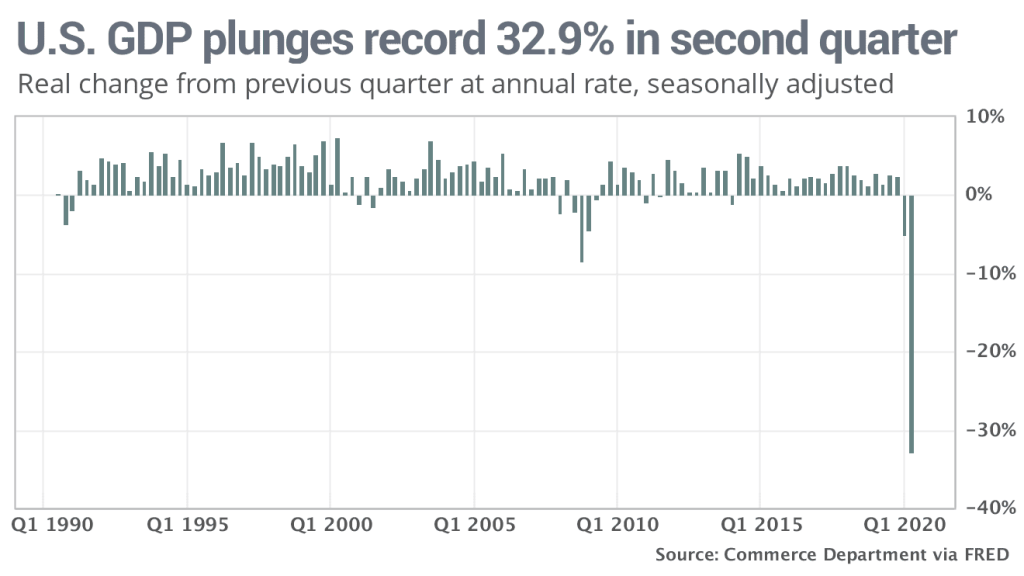

We all knew that economic data was going to be bad. I don’t think we expected anything like this though. It has come out that the US economy has suffered a Q2 GDP plunge of 32.9%! Numbers not seen since the 1940’s during World War II. Markets are shook. An overall decline of markets falling over 1% (except the Nasdaq at time of writing) with the Dow breaking below a major support level that we have been watching. The other indices remain above support. To add insult to injury, US jobless claims came out topping 1 million for a second straight week (1.434 million), raising fears of this so-called second wave of layoffs…and raising doubts on the recovery narrative.

Just to give you my real world experience: I live in a suburb of Vancouver. Yesterday, I decided to take the train down to downtown for the first time since March. The transit parking lot that I park in is generally filled up by 9 am as people commute to work early. Well at 10 am, I drove to the parking lot and parked right in front of the entrance of the train station…something I would never have been able to do before. I usually would be parking in the third overflow parking lot. Either many more people are working from home, or the layoffs have been immense, and jobs are NOT coming back!

There is hope for the markets still. It may come from the courtesy of the FANG stocks. We have Facebook, Amazon, Apple, and Alphabet (Google) all releasing earnings post-market. These are big companies that can impact the indices with their moves alone. We are especially watching Facebook, as ad costs have been the cheapest they have been since 2017, and there is a chance that Facebook’s earnings will reflect this. The moves in these stocks can be big enough to create a rally for the whole market. Until then, the market is still digesting the data, awaiting for post-market earnings, and most remain above key support zones. There are plenty of other opportunities out there especially from the Forex side.

