Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA

Stock futures were down 200 points at once, but those losses have been cut. However, stocks did open slightly lower. We had quite the ride last week, and this week will not differ. Traders and investors should realize this is the environment we are in going forward, but with what has been done on the monetary policy side, markets remain the only place to go for real yield.

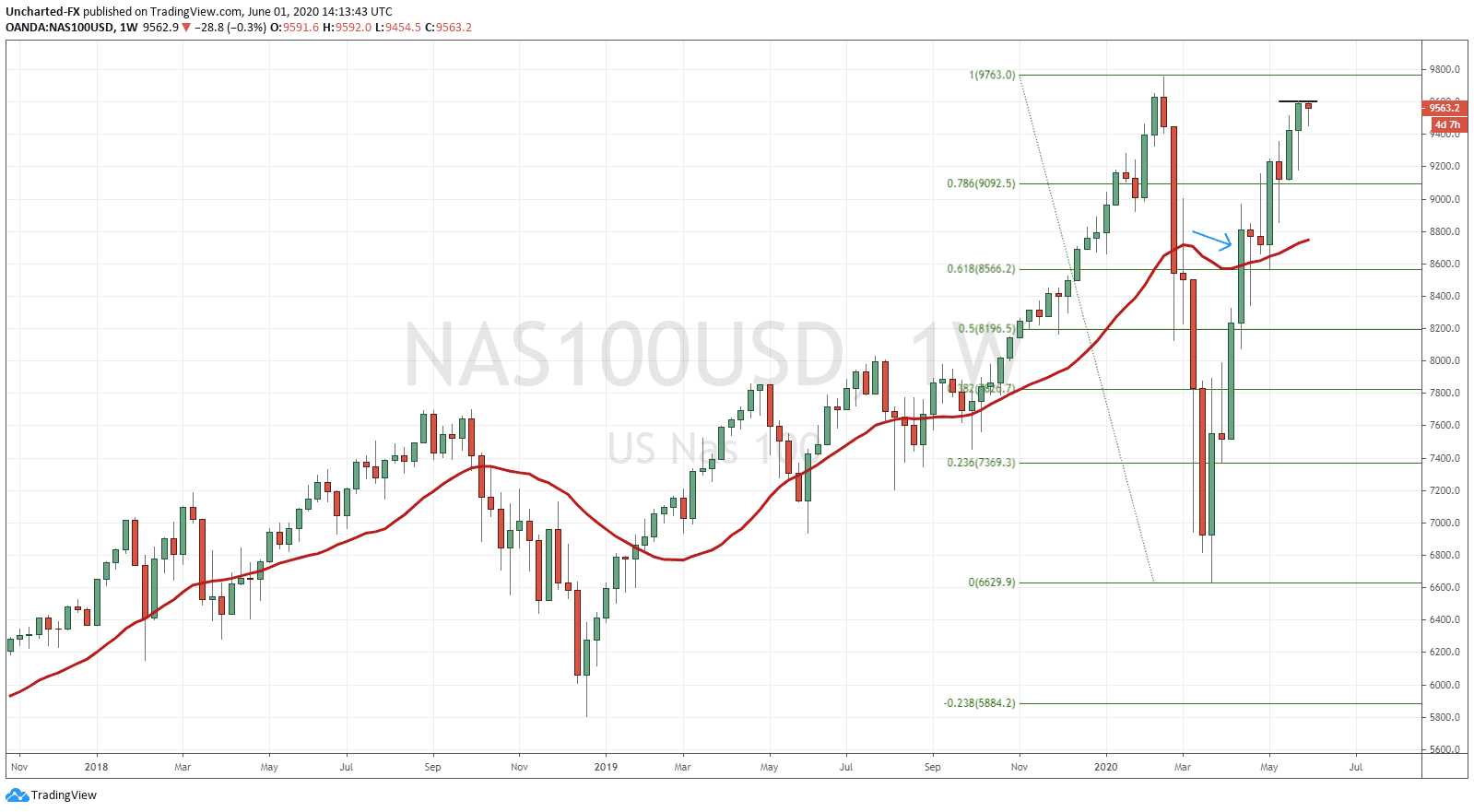

Readers and members of the Equity Guru Discord channel know the importance of the 61.8 fibonacci level. I have been saying the possibility of new lows in the markets were likely, as we were looking for a lower high to actually confirm that we are in a bear market. The 61.8 fibonacci is used as the line in the sand regarding pull backs and then a continuation of the move (in this case the down trend). I have said that if this zone breaks, we are more likely to make new record highs on the markets rather than new recent lows. The Nasdaq was the first to break above this key 61.8 fibonacci zone. Look at the follow through, and how close we are to previous highs:

