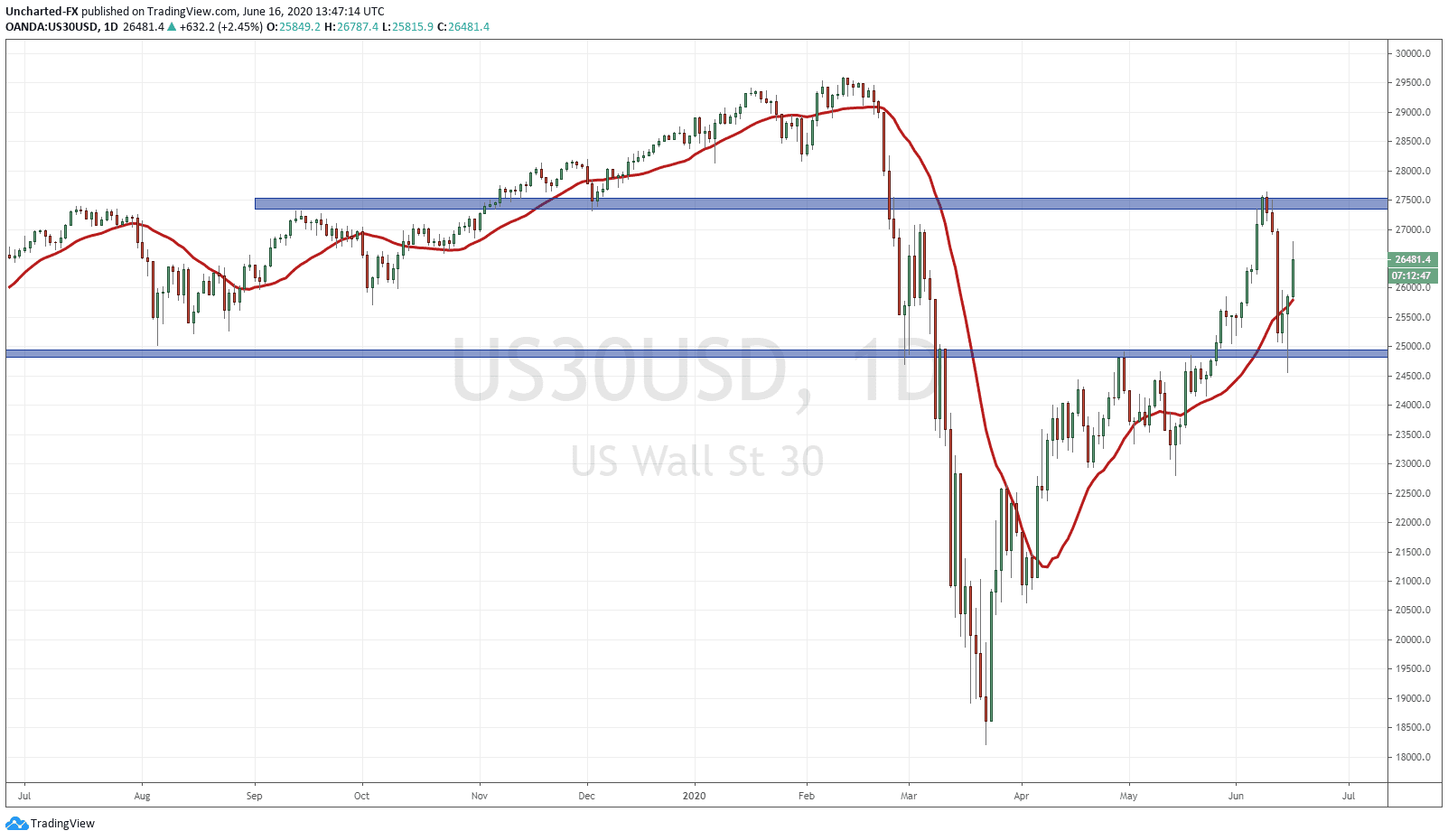

In yesterday’s Market Moment post, I spoke about markets pulling back as predicted, giving technical and fundamental backing to my prediction. The technicals still remain market structure positive. The fundamental arguments just got a whole lot stronger and confirmed.

