Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

As we start the month of May there is a stat that is unbelievable, given everything that is going on in the world. The month of April 2020 was the BEST month for US stock markets since 1987. Think about this for a minute. Over 30 million people in America have been laid off, the unemployment rate is over 10%, the economy is dead, manufacturing and GDP data is coming out terrible, yet markets are up. I have spoken about the hunt for yield. Eventually, when fear dissipates, fund managers that need to make up for their Q1 performance will look to make yield. Sitting in treasuries for 1 month or 3 months is okay for now but soon it will not make sense to hold bonds for yield in the long term. A lot has changed in two months for those who follow the asset allocation approach. Interest rates were cut down to near 0, and now the Fed is letting us know rates will remain low for a very long time. To be honest, they will be down forever. We cannot normalize given all the debt that has been issued now. What does this mean? This means that the stock markets will be the only place to go to make yield. Money will eventually flow back into stocks, because there is nowhere else to go.

This is the argument I have been giving for why I believe markets will eventually be going higher. The US markets will see a rush from foreign money as well which will just add to higher markets. However, what needs to subside is the fear. It is debatable on whether fear has subsided. Bonds are still relatively stable and the VIX has not moved to the lows it usually ranges in. This begs the question… who is buying here? The Fed is not legally allowed to buy stocks, but many think they are and that they will eventually disclose this. They could be doing it another way, and that is by giving money to the banks via repo and even through QE, so they have enough money for their operations AND enough to buy stocks and keep them propped. People like Jeffrey Gundlach have come out this week saying that there is still downside to the markets and they have just been moving up because of the Fed.