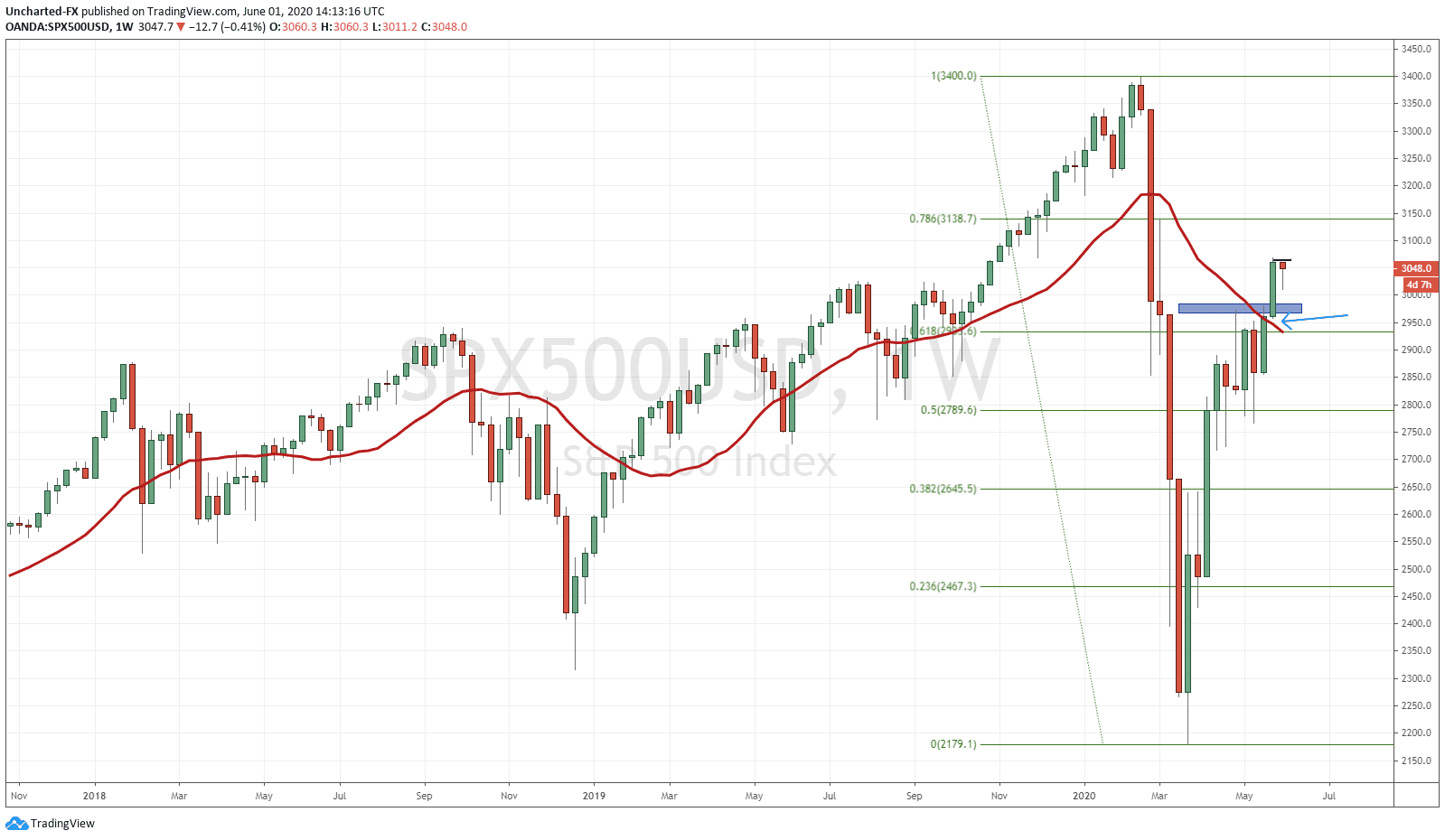

The S&P has been the primary market of focus for me, and when price reached that 61.8 fibonacci zone, you can clearly see the battle between the bulls and the bears (or the Fed vs the retail traders as some say). For 6 weeks we battled here. There was even a slight break above but not enough to warrant a break with strength as I discussed when the break occurred. We subsequently sold off until finally breaking clearly above the following week. I spoke about that last week and look at the follow through so far:

