We’ll dispense with a recap of yesterday’s financial headlines, cept to say, it was an across-the-board bloodbath.

Yesterday, in part one of a two-part roundup, we focused on hard-hit junior companies—co’s with market caps > $50M—with significant assets underpinning their beaten up valuations.

Today, we’ll take a look at a number of companies a little further down the food chain—a handful of sub-$50M entities I believe represent deep value at current levels.

Let’s dive right in…

- 191.63 million shares outstanding;

- $18.2M market cap based on its recent $0.095 closing price

Cartier’s 100% owned project Chimo Mine Project, a past producer of some 379K ounces of gold, has a current resource of…

- 3,263,300 tonnes at an average grade of 4.40 g/t Au for a total of 461,280 ounces of gold in the Indicated category;

- 3,681,600 tonnes at an average grade of 3.53 g/t Au for a total of 417,250 ounces of gold in the Inferred category.

These numbers apply to the company’s Central Gold Corridor.

This is a first pass estimate.

A resource estimate for the company’s North Gold Corridor and South Gold Corridor is due at any time.

There are a lot of moving parts to this company. The zones noted above could ultimately generate a multi-million-ounce resource at the end of the day—the company is currently in the midst of an aggressive drilling campaign designed to test mineralization at depth.

In a recent press release, the company cut 22.0 g / t Au over 2.0 meters from 1393 meters depth.

Clearly, the market doesn’t understand the latent value here. Cartier has endgame potential in Chimo. Agnico Eagle (AEM.TO) owns 17% of the company’s common. Agnico recently shuttered their nearby La Pa Mine. You do the math.

Once Chimo is monetized, Cartier will lean into its Benoist Project, only one in a stable of highly prospective projects lined up for a probe with the drill bit, all located in mining-friendly Val-d’Or, Quebec.

Shares in the company have been discarded with little thought to their underlying value.

The company tagged multi-year lows yesterday. Sub-dime might be considered a firesale. That’s not to say the stock can’t go lower, but anything in this price range has limited downside risk (author’s biased opinion).

- 46.26 million shares outstanding;

- $19.66M market cap based on its recent $0.425 close

Coral holds an uncapped sliding scale 1% to 2.25% net smelter royalty (NSR) on over 2.7 million ounces at Barrick Gold’s ( ABX.TO) Robertson Property located along the prolific Cortez Gold Trend of northern Nevada.

Robertson is a joint venture between Barrick (61.5%) and Newmont-Goldcorp (38.5%). This JV among mining behemoths is called Nevada Gold Mines, or NGM for short.

Coral’s share price performance through all the recent market mayhem has fared better than most, though there were opportunities to buy the stock at a significant discount.

If the price were to dip below, say $0.40, the downside from there would have to be considered limited. Click on the link, here, for a deeper delve into this high-quality royalty and exploration play.

- 39.71 million shares outstanding;

- $3.77M market cap based on its recent $0.095 close

Defense is developing its 1,708-hectare Wicheeda Rare Earth Element (REE) Project in the Prince George region of British Columbia.

Wicheeda’s current resource stands at 11,370,000 tonnes averaging 1.96% LREEs (a grade of 1% LREE is equal to roughly 2.5 grams per tonne gold).

2020 newsflow promises to be strong as the company pushes this strategic deposit further along the development curve.

This is another company getting caught up in the broader market volatility, with nary a thought given to the value being tossed.

In these topsy turvy times, stink bids stand a good chance of getting hit.

- 97.95 million shares outstanding;

- $39.18M market cap based on its recent $0.40 close

Fiore, a new producer in the gold space, is operating the Pan Mine in Nevada—a Carlin-style, open-pit deposit on the prolific Battle Mountain-Eureka Gold Tend.

This is only just the beginning of what the company hopes will evolve into a 150,000 oz-per-year production scenario.

Regarding Q1 results released on Feb. 28, Fiore’s CEO Tim Warman stated:

“Though quarterly gold production was below plan, the upward trend within the quarter was significant with Pan reaching almost 4,000 ounces in December and producing at similar levels into our second fiscal quarter. As the year progresses, we are guiding an increase in gold grades, stronger leach kinetics from crushed ore and a reduction in strip ratio. This should naturally increase gold production and lower all-in sustaining costs1. With the current strength in gold price and no hedges in place, we expect to see considerably stronger operating cash flows at Pan through the balance of the year.”

No surprise, Fiore common has taken it on the chin in recent sessions. But yesterday’s price action must have created more than a little concern among Fiore faithful.

Technical analysis doesn’t always work during market events. The blue line (above chart) should have acted as fairly decent price support.

The above chart also demonstrates the role stink bids can play in getting one positioned at extremely opportunistic levels.

- 41.17 million shares outstanding;

- $9.47M market cap based on its recent $0.23 closing price

Genesis is exploring its 100% owned Chevrier Gold Property located in the Chibougamau region of Quebec.

