I shot out of town for a few weeks recently, managing to get well drenched in a tent in the BC rainforest, and being without cellphone access for most of two weeks will teach a guy a thing or two about his relationship to the markets. It used to be said you should ‘sell in May and go away’, because all the brokers, big investors, deal makers, and even promoters would head out to their cabins over summer and drink and do blow and get a tan and ride the speedboat too close to the rocks, and everyone would come back in August to do business again. That was the way it used to be, back when stocks were traded by yelling things and writing numbers on chalkboards, but we’re in a new world now, where most trading isn’t even done by humans and massive swings one way or another can come on a random afternoon on no news, and terrible news can just as easily correspond with a stock increase as it can a stock drop.

These days, tou take time off to your peril. The market is a monster that no longer hibernates, where those with an interest on the west coast can watch the trading action in Asia at 11pm on a Sunday night, and wake up at 4am to read the Monday North American news releases as they drop, readying for trades at 6:30am while most folks are still an hour away from hitting the snooze button.

While checking out for a bit, I missed Nano One Materials (NNO.C) saying, at $1.59, that they had no idea why their stock was up. That’s a good thing, because I might have taken profits on the battery tech researcher/developer at $1.60. Instead, my long term shareholding sat unmonitored for two weeks. Today, it’s at $2.38 with slim asks suggesting it has more room to run. Blessed are the oblivious.

Before I left, I’d been hearing that Cannabis One (CBIS.C) was working on a rehabilitation of itself after a big slide in stock price nearly a year ago and subsequent months where they missed, well, everything. The pitch now was, the company had shaken off some of the ne’er-do-wells that had anchored it hard since its inception and a hard brush was being applied to its, frankly, syphilitic undercarriage.

Then came a regulatory halt, applied for a lack of financial filings that the company says will be fixed by end of week.

CBIS management says it understands it’s sitting 50 yards behind the starting line as it attempts to rejig, and had asked me to help hold them to account to show they’re not hiding from the past, job I relish doing. There’ll be some serious work to do for that turnaround to become real – few companies bring a more aggressive response from certain investors as CBIS… but if a company was to turn itself around properly, asking me to dig around in their trash and deliver ass-kickings where needed is a good sign.

