“Already plagued by a tough regulatory environment, disappointing sales and capital markets that had closed to all but the strongest companies, the [cannabis] industry is now facing a pandemic-related collapse in stock markets and ever-shrinking financing options,” stated The Financial Post.

According to fresh data from Viridian Capital Advisors, cannabis companies completed two capital raises worth just USD $5.6 million the week ended March 27, 2020. In the same time period a year ago, 17 capital raises worth $169 million were completed.

The lack of financing is starting to take its toll on the weakest companies.

In this dangerous business environment, three companies just released financials.

Let’s look under the hood.

The Good:

On April 8, 2020 Trulieve Cannabis (TRUL.C) announced financial results for the three and 12 months ended December 31, 2019 – expressed in USD.

TRUL is the largest licensed medical cannabis company in Florida, it also has operations in California, Massachusetts and Connecticut.

This company controls an astonishing 50% of the Florida market, with its vertically-integrated “seed-to-sale” operation. The company has 45 stores in Florida, with a patient base growing 10% per month. The propriety production line has over 340 SKUs.

“Florida finished 2019 with 300,000 active patients in the state registry (1.4% of the state’s population) and 212 dispensaries statewide (one dispensary per 1,415 patients),” stated MJ Biz Daily.

The Marijuana Business Factbook estimates Florida’s total 2019 medical marijuana sales range from $450 million to $550 million.

Florida is the 3rd most populous state in the U.S with 17% of Floridians over 65 years – it’s not surprising that there is a strong demand for medicinal cannabis and CBD products – which are used to treat cancer, joint pain and inflammation.

Key Trulieve Cannabis Q4, 2019 highlights:

Revenue of $79.7 million – up 13%

Sustained market share in Florida

Efficiencies optimization and economies of scale

Opened 7 news dispensaries in Florida

Increased total current cultivation capacity to approximately 1.7 million square feet.

Trulieve ended Q4, 2019 with $92 million cash against debt-plus-leases of $204 million. $130 million of that debt does not mature until 2024.

For full-year 2019, Trulieve’s revenue – minus production expenses & cost-of-goods – was $163 million.

The Bad:

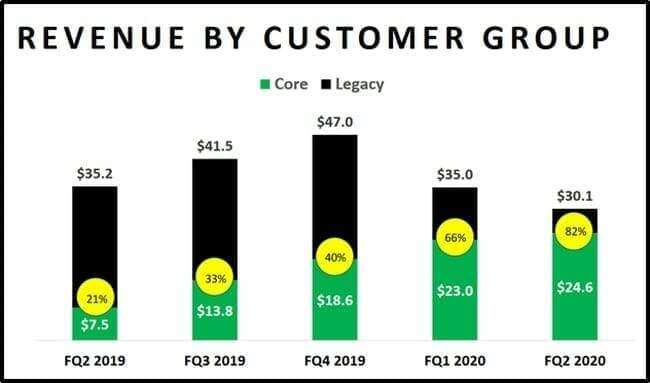

On April 8, 2020 KushCo Holdings (KSHB.OTC) reported financial results for its fiscal Q2, 2020 ended February 29, 2020. KushCo’s net revenue dropped 14% year-over-year to $30 million. The company announced a net loss of $44.4 million.

KushCo’s fortunes have been damaged by an explosion of bad press around vaping. In November 2019, KushCo kicked off its hemp trading business hoping it would juice up the bottom line, but it hasn’t worked out that way so far.

KushCo Q2, 2020 Key Highlights

- Net revenue decreased 14% to $30.1 million.

- Revenue from the company’s “core customers” increased 227% to $24.6 million, or 82% of total revenue.

- Sales, general and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative (SG&A) expenses were $27.2 million, compared to $18.8 million in the prior year period.

- Bad debts totaled $9.1 million

- Cash was $11.4 million as of February 29, 2020, compared to approximately $3.9 million as of August 31, 2019.

To save money, Kushco negotiated better deals with suppliers, consolidated its warehousing, reduced inventory, re-trained its sales force and “right-sized its workforce by approximately 50%” which is expected to save $12 million a year.

According to CEO Nick Kovacevich, KushCo has a “strategic plan to accelerate our path to positive adjusted EBITDA.”

That’s like saying you hope to organise a nature walk that will culminate in a gravel pit. “Positive adjusted EBITDA” sounds a close cousin of “profits” – but they live on different planets.

Common EBITDA adjustments include: unrealized losses, non-cash expenses (depreciation, amortization), lawyers fees, litigation expenses, losses on foreign exchange, share-based compensation etc.

EBITDA is not a generally accepted accounting principles (GAAP)-standard line item on a company’s income statement.

In Q2, 2020 KushCo’s Net loss was $44.4 million, compared to $8.9 million in the prior year period.

The Ugly:

Hexo’s (HEXO.NYSE) Q2, 2020 financials revealed a net loss of CND $289 million for the quarter ending January 31, 2020. The net revenue for Hexo increased 17% to $17 million from $14.5 million in the first quarter.

After completing a strategic review of its cultivation capacity, Hexo decided to list its Niagara grow facility for sale – booking an impairment loss of $138 million.

“Slower than expected retail store rollouts in Canada resulted in constrained distribution channels which have adversely affected market sales and profitability,” stated Hexo, “As a result of these factors, management performed an indicator-based impairment test of goodwill, booking a further loss of $111 million.”

Key Q2, 2020 Highlights:

- Net Revenue increased 17% to $17.0M from $14.5M

- Adult-use grams sold increased 57% to 6,579 kg

- Production levels increased to 22,305 kg from 16,107 kg

- Expanded Original Stash to Ontario, BC and Alberta

- Obtained Phase 1 licence for Belleville facility

- Obtained sale of cannabis topicals, extracts, edibles and beverages licence for Gatineau facility,

- Closed a $70M private placement of 8% unsecured convertible debentures, including key management and board participation of over 10%

- Closed two registered direct offerings totalling USD$45 Million

“Following a strategic review of the company’s core and non-core assets we believe we have positioned HEXO to meet these challenges head on,” stated Sebastien St-Louis, CEO and co-founder of HEXO.

Meanwhile Hexo is being sued by MediPharm Labs who claims that Hexo has reneged on a cannabis oil supply deal signed in 2019.

As of January 31, 2020, Hexo held cash equivalents of about $81 million. Barring further developments, Hexo estimates it will run out of cash in eight months.

Hexo is required to raise $40 million in equity by April 30, a “startling sum” that “could mean severe downward pressure” on the stock, according to CIBC analyst John Zamparo.

Hexo’s net loss of $298 million is 6,800% worse than its net loss of $4.3 million from the same period of the year prior.

“Borrowing money and expanding hard in competition with MedMen (MMEN.C) is a two-edged sword,” explained Equity Guru’s Chris Parry, “In a strong market, you’re building far more value than you’re borrowing but, in a down market, you’re under extra pressure to keep things together when debts come due.”

– Lukas Kane

Full Disclosure: Equity Guru has no financial relationship with the companies mentioned in this article.