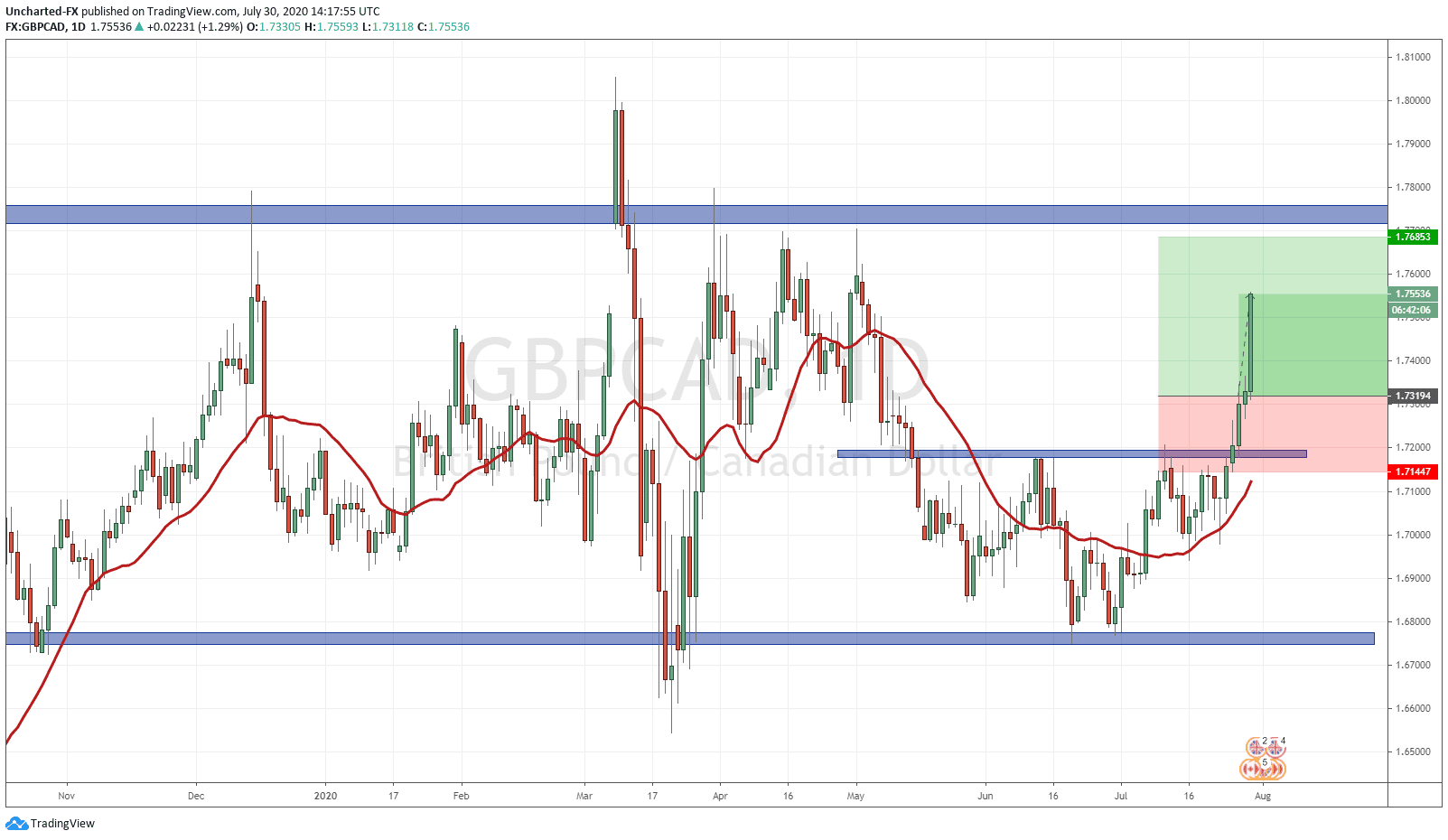

Yesterday, I spoke about our GBPCAD trade idea and want to give a quick update. The British Pound is hot today! On our discord channel, we look at GBPNZD and GBPAUD together with GBPCAD. If you took any of those trades, you would be making bank. Our GBPCAD trade idea is up over 200 pips! This is a profit between $200-$2000 depending on your position size! Not too bad for a one day hold! As you can see, GBPCAD has not hit our target resistance zone yet. We still can expect a move lower to form a higher low before climbing higher, so do anticipate this. Price rarely moves in a straight line to our target, but rather in waves.

What I have done is closed half of my position. I open two positions for my Forex trades sometimes even more depending on the risk to reward set up. This allows me to ride one position, while locking in gains to then have a risk free trade. Proper trading is consistent, and the way this is achieved is by taking trades with good risk vs reward ratios, and also being disciplined in following rules. Closing half locks in 200 pips worth of profit, and frees up margin for me to take another trade…say something like EURNZD!