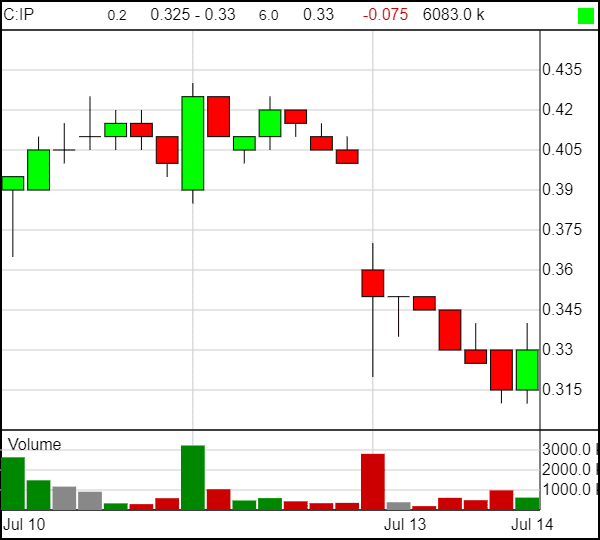

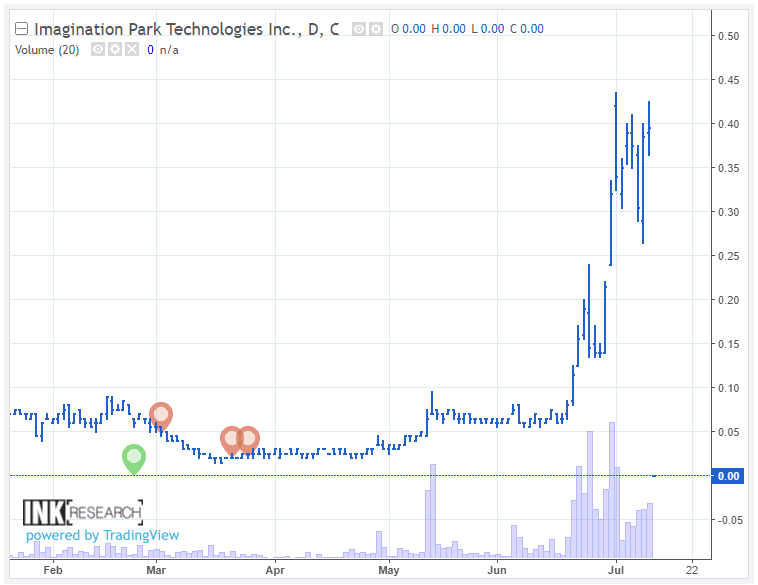

Speaking of digging around in trash, I noticed while I was gone that ImagineAR (IP.C), formerly Imagination Park, formerly Geonovus Media, formerly Geonovus Cannabis, formerly Geonovus Resources, is back from the dead and pumping hard. You may recall this crew from back in the days when I wrote this infamous destruction of their deal.

https://equity.guru/2017/03/20/short-hard-imagination-park-ip-c-story/

Back when it was called Imagination Park, we took a massive amount of value out of IP’s market cap when we exposed the company for lying to shareholders, making claims that couldn’t be backed, attaching itself to D-list celebrities for stock, and hyping itself to the point where it became a short term multi-bagger, and eventually a multi-term short-bagger.

Stay tuned: I’m about to do it again.

ImagineAR is going on a terrific run, to the point where folks are cashing in warrants and buying into the charge.

Sorry to tell you, folks, but ImagineAR is smoke and mirrors, just as its last six versions were.

The ImagineAR strategy is to take advantage of the fact that few people understand Augmented Reality/Virtual Reality (AR/VR), and will respond with a ‘gee whiz’ to just about any old piece of bullshit tech-heavy news release because they assume doing business in that space must – simply MUST – bring revenue.

The non-virtual reality on this is, VR projects are generally little more than demo reels for the people who developed them, they sit for free download on a variety of underwhelming aggregator sites, and there’s not enough folks out there engaging with them to matter in any meaningful way.

Flashback!

At Equity.Guru, we quietly watched IP.C stock go ape-shit over the last couple of weeks, jumping from a perennial $0.05 to ten times that, leading them to announce Monday that they’ll be raising $6 million to “aid in the Company’s ongoing efforts to create and deliver transformational experiences through the production and distribution of intellectual property for film and virtual reality and for general corporate purposes.” In other words, “Just give us money, dudes, we’ll figure out what it’s for later.”

The problem is, that sudden 10x spike definitely resembles the pump period of a process you may know colloquially as a ‘pump and dump,’ and anyone investing in that $6 million private placement is going to be stuck holding the stock for four months while, we believe, short sellers and early holders will tear the share price to ribbons.

This is exactly what happened, and pretty close to what’s happened again this past month.

The stock eventually dropped hard and skidded off the road, but it turned out it wasn’t shorters doing the damage. Rather, it was the executives at the company itself, who were selling what they could get away with selling in the days just before they announced a big (cheap) financing – a situation that was the very definition of illegal insider trading.

Eventually, the feds stepped in and asked the company to explain itself, and the company ultimately avoided legal issues by publicly agreeing to ‘educate’ its management team on ‘what insider trading is,‘ a tacit admission that yes, the execs broke the law but, no, they’re weren’t smart enough to know they were doing so

True believers didn’t appreciate our story because we were interrupting a big stock run. Management didn’t like it because we pointed out they were dumping their personal stock holdings days before a PP was announced. The deal guys behind the company actually made physical threats to my staffers and gave me ongoing stink eyes at investor conferences for several years after. (What’s up, Chad, you’re looking well…) But I was right about all of it.

Every word.

Every single fucking word.

Imagination Park was a lie.

We’re forward a few years now and, of course, it’d be fair to give the benefit of the doubt to today’s ImagineAR in the same way I’m hoping I will be able to in time with Cannabis One. Yes, there are some insiders from back in the dark times that remain at the table. Sure, nobody should be punished for the sins of the father. If not for second chances, there’d be nobody involved in the public markets at all.

