurrency still makes me a touch hesitant to endorse it. I couldn’t make this investment with any security. I’m still suspecting this is a bubble, and that enthusiasm for the coin and its services to dry up any week now.

Definitely one to watch, though.

Polkadot

market cap $4,012,260,429

Polkadot is an open-source project created by the Web3 Foundation. It’s a sharded protocol that enables blockchain networks to operate together in synergy. The DOT token does three things: governance over the network, staking and smart contracts.

It’s one of the three so-called ethereum killers. The other two being Cardano and Chainlink. But unlike those other two, it’s designed to coexist with Ethereum rather than compete with it. For some investors, that makes it more appealing because of Ethereum’s present ranking as the utility blockchain of choice.

Polkadot brings an active ecosystem, like Ethereum, that’s grown to 197 projects, according to data from PolkaProject, and given how early it is, and how disaffected some folks have gotten with Ethereum’s load and scaling problems, it’s likely to grow.

Bitcoin Cash

market cap $3,998,156,357

In previous weeks, we’ve covered the ongoing dissension within the Bitcoin Cash community. For awhile there it looked like they were going to patch things up, but apparently that’s not the case. Now the Bitcoin Cash community looks to be signalling support for an upcoming BCHN fork, and have devoted 82% of hash power to supporting the implementation.

The fork, slated for November, is looking likely, as 63% of the last 1,000 BCH blocks mined have used the community’s breakaway Bitcoin Cash Node (BCHN) implementation.

Now more than 700 of BCH’s network’s 1,262 nodes support BCHN, compared to 516 supporting Bitcoin ABC – which is the historically dominant implementation of the BCH protocol, headed by developer Amaury Sechet.

Binance Coin

market cap $3,639,758,397

Cryptocurrency exchange Binance confirmed that you can stake their native coin BNB on the Binance Smart Chain this week.

The update lets users to create or unlock a wallet on Binance Smart Chain to delegate their Binance Coin to one of the platform’s validators.

If you’ve only recently bought some BNB, this probably doesn’t mean much, but if you’ve got some and wouldn’t mind potentially finding a place where you can make some more, putting it on its parent site and seeing what happens might not be a bad idea.

Crypto.com Coin

market cap $3,115,569,280

Crypto.com’s exchange came back online after a system maintenance issue caused a prolonged power outrage earlier this week, and some users took advantage of the lapse in security.

The exchange evidently suffered from some variety of unknown database issue, which caused an outage, according to Kris Marszalek, crypto.com’s CEO. He said some users took advantage of the situation to manipulate the ETH/USDT price on the exchange.

“They locked in gains by selling to other coins en masse,” the CEO added, and also noted that the exchange’s risk systems blocked the users when they tried to make off with their loot.

Basically, what they’re saying is that they got hacked, but managed to get back online before they could get jacked.

“Some illegitimate trades will be reversed and balances restored. Since the risk systems kicked-in almost immediately, our monetary loss from this event is negligible,” said Marszalek.

Litecoin

market cap $3,010,471,708

I first bought into Litecoin back in 2017. I’d shapeshift my holdings back and forth from Bitcoin to Litecoin, taking a one or two time hit on the percentage paid to the exchange to bounce between coins, but ultimately enjoying the general upward trajectory of both at a time when crypto was riding high.

The two were equal in my profile, and I paid a lot of attention to the percentages and charts back then, just like we should today. But since then, Bitcoin and Litecoin have more or less parted ways and if I had to choose a coin to use to off-set Bitcoin’s lack of performance, it wouldn’t be litecoin.

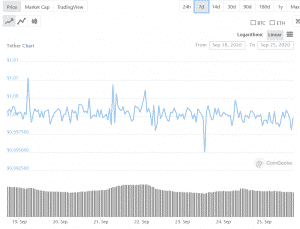

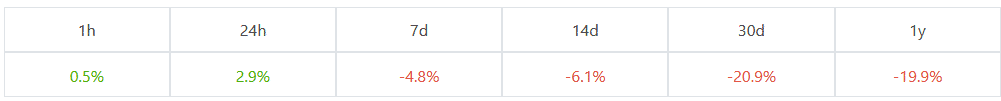

Check out the strip:

Those really aren’t good numbers. Especially the year to date. There’s no way I could justify using it now. There’s no security in it.

—Joseph Morton