A translation of this article is available in Chinese at our content partner NAI500 here.

The junior exploration arena promises to be a mosh pit of activity in 2020.

The merger and acquisition activity we witnessed over the past year demonstrates a growing appetite by gold Producers’—predators if you will—to devour smaller, resource-rich quarry.

Why this predatory behavior?

Because every day a Producer digs ore out of the ground—every day they’re open for business—their precious metal stockpile decreases. No matter how large the orebody, at some point, their ounces-in-the-ground will run out.

There is also a theory called Peak Gold, a concept we’ve explored here in recent months. With Peak Gold looming as a potential new reality, these shrinking inventories will not be easy to replenish.

Making matters even worse, the brutal bear market of the past nine years forced many Producers’ to dramatically scale back exploration spending.

They weren’t even looking for it.

Senior Producers’—those highest up on the food chain—require a robust pipeline of Tier-1 (5,000,000-plus ounce) gold deposits to maintain current production levels.

If a company is unable to grow this project pipeline organically, through exploration, it needs to change tactics. It needs to take on the role of acquirer, predator. It needs to hunt.

Barrick Gold has been at the center of much of the activity in the sector. Earlier in 2019, the mining behemoth completed its $6.1 billion all-stock takeover of African mining giant, Randgold.

Next among the Big’s, Newmont announced a friendly takeover of Goldcorp in a transaction valued at $10 Billion. But before the deal was closed, Barrick went after Newmont with a hostile bid worth $18 billion. Barrick eventually withdrew their bid and Newmont is now called “Newmont-Goldcorp”.

That was some pretty wild behavior—some might call it desperate—on Barrick’s part. In my mind, it adds validity to the theory that most of the low hanging fruit has already been picked.

Moving down the food chain, China’s Zijin Mining took out Nevsun, Pan American Silver took out Tahoe, Kirkland Lake Gold is attempting to bag Detour Gold (cast your vote), and Endeavour Mining is taking a run at Centamin PLC. This is by no means a complete list among the Mid’s.

On the lower end of the food chain, SEMAFO took out African ExplorerCo Savary, St Barbara took out maritime miner Atlantic Gold, China’s Zijin announced an all-cash takeover of Continental Gold, Titan Minerals has its sights set on Core Gold, and the list goes on.

Once again, the key to a Producer’s long-term survival is taking on the role of an apex predator.

One of my roles here at Equity Guru is keeping an eye on the potential prey—those companies on the verge of significant new discoveries, or those developing assets that a Producer might want (need) to acquire.

A takeover offer from a larger entity almost always comes with a substantial premium.

Recent Guru success stories in the junior exploration arena

We were successful in identifying a good number of undervalued, asset-rich companies over the past year or so.

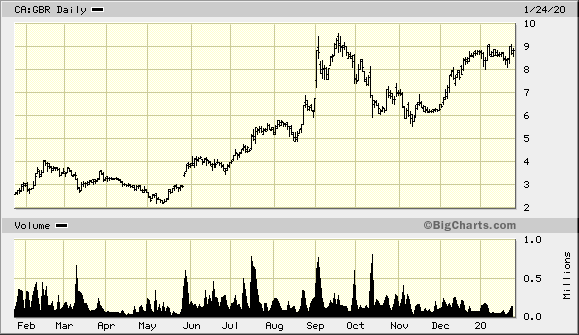

Great Bear Resources (GBR.V) was on our shortlist back in January 2019 when it was trading at a mere $2.03. Today, it’s a nine dollar bill.

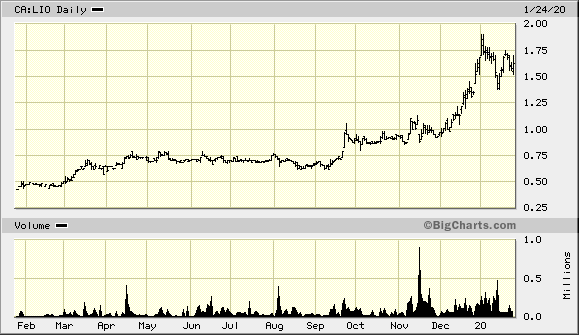

Lion One Metals (LIO.V) was singled out as an accumulation candidate in the $0.40 range back in December 2018. It’s currently trading north of $1.60