But with the modern iteration of this company currently going on a significant stock run showing all the same signs of last time, I figured I’d take a look at what’s driving the run and, oof. I found nothing has changed.

Namely:

- Loosely associate with celebrities, giving them shares to stick around

- Loosely associate with bigger companies, claiming basic vendor deals are amazing near-mergers

- Play up your tech as being ‘truly groundbreaking’ when it’s freely available through third parties

- Spend big on promo

IP today is choosing the same ‘we got celebrities’ and ‘everything VR makes money’ course it once ran to roar upward for a hot minute, and traders are, once again, going along for the ride and convincing themselves money will fall from the sky any time you hit ‘record’ on a VR-capable camera.

Here’s ImagineAR pitching you a Flo Rida grad ceremony:

Broward Education Foundation has teamed up with ImagineAR Inc. to create #2020gradsecret — an immersive augmented reality (AR) mobile experience for students graduating from Broward County Public Schools. Using the free ImagineAR app, grads are recording themselves in their homes accepting diplomas from Broward Schools superintendent Robert Runcie, joining international music superstar Flo Rida for a congratulatory message or dancing with either one of them — and instantly sharing the videos on social media. The interactive AR videos make it appear that Superintendent Runcie and Flo Rida are inside the graduate’s actual home. This AR experience has never been done before and is truly groundbreaking.

Truly groundbreaking! I mean, three years ago I had a god damned Snorlax show up in my bedroom through the Pokemon Go app, but yeah, okay, ‘this AR experience has never been done before!’ Sure.

#2020gradsercret is OUT! @browardschools

… World’s first augmented reality AR graduation celebration! Mr. Runcie…FLO RIDA and YOU starring in your own videos …in YOUR HOME! .. https://t.co/LEB57C1yXY CONGRATULATIONS! RT with #2020gradsecret @BrightStarCU @browardedfound pic.twitter.com/K9tTCmBr48— Broward Education Foundation (@BrowardEdFound) June 15, 2020

There have been a total of 27 tweets using the suggested #2020GradSecret hashtag since May, and none this month. Most are from the company itself or the Broward Foundation. It appears two grads have actually used it, and those have been retweeted by the company a dozen times.

COOL TECH.

It appears the opportunity to ‘dance with Flo Rida’ using augmented reality just isn’t as cool as IP thinks it is. Which is amazing because, KIDS, WHAT’S COOLER THAN THIS?

Virtual #2020graduation? ++ @browardedfound @iptechar #2020gradsecret Augmented Reality Graduation Celebration! Broward Schools seniors can record themselves w/ #SuptRuncie and #FLO_RIDA & share on social media with #2020gradsecret #epic @BrightStarCU @metrosigns @BECONTV pic.twitter.com/HsFxpU5Dob

— Broward Education Foundation (@BrowardEdFound) June 15, 2020

I’m no Zoomer but, oof.

Another routine Imagination Park used to pull was piggybacking on other companies with actual business to claim that business was going to come to them too.

On March 12, 2017, IP announced it had inked an exclusive agreement with Michael Bisping of the UFC to make a behind the scenes virtual reality program about him. Wows, guys! Fight VR! [..] There’s definitely an audience for this kind of thing. The proof of that is that the UFC has a department that produces these films by the dozen every year, and those productions not only get access to all the fighters, but they can use UFC branding, distribution, and media.

Imagination Park cannot.

Unable to use any UFC logos, branding, footage, or distribution, and with VR content usually being offered up for free, there was absolutely no business model for this plan at all.

Here’s where it ended up – 15 minutes of total footage, given away for free:

I mean, it’s fine I suppose, but IP pitched this to investors as ‘proof’ they were butting edge and ready to explode, but it took three years for them to get 13k views on this, and they’ve never made a dollar for it.

Later, IP would claim it was ‘partnering with Microsoft’ on VR hardware. That has also seen no revenue, but got a short term stock bump so, yay.