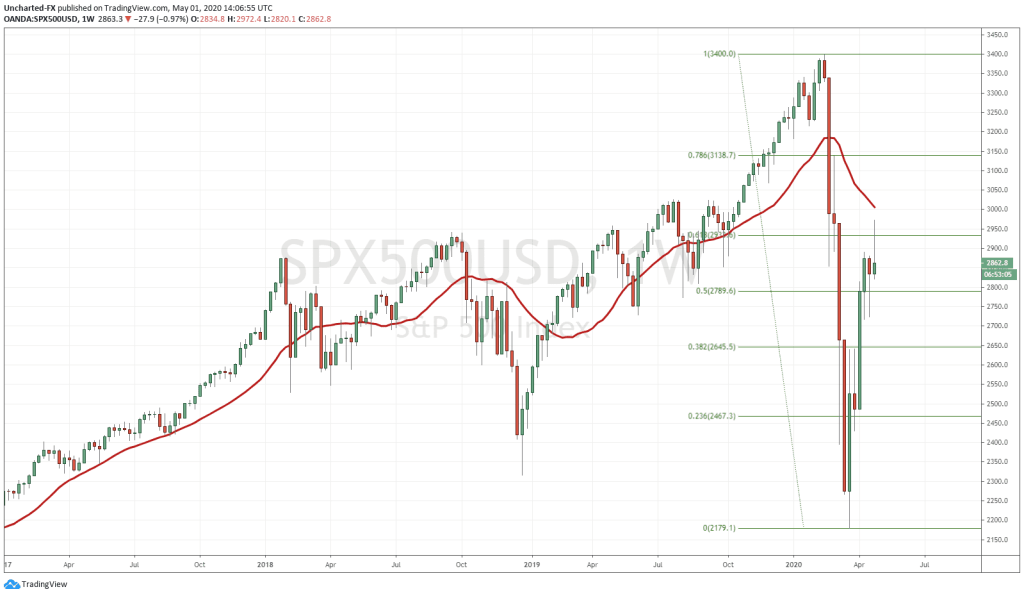

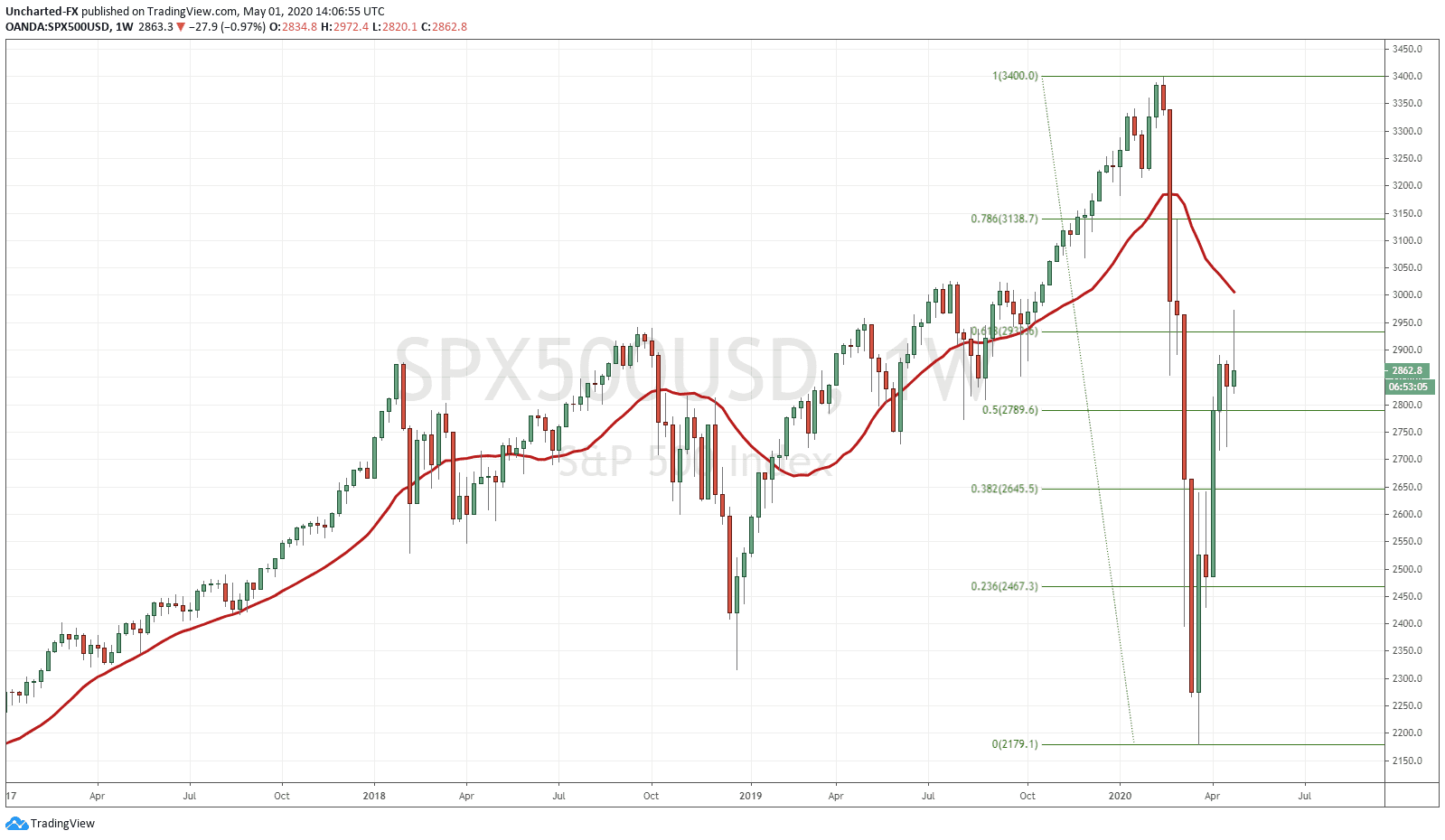

In terms of potential reversal, we are now at the 61.8 fib level for the S&P. If you remember, we here on Equity Guru’s Market Moment have been watching these fibonacci levels after the big fall in markets that happened a few weeks ago. We were expecting a further move to the downside in markets after testing these fib levels. Hitting the fib level is not a sign itself to go short, it is about the subsequent candle that follows which triggers our short. You can see we hit the 38.2 and 50 fib yet we continued higher. If you shorted you were killed. We are rejecting the 61.8 fib right now, but next weeks candle will be very telling. Remember, the Nasdaq has already broken above the 61.8 fib. According to fibonacci theory, once we break and close above the 61.8 fibonacci level, the chances of the move continuing is slim. In this case, this means the chances of continuing lower are slim. There is a better probability we will make new all time highs.

There is one way these markets can sell off from here. A major black swan event. It would have to be a black swan event unlike anything we have seen. It would have to be so big that it triggers a massive amount of sell orders. This could be anything political…or perhaps something like a Lehman Brothers event. The old saying is do not fight the Fed. I think this is some good advice given the Fed is everywhere right now. Buying up corporate debt, repo, bailing out states and municipals, and even bailing out countries by opening up swap lines with countries like Canada. Since the US Dollar is the world reserve currency, they can print as much dollars as they want due to the artificial demand (the French called this Exorbitant Privilege). There would be huge trouble if the Dollar loses its demand… something I have predicted if we see the US Dollar spike into all time record highs.

So to summarize, we either get our sell signal at this 61.8 fibonacci level which would take us to new lower lows (below 2179). Or we battle here and eventually get a weekly close above the 61.8 like the Nasdaq, where then, the probability of making new all time highs is greatly increased versus the chances of making new recent lows.

I like it, Vishal. Too much excitement to sit still in one place. Looking forward to testing your hypothesis come next week. Keep up the good work!

Thank you John! Definitely an exciting time for following and trading the markets. Let’s see how we respond here at this major level!