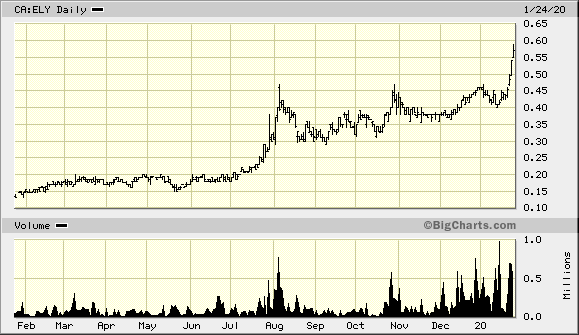

Ely Gold Royalties (ELY.V) was trading at $0.17 when we shortlisted the stock 10 months ago. Today it’s trading at $0.57 (nice shootin there Tex).

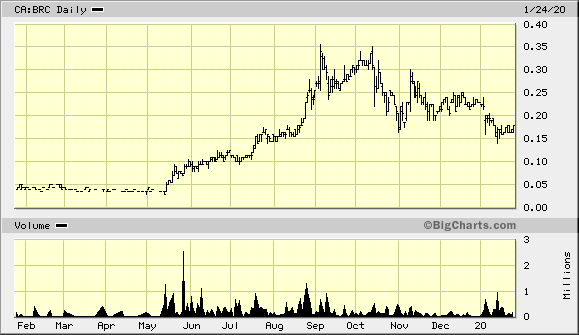

Blackrock Gold (BRC.V) is a company we began featuring when it was mired in the sub-nickel range. Though it’s currently trading at $0.17, it has traded as high as $0.35 in recent months.

Nevada ExplorerCos’ Renaissance Gold (REN.V) and Fiore Gold (F.V) also made our shortlist ten months back—both companies are up nearly 100%.

The undervalued and underappreciated

Gold, and the companies that make the metal their business, are consolidating recent gains. Translation: they’re in a holding pattern waiting for the right catalyst to push higher.

We’re going to focus the remainder of this article on companies with assets that are not being given their due by the market—companies that could see significant upside trajectory if (when) gold stocks begin their next leg higher.

We looking to buy dollars for dimes here.

The must-have criteria I applied to this list:

- the company must have a resource, OR, a project that stands a good chance of generating a significant resource.

- the company must have a market cap of < $100M Cdn dollars.

- the company must be helmed by an experienced management team.

- the company must be located in a mining-friendly jurisdiction.

By clicking on the name of each company featured below, you will find our most recent coverage—a decent enough starting point to begin your own personal due diligence. Cursory notes will follow.

I’m going to start up north, then travel south, then head north-east.

Here goes…

YUKON

Golden Predator Mining (GPY.V)

- 156.98 million shares outstanding

- 50.23M market cap based on its recent $0.32 close

Focused on its past-producing Brewery Creek Mine, and its high-grade 3 Aces Project, this one has both near term production AND exploration upside.

Gold went on a bit of a tear in late December/early January.

Note how this stock reacted to the rally in gold.

Golden Predator appears nicely correlated to moves in the metal.

Rockhaven Resources (RK.V)

- 187.64 million shares outstanding

- $23.45M market cap based on its recent $0.125 close

Rockhaven is focused on its 100% owned Klaza Property located in the Mount Nansen Gold Camp of southwestern Yukon.

Klaza hosts an Indicated resource of 686,000 oz gold and 14,071,000 oz silver (4.5 Mt grading 4.8 g/t gold and 98 g/t silver) and Inferred resource of 507,000 oz gold and 13,901,000 oz silver (5.7 Mt grading 2.8 g/t gold and 76 g/t silver).

These ounces in the ground are not being given their due by the market IMO.

Recent News: Rockhaven Drills Multiple Mineralized Veins Outside of Klaza Resource Area at its Klaza Gold-Silver Project, Yukon

Though RK has been a thin trader of late, the market is unlikely to ignore this resource when gold and silver breakout to higher ground.

Klaza also holds considerable exploration upside.

Strategic Metals’ award-winning team recognize the value in Rockhaven’s asset—they own 37% of the RK’s outstanding common.

Strategic Metals (SMD.V)

- 96.65 million shares outstanding

- $45.42M market cap based on its recent $0.47 close

Strategic boasts a project portfolio of over 100 properties representing a diverse suite of metals, most of which are 100% owned with no underlying royalties.

The Strategic team deploys the prospect generator business model, hence its tight share structure.

