Those of us who are married know that the most dramatic conflicts are often catalyzed by small disturbances to the status quo.

You made an omelet and left egg on the Spatula.

You replaced a toilet paper roll incorrectly.

You left a cigarette butt in the potted bamboo.

The ensuring 15-minute screaming match may be about the spatula, the toilet paper, or the cigarette butt – but the underlying cause is usually deeper.

Calling the coronavirus “egg-on-a-spatula” is pushing it (2,800 people have died) but the extent of the market carnage can not be solely explained by its current or likely-future economic impact.

The Dow is down 4,100 (-12%) from its Feb. 12, 2020 record-high close of 29,550.

Blue-chip stocks are “big companies with good reputations and rock-solid financials” (consistent earnings, dividends etc.), usually “market leaders” in their sectors.

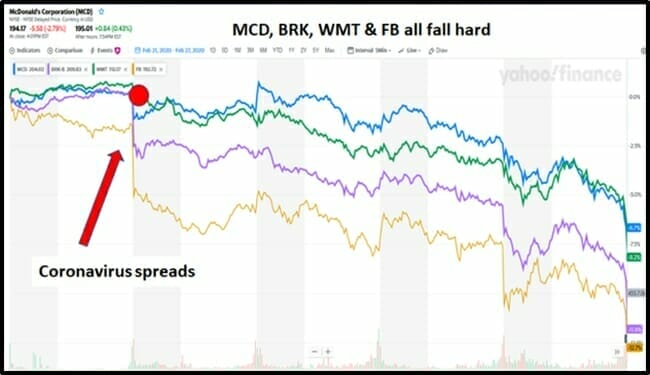

Investors choose blue-chip stocks like McDonalds (MCD.NYSE), Berkshire Hathaway (BRK-B.NYSE), Facebook (FB.Q) and Walmart (WMT.NYSE) because they don’t want to snap awake in the middle of the night fretting about hurricanes, federal cannabis laws or deadly Asian viruses originating from bats.

As you see from the chart below, the last five days, blue-chip investors have been losing sleep:

Here’s the thing: the marriage between investors and stock markets was already under stress.

The recent blood-bath in blue-chip stocks was catalysed by the spread of the coronavirus, but there are 5 underlying causes that have made it so dramatic and violent.

1. Consumer Debt:

“Consumer debt in the U.S. is now $1.3 trillion higher than the previous peak set in 2008,” stated CNN business, “Household debt has climbed 25% from the post-recession low of $12.7 trillion.”

Mortgages remains the largest chunk of Americans’ debt, accounting for $9.44 trillion. That’s up by $31 billion, from the end of Q2. Student loans climbed by 1.4% to $1.5 trillion, while credit card balances rose $13 billion during Q3 to $900 billion.

According to Fed Chairman Jerome H. Powell, there is no reason to panic, although $660 billion of household debt is delinquent, including $424 billion that is “seriously delinquent” (more than 90 days late).

Consumer debt default rates in black-majority zip codes are 200% higher than those in white-majority zip codes.

Each worker owes about $106,000 in personal debt. One quarter of the nation’s 131 million workers are over the age of 55, the average life expectancy is 78, the average salary is $63,000, and average savings rate of 8%.

Even if no new debt is accrued, 16 million of those indebted Americans are projected to die before they pay off the principal.

2. Weak Labour Force

The U.S. unemployment rate is near a 50-year low, however after 10 years of economic recovery, the labor force participation rate is just 63% as of January, 2020.

If you stop looking for work, if you are a professional drug dealer, if you’re in prison – you don’t count as unemployed.

Many of those who have left are not baby boomers, but prime working-age Americans (age 25-54) in their peak earning years.

Nearly 37% of all potential workers have opted out of the employment market.

How can this be?

Because “workers” are yesterday.

Facebook stock price has increased 900% in 7 years. It now has a market cap of $546 billion. But FB only employs 18,000 people.

That’s about 27 X fewer people than GM employed in 1956. “These days, the number of employees is less important as automation and sophisticated programs take over,” confirms Forbes Magazine.

