Streaming and royalty companies are a fascinating lot. While gold and the Senior Producers have put on quite a show over the past few months, the royalty and streaming Co’s—those higher up on the food chain in particular—have been screaming higher as if the metal had just launched a successful assault on all time highs. Actually, gold is already trading at historic highs in a number of currencies. It’s only in USD terms where there’s a lag.

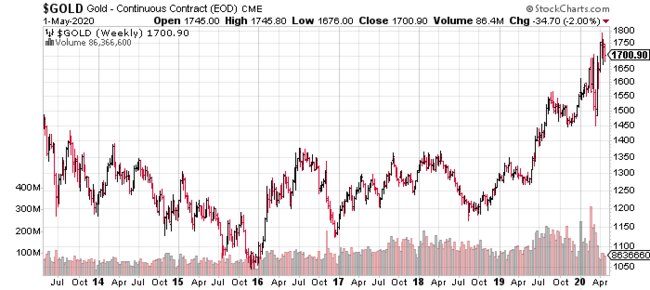

The metal, a seven year (weekly) view…

The above price action represents a challenge on seven year highs. Not too shabby.

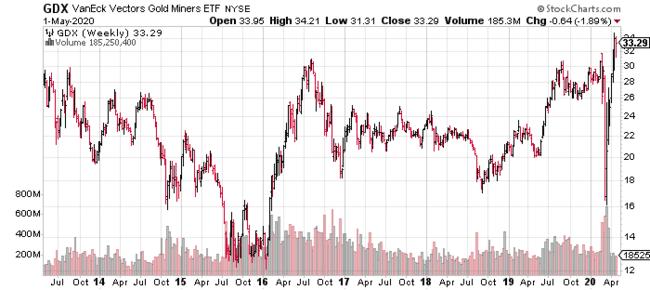

The Senior gold stocks, a seven year (weekly) view…

Similar price trajectory as the metal, except a much steeper decline during the mid-March crash.

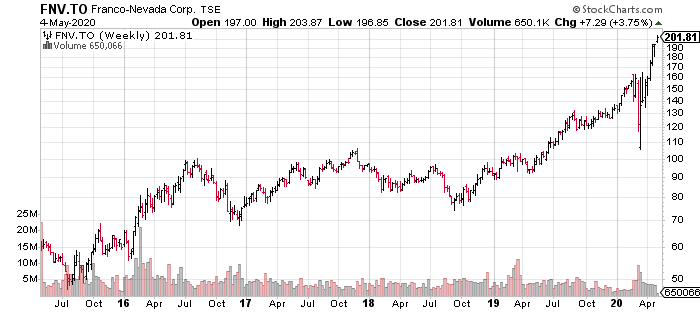

Now for a blue chip streaming-royalty company—Franco Nevada (FNV.TO), a seven year (weekly) view…

Of the three vehicles (the metal, the Sr. Producers, the blue-chip royalty company), Franco was the superior ride. In fact, Franco’s current trading level represents an all-time high.

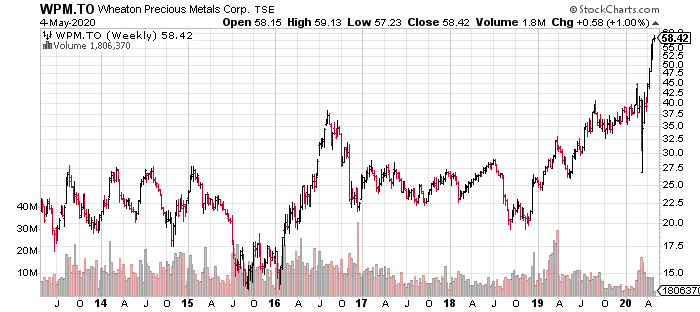

Wheaton Precious Metals (WPM.TO), another top-shelf company in the royalty-streaming space, has enjoyed the same stellar share price trajectory:

For those unfamiliar with the business model…

A Streaming deal gives a wannabe miner muchly needed development funds, UPFRONT, in exchange for the right to purchase a share of the metals produced, at a discounted price, over a specific period of time.

