For the last few years, if cannabis companies wanted money, there was a long line of folks happy to oblige. More recently, those financiers have dried up, causing raise-addicted cannabis pubco execs to reach for their ‘balance sheets for dummies’ text books and have urgent meetings with accountants regarding how they stay alive.

GTEC Holdings (GTEC.C) announced their most recent quarterly results this afternoon and, while the numbers aren’t a reason to pop corks, they’re most definitely evidence that GTEC is playing a tight, fiscally responsible game right now.

From the opening paragraph of the earnings release:

As the Company continues its objective in developing purpose-built indoor operations to produce and distribute ultra-premium cannabis in Canada, it has remained committed to operating in a disciplined and fiscally responsible manner while delivering substantial revenue growth, combined with significant reductions in operating expenses.

GTEC is trimming the fat, tidying up the balance sheet, limiting its debt exposure, and losing non-core assets.

The upside: They have cash on hand to continue as they are for two quarters, without having to raise more, dilute more, or sell more assets. Over those two quarters, revenues should reasonably rise significantly and give more runway still.

The downside: They’re going to be scope-locked on turning their small loss into a break even, rather than on the growth multiples investors in the cannabis space are used to.

Significant revenue growth of 845%, from the sale of 212 kilograms (“kg”) of cannabis, for total revenue in excess of $1 million (Q3 revenues were solely from the Company’s Alberta Craft Cannabis facility);

I’m not a big fan of posting percentage revenue increases for revs that are $1m or less as they’re largely meaningless on a small sample size, but it’s worth noting GTEC has three licensed cannabis facilities now, two of which were only recently licensed, so I’d expect that $1m revenue number to rise sharply in Q4.

Operating expenses were reduced by 37%, representing a $1.1 million reduction, as a result of management’s determination in implementing strict internal finance protocols;

Good good. It’ll need to come down harder still going forward, but 37% is a decent shift.

Net operating loss of $1.1 million and a net loss of $2.3 million.

For a company with $4.4m in cash, this isn’t ideal, but if those revs can climb as they ought to, this is manageable.

“With three operational licensed facilities cultivating our unique and premium genetics, the company is well positioned to continue achieving strong quarterly sales growth,” said Norton Singhavon, Founder, Chairman and CEO of GTEC. “Furthermore, we are committed to operating in a fiscally disciplined manner in order to achieve success under dynamic and challenging market conditions.”

GTEC has done what we wanted GTEC to do over the last few months:

- When a deal for a Canopy Growth Corp facility purchase couldn’t be done without rough financing options, GTEC aborted the deal and got their money back.

Received $250,000 deposit repayment from Canopy Growth Corp. as a result of not proceeding with a Purchase and Sale Agreement related to an acquisition target;

2. When folks assumed GTEC would struggle to get their facilities all licensed, they did regardless, and are now doing work in those facilities.

Successfully executed all of the Company’s licensing initiatives for 2019, which included:

- ACC receiving a Standard Processing Licence on July 26, 2019 (for sales into the Provincial & Territorial supply chains);

- ACC receiving a Medical Sales Licence on July 26, 2019 (for direct online sales to medical patients);

- Grey Bruce receiving a Standard Cultivation Licence on July 5, 2019; and

- Tumbleweed receiving a Standard Cultivation Licence, Standard Processing Licence and Medical Sales Licence on August 16, 2019;

- Commenced cultivation at Grey Bruce Farms, which commenced its first harvest less than 90 days after receiving its licence;

- Commenced cultivation at Tumbleweed Farms with its first production harvest expected in December 2019;

3. When they needed to clear up some debt obligations to run more streamlined, they cashed in their Cannabis Cowboy retail store equity, and have focused on their core business of farming weed.

Through these initiatives, the Company received a $4.06 million outstanding loan repayment from Cannabis Cowboy, and concurrently entered into an agreement to divest its 25% equity stake in Cannabis Cowboy for a sum of $1 million.

There will be naysayers who’ll say ‘GTEC is out of money’, and they won’t be wrong in a traditional weed market sense, where you’d usually just go raise another $10m when you got to two quarters of runway left.

But they’re also wrong, in that GTEC is closer to break even than most in the sector, with a realistic (if unexciting) plan to get there.

Also worth noting: At the current $30m market cap, and with three licensed facilities on their books, the liquidation value of this company looks to me to be about double its current market value.

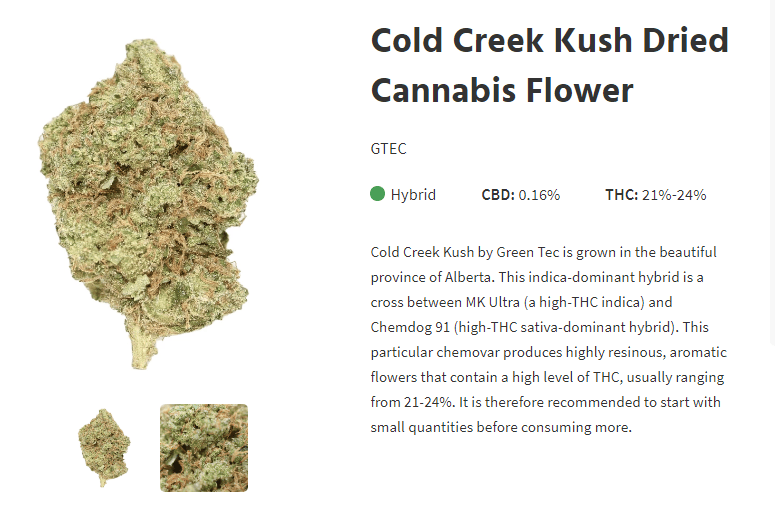

Three weed facilities. Multiple licenses. Quality product getting good reviews. For $30m, that’s an absolute bargain.

So, yeah, we’re holding underwater GTEC stock, but we’re not selling.

— Chris Parry

FULL DISCLOSURE: GTEC is an Equity.Guru marketing client, and the author has purchased stock in the company.

Chris, whats your feeling on TGOD at this stage? You mentioned it in your Oct 3rd article as one with a war chest. Their story has always been great, but Turns out they now need financing. IMO Lenders don’t care about what real estate you own. No one wants to take on the BS of foreclosing and then trying to sell a partially built green house. So with only $50 mil or so left and incomplete greenhouses with no sales in the foreseeable future do you see a light at the end of this tunnel?

Thanks man!

I’ve always been nonplussed about their ability to sell weed. To me, TGOD has always been a long term beverage play. As nobody is making a profit running a greenhouse yet, I see no damage due to delays, other than as a reason for people who want to beat it up to beat it up.