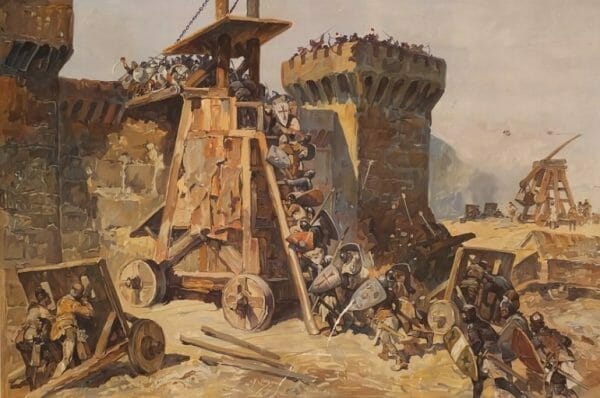

The streaming service war is about to get medieval, and nobody knows that more than Netflix (NFLX.Q), which has been desperately selling bonds to fund their moat construction as invaders Disney (DIS.NYSE) and Apple (AAPL.Q) settle in for a long siege.

If the company has a secret weapon that will help it fend off the invading hordes, it’s in its original content. But the problem is that it’s weapon frequently malfunctions. In terms of a moat, it’s easily forded, and the company is banking that the extra cash infusion will strengthen it.

It’s an old story for this company, though.

The streamer spent $12.04 billion in cash on content last year, up 35% from $8.9 billion in 2017, according to its fourth-quarter 2018 earnings report. That’s going to increase by 25% to somewhere in the ballpark of $15 billion, according to Wall Street analysts.

Meanwhile, Netflix will continue to burn cash. The company told investors that they anticipate recording negative $3 billion in free cash flow in 2019. They will keep going to debt markets to fund their spending, adding to the existing debtload of $10.4 billion in long term debt they had at the end of 2018.

Let’s put the financial side of things aside for a moment, though.

The Walt Disney Company has been a big name—the biggest, arguably—since the middle of the last century. In terms of content creation they have the biggest names. Most of their content becomes household names within months, and while they’ve been on a run of rehashing their old content for the newest generation, they’ve released some absolute screen gems lately as well.

And what they don’t have—they buy.

Marvel cinematic universe? Check.

Star Wars? Check.

20th Century Fox (with The Simpsons, Avatar, etc)? Check.

They’re a company in the running for the title of deepest pockets, and they’re in a much better position than Netflix.

And that brings us back to the siege analogy.

Siege warfare was a particularly brutal style of warfare in which an invading army (or armies) would surround a castle or city, block off the entrances and exits, and stop both the inward and outward flow of people. No food gets in or out. No supplies. Every time the doors open they’re met with violence. Cities and castles would be built with elaborate defenses to make them siege proof—including towers, walls in various sizes, and yes, moats.

But more than anything, siege warfare is a war of resources. Whoever ran out first won. And no, not all sieges were won by the invading armies, sometimes the besieged pulled an ingenious trick and either breached the invading line somewhere, or had a hidden supply line. Or sometimes they were just meaner, and there was no amount of suffering the invading army could inflict. In this case, we can think of Disney and Apple as the invading armies and Netflix as the besieged.

Their resources are their money (and the ability to raise capital) and their siege defense is their moat. Nobody else—not Disney and not Apple—can lay claim to Netflix’s original content. Right now, it’s their bread and butter. But it’s costly.

Since their modus operandi of the company is not to allow third party advertisers, they’re left with two options to raise cash: they can raise their subscription prices and they can take on debt. Both of which they’ve been doing. Both of which are unsustainable in the long term when competing against companies like Disney and Apple.

So Disney, Apple and other companies involved in the running like AT&T (T.NYSE), can sit quietly outside of Netflix’s walls and wait. They can put out their own content, and dig into their pockets to outbid Netflix for syndicated content. Or don’t, and drive the price up so high that getting the content costs far more to Netflix with its dwindling resources.

Then when Netflix’s moat dries up because it lacks the funds to continue to produce original content, sweep in and offer a sweetheart deal. And then we’ll have Netflix—sponsored by Disney. (Or Apple, or AT&T)

Cue the sad trombone.

—Joseph Morton