A Royalty deal gives a mining company muchly needed development funds, UPFRONT, in exchange for the right to a percentage of revenue when the mine is put into production.

Companies in the royalty-streaming arena are considered low risk as they have no direct exposure to the operating risk mining companies often face.

A rapidly growing gem

Metalla Royalty and Streaming (MTA.V) owns royalties/streams on deposits operated by some of the biggest and best in the gold and silver arena: Agnico Eagle (AEM.TO), Newmont-Goldcorp (NGT.TO), Pan American Silver (PAAS.TO), St. Barbara (SBM.AX), Osisko (OR.T), and now NGM, a JV between Newmont and Barrick.

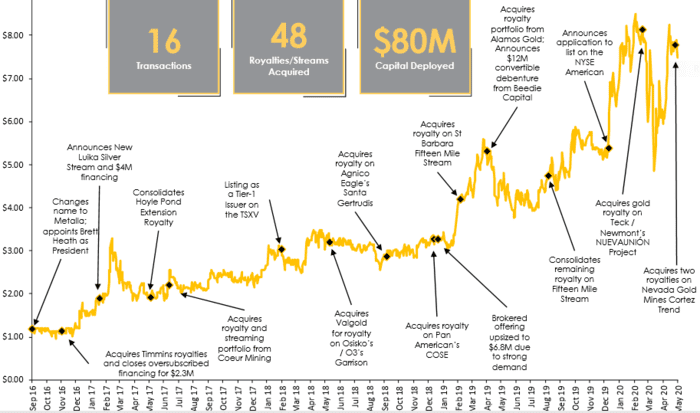

This rapid growth is best demonstrated via the following slide from the company’s i-deck…

Metalla’s biz-model is unique among its peers. The company typically partners with 3rd party royalty holders—companies or individuals looking to maximize the value of royalties they hold on producing, development, or exploration stage assets.

By focusing on projects located along large structural trends like the Battle Mountain-Eureka Trend of Nevada, Metalla increases the odds of tagging an interest in a major discovery. But how does one go about acquiring these highly prized royalties?

It’s a problem. These 3rd parties are often reluctant to give up their coveted assets for fear of missing out on future growth. These royalties seldomly come up for sale… at any price.

This is especially true in Nevada.

“Nevada is ground zero for the royalty business” (Metalla CEO Brett Heath).

If you look at the true giants in the royalty-streaming space, the foundation of their tremendous growth was due to one or more strategic NV based royalties.

The solution

By offering a combination of cash and common shares, these 3rd parties can be swayed—they get paid and still maintain exposure to the future growth of their prized royalty. They also benefit from dividends, and the diversification Metalla common shares offer via a robust asset portfolio.

Inking multiple deals with 3rd parties also adds layers of disciplined ‘smart money’ to Metalla’s shareholder base.

Win-win.

Metalla’s recent NV deal

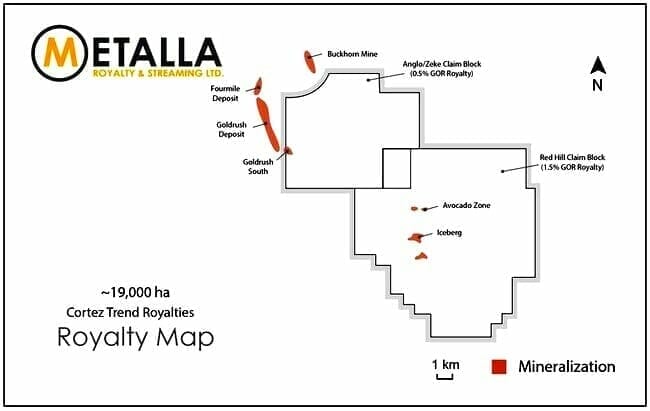

In this deal valued at $4M in cash and shares, Metalla secures two Gross Overriding Royalties (GOR) on a pair of claim blocks strategically located along the prolific Battle Mountain-Eureka Trend.

