Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA

Gold, along with silver, are my two favourite assets that I enjoy following, and is where I personally am moving a lot of my money into, aiming for the long term. As an investment, not a trade. Gold has had the rally based on the uncertainty and the monetary policy. The pandemic, the great depression like job data, millions of layoffs, US-China trade deal stalling, Hong Kong, India and China border dispute, killer hornets (yes that was a thing), US and Global riots/protests, crazy money printing and stimulus programs with nobody asking how it will be paid for, interest rate cuts, and I am sure I might have missed something. It has been that type of year.

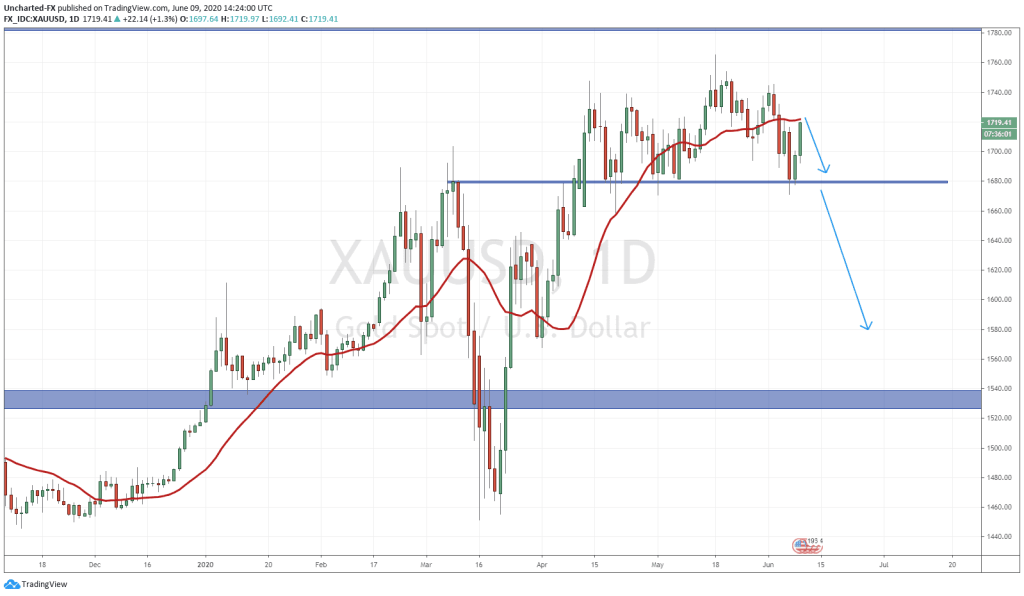

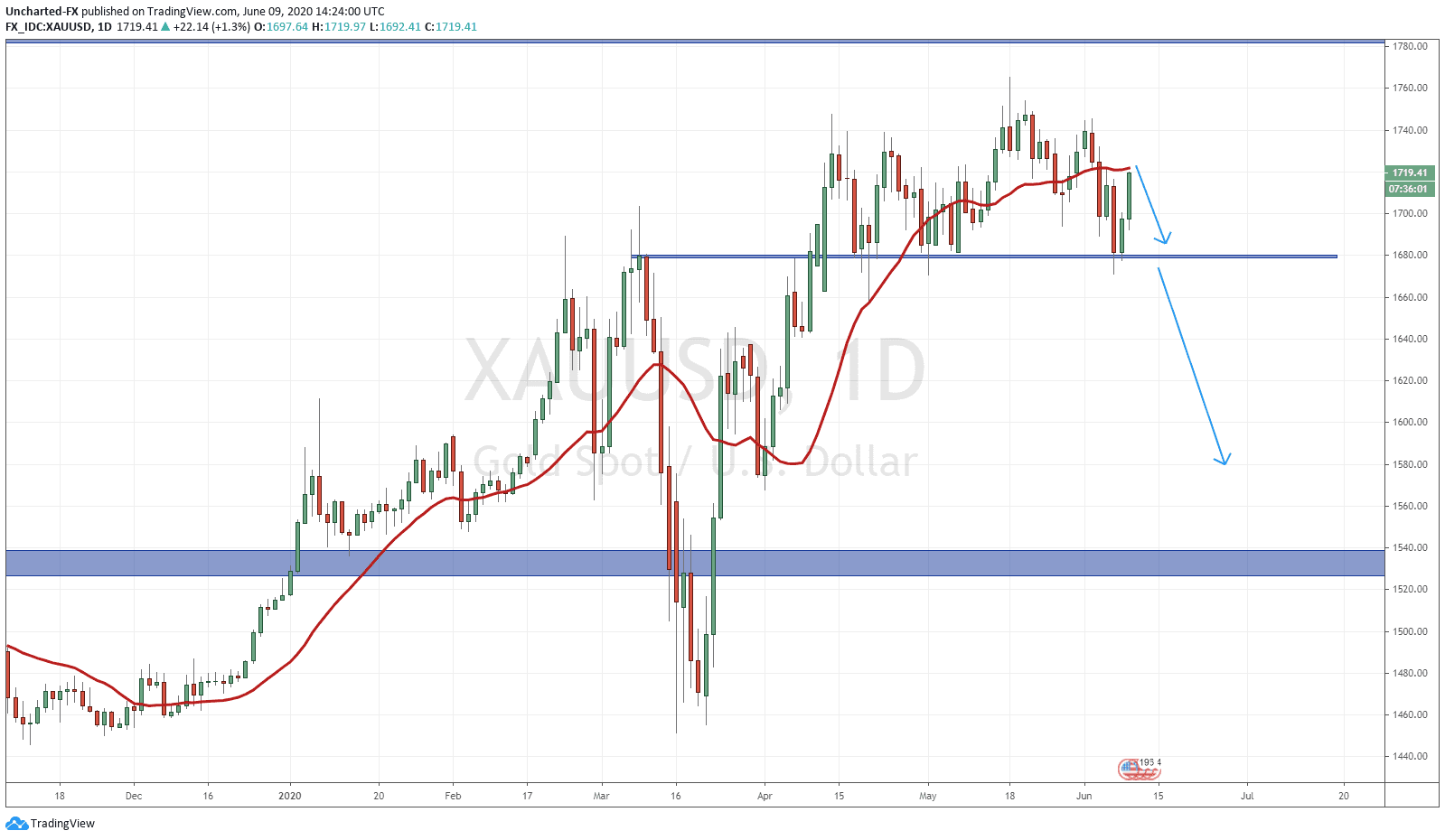

Many would say that because of the environment I just described, it actually would mean Gold will be moving much higher. I do think that is the case, but it appears as if Gold wants a pullback. For it to continue the run higher, technically it would require a break above recent highs at the 1766 zone. There is then an important resistance zone at 1790 that Gold will have to deal with before testing all time highs against the USD at the 1920 zone.

My followers and readers know that I am a market structure guy. I believe all markets only move in three ways, and these occur in cycles. Nothing moves up or down in a straight line forever. In an uptrend, we are more concerned with the higher low swing. By definition, as long as price remains above this higher low swing, we are in an uptrend. For Gold, that comes in at 1680. That low is what we are working with, as it created a higher high up to 1763. This zone also is significant for another reason.

Notice how after the higher low at 1680, price just could not rally and break above. We had one attempt afterwards, but that was sold off, and some may argue that we are having another attempt currency as we have a nice big green candle today. That is fine with me, as we look for a break and candle close for our trades to trigger.

What I am seeing is a topping pattern here. The most famous of them all. The head and shoulders pattern. We can clearly see the left shoulder, and then also the head, which was the run up to 1763. I am watching price here to see if we can form the right shoulder here. For that, I would want to see the daily candle close and remain below 1725.

What is the trigger? Well the 1680 zone which I mentioned is the higher low, but is also the neckline/ support for our head and shoulders. I would want to see a break and close below 1680 for the trade to trigger. There will be an opportunity to front run the right shoulder and the break of that support. That will depend on how today’s daily candle closes. For a comparison, let’s look at a chart I notified the members over on our Discord Channel.

