A big day for markets. It is Fed day. The Federal Reserve is set to give us their interest rate decision and updates on monetary policy today at 11am PST/2pm EST with the Jerome Powell press conference to follow at 11 30am PST/2 30pm EST. It is the press conference that you really want to watch. For anyone interested in trading the markets, I suggest listening to the conference and having 1-5 minute charts open on the S&P or the Dow, and the US Dollar. A rule that I have been following for swing trading is to not trade these high risk events. You never really know how the markets and currencies will react. This means that the day before the Fed rate decision, I do not open any positions betting on equities (S&P, Nasdaq, Dow) nor any currency pair with the US Dollar. If I have been in an equity position or a US Dollar position as we approach the Fed meeting, I will close the position. These are just rules that I follow and are meant to minimize risk. The last thing I want is to be up in a swing trading position just to see it trigger a stop loss on a major event. To the Forex world, this is similar to playing earnings. Many people know that certain earnings will come in great, only for the stock to sell off on the data. It comes down to whether the market has priced all that information in or not. This can be difficult for new traders, but this is why I enjoy technicals. I believe technicals can tell us what certain events or data will turn out to be sometimes weeks or days in advance. It shows us how money is being positioned.

Stock markets have been the major talk since February. However, I believe the largest moves to come in the future, and the moves that will have the largest repercussions will be in the currency markets. We are already seeing this with Gold making new highs against every fiat currency including the US Dollar. This is generally a sign that those currencies will be inflating. With current central bank and government fiscal policies you can see why. The term currency war has been thrown around a lot especially in context with the US China trade deal. In this world every nation is in a currency war. Every central bank is trying to weaken their currency. A race to the bottom. As a macro, geopolitical and economic history junky,it really is the market to watch.

So many people know that in stocks, you get profit for every cent the stock moves higher. We call this ticks. From Investopedia:

The equivalent in the Forex world is pips, or from our friends over at Investopedia:

Essentially when USDCAD moves from 1.3340 to 1.3352, that is 12 pips. In profit terms it really depends on how large your position is. Instead of shares, we buy lots. There are things such as micro lots for really small accounts, but due to the leverage and margin in Forex, generally any account can trade normal lots. The standard full lot is 1.0, but you can trade portions of that such as 0.1 or 0.5 lots etc. A standard full lot at 1.0 means an equivalent of $100,000 of that currency. Therefore a 0.10 would be a $10,000 trade, a 0.5 would be $50,000 and so forth. A standard full lot at 1.0 means that for every pip the trade goes, you make a profit of $10. This is different for some Yen and Pound pairs, but for major currency pairs (pairs linked with the US Dollar- EURUSD, GBPUSD, USDCAD, NZDUSD, AUDUSD) this is the case. Whereas a 0.1 position means a profit of $1 per pip.

Forex pairs move quickly. It is a fast market. A 12 pip move can occur in less than 5 minutes. This means that is $12 or $120 profit depending on your lot size. Forex is also quicker to enter and exit. You can do so with one click of the mouse rather than placing orders. The Forex markets are open all day (opens on Sunday during Asian markets, and closes Friday after the US markets). And finally, most currency pairs move at least 200 pips in a day. You can see why the Forex market is attractive to those with smaller accounts or the day traders. Oh and by the way, about $6 Trillion worth of currency is traded over the Forex market per day.

With the Forex markets being open all day, I prefer the swing trading method by looking at daily or 4 hour charts. Once again, I use the same strategy technically to trade all markets because it focuses on market structure. Market structure is the way all markets move. In three ways only: downtrend, range, and an uptrend. Our job is to find a trend that is showing signs of exhaustion, and then take the reversal trade once a new trend is confirmed.