The Fed and Jerome Powell’s diction was one of the reasons mainstream financial media blamed for the sell off in stocks last week. They claimed the Fed not even thinking of raising rates until 2023 raised fears and uncertainties due to the Fed’s gloomy macro outlook. I mean seriously. Was anyone not expecting this? Overall, I thought his statements were bullish for the markets. Powell pledged to support markets. A continuation of programs as required, and perhaps the more relevant aspect after yesterday’s news, the continuation of the Fed buying corporate bond ETFs and Mortgage Backed Securities. I know I keep saying this, but for all the new readers: the Fed and other central banks around the world are morphing into the most powerful institutions in human history. They are becoming buyers of everything and will be the buyers of LAST RESORT.

I argued that Powell’s testimonies before the Senate today and tomorrow will be a chance for the Fed chair to clarify his statements and his pledge to do what needs to be done to keep markets propped. It seemed we did not have to wait for the testimony at all. The Fed announced yesterday that it would purchase $250 Billion of INDIVIDUAL corporate bonds, with the ability to go up to $750 Billion. This comes three months after the Fed’s Secondary Market Corporate Credit facility, and roughly a month after the Fed announced it would be buying Corporate Bond ETFs through this program. Anything and everything will be done to keep markets propped. The Fed used actions, not just words to let market participants know that they will keep this system propped. Markets loved the news. Do not be surprised for the Fed to follow the footsteps of the Bank of Japan, the Swiss National Bank, and the European Central Bank in buying stock ETFs or shares if they must to keep markets propped. Some claim this is already happening (even though legally the Fed is not allowed), but it could be from providing extra repo to banks, who then use the excess funds to buy shares etc. Dark pools is another theory.