The current resource at Chevrier stands at 395,000 ounces of gold averaging 1.45 g/t Au in the Indicated category and 297,000 ounces of gold averaging 1.33 g/t Au in the Inferred category.

In recent news, the company launched an aggressive 8000-meter drilling program at Chevrier, focused on “improving definition and expanding the volume of higher-grade domains which form of plunging “shoots” within the Chevrier Main deposit.”

This is a resource that could see significant expansion. There are also a number of regional targets the company plans to test during this drilling campaign.

Looking at the company’s price chart, it has seen better days.

The stock tagged multi-year lows yesterday. With a fully-funded (up to) 8000-meter drilling campaign in motion, this could represent solid value as a resource expansion play in a mining-friendly clime.

Golden Predator Mining (GPY.V)

- 156.98 million shares outstanding;

- $31.4M market cap based on its recent $0.20 close

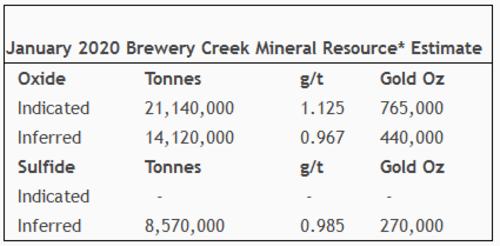

Focused on its past-producing Brewery Creek Mine, and its high-grade 3 Aces Project, this one has both near term production and exploration upside.

At Brewery Creek, the current resource stands at…

In recent news, the company continues to expand the geological footprint at Brewery Creek.

At 3 Aces—an orogenic type setting with at least six mineralized zones extended over a thirty-five-kilometer trend—the company has poked well over 300 holes into the Central Core Area, 37% of which cut grades of 5 g/t Au or better… 27% cut 8 g/t Au or better.

Also in recent news, the company is working with partners on a non-invasive extraction technology utilizing environmentally-friendly liquids to recover gold and other metals.

Golden Predator Announces Commercial Launch of New Green Extraction Technology for Gold

The company’s shares appear to want to test the lows set two summers back.

Stink bids might be the way to play this one.

- 40.21 million shares outstanding;

- $30.56M market cap based on its recent $0.76 close

HighGold is top shelf stock, about as A-List as they come in this arena.

The company’s Johnson Tract property in southcentral Alaska bears flagship status. We covered Johnson Tract in some detail late last January in A high-grade gold and base metal play with Tier-1 potential.

The company also controls three highly prospective projects in the world-class Timmins Gold Camp of Ontario—Munro-Croesus, Golden Mile, and Golden Perimeter.

HighGold is teeing up a significant drilling campaign at Johnson Tract later this summer. In the meantime, 5000-meter program was recently launched in the Timmins camp.

HighGold Mining Commences 5000-Meter Winter Drill Program on Timmins Area Gold Projects

HighGold shares have really taken it on the chin in recent sessions.

A relatively new trader in the junior arena, the stock tagged the lowest price registered since it began trading six months ago.

If I had to create an even shorter list out of my current shortlist, HighGold would be on that abbreviated ticket. Nough said.

- 110.26 million shares outstanding;

- $35.28M market cap based on its recent $0.32 close

Impact was featured prominently in these pages after Lukas Kane and I ventured south to view the company’s Mexican assets in recent weeks.

We both walked away sufficiently impressed. There’s extraordinary leverage to rising silver prices here.

There’s also a lot of moving parts to this story, too many to even begin summarizing here in this small space. For a closer look, the following feature article should more than bring you up to speed:

Since our site tour, the company’s shares have been taken out behind the woodshed.

The $0.30 zone should have provided solid support for the stock. It still may. If the extreme volatility witnessed in recent sessions continues, stink bids below yesterday’s low might see a fill.

- 311.47 million shares outstanding;

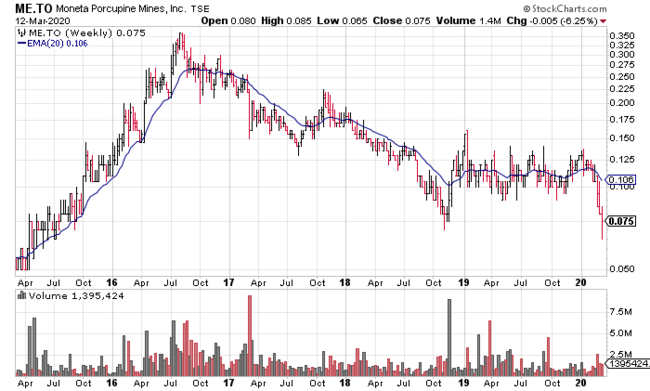

- $23.36M market cap based on its recent $0.075 close

Moneta’s Golden Highway Project is located along the Destor Porcupine Fault of the Timmins Gold Camp in northeastern Ontario.

