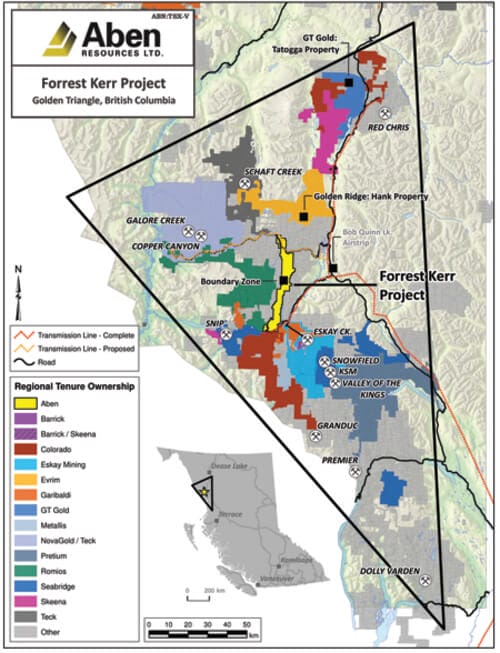

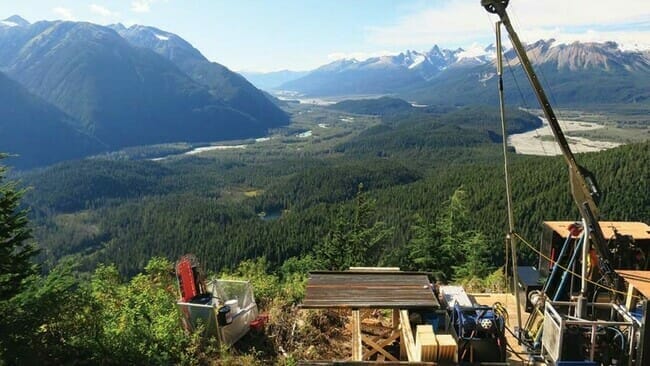

The rugged, beautiful and often challenging terrain of British Columbia’s Golden Triangle, a world-class destination for precious and base metals, is beginning to make headlines again.

The region hosts some of the richest and largest mineral deposits on the planet, and if recent newsflow out of the area is any measure, significant discovery potential remains.

The goal of every serious, seasoned investor in the junior exploration arena is to find a play with endgame potential – a mineral discovery that leads to a fat takeover offer from one or more resource-hungry producers.

New discoveries that evolve into monsters, like the deposits highlighted below, have the potential change the fortunes of those with the good sense to get in early, and the greater sense to recognize an endgame in the making.

“Be right, sit tight” is the apposite adage.

Eskay Creek – 3.3 million ounces of gold (Au) and 160 million ounces of silver (Ag) mined at average grades of 45 g/t Au and 2,224 g/t Ag. This high-grade extravaganza produced for 14 years, beginning in 1994. Back in the late 1980’s, shares in Stikine Resources (50% Eskay Creek owner), went on a tear from mere pennies (pre-discovery) to an eventual $70 per share takeover offer by Placer Dome. This is what’s meant by ‘endgame’ potential.

Brucejack – a relatively new mine on the Triangle scene sporting crazy high-grade reserves of some 8.7 million ounces of gold.

KSM – aside from massive copper, silver, and moly values, it stands as one of the worlds largest undeveloped gold deposits boasting over 106 million ounces in all three resource categories.

Red Chris – sporting resources of 13 billion pounds of copper, nearly 20 million ounces of gold, and 64 million ounces of silver. Project operator, Imperial Metals (III.T) recently made headlines when it sold 70% of Red Chris to Australia’s Newcrest Mining Limited (NCM.ASX) for a paltry USD$806.5 million in cash.

Schaft Creek – proven and probable reserves currently stand at 5.6 billion pounds of copper, 6 million ounces of gold, 372 million pounds of molybdenum, and 52 million ounces of silver.

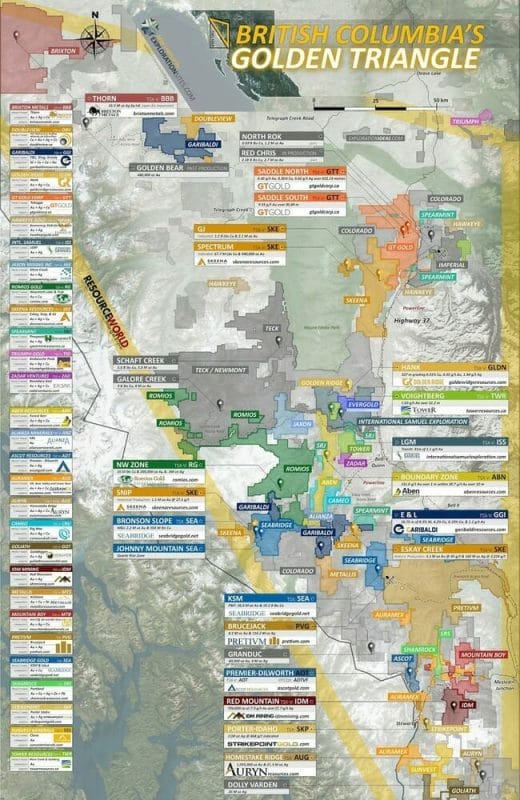

They say a pic is worth one thousand words. This claims map gives you an idea of just how congested it is up in the Triangle currently.

