Trust me, there’s nothing I’d like more, as the publisher of a financial markets-focused media outlet, than to tell you all it’s time to buy back in on these ailing markets. I’ve got clients who’d reward me well if I were to convince you that it’d be a good idea to buy their stock in the middle of a stock slide. I’ve got employees that I’m still paying and not laying off that are ready to do their thing and share good investing opportunities with you all, especially at a time when you’re all at home looking for information.

But now’s not the time.

People are dying. Companies are suspending operations. Folks are becoming jobless. International travel has stopped and borders are closed. We’re literally hiding in our homes.

And yet, today, airline stocks rose 30%.

- American Airlines (AAL.Q) up 33%

- Spirit Airlines (SAVE.NYSE) up 31%

- Allegiant (ALGT.Q) up 25%

- Delta (DAL.NYSE) up 22%

- United (UAL.Q) up 21%

- JetBlue (JBLU.Q) up 21%

- Alaska Air (ALK.NYSE) up 21%

That’s some bullshit.

Here’s a chunk of the last news United put out:

Atlantic

- United is drawing down its remaining trans-Atlantic operation. The final westbound departures will take place on March 25, with the exception of its Cape Town–New York/Newark service which will operate as previously scheduled with the last flight departing Cape Town on March 28.

Pacific

- United will reduce its remaining trans-Pacific operation starting March 22, with final eastbound departures on March 25, with the exception of service between San Francisco and Tahiti and San Francisco and Sydney which will have final returns to San Francisco on March 28.

- United will maintain some Guam flights as well as a portion of its Island Hopper service.

Latin America

- United will reduce its Mexico operation over the next five days. After March 24, it will only maintain a small number of daytime flights to certain destinations in Mexico.

- United will draw down its remaining Central and South America operations. The last southbound departures will take place March 24.

Canada

- United will temporarily suspend all flying to Canada effective April 1.

The airlines are fucked and yet, on a random Tuesday, on no news, they all climb 20%+?

Why, it’s almost as if someone said to an organization with unlimited funds, “Buy all the airlines, get them all up 20%.”

Also weird, Expedia (EXPE.Q), which lives and dies on air travel, is only up 12% today. Not part of the grand plan?

What we’re seeing on the markets today is not a sudden unbridled enthusiasm across North America for a sector that is going to be decimated come earnings season, you’re seeing the Fed buying everything to prop the market up in the hope you’ll follow it in.

DON’T.

Yes, your weed stocks are up today. Yes, the blue ribbon stocks are on the move.

But it’s fake. It’s a honeypot. The idea is to convince you the bottom is in and if you don’t move your cash to equities right now, you’ll lose your chance to profit on the way back up.

This is some bullshit. The US government is working as a stock promoter, pumping the market with taxpayers’ money, and will ultimately be stuck with massacred equities when that attempt to hold back the tide fails.

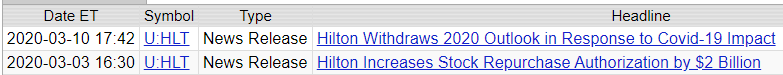

Here’s a screenshot that’ll piss you off royally:

Hilton (HLT.NYSE) up 12% today.

But hey, maybe the bottom really is in? Maybe, from here, everything surges? Maybe next week this will all be okay?

Nah.

Watch the real estate market.

My neighbor is an @Airbnb super host.

She is on forums with other hosts.

Many of them have 10+ mortgages.

0 guests are booking their properties.

They are running out of cash.

— Spencer Noon (@spencernoon) March 24, 2020

Boeing is up while airlines are shutting down and nobody wanted their planes anyway. Exxon is up big, despite me being able to fill my tank for 1/3 less today than it cost two weeks ago. Staples is up 5% while most companies are shutting their doors and sending people home. The Gap is up, though shopping malls are ghost towns.

Meanwhile, Costco, which is doing more business than anyone, is down. Netflix down. Activision down. Zoom, which half the world is using for video conferencing today (including me) is down.

None of it makes any sense, except to say The Fed is blasting cash at the market to keep it from looking bad.

The US Government is yelling "Buy frozen concentrated orange juice!" while COVID-19 is checking his tie in the washroom mirror, ready to walk out and yell "SELL!" pic.twitter.com/12ZKvTGoaU

— Chris Parry ™ (@ChrisParry) March 24, 2020

I’m not saying there aren’t some deals that are already as low as they’re likely to get, or that you can’t find things that will legitimately run for real reasons. Your research can of course, find outliers.

And some of our clients and investment targets are finding favour, despite the wider carnage. We’ve seen new Equity.Guru client Revive Therapeautics (RVV.C) jump hard over the last few days on the back of their pharma IP that may have COVID-19 uses. Rare Earths explorer Defense Metals (DEFN.C) is up 47% today. Supreme Cannabis (FIRE.T) is up 65% over the last week. American Aires (WIFI.C) is up 35% today. Patriot One (PAT.T) is up 12%, Vext Science (VEXT.C) is up 9.9%. AMPD Ventures (AMPD.C) is up 65% as I write this, albeit on tiny volume. 1933 Industries (TGIF.C) is up 9%.

That’s all nice. But my advice is now, as it has been for weeks:

BE. IN. CASH.

Your favourites will survive, if they’ve been smart and financed themselves well. You don’t need to ‘be on their team’ and eat losses. Stay cashed up and nimble, and be the prettiest girl at the dance when the economy actually ramps back up.

The stock opportunities will come in time but, for now, have money available to you to keep your rent paid, keep food in your fridge, keep your life stable if you’re laid off, and be ready to splash the hell out on equities when you KNOW this is all over.

Not a day before. My clients can wait.

— Chris Parry

Full Disclosure: 1933 Industries, Defense Metals, Revive Therapeutics, Supreme Cannabis, American Aires, Patriot One, and Vext Science are Equity.Guru marketing clients.