Market futures opened slightly lower today, and at time of writing, are red but not by much. Even the Nasdaq has pulled back but price action is indicating it wants new highs. Facebook is testing previous all time highs, Apple made new record highs, and Netflix blew past 500 to make new all time highs before retracing. Biotech and pharmaceuticals are moving today after the news that Novavax received 1.6 Billion Dollars in funding from the Federal government through operation Warp Speed, the program to develop a vaccine as fast as possible. What is weighing in on markets is China. Overnight, the Chinese slammed the US on a slew of issues which is raising doubts on the trade 1 phase deal. We know that there really is no deal. Peter Navarro said this, before he retracted his statement about the deal being “dead”. My followers and readers know what I suggest the President to do: give China an out. The Chinese know the President needs higher markets for re-election. Their strategists are banking on the fact that if markets move lower due to China hesitating on trade deals, it will be President Trump who will want the trade deal which the Chinese would dictate. They do not expect the US to tear up the deal. If this is done, yes both Chinese and American markets would fall initially, but I think it would reverse on an actual real deal being formed, not this farce deal. This is what is weighing in on the markets as I have discussed many times in the past. It is not covid cases and other bad data as markets have overcome all of this before. Only a black swan can bring these markets down, and the geopolitical chessboard is the most likely candidate for this. Currently, we are hearing the US may ban TikTok just like India did, but markets can move lower depending on what the President says about China and this deal. However, I want to talk about what has usually been seen as a bullish market case: Warren Buffett.

Everyone knows that Berkshire Hathaway is sitting on its largest cash position in history. Experts and analysts have called Buffett out on this. Buffett has lost 7 Billion in his last three positions, Delta Airlines being the most famous. This has led to the question: has Warren Buffett lost his touch? I have watched the Berkshire Hathaway annual shareholders meeting which was uploaded online this year, and Buffett admitted he does not know how all this will end given the Federal Reserve’s unprecedented monetary policy. He probably knows, but just cannot give us his true opinion as markets move on his words. In this market, it is tough to find “value” in stocks when everything seems overvalued. To be honest, I think money will flow into commodities for two reasons: what is going to happen with the US Dollar which will be positive commodities, and secondly, because the commodity sector will be considered cheap and undervalued relative to everything else. And what do you know, Warren Buffett did indeed open his 137 Billion dollar war chest for a commodity play.

When Buffett begins to buy, the market pays attention. He is seen as the oracle and funds and market participants follow his guidance. When Buffett began buying stocks during the Great Financial Crisis of 2008, many followed suit which led to a stock market recovery and rally. CNBC has been begging for Buffett to announce an acquisition many times these past few months because it would ease fears, and cause many others to begin buying stocks again. This is how much influence he has on markets.

It was announced that Buffett struck a 10 Billion Dollar deal with Dominion Energy for its Natural Gas transmission and storage business. Berkshire’s energy unit will pay about $4 billion in cash and shoulder $5.7 billion in existing debt in exchange for over 7,700 miles of pipelines, 900 billion cubic feet of storage, and other assets. This is Berkshire’s largest takeover since 2016 and comes at a time when Buffett has been criticized for his inactivity during the pandemic.

Has this now led to optimism in stocks? I would not say so yet. I still do think the Fed has a huge role in this market movement…and perhaps the retail day trading crowd too on tech stocks.

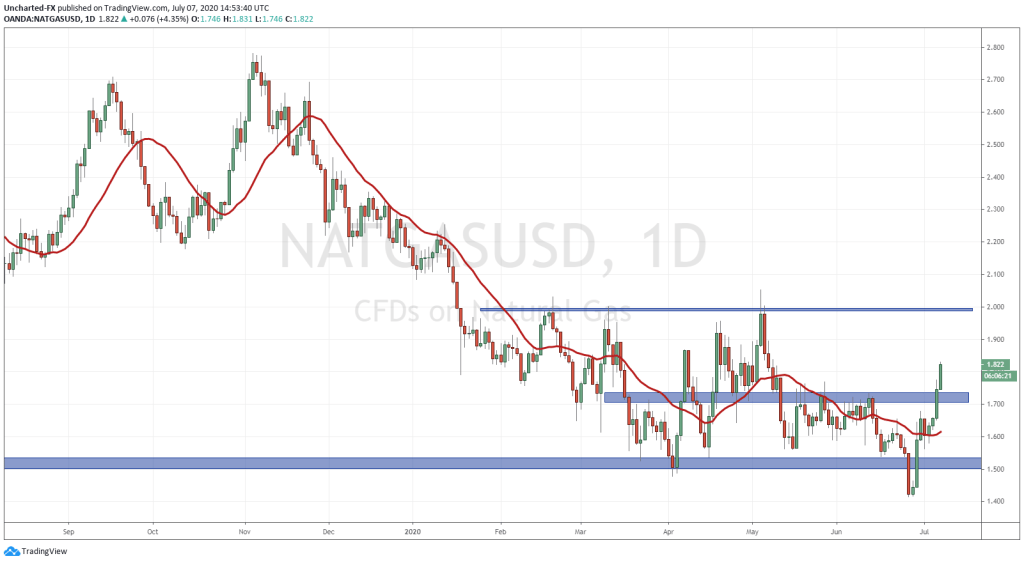

We did not really see the energy sector take off as one would expect. XLE is still holding the break out support, and did not gain momentum on the news.

