The Dow Jones Industrial Average (DJIA) is trading at an all time high of 27,880.

The trade war with China has hurt American factories, but exports and imports account for just 27% of the U.S. GDP.

According to the World Bank, the only countries where trade represents a smaller percentage of GDP are Nigeria, Cuba, Burundi and Sudan.

In 2018, U.S. manufacturers added an average of 22,000 jobs a month. This year, it’s down 80% to 5,100 a month.

Manufacturing generates 8% of American jobs, down from a peak 32% in 1953.

The trade war with China has also hurt U.S. farmers. Year to date, U.S. farm exports are down 4%. But farming accounts for only 0.6% of the U.S. GDP.

Farms and factories are yesterday’s news.

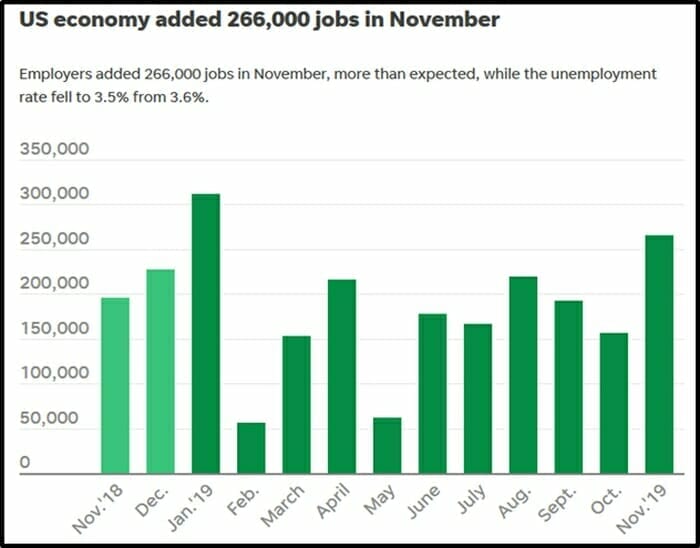

This month, the U.S. added 266,000 new jobs.

True, 46,000 of those jobs were General Motors’ (GM.NYSE) employees returning to work after a six-week strike – but it’s still a good number, pushing the unemployment rate down from 3.6% to 3.5%, matching a 50-year low.

Beneath the gleaming surface of low unemployment numbers and soaring stock markets, some dark clouds lurk.

In Q3, 2019, U.S. worker productivity fell by the most in 50 months.

“Some economists blame soft productivity on a shortage of workers as well as the impact of rampant drug addiction,” stated Reuters.

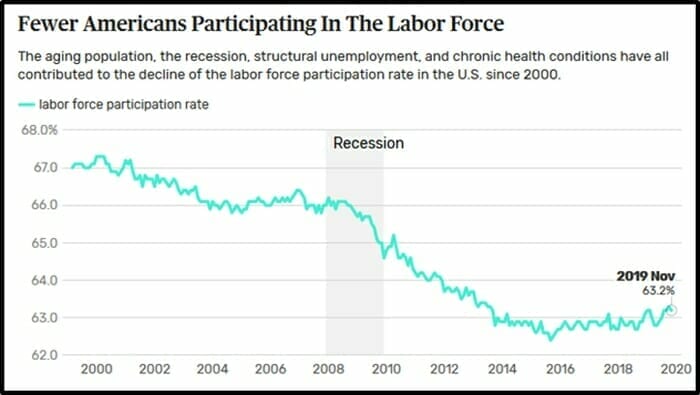

The Labor Force Participation Rate (LFPR) dropped to 63.2% in November 2019.

From 1948 to 1963 – when being a “housewife” wasn’t ironic – the LFPR remained below 60%. But as more women entered the labor force it creeped up to a peak of 67.3% in January 2000.

After the 2001 recession, the LFPR fell throughout the “jobless recovery.”

According to the Federal Reserve Bank, half of the decline is due to the aging of America. Young people are also staying in school longer. Those without a college education struggle to find work.

Almost half of the prime-age men not in the labor force take pain medication daily to treat chronic health conditions. 13% of unemployed people aged 56 to 60 have significant health problems (largely from over-eating and lack of exercise).

