Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

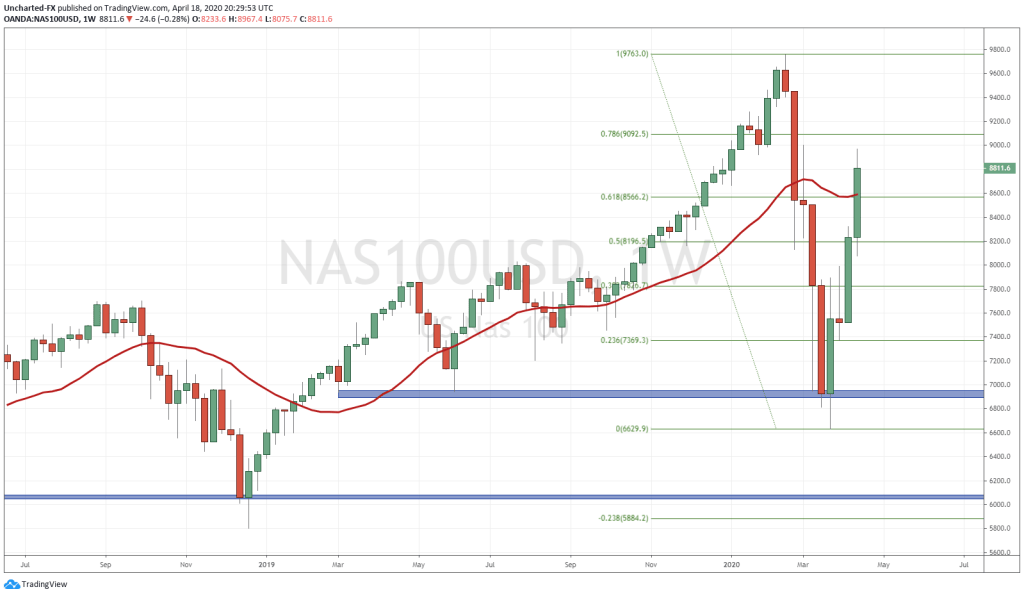

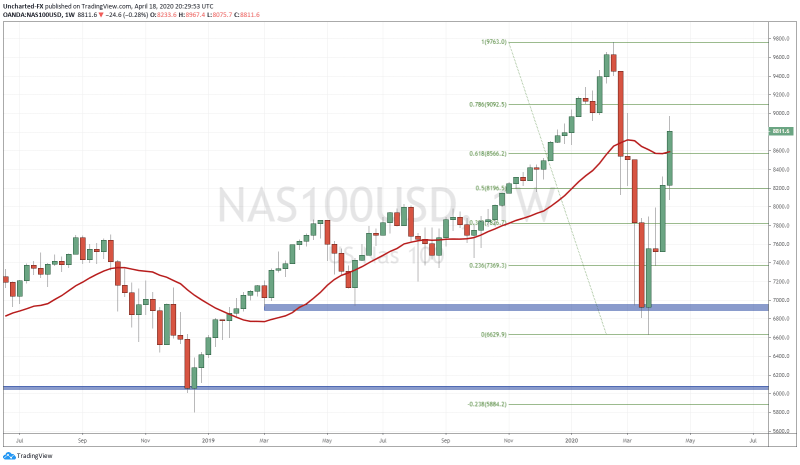

On the discord channel, and on the Market Moment posts, we have been waiting for a lower high swing on the weekly charts for the US equity markets. Fibonacci is a great tool to use to determine where price MAY react to give us a sell off. However, there are other criteria we look for in order to actually confirm the lower high and a move lower. None of this happened with the test of the 38.2 and the 50 fibonacci levels which we noted and observed for a possible move lower. Sure, market structure does dictate that we should see a swing as markets do not move in a straight line during a trend, but we trade the markets we see, not the markets we hope to see.