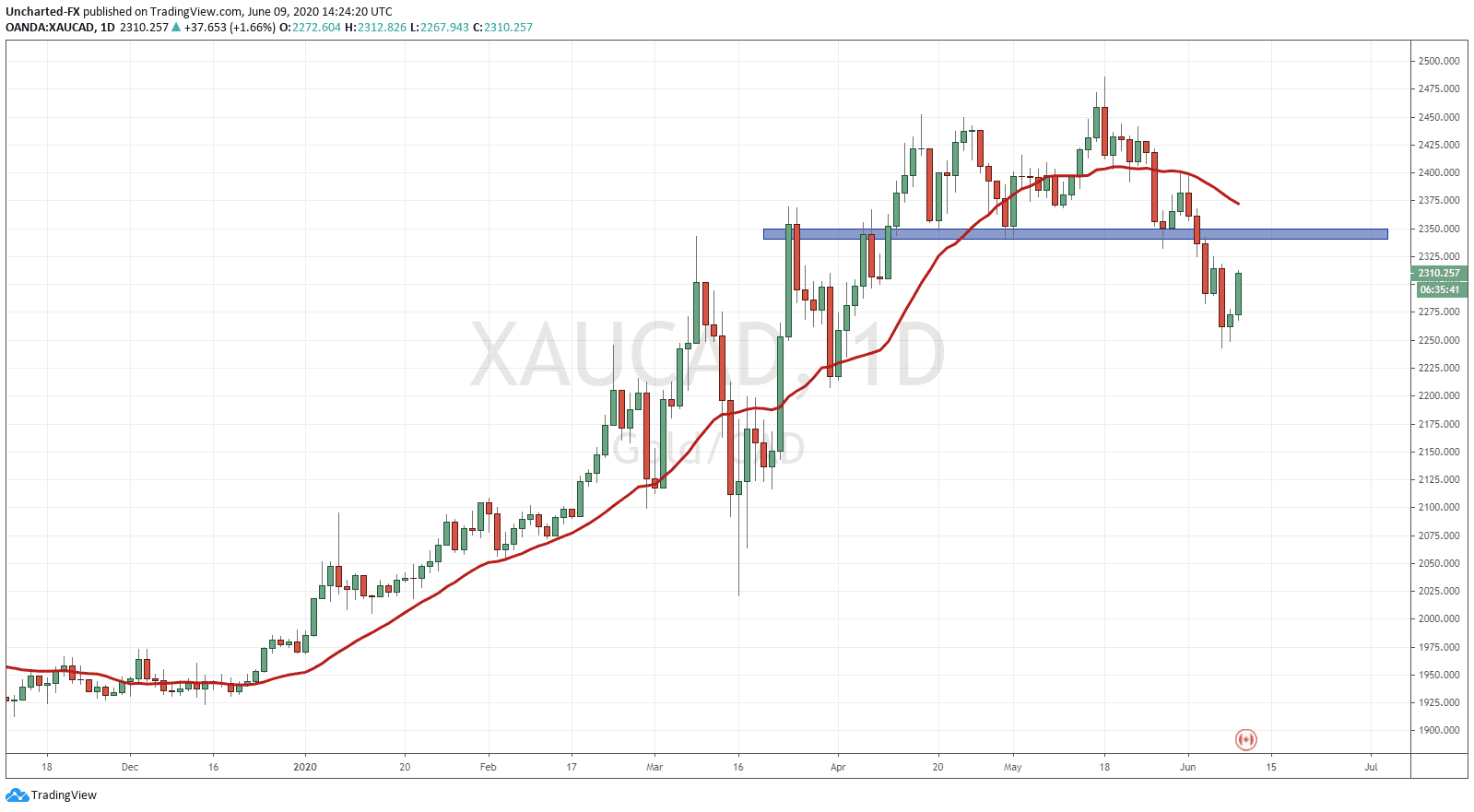

Take a look at XAU/CAD, or Gold against the Canadian Dollar. We created the head and shoulders pattern on the daily chart. Look at that right shoulder before the break of the neckline/support. This is what I want to see on XAU/USD. XAU/CAD can still make another lower high swing as long as it remains below 2350.

So I already mentioned the uncertainty, and the fear which is driving people into Gold. Also, at the time of writing, the US Dollar (DXY) has made new recent lows indicating further weakness. What I am seeing though is the end of the risk off trend. Why? The bond market, especially the 10 year yield. There was a big breakout pattern I spoke about in yesterday’s post, and I did say we should expect a pullback before a move higher on the 10 year yield. Remember, this indicated money leaving bonds and heading somewhere else. Could it be Gold? Perhaps but it remains to see if Wall Street loves Gold that much to the point where they would follow Ray Dalio’s idea of holding Gold is better than holding Bonds for safety. I don’t think we are there just yet. I personally think this money will be running into stocks.

This then leads to the BIG factor here which can impact the Gold chart. We have the Fed interest rate decision tomorrow. Many are expecting things to be the same: lower rates for a long time and a continuation of implementing unprecedented policies if required. What I will be observing is Fed chair Powell’s take on the unexpected job data that came out Friday. If the economy is recovering, would that mean the Fed tapering off a bit? OR there is the other big scenario. That is the Fed goes to negative rates in June. Pretty extreme, but there has been a lot more discussion on that. Anything can happen in this environment, but I would rule out negative rates in June. I do think negative rates are coming down the line, but you would not announce them after employment data like that…unless things are far worse in the credit and repo markets.

So in summary, we will be watching today’s close on Gold to see if it is constructive to a short case. Again, I would like to see today’s candle remain and close below 1725. This could set up then for a doji type candle, or even a plain out red candle tomorrow before we go to test the neckline support at 1680, thereby confirming the right shoulder on the head and shoulder pattern.