On October 9, 2019 CLS Holdings (CLSH.C) reported unaudited consolidated cannabis revenue of $1.0-million for the previous month of September, 2019.

CLS Holdings is deploying a “seed to sale” growth strategy that involves buying cannabis dispensaries, cultivators and producers.

The company launched into the booming Nevada market, powered by the state’s 46 million annual tourists.

This fiscal year Nevada’s cannabis industry generated more than $100 million in TAX revenue, collected from dispensaries, cultivators, laboratories and producers.

In Nevada, the CLS uses its City Trees cultivation and production arm to supply its Oasis Cannabis dispensary in downtown Las Vegas.

Oasis Cannabis was voted best dispensary for Pot Pros March 2019. It completes about 1 order every 2 minutes throughout its 24-hours-a-day retail selling cycle.

September, 2019, highlights:

- Consolidated revenue from Oasis Cannabis and City Trees of $1.0-million compared with $700,000 in September, 2018, an increase of 40.3%

- Consolidated gross margin of 49.1% compared with 42.1% in September, 2018

- A 90.8% increase in dispensary customers, from 10,294 (343 per day) a year earlier, to a record 19,637 (654 per day) in September, 2019;

- September, 2019, dispensary gross margin of 47.9%, up from 39.5% in September, 2018;

- Revenue from City Trees, the company’s branded products and bulk flower division, of $340,529, a 23.2% increase over September, 2018

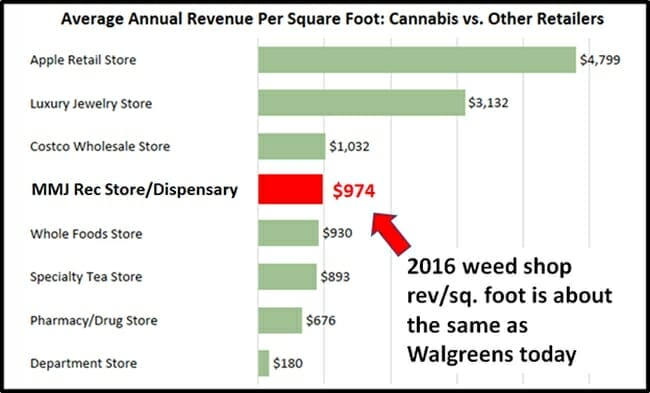

All of the above is good news. But the revenue per square foot of $422 is even better. That compares with $250 per square foot a year earlier – an increase of 69%.

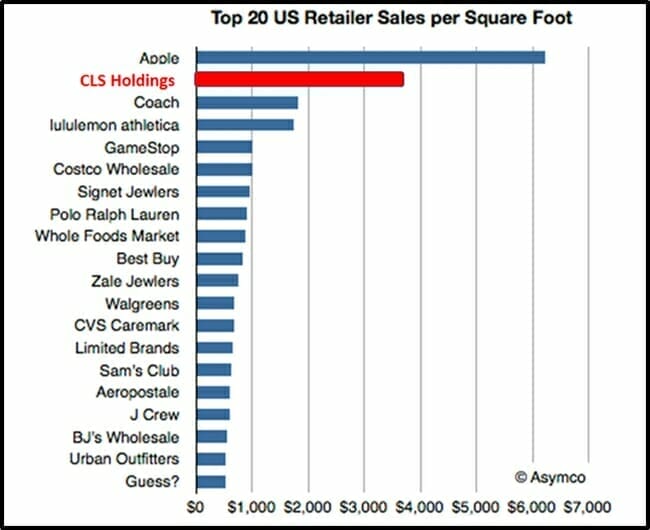

If the CLS Holdings revenue/square foot stops growing, that extrapolates to CND $5,064/sq. ft/year. Converting our Northern Pesos to Benjamins – you get an annual revenue of $3,796/sq. ft.

That’s 400% higher than the average dispensary revs five years ago.