Since the weekly candle has now closed above the 61.8 fibonacci level, according to fibonacci rules, the downtrend is now nullified and we should not be looking for a lower high to form. It would take another black swan event to cause a large fall from here. Essentially, just looking at price action alone, it is more probable that we will hit all time record highs rather than new lower lows. These markets are very different now with the Federal Reserve buying Junk bonds and ETF’s. This is just conjecture, but I believe they will eventually disclose that they are buying stocks, following the foot steps of the European Central Bank, the Bank of Japan, and the Swiss National Bank. There is also the thought that the money going to banks is being used not only to keep rates low and banks solvent, but as a way for banks to buy stocks to keep them propped up.

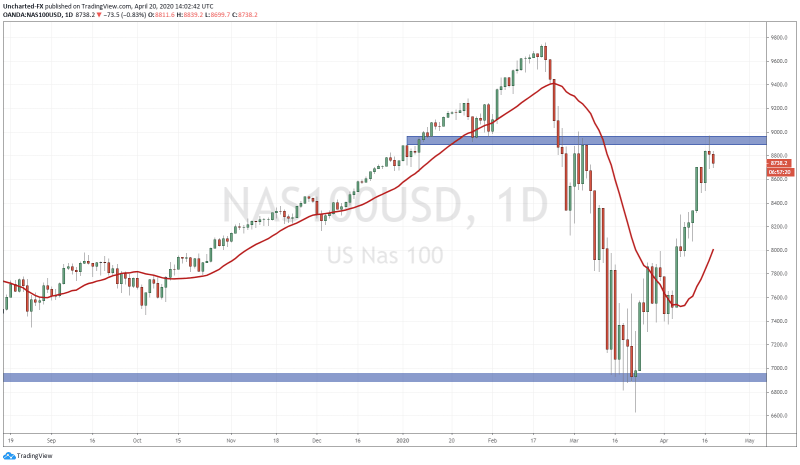

Where price is on the daily chart is well worth the look, a key resistance zone:

What is so key here? Well the area we are testing is first of all a large flip zone (an area that has been both support and resistance in the past). Secondly, this is the higher low that we broke below which ended the infamous bull market we have been in until recently. You can see that so far price is rejecting this zone, but this does not mean much yet. We would like to see a pattern form here before shorting this market.

It is worth to point out that the other US equity markets, the S&P and the Dow Jones, have NOT yet tested the 61.8 fibonacci on the weekly charts, but are at or near key flip zones on the daily chart, just as the Nasdaq is.

So why has the Nasdaq been leading? Two words: Amazon and Netflix. Both stocks are now at all time record highs. One can see why these companies would do well during lock downs. Amazon is providing a service where one can order essential items without having to leave the house, while therefore, staying home to binge on Netflix.

One other thing that tech has for it, is the fact that most of these companies will not require government money in order to survive and keep employees on the payroll. Their employees can for the most part, continue working from home. In the case of Apple, yes their stores shut down for sometime, but they had the cash to weather it, and they did announce a new phone. Innovation can continue.

As an investor, tech provides value. If you think the world will continue on and technology will improve, then some of these companies look very attractive with the general stock market sell off. For the long term, it is worth dipping your toes into these markets. Some have already been well rewarded.

So where are stocks going to head here? Still sensing a lot of fear though there are a lot of new developments on the virus side. Countries wanted to shut down for months, but are now re-opening as soon as May 1st. Some European nations are already re-opening, and Germany will be set to do so on this upcoming Monday.

What will be required is some sort of successful treatment. People are still afraid of each other. Only a vaccine, or a successful treatment will ease fears and society can get back to normal. This is a big thing that must happen for normalcy.

Both of these news items would be stock market positive: Economies re-opening and a treatment being developed. Now just imagine the first week of the full re-opening. The euphoria. People are going to be spending tons of money. Bars and clubs and malls are going to be packed. You can bet the mainstream media will be touting about how the recovery is coming. However, we must keep our attention on the debt. This will eventually lead to a debt and monetary crisis. This is next, and what I have been warning about. Central banks around the world are issuing more debt and are attempting to inflate (devalue) their currencies to keep things propped up.

In this upside down world, where bad news is good for stocks, where the disconnect between the stock markets and the real economy widens, money will still flow into stocks. Stocks remain the only place to go for REAL yield, that is nominal yields adjusted for inflation and taxes. Money will eventually flow back into stocks because there is nowhere else to go for making money.