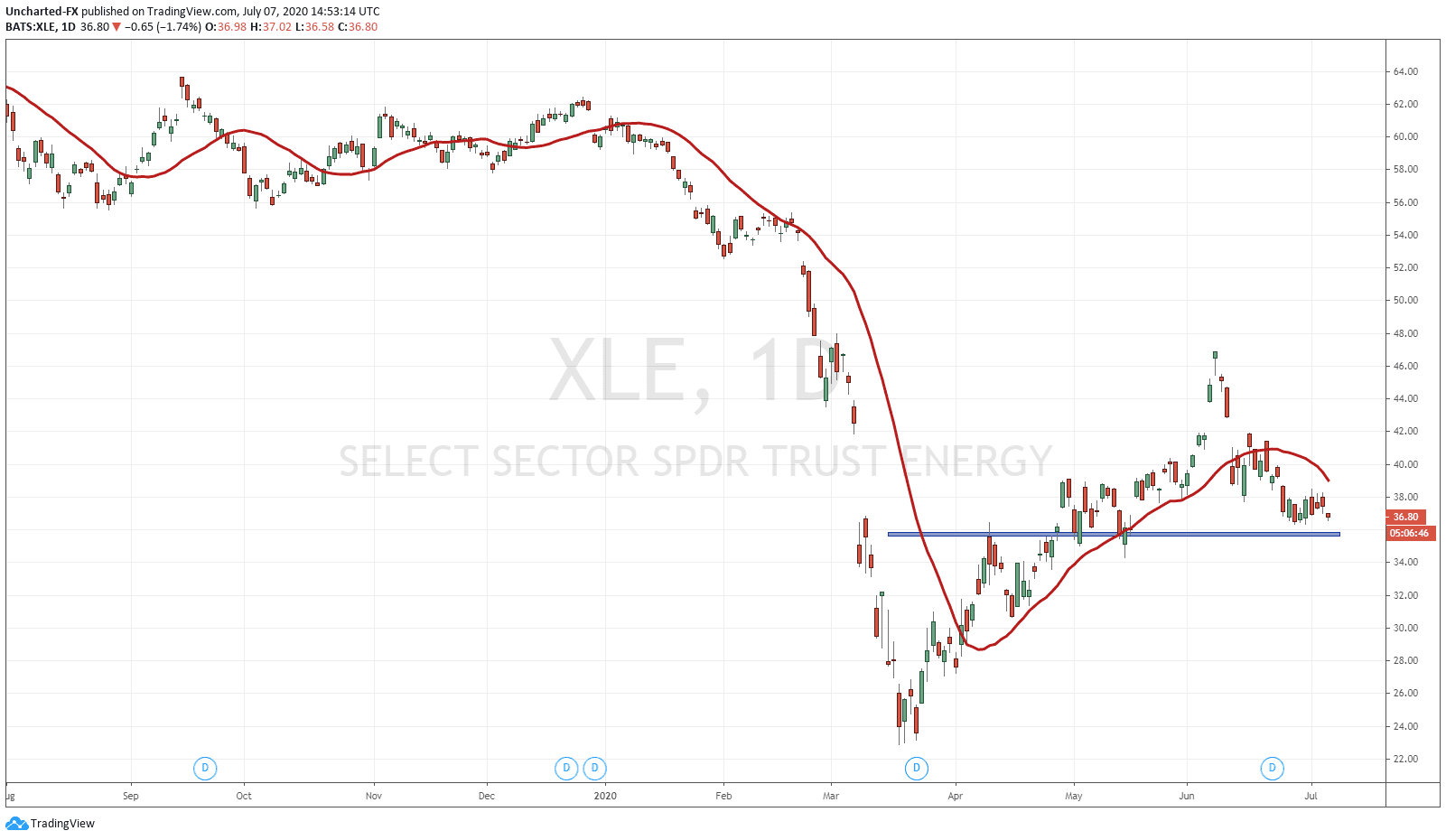

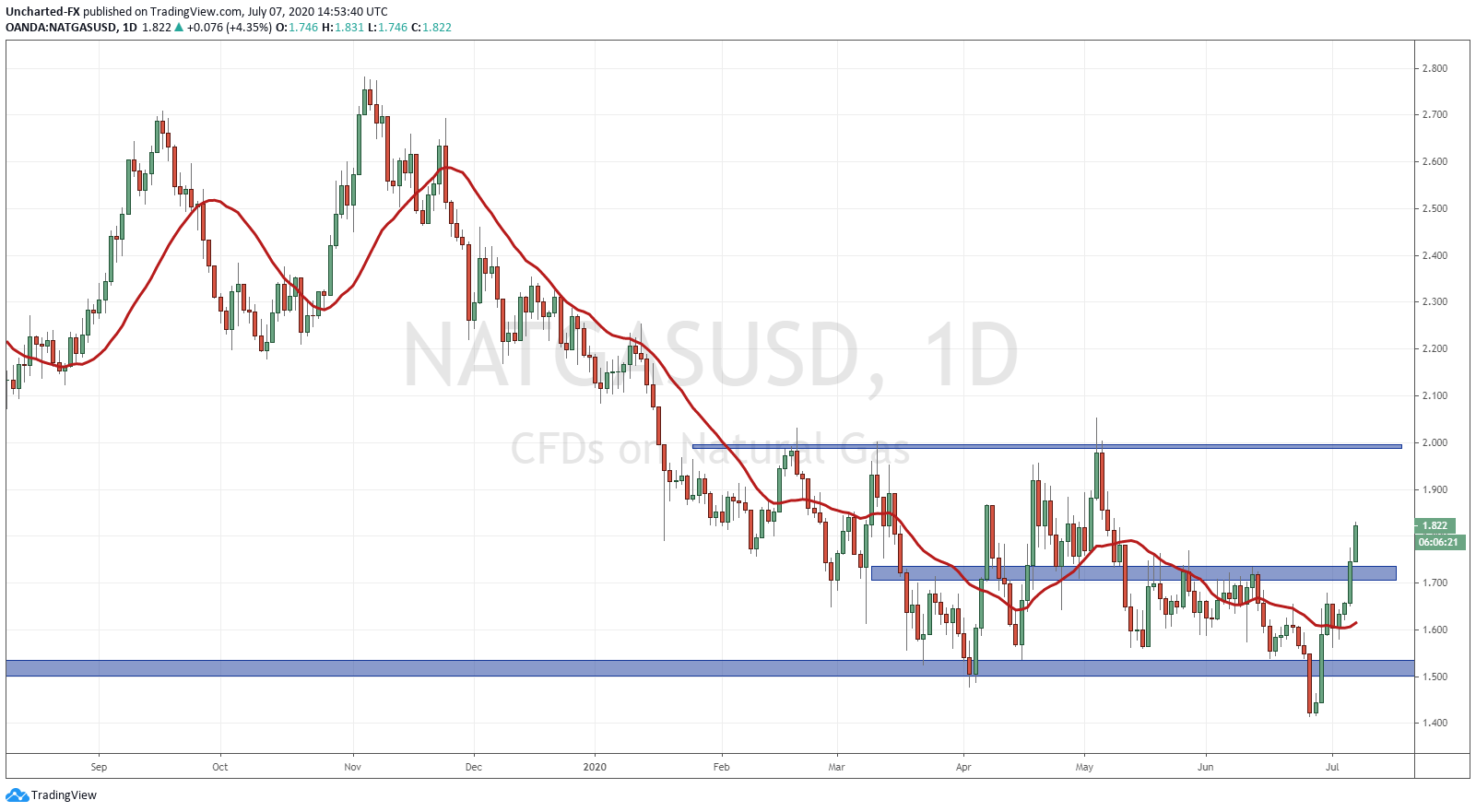

Natural Gas had a nice 5% move yesterday and is continuing higher today. However, this comes after Natural Gas hit all time record lows, and the technicals were indicating a reversal. We had a fakeout after breaking lower below 1.50 and now broke and closed above previous lower highs at 1.70 ending the downtrend. This is a bit strange since Natural Gas is seasonal. Usually moves lower during the summer months but the excess supply of Natural Gas has impacted the markets. On this break, we can target 2.00-2.10 purely on the technical break.

Back to Buffett. Is this a signal investors on the sidelines have been waiting for? There is one big issue about this acquisition. Yes it is showing Buffett is using his war chest, BUT it seems he is entering in on defensive positions. This is not indicative of someone wanting to take higher risk and betting on the revival of the US economy akin to buying companies like General Electric, Bank of America and General Motors as he did back in 2008. Utility stocks are seen as defensive because people always will have to use energy and electricity. It is a safe bet. So I would not be too assured with Buffett entering here in Dominion Energy. He will definitely be making a return in yield on this trade, but the dividends are more concrete than one betting on the US economy returning and consumer spending.