The new ImagineAR is still working this same line today, ‘partnering up’ with a big consulting company but not getting any actual committed business out of it.

North Highland specializes in many areas to serve its global customer base, including the media, entertaining and communications sectors; at its core the firm is the world’s leading change and transformation consultancy. With augmented reality expected to play an increasing role in both the enterprise and consumer markets, proper adoption of AR solutions will be important for companies that are seeking to expand their capacity of digital and embrace new technologies.

The addition of the ImagineAR augmented reality platform to North Highland services will provide the firm with another innovative option to deliver fully immersive mobile experiences to its exclusive list of global clients.

The company partnered up with the Louisville Bats minor league baseball team for the #CurbsideBuddy restaurant ordering drive, where folks were encouraged to download the ImagineAR app and post when they got food at a drive-thru.

Bats partners will have exclusive sponsored Mascot AR engagements at their food pickup locations. When fans place a carryout order for any of the participating restaurants, they can use their mobile phones at the curbside pickup location to enjoy the unique Bat’s AR Model e-collectible and share the picture on social media with #CurbsideBuddy.

The Bats didn’t pay anything for this, which is probably a good thing because it appears only 15 people appear to have bothered entering.

#CurbsideBuddy pic.twitter.com/3WEZ6Zlr0s

— Chris Davidson (@chrisdavidson81) April 20, 2020

And, more recently, the company crowed that it was giving AR something or other to a company that owns three New Jersey-based escape rooms and a couple of ‘rage rooms’ where you can go break old TVs and such. No revenue mentioned because, let’s be honest, if they’re earning four digits on the deal I’m Dutch.

You can also use their app to put a terrible flag on a wall. Amazing.

Since we’ve had a rainy week we’ve finally got outside to celebrate being Canadian! @IPtechAR #imagineARholiday #imagineAR #canada #CanadaDay2020 #CanadaDay pic.twitter.com/Xt70cAsfa3

— SH (@flacker1985) July 5, 2020

Six people have bothered, based on the hashtag.

I’m not going to suggest money can’t be made on AR, but it most assuredly can’t be made doing instagram videos for minor league baseball teams or sticking a flag on a blue wall with your phone. I mean, Snapchat filters have been doing this for years, to the point where you can’t do anything on the online dating world with blocking girls with dog ears, so where is IP going to make, like, any money?

They better figure that part out soon because, here’s IP’s most recent financials:

- Revenues: $27,023

- Office rent: -$41,382

- Shareholder promo: -$99,760

- Software costs: -$174,147

- Consulting fees: -$465,438

- Net loss: -$877,003

All of that genius tech, all of those hashtags, all the Flo Rida you can handle, and $27k in quarterly revenues?

But somehow, regardless of the emptiness of their news releases, the lack of revenues, the fat loss, these guys have gone from a $5m market cap to a $40m market cap in a month, a trick so stunning it’s almost impressive.

To get there, IP borrowed $1.4 million in two tranches in February, at 12% interest, and then put that money towards promotion of the stock.

Here’s what that’s bought them:

ImagineAR Has Already Started Commercializing Its Augmented Reality Platform

Clients Include:

- NBA Sacramento Kings

- Mall of America

- AT&T Shape

- Basketball Hall Of Fame

- Milwaukee AutoShow

Amazing. Incredible. Such win! These amazing deals must have brought in fat revenues, right?

Not exactly.

- On the upside, last quarter they “sold Imagination Park Alberta Ltd. for proceeds of $6,000, which resulted in a gain of $8,758.” Profit!

- Downside: “Dissolved 1142128 B.C. Ltd. due to inactivity which resulted in a loss of $8,902 during the year ended August 31, 2019.” Loss 🙁

- Upside! “Impaired 3 Seconds Holdings Inc. due uncertainty around future benefits which resulted in a gain of $465 during the year ended August 31, 2019.” Profit!

- Downside: “Impaired investment in Kindergarten Holding. due uncertainty around future benefits which resulted in a loss of $20,117 during the year ended August 31, 2019.” Loss 🙁

This sort of thing isn’t new for IP. In December 2017 they announced, with great fanfare, that Hollywood producer Jeff Rice was joining their advisory board and selling his production company to them for $50,000 in stock.