These tech giants incur fewer costs in comparison to those in the auto industry. Facebook spends virtually no money on raw materials or keeping inventory.

When 37% of your eligible workers aren’t drawing a pay check, that creates an economic stress point

3. The 2020 U.S. Presidential Election

Anxiety about the U.S. presidential election’s outcome is creating jitters in the markets.

Financial pundits believe that if Sen. Bernie Sanders, an independent from Vermont who characterizes himself as a democratic socialist, wins the Democratic presidential nomination, and possibly even the presidency, stocks would take a hit as he an antibusiness candidate.

“The risk to U.S. stocks is pretty significant if Bernie gets the nomination,” confirmed Ed Moya, a senior market analyst with OANDA.

“If we are going to break the stranglehold of corporate interests over needs of the American people, we have got to confront a Washington culture that has let this go on for far too long,” stated Sanders.

Bernie could easily cool investor fears by saying, “I’m not against rich people. When I’m President, people will get even richer. But rich people will need to pay their share.”

But that’s not Bernie’s style.

The possibility of a socialist in the White House is a destabilizing market force.

4. Addiction to Shopping

Shopping in the U.S. generates a whopping 68% of its GDP. There are more shopping malls in the U.S. than high schools.

Americans collectively carry $870 billion in credit card debt, but still spend $70 billion a year on pets, including must-own products like “Poop Freeze”.

By comparison, Chinese shopping skills are abysmal. Shopping in China accounts for only 54% of China’s GDP.

The Chinese don’t get it! They buy boring shit like groceries, furniture and fridges.

A research paper published by the New York Federal Reserve Bank estimates that U.S. tariffs on China cost the typical American household $831 per year.

That means that U.S. consumers will have to buy less stuff, or borrow more money.

Buying less stuff will trigger a recession.

Countries with healthy economies usually have a primary skill set that creates value (mining, agriculture, manufacturing tourism etc).

When the one thing you are best at is spending money you don’t have, that’s a ticking time-bomb.

5. Corporate Debt

$1.2 trillion worth of corporate junk bond debt will mature in the next few years, leaving investors in a world of pain, as many of the bleeding corporations will be unable to repay the principle.

“The biggest boom in corporate credit since the Great Recession in 2008 has led to warnings from regulators that a bubble in business debt could end badly,” stated Market Watch.

Moody’s now has a “negative” outlook on nine industries where junk-rated companies have a collective $223 billion of debt maturing by the end of 2024.

Financial analysts use the junk bond market as economic bellwether. If few investors buy junk bonds, it suggests wide-spread pessimism. If lots of investors buy junk bonds, that indicates wide-spread optimism.

In 2019, a lot of optimistic investors piling into corporate junk bonds.

Ford Motor Company (F.NYSE) has $160 billion of maturing corporate debt on its books. Ford booked a $2.2 billion “accounting charge” last year to pay retired factory workers.

“I’m bursting with pride – I just bought a brand-new Ford Fiesta!” – said Nobody Ever.

Last September, Moody’s downgraded the Detroit automaker’s credit rating to junk.

High demand for junk bonds makes it easier for weak companies to borrow money.

That’s not healthy.

A Congressional Budget Office study found that a coronavirus pandemic “could produce a short-run impact on the worldwide economy similar in depth and duration to that of an average postwar recession in the United States.”

According to Bloomberg, “Global debt hit a record $184 trillion last year, equivalent to $86,000 per person — more than double the average per-capita income.”

A lot of that borrowed money has sloshed into the stock markets.

The S&P 500 is trading at 19 X the forward earnings estimate among analysts. That is up from 16 X a year ago. Aside from a brief spike in 2018, it is the highest forward price-to-earnings ratio since 2002.

Screaming matches between spouses usually have deep underlying causes.

(Resentments, lies, inequities that we don’t have the courage to speak about directly)

On Friday February 28, 2020, the blue-chip DJIA trended lower for a 7th straight day – down another 357 points.

– Lukas Kane