The Anglo/Zeke claims (0.5% GOR):

These claims cover more than 7,500 hectares of exploration land owned by NGM east and southeast of the Goldrush deposit.

- NGM is a joint venture between Barrick Gold (61.5%) and Newmont (38.5%), a JV created in July 2019 to combine Barrick and Newmont’s significant assets across Nevada to create the single largest gold producer in the world.

- The Goldrush deposit is a large Carlin-type gold development project targeting 450,000 ounces of gold per annum during its first full five years of operation beginning in 2021. Reserves currently stand at 2 million ounces at 9.7 g/t gold. Measured and Indicated resources currently stand at 9.4 million ounces at 9.4 g/t gold.

Barrick previously has disclosed that mineralization at Goldrush is open along strike towards the north and east where the royalty property continues with the favorable stratigraphic host of the Goldrush, Cortez Hills, and Pipeline deposits, and has identified a mineral potential area known as Goldrush South on the Anglo/Zeke claims.

We should see drilling on the Anglo/Zeke claim block within 12 to 14 months.

The Red Hill claim block (1.5% GOR)

The Red Hill project, owned by NuLegacy (NUG.V), covers more than 11,500 hectares to the southeast of the Anglo-Zeke claim block.

We covered NuLegacy and its Red Hill project in a piece titled, Gold opportunities in the mother of all mining jurisdictions: 21 Nevada ExplorerCo’s for your consideration.

NuLegacy is developing multiple zones at Red Hill—Avocado, Serena, and Iceberg, to name a few.

Past drilling along the Serena and Iceberg zones intersected high-grade intercepts including 22 meters at 6.59 g/t Au and 31.2 meters at 3.9 g/t Au.

More recently, NuLegacy completed a geophysical survey that identified an untested anticline structure known as the Rift Anticline. The company views this geophysical anomaly as an analogue to NGM’s Goldrush deposit to the northwest. If true, this would be a major homerun for both NuLegacy and Metalla.

“NuLegacy expects to receive an expanded drill permit to test the Rift Anticline target by the end of 2020 with a preliminary drill program of 12 to 15 holes.”

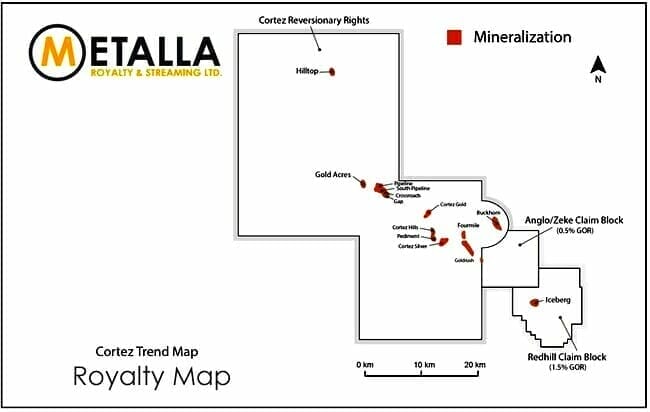

The Cortez claim reversionary rights

“The IRC acquisition will also provide Metalla the opportunity to acquire the mineral claims under the Cortez Joint Venture plan of operations should NGM choose to relinquish their mineral claim interests. The claim reversionary rights cover the Cortez, Cortez Hills, Goldrush, Fourmile, Hilltop, Gold Acres, and Pipeline deposit mineral claims in Lander & Eureka County, Nevada.”

The discovery potential in this part of the world is wide open.

