Dionymed Brands (DYME.C) had a killer Tuesday, seeing a 47.6% bump in share price on news they received three provisional licenses in…California.

The company received two retail licenses in Los Angeles and San Francisco and a distribution license in L.A., adding to Dionymed’s existing collection of licenses throughout Calfornia.

The retail license in L.A. allows the company to sell cannabis and CBD-oriented products to customers and patients throughout Southern California through the company’s concierge cannabis delivery service.

Dionymed also holds “provisional distribution, manufacturing and non-storefront retail licenses in Oakland, CA and an additional provisional distribution license in Santa Rosa, CA.”

Basically, the company sells and distributes cannabis in a cannabis-rich space.

Nuts ‘n bolts

By the end of Q2 2019, DYME had $1.58M in cash. Total assets exceed $55M but the company’s liquid assets wouldn’t exceed $12M even if accounts receivable and inventories were included in our calculations.

Liabilities topped $62M at the end of Q2, prompting this writer to scratch his head. I haven’t seen a quick ratio this awful since I profiled Zenabis (ZENA.T) late last month.

Read: Zenabis (ZENA.T) to pay through the nose for $50M loan and we’re just getting started

It’s worth noting goodwill and intangible assets make up 60% of the company’s asset line.

Gross revenues equaled USD$10.3M for Q2, while net revenue after discounts neared $9M, up substantially from the $1.3M earned during the same period last year.

Direct costs were $7.36M for the quarter though, leaving the company with a gross margin of $1.44M.

Line items exceeding gross margin are: wages and salaries ($6.4M); sales and marketing expense ($1.61M); https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative and other ($3.7M).

The comprehensive loss for the quarter was $10.6M and the accumulated shareholder deficit increased $6.6M to $66.6M. Loss per share was $0.16 for the quarter, nearly double when compared to the same period last year.

The deadly debenture

In June 2020, Dionymed has $9.1M of convertible debentures coming due. Besides bearing an annual interest rate of 14%, the debenture can be converted at CAD$2.06, roughly USD$1.56 as of the time of this writing.

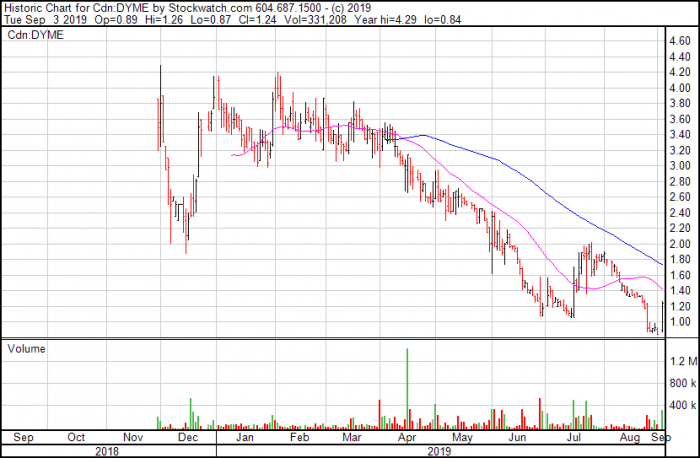

DYME closed at CAD$1.24 today, an enormous $0.40 gain on news of additional license allotments, but down from its year high of $4.29.

A few more of those and they won’t have to pay back the debenture, but cannabis is getting hammered at the moment (see: HMMJ ETF).

But the company has cash issues, even if they reach the strike price:

On July 24, 2019, the Company closed the acquisition of certain assets from MMAC including 1.83-acre Los Angeles cannabis campus, retail, distribution, manufacturing and cultivation licenses, and a dispensary attached to the property for the purchase price of $13,067,000 in cash and $6 million in the Company’s series A shares.

In conjunction with the close of the MMAC transaction, the Company entered into an agreement to sell the Los Angeles cannabis campus to Innovative Industrial Properties, Inc. (“IIPR”) for $13 million and lease back the Los Angeles cannabis campus through a 15-year lease with two optional 5-year extensions. IIPR is also providing the Company up to $2 million of capital to make improvements at the property.

In order to pay for one property, they have agreed to sell another property. There’s an old Native American adage that goes something like this: “Only the Government would believe that you could cut a foot off the top of a blanket, sew it to the bottom, and get a longer blanket.”

That’s what we have here. What’s notable is that they’re still leasing the cannabis campus they sold off, meaning they are needing to sell operational assets to fund expansion.

Not great.

–Ethan Reyes