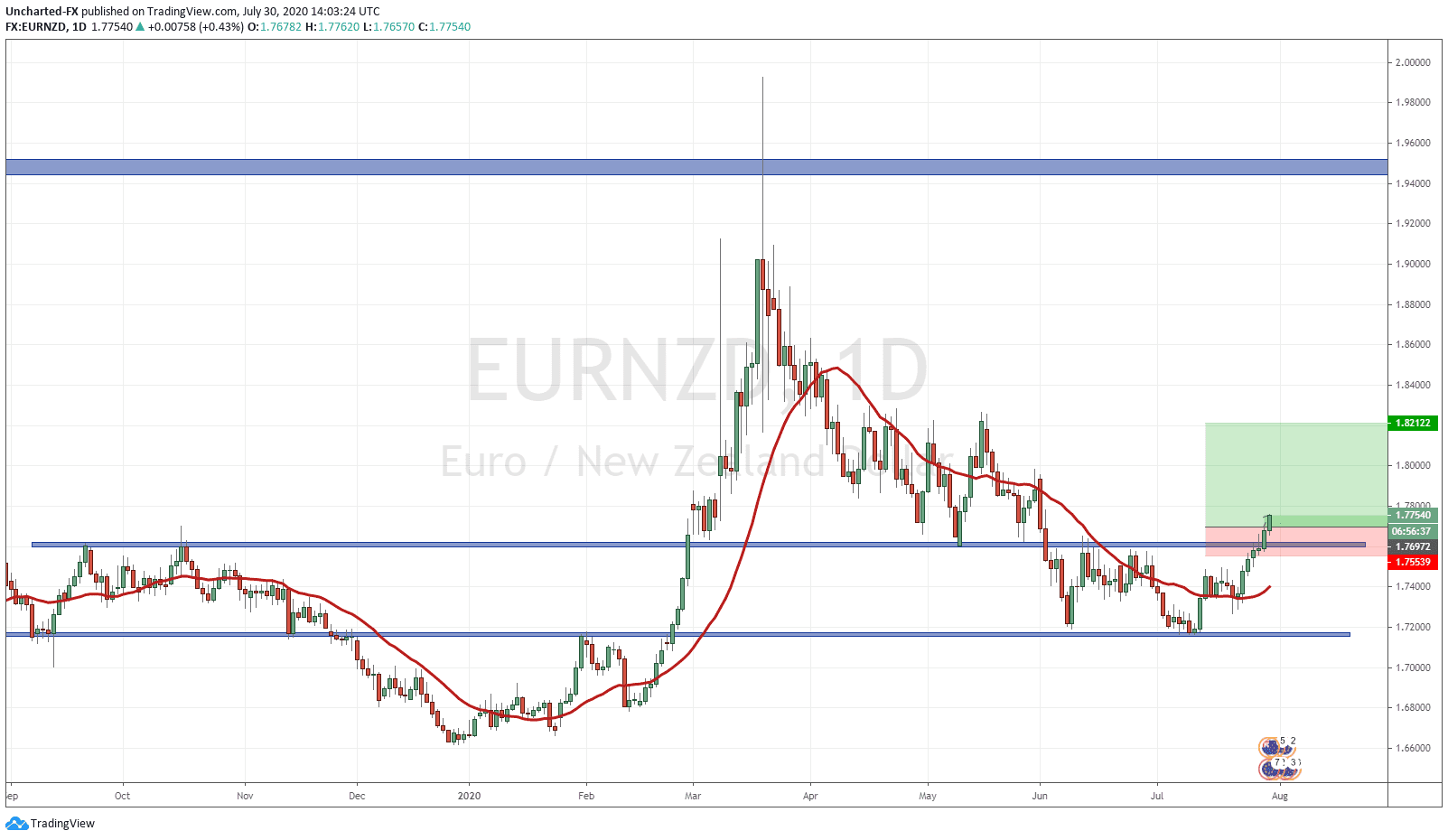

A lot to love about this set up. First of all, it was in a prolonged downtrend making lower highs and lower lows. Multiple waves down. We then hit a major support/flip zone at 1.7160. From there, we had signs the downtrend was exhausting because we stopped making new lower lows. In fact, we formed a somewhat deformed head and shoulders pattern with the right shoulder coming in at 1.7350. This was confirmed with yesterday’s breakout and close above 1.76. A nice break and we are in!

This trade has a good 1:3 risk vs reward area targeting the 1.82 zone with our stop loss below the breakout candle, but of course a few pips below to avoid market makers and brokers from hunting our stop losses. I would watch the interim resistance at 1.80. What I will do is assess how candles react there, but I am very likely to close my first position and let the second ride.

Remember everyone that this same strategy and analysis can be applied to any chart or any assets whether it be Forex, Equities, Cryptos or Commodities. Market structure is just how every market moves. I have proven this with trade ideas on all sorts of assets, and I will continue to do this here on Equity Guru’s Morning Market Moments.