Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

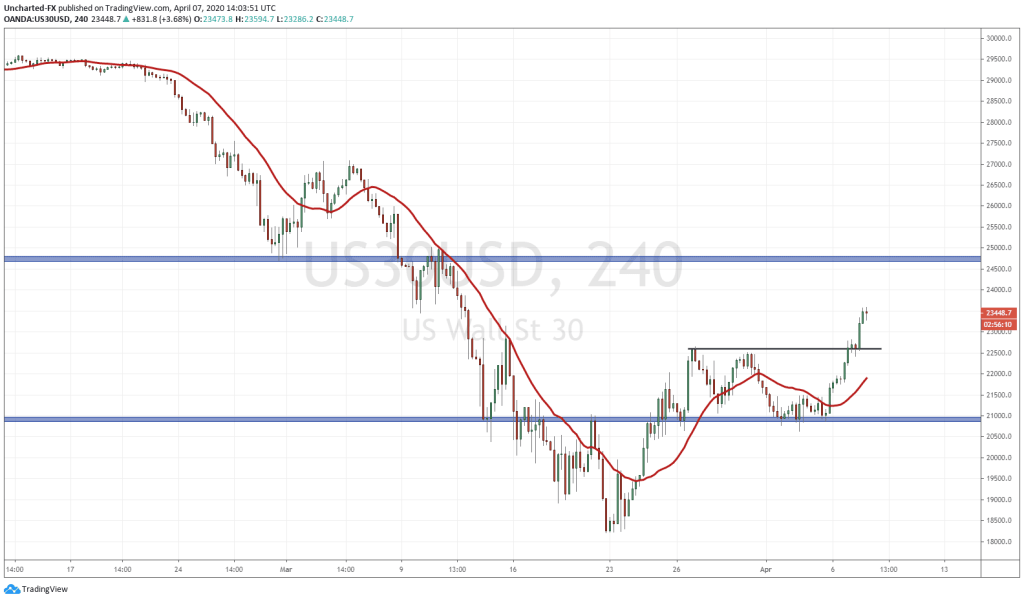

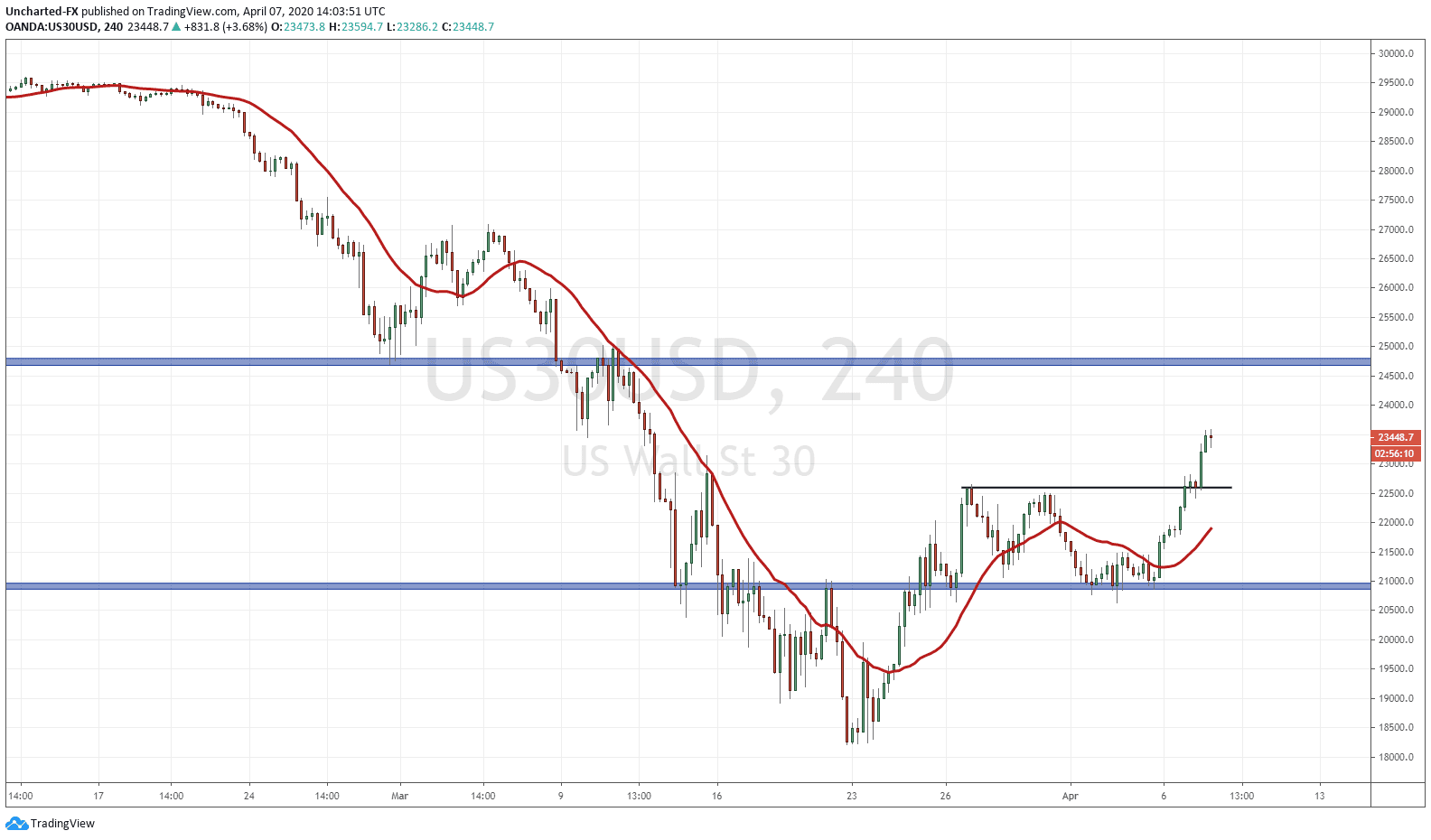

The area of support that markets held for three long days last week has held. And I mean it held. This analysis holds true for all three major US equities (the S&P, Nasdaq and the Dow: pictured here). Narratives change very quickly, and apparently markets too. Near the end of last week, President Trump spoke about how these next few weeks will be horrible. How we should be prepared for lots of death. There was even a comparison at one of the covid briefings of this time period being a new Pearl Harbour like event. Then came Sunday. Before market futures opened, President Trump came out saying that it seems the virus cases are subsiding. Fast forward to today, we are now seeing an increase in cases in the US, while China has announced no new deaths for the first time since announcing data from the virus outbreak in January of 2020. In terms of the US equities, the market seems not to care about this data. One can argue that all the bad news has been priced in.

On the Discord channel I have given my thoughts on equities many times. We played the big drop and the multiple lower high swings to the downside. We were expecting a pullback to test one of the fibonacci levels, while the weekly chart still can give us a sign of a reversal but we would require the right signal. The 4 hour charts have given us the quintessential reversal pattern: the head and shoulders. The first higher low swing that we have been working with. The weekly fib levels are still in play, and it seems this breakout will ensure we do test these levels.

Onto the fundamental reasons for buying stocks: there is nowhere to go for yield. For real yield. Especially now when central banks in the West have cut close to 0, and bonds are now yielding very low. Put yourself in the shoes of fund managers looking at their Q1 performance. A lot of red. Their jobs are on the line as they are paid for one thing: to make yield. These fund managers are assessing their next steps to make yield. This money will eventually move into the stock markets. It is inevitable. The stock market does not reflect the real economy, it is just the only place left to go for yield.

Apparently the experts are giving mixed signals too. We had Morgan Stanley call this the market bottom, and even Bill Ackman came out saying he is optimistic about the US…when a few weeks ago he gave a CNBC interview stating hell is coming. While Jamie Dimon, the head of JP Morgan has said to prepare for more weakness and a ‘bad recession’ in his recent shareholder letter.

We trade the charts we see. And currently, this breakout is a significant technical event. You can see that we got follow through on the retest as well. There is one thing to consider. We are still seeing bonds go up. During some days gold, and the US Dollar went up with bonds as well, while stocks were moving up. This does not show money leaving the safety of risk off assets into risk on assets. We are not seeing money leave bonds into stocks. There is still some fear. You must consider who is buying stocks at these levels. I would have my eyes on the Federal Reserve and other central banks in their respective countries.