Golden Highway hosts a 43-101 resource of some 556,500 ounces of gold in the Indicated category (3.8Mt at 4.53 g/t Au) and 1,174,000 ounces of gold in the Inferred category (8.5 Mt at 4.31 g/t Au).

Drilling from a recently boosted 2019/2020 winter drill program continues to expand known and new zones of mineralization.

Moneta is another junior ExplorerCo taking an unscheduled trip down memory lane, visiting multi-year lows (the following is a 5-year weekly chart).

Continued market oppression could drive these shares back down into the nickel range. For now, the seven cent level should offer a modicum of support.

- 58.12 million shares outstanding;

- $33.71M market cap based on its recent $0.58 close

This will be the company’s first mention in these pages.

Sailfish is a precious metals royalty and streaming company with several advanced-stage assets in its portfolio—a gold stream equivalent to a 3% NSR on the San Albino Gold Project in northern Nicaragua, and a 2% NSR on the remaining area surrounding San Albino.

The company also holds an NSR (up to 3.5%) on the Tocantinzinho Gold Project in the prolific Tapajos district of northern Brazil. For those with a memory, Eldorado (ELD.TO) acquired Tocantinzinho from Brazauro Resources back in 2012. I remember that transaction. I had bids in to purchase Brazauro—bids that went unfilled—only days before Eldorado swopped in and took out the stock at a nice premium.

Last summer’s acquisition of Terraco Gold adds a major asset to the company’s portfolio: an NSR (up to 3% ) on the multi-million ounce Spring Valley gold project in Pershing County, Nevada.

There is debt on the company’s books—roughly $11M. This is something to be examined closely if liquidity becomes an issue.

Sailfish was given what-for in recent sessions.

If one were attempting to pick an entry point in all of this broader market chaos, it’s difficult to imagine how current prices wouldn’t work out in the medium to long term, but of course, stink bids below the current market could see a fill.

- 96.65 million shares outstanding;

- $29.96M market cap based on its recent $0.31 close

There are over 100 properties in Strategic’s portfolio, representing a diverse suite of metals, most of which are 100% owned with no underlying royalties.

The company has working capital of roughly $25M—a combination of cash and marketable securities.

This is one company on my list that doesn’t have a resource, but its 36.3% stake in Rockhaven Resources (RK.V) gives it exposure to one…

- an Indicated Mineral resource of 4,457,000 tonnes grading 4.8 g/t Gold, 98 g/t Silver, 0.7% Lead and 0.9% Zinc, containing 686,000 oz Gold, 14,071,000 oz Silver, 73,268,000 lbs Lead and 92,107,000 lbs Zinc… or, a Gold equivalent metal content of 907,000 oz at a Gold Equivalent Grade of 6.3 g/t.

- an Inferred Mineral resource of 5,714,000 tonnes grading 2.8 g/t Gold, 76 g/t Silver, 0.6% Lead and 0.7% Zinc, containing 507,000 oz Gold, 13,901,000 oz Silver, 77,544,000 lbs Lead and 89,176,000 lbs Zinc… or, a Gold equivalent metal content of 725,000 oz at a Gold Equivalent Grade of 3.9 g/t.

The company’s Mount Hinton Project in the world-famous Keno Hill Silver District is what I’m really excited about here.

Strategic Metals Continues To Discover High-Grade Gold At Its Mount Hinton Property, Yukon

The company’s price chart has seen better days.

The $0.28 level from a few sessions back represents a test of multi-year lows. I would consider an entry anywhere near that price an absolute gift, but the market has a way of humbling people like me.

- 425.35 million shares outstanding;

- $27.65M market cap based on its $0.065 share price

WKM is developing its 75% owned advanced stage Hasbrouck Gold Project in the Tonopah area of Nevada.

A fully permitted project, Hasbrouck sports 784,000 ounces of gold in the Mineral Reserve category.

This is a simple mining scenario—about as simple as it gets.

A pre-feasibility study tabled in 2016 shows a CapEx of US$47M, an after-tax NPV of US$120M, and an IRR (after tax) of 43%… all based on a $1275.00 gold price assumption.

These are solid numbers—the project’s CapEx is very modest.

In recent days, the US Bureau of Land Management accepted the company’s Mine Plan of Operations (“MPO”) and will commence the analysis of the MPO under an Environmental Assessment.

West Kirkland Obtains Positive Decision from BLM on Permitting Process for Hasbrouck Mine

The company’s price chart over the past year hasn’t exactly inspired confidence.

Long time shareholders in the company are waiting for a payday—the day WKM starts pumping out gold bars.

There could be an endgame here too—a takeover by a resource-hungry Producer.

In recent sessions, the stock has traded in the sub-nickel range, a logical entry point.

That’s it for our list of the beaten down and battered—the deep values in the sub-$50M category.

END

—Greg Nolan

Full disclosure: of the companies featured above, only Defense Metals is an Equity Guru marketing client.