Falling participation rate suggests a growing accumulation of men and women who are neither working nor unemployed, but rather disengaged. Few journalists juxtapose the low unemployment rate (good news) with the low participation rate (bad news).

Add it all up, and 95 million Americans above the age of 16 are out of the workforce.

Of those, 44.5 million are retired, 14.5 million are in school or job training, 12.8 million are taking care of a loved one, 15.3 million are sick or disabled, 7.5 million want a job but are “discouraged” (not actively looking).

Perhaps – like factories and farms – “workers” have become unimportant. Facebook (FB.NASDAQ) stock price has increased 900% in 7 years. It now has a market cap of $520 billion.

But FB only employees 18,000 people. That’s about 27 X fewer people than GM employed in 1956.

“These days, the number of employees is less important as automation and sophisticated programs take over,” confirms Forbes Magazine.

Shopping in the U.S. generates a whopping 68% of the U.S. GDP.

There are more shopping malls in the U.S. than high schools. Americans collectively carry $870 billion in credit card debt, but still spend $70 billion a year on pets.

What is the significance of 95 million Americans with no paycheck to retail investors?

It suggests that the reported “health” of the U.S. economy may be overstated.

The 2019 U.S. deficit is on track to reach $1.4 trillion ($9,000 per U.S. taxpayer) so there’s lots of borrowed money sloshing around to stimulate consumption.

According to a New York Federal Reserve Report U.S. household debt increased 0.7% during Q3, 2019, to $14 trillion.

“Consumer debt is now $1.3 trillion higher than the previous peak set in 2008,” stated CNN business.

Borrowing money that you can not re-pay usually ends badly.

Maybe it’s different this time.

But if the money-printing orgy results in a devaluation of fiat currency, the price of gold will go up.

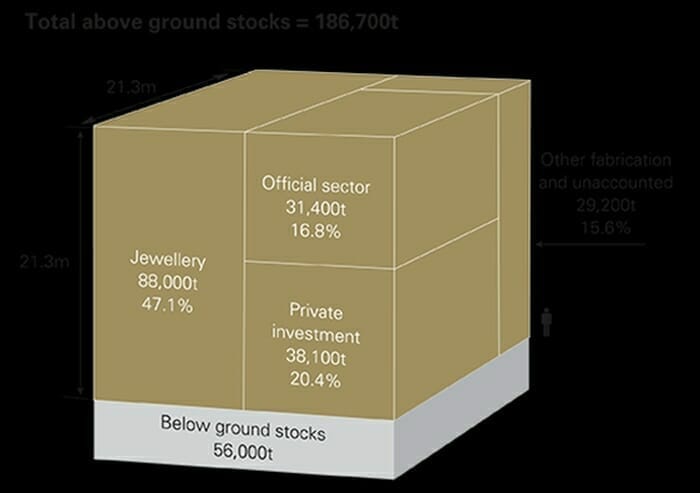

Here’s the thing. Gold’s not that easy to find. Throughout human history, a total of about 185,000 tonnes of gold have been mined. That’s a cube: 60’ by 60’ by 60’. Given all the blasting and digging – that’s not a massive object.

We could argue about the collective intelligence of the world’s central bankers, but whatever your opinion, it’s worth noting, they are gold buyers.

“Gold prices will climb to $1,600 per ounce over the next year”, states Goldman Sachs, noting that “central banks are consuming a fifth of the global gold supply“.

“Demand from central banks for gold is biggest since the Nixon era,” stated Goldman, “We like gold better than bonds because the bonds won’t reflect that de-dollarization.”

According to the World Gold Council, Central banks added 156 tons of gold to their reserves in Q3, 2019

One of the more compelling reasons to own mining stocks RIGHT NOW is the fact that the entire sector is trading at a huge discount relative to general equities,” states Equity Guru’s Greg Nolan.

Nolan believes that gold asset prices today are “sicker than they were during the Great Depression and the Dot-Com bubble.”

Nolan covers a basket of Yukon explorers here.

Financial pundits seldom talk about the 95 million Americans who don’t receive a paycheck.

But it’s important to remember them.

Their non-productivity is a central part of the argument for gold.

– Lukas Kane