When cannabis was legalized in 2017, it was thought to be more akin to a land of milk and honey for investors. Everyone was going to get on board—from daytraders to grandma putting up her pension to make some sweet post-retirement cash—and for awhile, it looked good. Some companies ran hot. Others not so much. But eventually, the bubble got so big that there was no coming back. Now the cannabis sector looks like a field hospital circa the first world war. All screaming and howling in pain, and baskets full of severed limbs where doctor’s needed to amputate the limb to save the soldier. Except the screaming and howling is coming from investors, and the baskets of limbs are from companies taking an economic bonesaw to underperforming assets to cut costs.

Also, if a soldier survived the procedure, he’d usually end up spending the rest of the war in a hospital, alternatively freaking out over missing a limb and maybe flirting with nurses. For cannabis companies, there’s no hot nurse and phantom limb freakout—they’re right back out there, this time suited up for cannabis 2.0.

Harvest One Cannabis (HVT.V) is one such company.

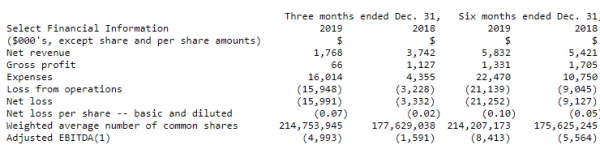

Compared to some of the companies shuddering from the post-battlefield rattles from their time in 2018, Harvest One isn’t doing so badly. Their financials show a company despite losing $15.99 million loss in Q2, and there’s definitely some strategic realignment required, but there’s room and opportunity to grow.

“In light of industry challenges, Harvest One realigned its strategy to focus on our core strengths of brands and distribution and undertook significant cost cutting initiatives to rightsize the organization. We anticipate a strong rollout of our Cannabis 2.0 products, specifically our LivRelief — cannabinoid-infused topical creams, which are in strong demand from retailers,” said Grant Froese, chief executive officer of Harvest One.

Back to the front

Harvest One’s cannabis 2.0 hopefuls include a selection of pain relief topical creams and vape pen cartridges. The products have all undergone all of the necessary Health Canada notifications and are presently going through the process to get listed in Ontario, British Columbia, Alberta, Saskatchewan and Manitoba. All five provinces have completed registrations and the company is putting the finishing touches on the arrangements with a production partner to finalize its product launch. Harvest anticipates the products to be on shelves later this quarter.

The company received permission back in November, 2019, from Health Canada to import Satpharm’s 10mg CBD Gelpell capsules into Canada for research and development purposes. The company is working to prepare for a launch of the CBD Gelpell capsule into Canada. The development of this business, the company hopes, will be a key element in the future growth for Harvest One, depending on whether or not they can get more financing.

Delivra has two topical pain relief SKU’s called LivRelief that have gotten the nod from the US Food and Drug Administration (FDA) and started selling on Amazon in January, 2020. The company anticipates using its US Dream Water distribution network to rollout US LivRelief with major retailers across the United States.

The company is waiting on clarification from the FDA about their CBD-infused topicals and ingestibles. They’re done with the formulation and development work, but won’t be able to capitalize on it until the regulatory environment changes in the United States.

Harvest One’s Phantom limb syndrome

What’s that grinding bone-on-metal noise you’re hearing? That’s Harvest One, severing ties with its 19.99% interest in Burb Cannabis Corp. , a B.C. based private cannabis retailer for $1.5 million in cash last month, and having penned a definitive agreement to sell its interest in its 398-acre site in Lillooet, B.C. for $770,000 in cash.

That’s only half of it.

The other half has the company in discussions to divest its 50.1% interest in the Greenbelt Greenhouse facility in Hamilton, Ontario, which would give the company some capital and let them refocus on growing their cannabis 2.0 stake, product branding and distribution.

Cost Reduction Tourniquet

The company wrapped their wounds in a cost-reduction tourniquet in November 2019, beginning with a number of initiatives that they hope will amount to a 30% reduction in selling, general and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses yearly. These include layoffs, reducing senior management salaries, downsizing or consolidation of corporate offices, and implementation of remote workforce programs—or telling people they can work from home. The company says they’ve worked so far, and anticipates even more cost cutting measures throughout 2020.

The company has also had to suspend development and its Lucky Lake and Mission Road facilities. Lucky Lake had been completely redesigned to support the company’s renewed focus on cannabis 2.0 products and distribution, and the Mission Road Phase 1 expansion had just received its license. Now additional investment is going to be required if development is going to continue.

Here’s their financial results summary:

Here’s what they have to say:

“We remain focused on solidifying our balance sheet with additional sales of non-core assets and continuing to evaluate various financing alternatives. We are confident that we are taking all the necessary steps to reduce costs and move the Company towards profitability,” said Froese.

Can you hear the optimism in there?

It looks like they’ve got some more bleeding to do before it’s finally over.

—Joseph Morton