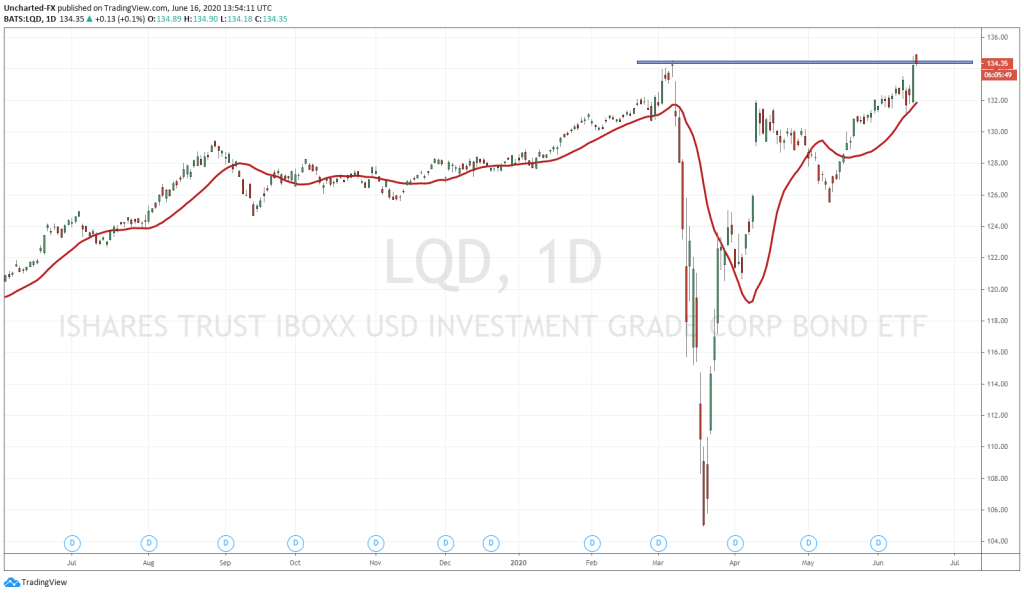

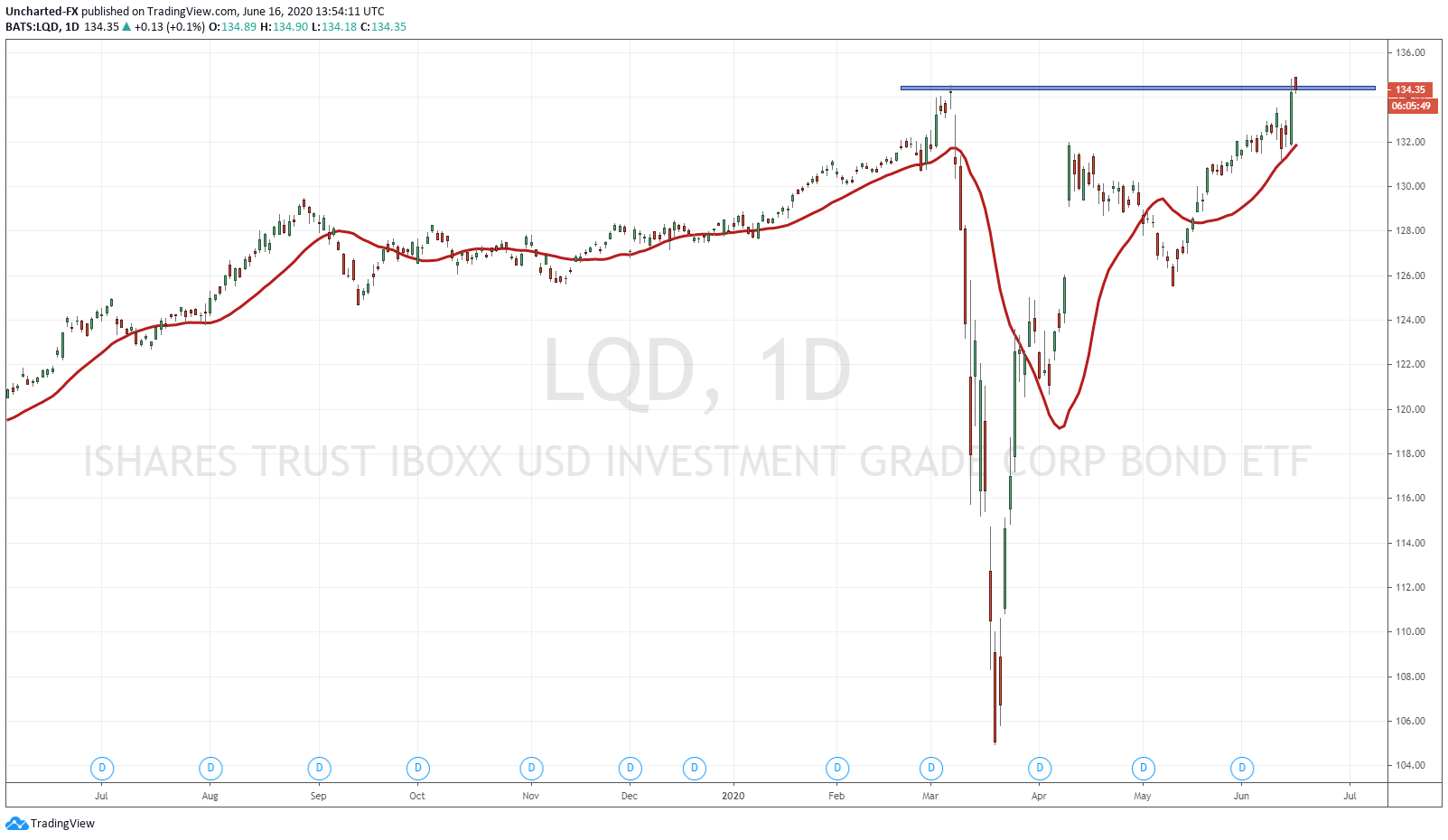

I generally follow the charts of BND, JNK and HYG for my corporate bond market observations, but I think it would be best to look at the top corporate bond ETF: LQD.

LQD is composed of Investment Grade Corporate Bonds. The holdings can be seen here.

Break out on the chart seems inevitable and coming. Seriously, the advice by some fund managers to buy what the Fed is buying works. Do not bet against the Fed. Do not bet against this market. There is a disconnect of the real economy and the stock market which will just get more exacerbated. The only thing that can bring these markets down would be a black swan event.