The last time we checked in, the company had $29M in cash and marketable securities.

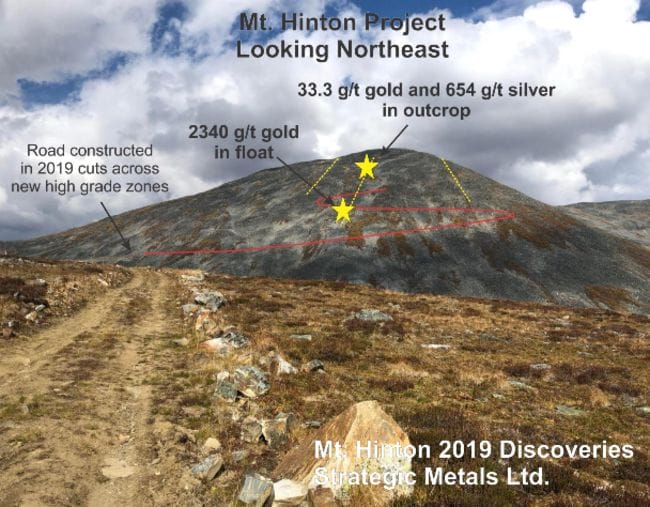

There are a lot of moving parts to Strategic, but what has my complete, undivided attention is the company’s Mount Hinton Property in the world-famous Keno Hill silver mining camp.

Strategic Metals Continues To Discover High-Grade Gold At Its Mount Hinton Property, Yukon

It is possible Strategic will break the vow of the prospect generator business model and go it alone on Mount Hinton (we stand to watch).

Buying this stock on weakness could play out extremely well in H2 of 2020.

Golden Triangle B.C.

Tudor Gold (TUD.V)

- 143.44 million shares outstanding.

- $96.67M market cap based on its recent $0.66 close

American Creek (AMK.V)

- 339.67 million shares outstanding

- $25.48M market cap based on its $0.075 share price

Teuton Resources (TUO.V)

- 43.32 million shares outstanding

- $21.66M market cap based on its recent $0.50 close

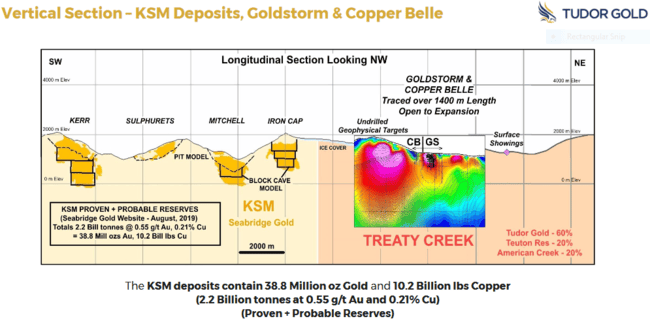

All three companies highlighted above are joint venture partners in Treaty Creek—a project that continues to demonstrate considerable scale.

According to the Teuton’s project page:

“This system—marked by kilometers of bright yellow, orange and red zones of alteration (gossans)—hosts the world’s largest undeveloped gold and copper reserves in the Kerr, Sulphurets, Mitchell and Iron Cap deposits owned by Seabridge Gold.”

Tudor News – December 18: Tudor Gold Discovers a Significant New Copper-Silver Horizon Within the Goldstorm System and Reports up to a 24% Increase in Gold-equivalents from Previously Reported Gold-Only Results at the Treaty Creek Project from Six Drill Holes

Walter Storm, President, and CEO of Tudor Gold:

“These new gold equivalents are extremely encouraging as our technical team continues to take positive steps advancing Tudor Gold’s flagship Treaty Creek Au-Ag-Cu project. During the following months our geologist and engineers will continue to work with the geological model and begin to prepare the diamond drill hole proposal for 2020 .”

Though Treaty Creek is in winter lockdown, the shares of all three companies are trading firm, an indication that this group is under accumulation. (note Eric Sprott’s continued appetite for Treaty Creek):

Tudor News – December 30: Tudor Gold Closes $2.9 Million Flow Through Private Placement with Mr. Eric Sprott

Keep a watchful eye on these three. Buying on weakness could pay off handsomely in H2 of this year.