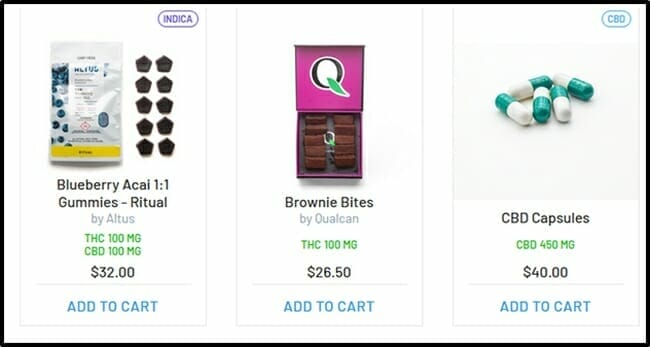

The cannabis retail industry (not the investment sector) is gaining traction. Turns out you can pack a lot of product into a small amount of counter space. You don’t need a cavernous hall with racks of summer dresses, or long aisles selling “toiletries”.

A single glass counter can contain dozens of expensive high-margin, differentiated cannabis products.

Apple (AAPL.NASDAQ) is the top retailer in terms of sales per square foot, coming in at about $6,000 per square foot. Leading apparel retailer Lululemon Athletica (LULU.Q) pulls in about at $1,560 per square foot.

A couple of things to note here: CLS Holdings is comparing its September, 2019 numbers to September, 2018 numbers – which is a bit like putting a tape-measure on your teenager and marveling that it’s got taller.

“Getting taller” is what teenagers do.

That is the only thing they can be relied on doing.

The other proviso is that cannabis stores in general are doing boffo revs/sq. ft numbers.

For instance, In Q1, 2019, MedMen booked a whopping $6,188 annualized sales per square foot. But that has a muted benefit for investors when key management is jamming their pockets with cash and generally acting like assholes.

“In September, 2019, at our Oasis Cannabis dispensary, we set record customer volumes and expanded gross margins compared to a year ago,” confirmed Andrew Glashow, president and COO of CLS Holdings.

CLS Holdings milestones:

Acquired Oasis Cannabis Dispensary in Las Vegas

Successfully completed a remodel Oasis

Completed multiple rounds of capital infusions

Achieved rapid growth of our City Trees brand

Began build out of proprietary conversion and extraction facility

Agreement in Massachusetts to acquire In Good Health

Granted patents for extraction IP in the US, EU and Canada

USD $5.5 million cash in treasury as of August 2019

CLS’s previously announced its dispensary expansion should be completed in mid-November and will increase available retail space from 1,750 square feet to 2,000 square feet.

“Upon completion the dispensary will be able to accommodate 1,000 customers a day and provide our customers with a better overall customer experience,” stated Glashow, “Our City Trees line of branded products is accumulating shelf space and is now available throughout the state.”

Three weeks ago, CLS announced that its acquisition target “In Good Health” – has received final approvals from the state of Massachusetts to begin processing and dispensing recreational cannabis.

“To be among the first medical dispensaries in the state to navigate the rigorous gauntlet of regulatory oversight to obtain recreational or “adult use” status is a major accomplishment,” stated Jeff Binder, chairman and CEO of CLS.

To date, only 27 recreational cannabis retail licenses have been granted by the Massachusetts’ Cannabis Control Commission (CCC).

Despite all this, the CLS stock price has taken a pounding:

CLSH has also developed a proprietary method of extracting cannabinoids from cannabis plants and converting the resulting cannabinoid extracts into concentrates such as oils, waxes, edibles and shatter.

Key Tech Features:

- High consistency.

- Cleaner and safer products

- Reduce growing costs

- Provide 2 X Delta-9 THC compared to competitors.

- Higher Delta-9 THC creates higher

Delta-9-THC is one of 60 cannabinoid molecules in the cannabis plant, and it is recognized as the main psychoactive ingredient

The technology has the potential to provide “one-stop, multi-state services to companies wishing to build private label brands”, by extracting and converting cannabinoids in a greater yield than methods currently used in the industry.”

CLSH is currently trading at .31 with a market cap of $39 million.

Full Disclosure: CLSH is an Equity Guru marketing client.