Trade ideas and discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Today is the end of quarter 1 (Q1) and it is set to be the worst quarter for the Dow ever. The end of the quarter is usually when funds want to reallocate and rebalance their portfolios. Generally, if you are a fund manager, you want to show a gain and some locked in profits every quarter. You see firms sell positions to get into cash. It remains to be seen if this will be the case as not many funds are in the green. They could very well be using the end of Q1 to readjust back into stocks, as they see that they will need to be making yield for the future after the performance they are seeing in Q1. The red in their portfolio hits home. Fund managers jobs are on the line as they fail to do the one thing they are supposed to: bring in yield.

In this world, and for the post-coronavirus world, the stock market is the only place to go for real yield. You do not hold bonds for yield (but you can trade them for capital appreciation betting on interest rates to drop into the negative), and you do not get it much in real estate (even for rental properties as property taxes take a good chunk out and it is very likely you will not be beating the real rate of inflation). This is why stocks can still get a bid when the fear begins to dissipate. Central banks have created an environment where money is forced into equities. They are the only place to go for yield.

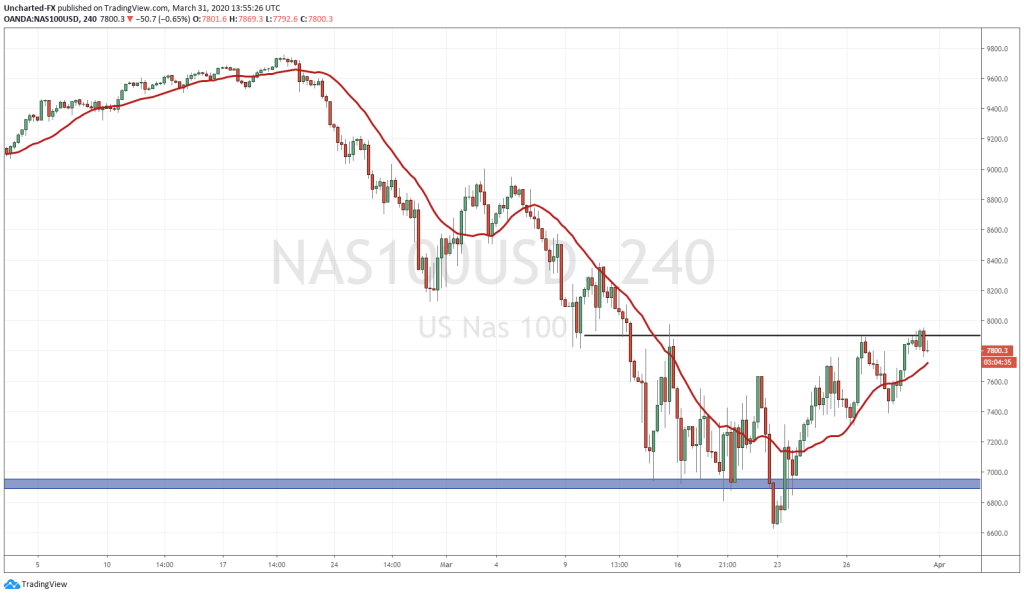

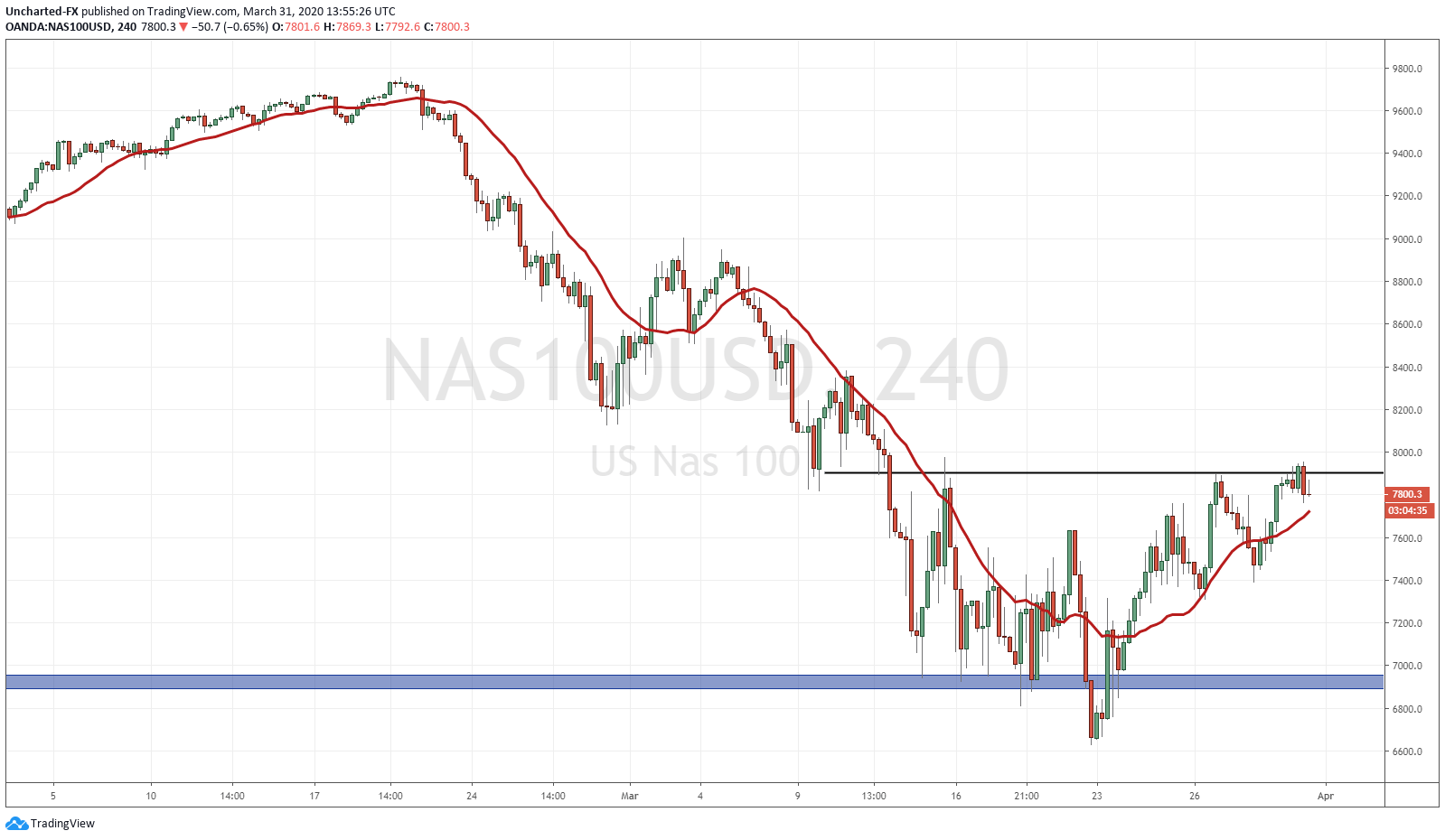

In the Discord channel, we have been watching the weekly chart for a potential move lower (a lower high), but this is assessed on a week to week basis. On the 4 hour chart, I have covered the case for a bullish move higher. We are seeing appetizing reversals and a shift from lower highs to now higher lows. We even have a head and shoulder pattern. The Nasdaq chart here looks the best. As many companies require bailouts and are laying off, many of the big tech companies have the cash to survive, and prevent massive layoffs. Their stocks have also fallen and many see this as an opportunity to get into good companies at a cheap price. It is tempting to load up here for funds.

We will be watching to see if this zone breaks. There is no trigger yet. We do have both the fiscal and monetary side of policy implementation to keep assets propped. In fact, US congress is already talking about a fourth relief package. More money will be thrown to keep assets propped. We have been watching equity market price action on Discord, and a few things do not seem to be right. The VIX is still high, bonds are still getting a bid, not indicating money leaving bonds for stocks. Fear is still present. Which begs the question…who is buying stocks? It is very likely the central banks are, as the Fed has made it clear that they would buy securities.