Mr. Rice has produced over 90 movies including 2 GUNS (Denzel Washington) and END OF WATCH with Jake Gyllenhall and Michael Pena. He has worked on some of Hollywood’s most successful movies and with stars ranging from Robert De Niro to Russell Crowe.

The company bragged he would immediately bring them an option for a big Hollywood film called Truth. Eight months later, the company wrote off that option and the $50k they spent getting it. Loss 🙁

Then this:

The Company acquired 66.67% of the outstanding share capital of 3 Seconds Holdings Inc. in consideration for a cash payment of $126,659 (US$100,000). The acquisition was determined to be an asset acquisition and the total consideration, including the non-controlling interest, of $189,989 was allocated to a net profit interest in the film “The Informant”.

What happened to that one?

During the year ended August 31, 2018, $189,989 of net profit interests acquired were expensed due to uncertainty around future benefits.

Yep, they paid $100k to get a net profit from a film that was never made, in an industry that notoriously never pays net profits, ever. Batman, one of the highest grossing movies of all time, has never paid out net profits to the people behind it, because Hollywood always always always finds ways to add expenses on the books to ensure they don’t have to cut cheques.

That’s why big stars take a piece of the GROSS PROFITS. We mentioned this a couple of years ago, while IP fanboys were yelling about the amazing deal IP had done and how they were all going to be sipping champagne at the Chateau Marmont soon.

Another thing IP has been great at has been farming out warrants and options to anyone who looks at them sideways. Currently, with the stock at $0.40, there are 4.8 million stock options out there priced at $0.10 or less. Rather, there were. A lot of those are being cashed in right now.

With the stock suddenly jacked, the company says it’s raised $1.5 million on the back of those executions. That’s good for the company, but it’s even better for Sheldon Inwentash, who sits on the company’s board, who sold nearly 3 million shares of IP directly, and indirectly through ThreeD Capital (formerly Brownstone Energy) and 1313366 Ontario Ltd, which was the company Brownstone RTOed into.

‘So what,’ I hear some of you asking. ‘If Sheldon likes the company enough to cash in warrants in it, why shouldn’t he?’

And you’re right., except Inwentash, ThreeD, and 1313366 Ontario sold some 2.9 million shares in the company at between $0.047 and $0.02 (totaling around $180k), which they then turned around and loaned back to IP through a debenture, which brought them another 7 million warrants to add to the 7 million they already had.

Immediately following the transaction, [ThreeD] held an aggregate of 2,626,000 common shares and convertible securities, including the subject debentures, entitling the acquirer to acquire an additional 15.15 million common shares of the company, representing approximately [..]13.5 per cent assuming exercise of such postconvertible securities only).

Keeping up?

After some rabid promotion, IP is now trading at $0.40, meaning Inwentash and his pals could potentially take 13.5% of IP, good for an instant 20x on their cash. They sold at $0.02 to finance an investment at $0.02, with warrants jammed so far up their arse, they’re shitting cheap paper.

- So the big question right now is not ‘does ImagineAR have a business model that makes money’, because they don’t.

- And it’s not, ‘can they continue this run’, because they realistically can’t unless they actually figure out how to make revenue in an industry where everything is given away for free – or continue overpaying for promotion.

- And it’s not, ‘will thousands of Broward County grads dance with Flo Rida thereby bringing IP fat money’, because they’re not.

The big question is, can IP keep it’s share price elevated based on pure pumpage and hype long enough to let Sheldon take his warrant profits (which come free trading in July by my reckoning) without the stock collapsing under the selling action?

If Inwentash is a long term holder with all the faith one can muster in the company, why sell stock in February, at a mighty $0.02, to finance the purchase of more? The man has more money than three Kevin O’Leary’s (side note: So do you, Kevin O’Leary is a billionaire on TV only) so why bother selling $180k of stock to loan out $200k?

If he loves IP, why isn’t he buying more? Why is nobody connected to the company on an insider level buying anything but sub-2c warrants?