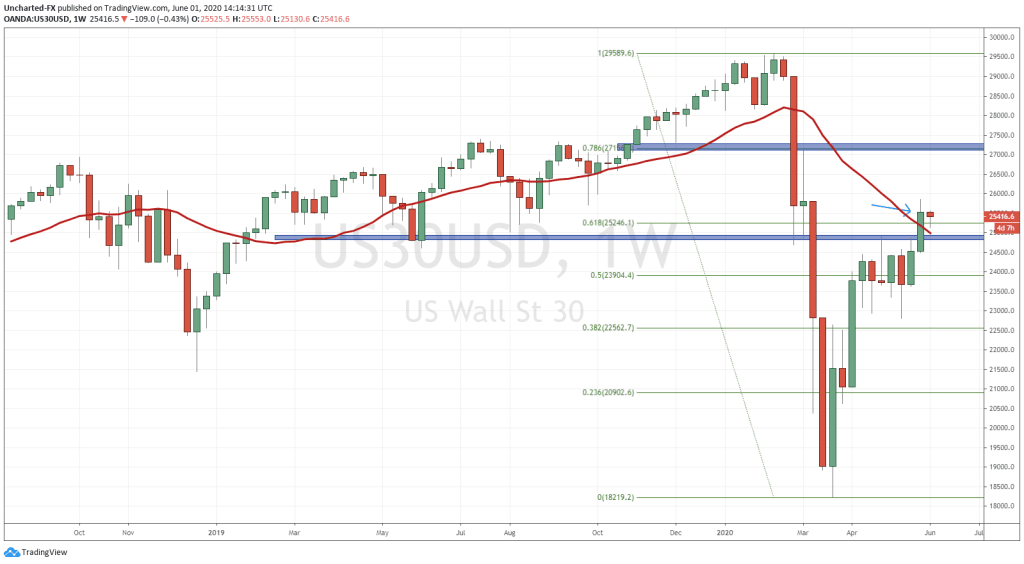

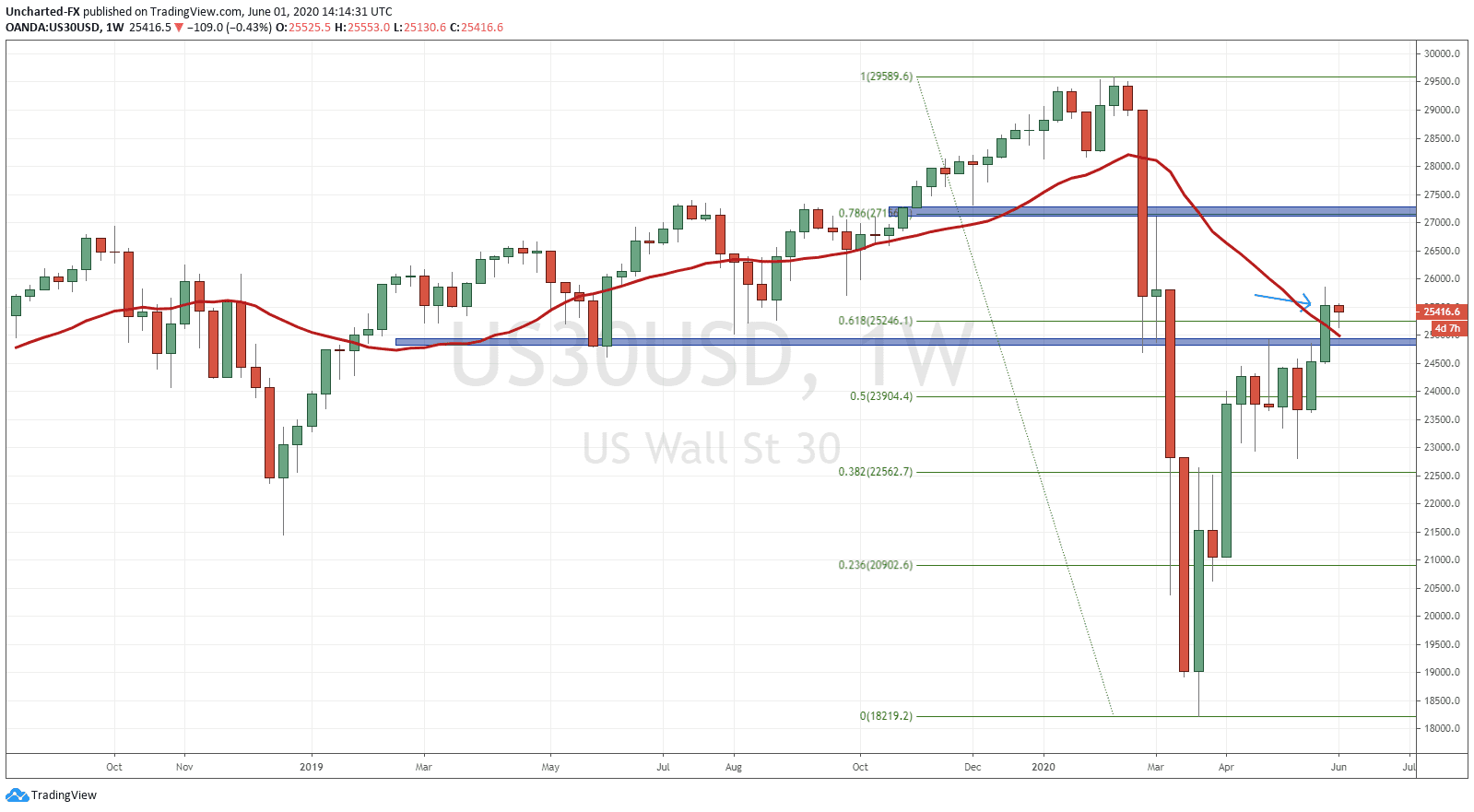

The Dow Jones is the last major US equity to close above the 61.8 fibonacci on the weekly chart (featured picture above). If the pattern and history repeats, we should expect the same type of follow through that we have seen on the S&P and the Nasdaq.

For my thoughts on what drives the markets, you can take a look at my post here. But a quick summary is that as a fund manager, or anyone looking for yield, the stock markets are the only place to go. This is why the markets shrugged off great depression like unemployment and data. The real economy and the stock markets are completely different. The media like to use headlines such as markets are up or down depending on vaccine trials or other covid things. The truth is that all that stuff is noise. These markets will only fall on a black swan event. Something that is so unexpected that it takes the market off guard.

Are we close to one? Very possible. I think getting closer to the US elections in Fall will mean more volatility and more division. Speaking about division, this past weekend we have seen images of US cities burning as riots and protests have begun. Could this be a black swan? It depends on the response and what follows after. The Chinese are watching this very closely as then they could call the US hypocrites on their stance towards Chinese intervention in Hong Kong.

China’s response this week could be another element to add uncertainty to the markets and even lead to a black swan. That is the severity of China’s response and retaliation to the US after President Trump condemned and accused China of many things at the conference on Friday…a conference that many deemed a measured and somewhat weak retaliation. Many were expecting new sanctions on officials and/or the dropping of the phase 1 trade deal. Both of which mind you, can still happen, and it appears the Chinese are hinting towards this. It came out this morning that China is set to renege on their part of the phase 1 trade deal, which is to buy more US agriculture. We shall wait and see if this indeed is China’s tit for tat response to the US. We should expect this to escalate as we are firmly in a Thucydides Trap between the two nations.

So these are the two events which add more uncertainty to the markets to watch for this week. Once again, I am still bullish on the markets barring some black swan event. The geopolitical side could create a black swan, but I am keeping my eye on something financial like a large bank going under. Some say this could be a corporation going under, but the Fed has specifically been buying corporate bonds as a way to provide liquidity to them and keep them propped. It does come down to the fact on whether the Feds programs fail. They are literally bailing out everything and everyone as they morph into the strongest institutions in human history and become buyers of last resort.