BC-based battery metals developer Nano One Materials (NNO.V) has long been a favourite at Equity.Guru – in fact, it’s been the stock we’ve held longest out of all the companies we hold. That’s been a wise decision, as we’ve watched it roll from $0.50 a few years back to $1.15 more recently, but the one beef we’ve long had with the Nano crowd is, they’re very operation-focused and can, at times, forget about the stock for extended periods while they continue to prove out their tech and advance some large scale partnerships.

We do like them BECAUSE they’re good operators and truly growing something with the potential to be huge. But you also need trading volume so folks can know, when they need to, they can get out of the stock, be it for a profit or otherwise.

Hell, we even sold some NNO for the first time in years a few months back because of this very issue.

Now, it appears the company is coming out of its slumber.

That sort of jump is worth adding a company to your watchlist by itself, but the added beauty of Nano One right now, at least if you’re an accredited investor, is that rise coincides with an announced financing at $1.15.

Yes, NNO is raising $5 million at a $0.30 discount to the stock price. Not deliberately, mind; They locked in the raise after an extended period of the stock sitting at $1.15, but recent news has started to bring new eyeballs to the stock and it’s traded so lightly that a sizable jump followed.

Also worth noting: The raise wasn’t ‘survival financing’.. in fact, it’s to help the company bring in matching funds and secure their corner of a big partnership looking to make inroads in the rechargeable battery space.

The proceeds of this private placement are intended to be used for corporate development, facilities expansion, technology advancement and general working capital.

Nano One’s chief executive officer, Dan Blondal, commented: “Most importantly, the $5-million in proceeds will be leveraged by an additional $5-million in non-dilutive and non-repayable contributions that was awarded to Nano One by Sustainable Development Technology Canada in May of 2019. The sum of $10-million will help fast-track testing and co-development activities, including those with existing collaborators Volkswagen, Pulead and Saint-Gobain. This positions us very well to execute on our business plan.”

To be clear, Volkswagen is a $100 billion car manufacturer, Pulead Technology is a large Chinese electrochemical cathode producer, and St Gobain is a 350-year-old European construction materials giant worth $40 billion.

Nano One, at the heart of their partnership and holder of the tech they’re building around, is valued at just $88 million.

While the chart above may seem to some to be a little pumpy, take into account that the highest office in Canada recently gave it a stamp of approval:

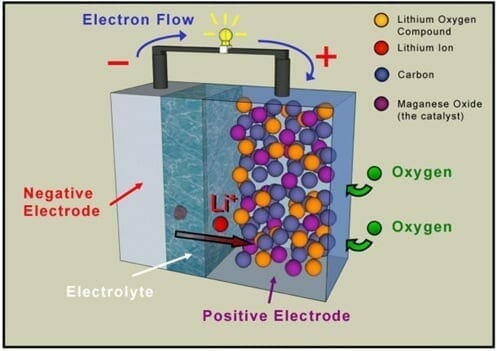

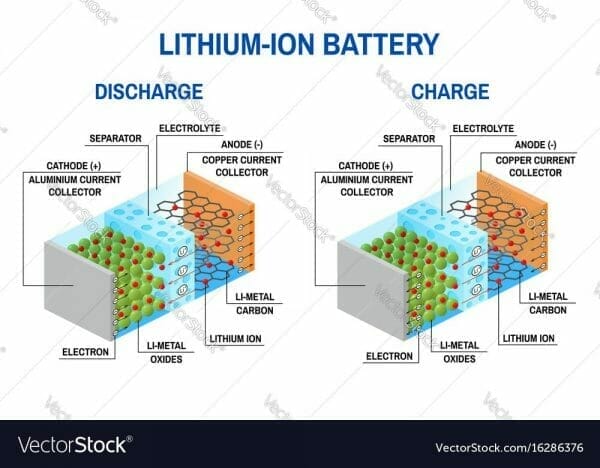

The Financial Post reports in its Friday, Sept. 27, edition that on Tuesday, Prime Minister Justin Trudeau travelled to Burnaby, B.C., to announce his latest climate change efforts at the pilot plant of an upstart company that is tinkering with lithium-ion battery technology.

The Post’s Gabriel Friedman writes that the PM’s choice of venue revealed much about the opportunities in Canada as a new supply chain takes shape on the electric vehicle industry, which relies on lithium-ion batteries, not oil. The latest rush around battery metals may end up providing more opportunities to this country’s fledgling technology sector. It is companies such as Nano One Materials ($1.27), as well as lithium brine extraction and recycling companies, that are generating publicity, drawing investments, partnerships and government support for their plans to build businesses around the rising demand for lithium.

If the partnership and the tech and the $0.30 discount per share financing and the matching funds aren’t attractive enough for you, the warrants attached to that financing sit at $1.60, a mere $0.15 away from the current price.

Not a client, but we appreciate good work.

Watchlist it.

UPDATE: The raise has expanded to $10 million since this article was written.

— Chris Parry

FULL DISCLOSURE: Nano One has, at various points over the last three years, been an Equity.Guru marketing client. We continue to hold the stock.

Excellent commentary. Hard to argue with. Nano appears to be the real thing !