Brett Heath, President and CEO of Metalla:

“We are pleased to add two high-quality strategic gold royalties on trend of one of the largest gold operations on the planet. This transaction gives shareholders exposure to one of the most prolific gold structures covering approximately 19,000 hectares on the Battle Mountain-Eureka trend in Nevada, of which 7,500 hectares are owned by the two largest gold producing companies in the world, Newmont and Barrick.”

Deeper insights into this recent acquisition, and the company itself, can be gained by following the link below…

Metalla Royalty enters prolific Cortez Trend acquiring Idaho Resources Corporation

There’s a new royalty and streaming company set to burst onto the scene—Nomad Royalty Company (GV.V).

It hasn’t begun trading yet, but we’re close.

A preview

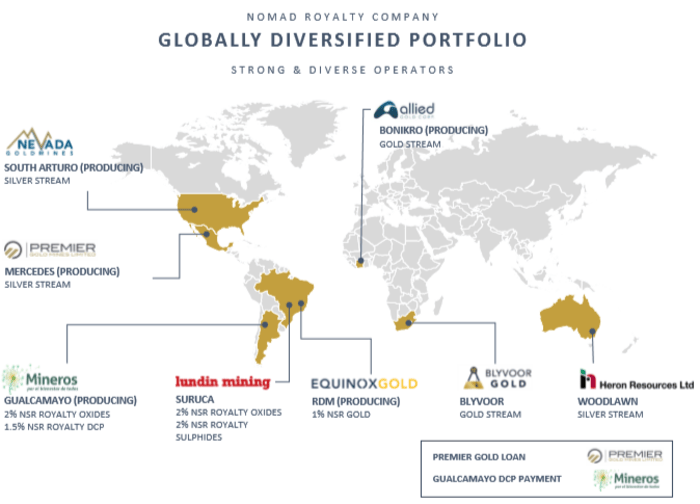

Nomad acquired two royalty and streaming portfolio’s, one from Yamana Gold (YRI.TO) for $65M, the other from Orion Resource Partners for $268M.

Orion owns 77.6% of Nomad’s outstanding common shares, Yamana owns 13%.

We’re not talking about early-stage exploration here. This is a highly diversified royalty and streaming portfolio with significant cash flow.

Shareholders seeking exposure to gold and silver get 100% exposure.

The company currently holds ten assets—five are in production, two are in the construction ramp-up phase (production is scheduled for 2021), and three are development stage projects.

17,000 ounces of gold and 675,000 ounces of silver (25,000 AuEq ounces) are the estimated deliveries for 2021.

At a $1,500 gold price, 2021 operating cash margin will be in the C$40M range.

If we assume current spot prices (~$1,700 gold), 2021 operating cash margin rises to roughly C$46M.

Management timed this deal nicely. They also structured the deal in a low gold price environment ($1,475 Au).

Speaking of management, this is a highly competent team—it required one to put this complex deal together. Having played key roles in the evolution of Osisko Gold Royalties (OR.TO), it’s a world Vincent Metcalfe (CEO), Joseph De La Plante (Chief Investment Officer), and Elif Lévesque (CFO) know well.

“We are a new generation team that is well known to royalty and streaming investors and is ready to execute”

This deal was priced at C$0.90 per share, at 11.5x P/2021 Cash Flow or a 1.05x Net Asset Value. Peers in the royalty space are currently trading around 18.0x P/2021 Cash Flow or roughly 1.8x Net Asset Value.

Translation: there’s potential for a significant re-rating as these shares commence trading and the market homes in on this anomaly.

As we noted at the top of the page, the macro backdrop for the royalty-streaming space couldn’t be better with Franco Nevada having tagged an all-time high.

This is a rare opportunity (author’s humble opinion). It’s not every day a high-quality royalty-streaming vehicle comes into play.

There’s more to this story. Much more. We’ll give you a proper in-depth look when Nomad debuts on the TSXV in the coming days.

END

—Greg Nolan

Full disclosure: Metalla and Nomad are Equity Guru marketing clients.