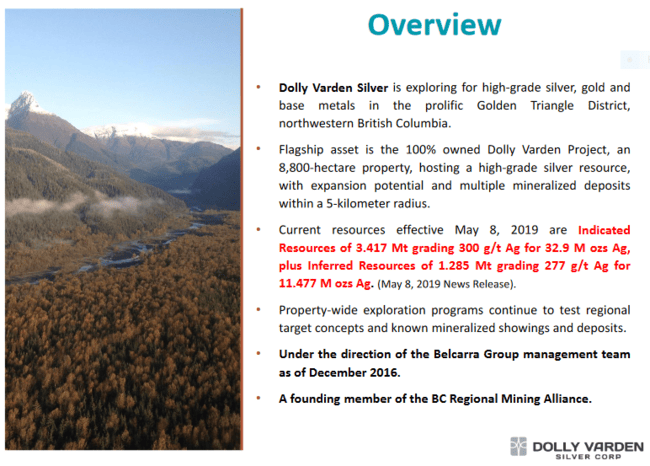

Dolly Varden Silver (DV.V)

- 77.75 million shares outstanding

- $18.66M million market cap based on its recent $0.24 close

Dolly isn’t getting much love from the market these days.

To its credit, the company has 32.9 million ounces of silver grading 300 g/t Ag in the Indicated category and a further 11.477 million ounces grading 277 g/t Ag in the Inferred category.

Unlike the above Gldn-Tri plays, DV is plumbing its lows. This current pricing could represent an opportunity.

It wasn’t that long ago that Hecla Mining took a run at Dolly Varden offering $0.69 per share (DV is currently trading at well less than half that amount).

Hecla knows how to exploit narrow high-grade vein structures—was their 2016 TO bid fair?

Hmmm…

Due diligence required on this one.

NEVADA

Coral Gold Resources (CLH.V)

- 46.35 million shares outstanding

- $23.17M market cap based on its recent $0.50 close

Coral registered solid gains since we first featured the company back in early March 2019.

Coral holds a sliding scale 1% to 2.25% net smelter royalty (NSR) on over 2.7 million ounces at Barrick Gold’s (now Nevada Gold Mines, or NGM) Robertson Property located along the Cortez Gold Trend.

This is a company I recently profiled in a report titled: Highballer’s Top Three Picks for 2020

FYI, Highballerstocks.com is my new weekly newsletter, one designed to complement the coverage and research I carry out here at Equity Guru.

It should be apparent that I hold Coral Gold in high regard.

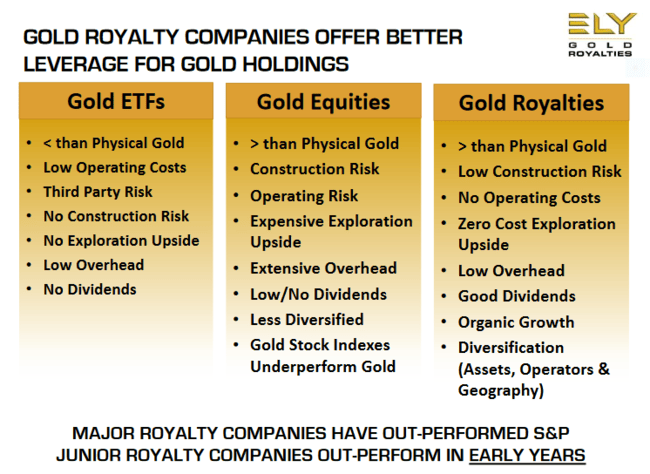

Ely Gold Royalties (ELY.V)

Investor presentation

- 100.31 million shares outstanding

- $54.17M market cap based on its recent $0.54 closing price

As noted further up the page, ELY has performed well since we first featured the company only ten months back—a better than 200% gain.

Ely is an emerging royalty company with projects based in Nevada and the Western U.S. (royalty companies like ELY offer upfront funds for a percentage of a Producer’s future gold production or revenue).

ELY’s current portfolio includes 35 deeded royalties and 21 properties optioned to third parties.

The company’s royalty portfolio includes producing royalties, fully permitted mines and development projects that are at or near producing mines.

Just last month, the company trotted out the following acquisition:

Ely Gold Royalties (TSXV: ELY) (OTCQB: ELYGF) Purchases Net Profit Royalty from Liberty Gold

It’s always good to have a royalty company tucked away in your gold stock portfolio. It can offer a modicum of safety and diversification.

ELY shares have gone on quite a tear over the last few sessions. Patience may produce a better entry point.