How long will it take before we see a $0.40 private placement (or, more likely, a $0.32 placement designed to look ‘cheap’ to raise money to pay off Sheldon’s debentures, or do more promo?

And how long will it take for Sheldon to take his profits and leave ImagineAR once again buckled in the gutter?

This sort of jiggery fuckery has happened at IP before. They’ve enacted a long line of phantom partnerships that came to zero, announced big deals that have been written down to nada, and grabbed hard on the coat tails of any celebrity they might be able to find that might make it appear they’re better than they are.

This sort of jiggery fuckery has happened at IP before. They’ve enacted a long line of phantom partnerships that came to zero, announced big deals that have been written down to nada, and grabbed hard on the coat tails of any celebrity they might be able to find that might make it appear they’re better than they are.

Like when they took C-level actor Lochlyn Munro onto their advisory board back in 2016. Munro seems to be a nice enough guy and all, but his involvement also appears to be more about talking them up on Twitter than any actual ‘advice.’

He comes cheap, if this recent tweet is any indication:

Hey, Vancouver Peeps!! My good friend, joeyk1964 , is an @underarmour rep and they are having a huge sample sale in Vancouver next week. So if you are in Vancouver, head on down to :

FX Building

Room #242

1951 Glen… https://t.co/86wsnokf9V— Lochlyn Munro (@LochlynMunro) July 11, 2020

Hey, a man’s gotta live.

That ‘massive’ celebrity signing happened around the time IP gave up some $172k to B-list movie producer Gabe Napora for a net profit interest (we talked about how that’s vaporware earlier) in some films he was producing. IP also agreed to finance those films into the deal, but never managed to do so, which meant the $172k was written off, thoguh Napora made much more than that when he received 5c stock and sold post-pump, pre-placement for some 5x more…

The only time I’m aware of that IP actually turned revenue was as part of this hinky deal that still makes no sense:

..revenue of $454,854 (2017 – $37,024). Revenue in 2018 is related to the production of the Chinese television series “Always With You” through the Company’s newly acquired subsidiary, 1142128 B.C. Ltd. The Company has also incurred $454,854 of production costs in 2018 relating the production for net profit of $Nil.

My personal favourite was back when the company agreed to buy the back catalogue of the garage band led by then IP director and former Affinor Growers (AFI.C) boss Nick Brusatore, after he quietly said (I was in the room when it happened) he’d put the money back into the company’s stock on the open market.

Instead, he sold the stock.

And whatever happened to that deal?

The assets purchased during the year ended August 31, 2015 consist of intangible music publishing rights, of which $449,900 has been expensed due to uncertainty regarding the future value. As at May 31, 2017, $100 remains capitalized on the consolidated statement of financial position.

Last I heard, Brusatore had moved to the Caribbean.

ImagineAR is a shitty deal for multiple reasons – the insider-friendly deals, the long history of never turning a single opportunity into substantial money, or any money, or better than a loss, the cavalcade of ‘celebrity advisors’ who don’t advise, the directors who churn in and out, the business models that sound great until you ask how they’ll make a profit, the ongoing and substantial losses, and the handing over of a significant portion of stock in the company to guys in return for money they loaned that was sourced from selling company stock.

To be clear, I haven’t a dog in this fight. If you guys want to chase the dragon on this thing and figure you won’t be the ones left holding the bag after Inwentash and co sell out, or while they figure out how to direct another 7% of company stock back to themselves, or as more ‘Hollywood producers’ roll through offering net profit on films that don’t exist yet, or as news releases pile up describing how a Schenectady Popeyes has agreed to sell ImagineAR technology, or that a Florist’s shop in Albequerque is now using AR to sell carnations, hey, you do you.

But I don’t like seeing folks lose their savings. This one is primed for a short attack and, the way folks are positioned, it may well come from within.

It won’t come from me, because that’s not how I roll, but boy howdy do situations like this one make me rethink that rule.

May god have mercy on your souls.

UPDATE: Looks like some shareholders agree with me. This morning’s trading has been… interesting. Down 22% at the time of writing.

FULL DISCLOSURE: Really, Chad, how are ya, bud?