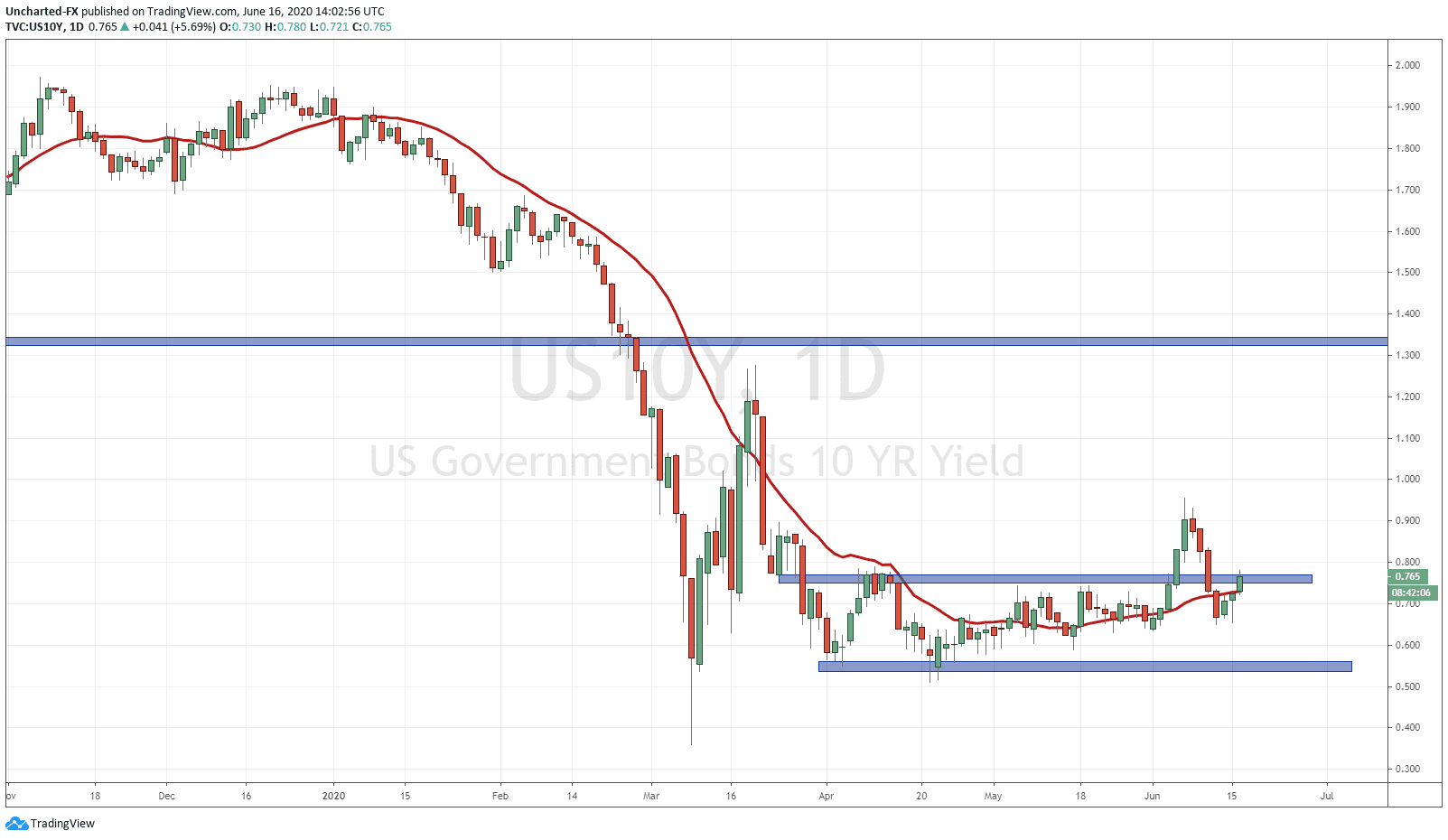

My favourite chart here to follow is the ten year yield. It based nicely and this was what we were looking for over on the Discord chat during market hours to confirm a move higher in markets.

We want to see money leaving bonds and flowing into the stock markets. It really makes no sense in holding bonds for yield to beat real inflation. You have to be in stocks for yield. This dabbling in the debt markets, even on the corporate level, will be creating even more issues going forward. The Fed is playing a larger role in managing the markets, and will end up buying even more to keep them from falling.

So at time of writing, markets are up quite nicely, and are continuing the move I predicted yesterday on the article and from last week over on our Discord channel. We will await to hear what occurs during the testimony before the US Senate as markets tend to hinge on every syllable that comes out of Powell’s mouth in these sort of things. Everything else currently indicating market strength is also playing out: 10 year yield is moving up, EURAUD showing a rejection at resistance, Oil looking to move higher and confirm the higher low swing (mainly Brent as WTIC is on its second leg), and the US Dollar is showing a lower high being formed on the daily charts.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA