NetCents Technology (NC.C) added its platform into the banking automated clearing house (ACH) for all United States-based merchant payouts today.

NC’s addition to the banking ACH will lower the transaction costs for their clients, allowing the creation of a costless bridge between cryptocurrency and traditional fiat, giving the company and its clients more business opportunities through a more developed product suite.

“This development is a massive leap forward for us in driving cost out of the financial infrastructure for our clients. When we pivoted NetCents to focus on Crypto transactions it was paramount from our perspective that we drive down transaction costs and deliver on the promise of a seamless frictionless economy. This milestone essentially creates that costless bridge between the crypto world and the traditional world – enabling us to attack more business opportunities – and offer a more fully developed product suite. Everyone hates paying wire fees – understanding that they are just another way for commercial banks to gouge their clients. We are really happy to be able to offer this costless transfer feature, and believe it will further accelerate adoption of our platform,” said Clayton Moore, Founder and CEO of NetCents Technology.

ACHs are responsible for processing large volumes of credit and debit transactions in batches. ACH credit transfers include direct deposits, payroll, retail payments and vendor payments. These direct debit collections are initiated by the payee with pre-authorization by by the payer.

On the other side of the crypto to fiat divide—some cryptocurrency exchanges will soak you for a small percentage of your stake for converting crypto to fiat, and nobody likes to pay those fees either. It’s a matter of finding out which ones do and deciding whether or not the other perks they offer are worth the bilking. Mostly, they’re not. The charge is almost pure markup—it costs the firm nothing to shapeshift—instead, like data fees for cellphones, it’s purely a money making scheme.

Presenting the ability to make these transactions in an automated no-fee environment outside of exchanges could bring stronger, faster adoption.

The ACH system allows for approved parties to transfer client funds without cost. This is a vast improvement over the legacy bank wire product:

- The company has now integrated into ACH for US-based merchant payouts

- Streamlining the process and eliminated all costs currently associated with US merchant payouts and costs to merchants to receive their payouts

Regardless of the opinions of cryptocurrency hardliners, the marriage of financial institutions and cryptocurrency can only benefit both forms. Financial institutions in that, once the regulatory wrinkles are ironed out, can acquire more customers and cryptocurrency because of the legitimacy and stronger adoption rates.

“The writing is on the wall with the commercial banking industry – for years the leaders of the financial world have dismissed crypto and blockchain as a fraud and a fad, and now they are throwing in the towel, and adopting and embracing Crypto and blockchain as the future, luckily – our user interfaces and workflows are designed to look and feel like state of the art banking systems, so bank executives readily value our technologies from the outset, our job is getting easier as we knock down these doors,” said Moore.

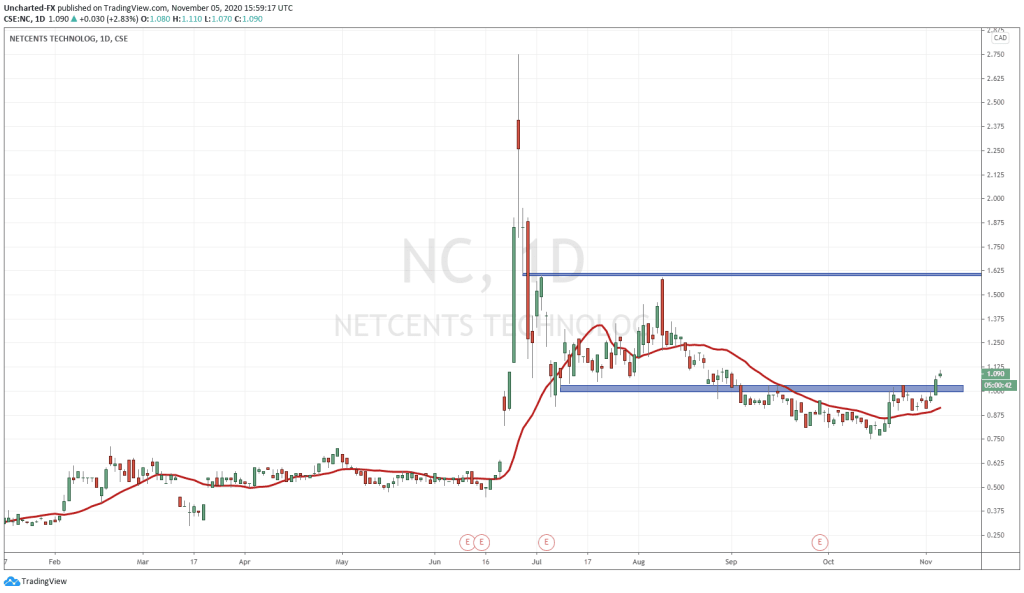

A quick glance at their chart shows that Moore’s words display a hint of truth. This is one of the rare companies in the blockchain and cryptocurrency space that have not only managed to stay afloat come COVID-19, but done well for themselves.

Maybe it shouldn’t come as much of a surprise, though, given Bitcoin’s recent run. When Bitcoin bulls run mostly everyone benefits.

—Joseph Morton