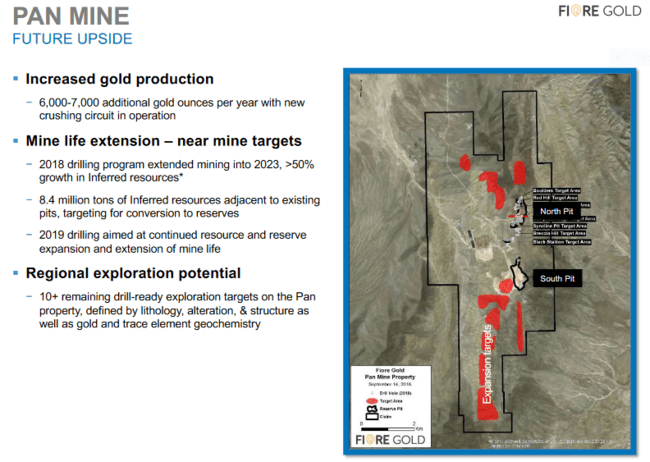

Fiore Gold (F.V)

- 97.95 million shares outstanding

- $52.90M market cap based on its recent $0.54 close

Fiore, a new producer in the gold space, is up significantly—nearly 100%—since we first featured it back in early March 2019.

The company’s Pan Mine in Nevada—a Carlin-style, open-pit, heap-leach mine on the prolific Battle Mountain-Eureka Gold Tend—is just the beginning of what the company hopes will evolve into a 150,000 oz-per-year production scenario.

Last October the company announced it had met full-year production guidance of 41,491 ounces.

Exploration continues at its Pan mine.

Assays released last month include oxide mineralization grading 35.1 meters of 0.64 g/t Au and 38.1 meters grading 0.79 g/t Au.

A junior producer with under 100 million o/s shares is a rare thing this day n age. This is a tight crew.

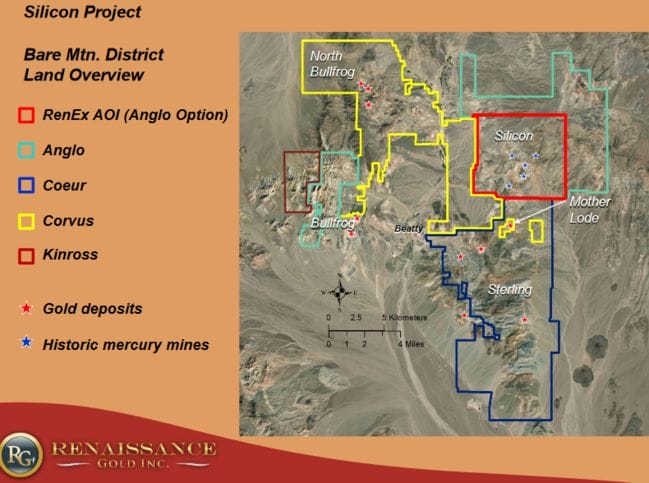

Renaissance Gold (REN.V)

- 68.46 million shares outstanding

- $21.91M market cap based on its recent close at $0.33

Though Renaissance does not have a 43-101 resource, its shares are up nearly 100% since we first featured the company last March (the stock tested significantly higher ground only a few months back).

Renaissance is another Nevada ExplorerCo deploying the prospect generator business model. Its project portfolio holds the potential for Carlin-type, epithermal, and intrusive-related deposits.

On January 6, the company summarized its 2019 exploration efforts, highlighting the following:

“The Company enters 2020 in a strong position, with funding partners on 6 of its projects and a healthy treasury (C$3.56M as at 9/30/19). We currently anticipate partner drilling on at least 3 of those projects in 2020. AngloGold has significantly advanced our Silicon project with extensive geophysical surveys, completion of 47 drill holes, and plans for additional drilling under a new Plan of Operations permit. Should AngloGold choose to complete their purchase option, the final payment of US$2.4M (C$3.1M) comes due in June 2020, with the Company’s retention of a 1% NSR. The payment would be very meaningful and would fund the Company for nearly 2 additional years and the royalty could potentially be very material for the Company as the Silicon project progresses and the NSR becomes monetized.”

