World governments started paying serious attention to Bitcoin around the time of Mt.Gox and when Dread Pirate Roberts rode the Silk Road straight to jail. Naturally, they pretended they weren’t, because to admit that Bitcoin was worth their attention would confer upon it some serious legitimacy. But there’s no stopping it, and once governments realize that they can’t actually defeat a movement, they usually try to co-opt it.

Except in the case of cryptocurrency, there’s a bit more to it than co-opting it. China has released an update on their Digital Currency Electronic Payment (DCEP) project that likely has the butts of the boys at the Federal Reserve in a pucker, because if China gets out a cryptocurrency out faster than the United States the world will end, or something.

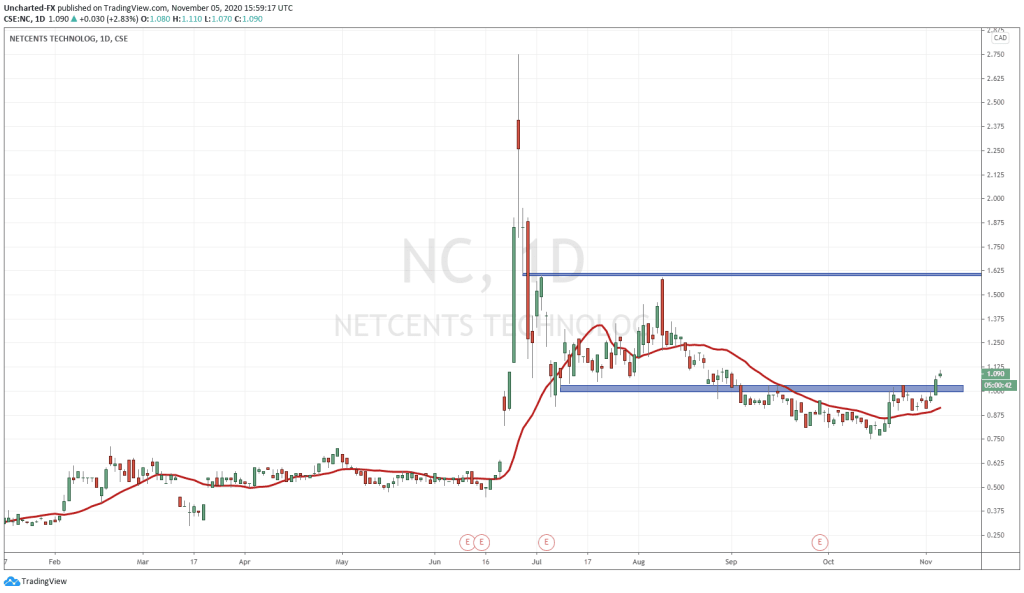

Now that the United States congress is seriously thinking about creating a U.S. Federal Reserve digital currency as part of two different versions of the first COVID-19 stimulus bill, (but didn’t include it in the final version of the first bill), companies like NetCents Technology (NC.C) are looking for opportunities to get onboard.

“We fully support the U.S. government in its creation of the contemplated digital reserve currency. The U.S. dollar is already the reserve currency of the world — so moving it to a digital format makes total sense. The U.S. might have 63 million unbanked, but the planet Earth has billions of unbanked — it only makes sense that the dollar take a digital form to enable remittance and micropayments for the unbanked globally — as well as ensure its status as the world’s dominant currency,” said Clayton Moore, chief executive officer of NetCents.

That’s definitely one side of the argument.

The other side is that cryptocurrencies were invented as a means of protecting yourself from the criminal bumbling and overreach of moribund, inefficient governments. A Federal Reserve promoted cryptocurrency would technically be a stablecoin because being tied directly to the US dollar would produce stability in its fluctuations, but it fails to observe most of the key problems that bitcoin was meant to resolve—namely, inflation and value degeneration by a central government. But the use of the blockchain in this context adds an extra worrisome element:

“A Federal Reserve created digital coin could be one of the most dangerous steps ever taken by a government agency. It would put in the hands of the government the potential to create a digital currency with the ability to track all transactions in an economy—and prohibit transactions for any reason. In terms of future individual freedom, this would be a nightmare,” said Blogger Robert Wenzel.

That element is the blockchain itself, which requires a consensus mechanism to verify every transaction. This would require some government body to give the nod to every transaction you make on the blockchain. Imagine a hard month where you have to decide between your student loan payment or feeding your kids—now imagine a government body taking that decision away from you, and forcing a soul-crushing appeals process that will take 6-8 weeks with the backlog. We need less bureaucracy. Not more.

Contrast that with this quote from Moore.

“The benefits to the treasury would accrue into many billions of dollars in innumerable ways. Societal benefits would be created as well; a digital dollar would be difficult to use for crimes and funding terrorism for example. This milestone is the ultimate endorsement that cryptocurrency and blockchain are here to stay. We look forward to offering our platform to U.S. banks and then to global banks so that they can meet the requirements for a digital USD wallet.”

What you get when you boil it down to its core essentials is that the government gets complete control over the economy, from the figurative digital printing press to accepting or denying how the currency gets used. That way, they can stomp out crime and promote positive habits that serve their interests, including giving government insight into your life and spending habits—an insight that history has proven we can’t trust them to use responsibly.

Imagine the campaign that comes along with the rollout. It’ll be a rehash of George W. Bush’s old political blathering following the passage of the USA PATRIOT Act: If you have nothing to hide then you have nothing to worry about.

And that’s not even getting into problems associated with scaling the technology: imagine punching in your US-Fedcoin app into your phone and waiting ten minutes (or more – this is government we’re talking about here) for the block to close so you can pick up your morning coffee. Hard pass.

For right now, though, the establishment of these products is intended to simplify the cost and process of distributing the millions of stimulus payments contemplated by the bill, but the effects of this move will be far reaching. The complexity behind establishing the cryptocurrency meant they couldn’t cram it into the first bill, but NetCents management believes that adoption is a foregone conclusion.

The bill is expected to establish a digital dollar defined as a “balance expressed as a dollar value consisting of digital ledger entries that are recorded as liabilities in the accounts of any Federal Reserve Bank or … an electronic unit of value, redeemable by an eligible financial institution.” The continues on to define a digital wallet and a requirement for U.S. chartered banks to get onboard with the project by carrying the wallet.

NetCents has developed the support software already.

—Joseph Morton