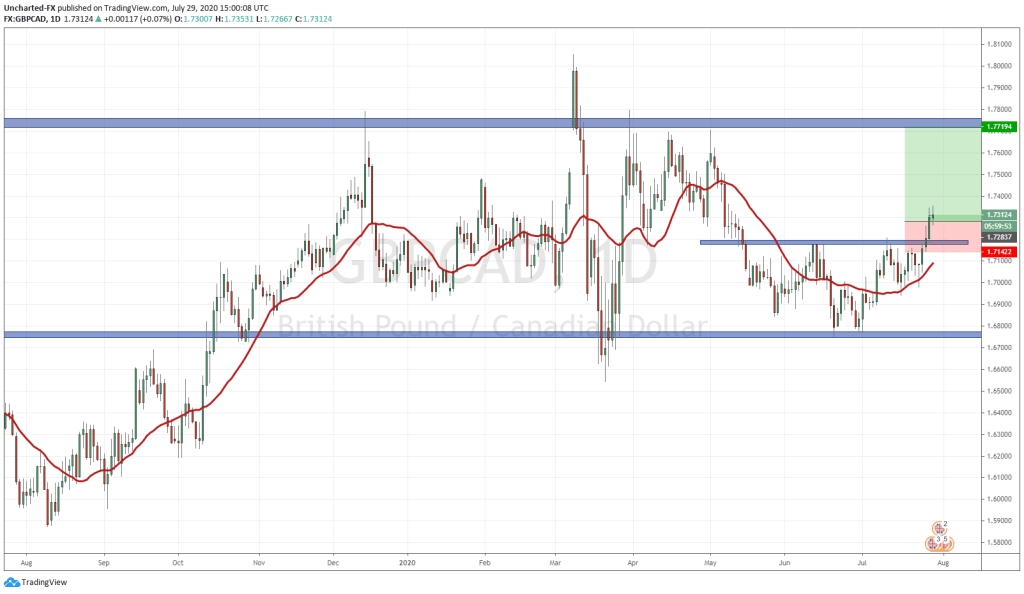

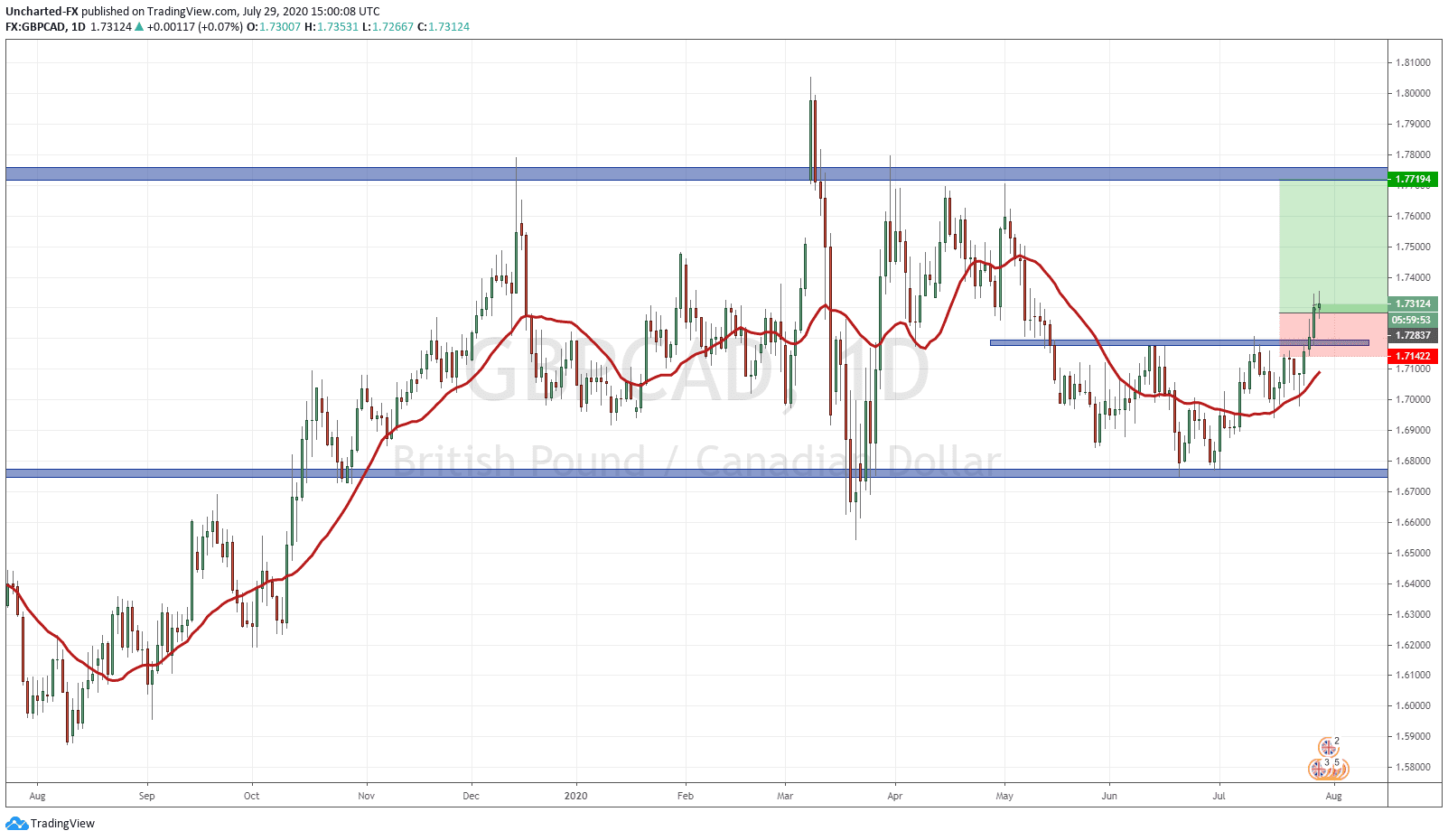

Over on our discord channel and other social media channels, I put out the GBPCAD trade idea yesterday. We have been in an interim downtrend with lower highs, finding support at a major flip zone (a zone that has been both support and resistance) at 1.72. From there, new lower lows were not being made, and a certain reversal pattern pointed out that the downtrend was exhausting. I am talking about the head and shoulders pattern. Technically, it would be the inverse head and shoulders pattern as it is showing us a shift from a downtrend to an uptrend. All it does is show us a switch from lower highs to higher lows.

The most important thing though is the trigger of the pattern. Our entry is only triggered with a clean and strong break above the neckline. As you can see from the chart, we did break above on Monday but I did not like the strength of the candle close. It was a large wick with a tiny candle body above resistance. Yesterday’s candle close was much stronger and was the trigger for entry.

Rules for a typical stop loss means we will place our stop loss below the breakout candle. Slightly lower in case our stops are fished out by brokers and market makers. The most important thing is our risk vs reward ratio is at least 1:2 to ensure long term profitability. For GBPCAD our take profit is 413 pips away at the 1.7720 zone. A risk vs reward of 1:3.

So in terms of profits, it depends on your lot size. This will be a $413 or $4130 trade which can even meet the target by the end of this week, but more likely, sometime next week. Once we reach near our target zone, I will play it candle by candle. We should expect a lot of selling pressure around that zone, which means price may not reach that zone to the dot. So far great trade. I am already up 60 pips and will keep you all updated on how it goes.