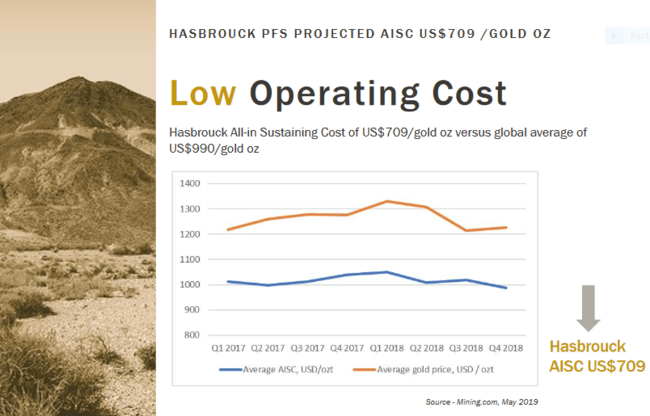

West Kirkland Mining (WKM.V)

- 408.67 million shares outstanding

- $24.52M market cap based on its $0.06 share price

WKM continues developing its 75% owned advanced stage Hasbrouck Gold Project outside of Tonopah Nevada.

This is a company waiting for its day in the sun, waiting for the day gold launches to a level where its t 784,000 (reserve) ounces can’t be ignored any longer.

The project is fully permitted.

This is a simple mining scenario, as simple as it gets.

A pre-feasibility study tabled in 2016 shows a CapEx of US$47M, an after-tax NPV of US$120M, and an IRR (after tax) of 43%… all based on a $1275.00 gold price assumption. These are solid numbers—the project’s CapEx is very modest.

These shares should perform extremely well when they decide to push Hasbrouck further along the development curve.

ONTARIO – Quebec

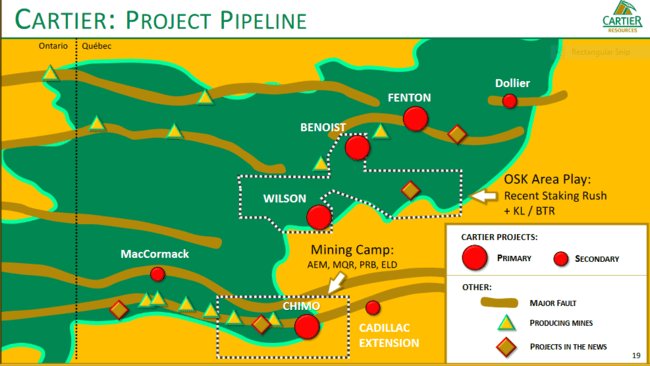

Cartier Resources (ECR.V)

- 191.63 million shares outstanding

- $27.79M market cap based on its recent $0.145 closing price

This is also a company I recently profiled in my report titled: Highballer’s Top Three Picks for 2020.

Like Coral Gold, this is a company I hold in the highest regard.

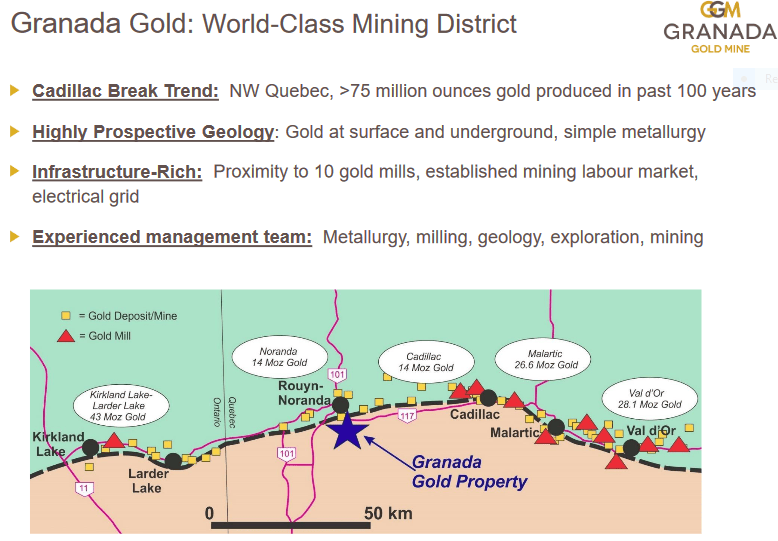

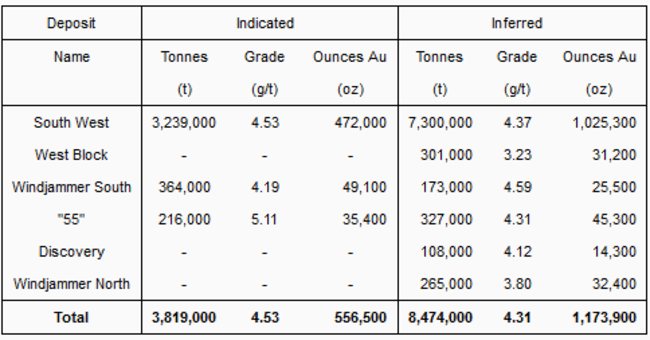

Granada Gold (GGM.V)

- 80.56 million shares outstanding

- $13.29M market cap based on its recent close at $0.165

Granada made headlines in recent weeks with a hit of 11.45 g/t Gold over 33 meters at their Granada Gold Project near Rouyn-Noranda, Quebec.

According to the January 9 press release:

“Unexpected near-surface, high-grade mineralization has been discovered within the recently explored two-kilometer LONG Bars Zone of the five and half kilometer Granada Shear zone which trends east-west on the property.”

The above drill hit should be examined closer via Brent Cook’s Drill Hole Interval Calculator (DHIC).

Cook’s DHIC gives you a means of “estimating the grade of drill hole intervals between the “highlights” of a longer assay interval“.

On January 14, Granada announced plans to begin a bulk sampling program later this spring on the high-grade, mineralized structures exposed at surface.

These shares are also up sharply from when we last checked in.

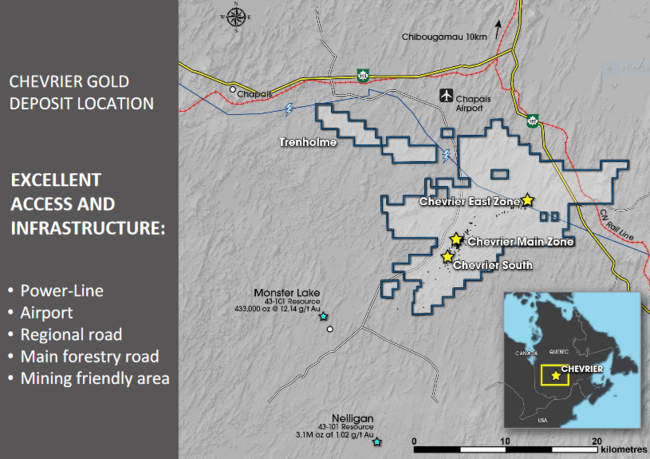

Genesis Metals (GIS.V)

- 41.82 million shares outstanding

- $15.89M market cap based on its recent $0.38 closing price

Genesis is exploring its 100% owned Chevrier Gold Property located in the Chibougamau region of Quebec.

The current resource at Chevrier stands at 395,000 ounces of gold averaging 1.45 g/t Au in the Indicated category and 297,000 ounces of gold averaging 1.33 g/t Au in the Inferred category.

As we opined back in October, this is another Abitibi ExplorerCo that prefers the slow dance when the resource arena is quiet. While this strategy may appear uninspired and tedious to some, company management is using good science—(new age) till sampling analysis, geological mapping, trenching, and geophysics (magnetics and induced polarization)—to methodically prioritize targets for future drilling campaigns.

Smart crew. Resource expansion potential. 2020 should be an active year for the company.

Moneta Porcupine (ME.T)

- 311.21 million shares outstanding

- $37.34M market cap based on its recent $0.12 close

Moneta’s wholly-owned Golden Highway Project is located along the Destor Porcupine Fault of the Timmins Gold Camp in northeastern Ontario.

On November 26, 2019, the company tabled a property-wide resource update.

The company continues to drill the project. Last week, assays flowed out of the new Westaway Target and extensions of the West Block deposit (ground located outside of the main resource block).

I’m waiting for this crew to hit a real boomer of a hole—a new zone with long intervals and decent grades—something along the lines of the 2.02 g/t Au over 114.5 meters they tagged back in 2014.

A hit of that caliber would goose these shares but good.

There it is

That’s our roundup of the sub $100M market cap ExplorerCo shares we like.

On deck in the coming days: a roundup of $100M-plus market cap shares we like across the Yukon, Golden Triangle, Nevada, and Ontario-Quebec.

END

—Greg Nolan

Full disclosure: Equity Guru has no relationship with any of the companies featured above.