Right down to business

This happened roughly four months back:

These were very timely articles. Gains well in excess of 100% were achievable had you positioned yourself immediately after the publication of these articles, while the chill was still in the air earlier this spring.

Give both of these pieces a thorough read, especially if you’re new to the Triangle and want to get acquainted with the regions extraordinay geology.

I’m going to attempt to dispense with the wordy flourishes on this one in an effort get right to the point (no easy task over here).

I’ll let the charts and recent press releases do the talking.

If you have questions regarding any of the following companies, re-read the above-referenced articles, call the management teams involved, and visit the company-specific channels over at Tommy Humphreys’ ceo.ca for a variety of opinions.

My handle over at ceo.ca is @dirkdiggler (ya… I know).

We’ll start with the biggest gainers on our list and work our way down.

The Gldn-Tri companies

Once again, you’ll need to read part 1 of our two part coverage in order to connect the dots here.

The first three companies on our shortlist have registed spectacular gains in recent weeks – gains accompanied by significant volume.

Though American Creek, Teuton Resources and Tudor Gold are separate entities, they all share, via a joint venture agreement (JV), a large swath of Gldn-Tri terra firma that has generated fantastic results so far this year.

The ball got rolling when the JV announced the commencement of a highly anticipated drilling campaign at their flagship Treaty Creek project on June 11.

In the days that followed, serially succesful resource investor and billionaire, Eric Sprott, waded into the fray taking down large equity positions in all three companies.

Eric Sprott’s arrival signaled game on for the JV trio.

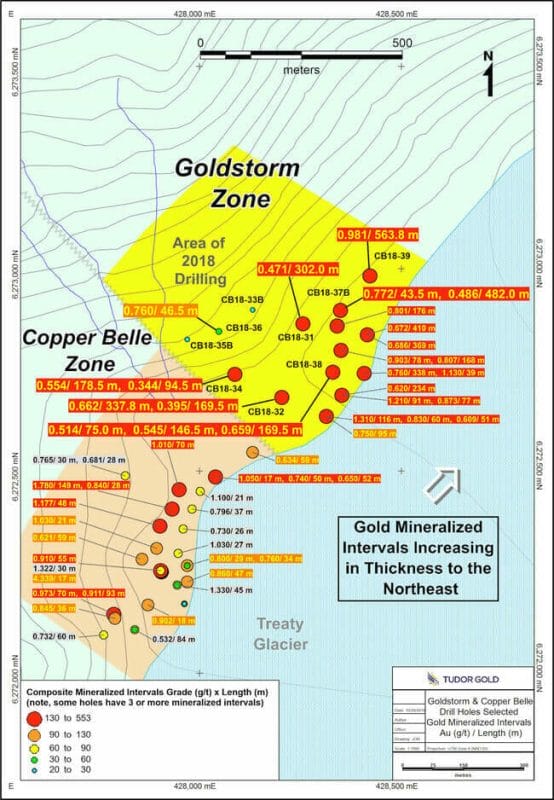

Then, on July 30, this news dropped. Boom!

(Editor’s note: the caps in the above news release are not mine, they are Tudor’s)

This is an extraordinarily fat hit, and a big stepout hole on a deposit that is growing in size with each turn of the drill bit.

The mobilization of a second drill rig to the property marks an escalation point in activity (things are getting interesting at Treaty Creek).

All three of these Gldn-Tri ExplorerCos need to be watched closely.

This JV project could have an endgame. Eric Sprott certainly thinks so.

Treaty Creek newsflow is only just beginning – additional assays from the Goldstorm zone are pending.

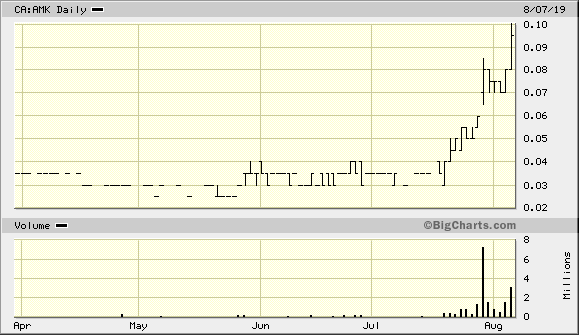

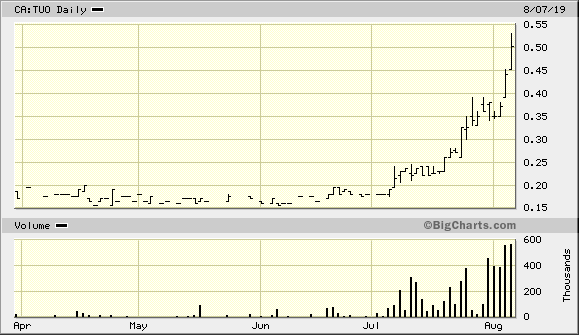

Note the JV’s short-term price gains below.

American Creek Resources (AMK.V)

- 279.94 million shares outstanding.

- share price at the time of our coverage four months ago: $0.03

- current share price (08/07/19): $0.095

- four-month gain: +217%

Teuton Resources (TUO.V)

Investor Videos (no corp presentation)

- 39.32 million shares outstanding

- share price at the time of our coverage four months ago: $0.20

- current share price (08/07/19): $0.50

- four-month gain: +150%

Tudor Gold (TUD.V)

- 108.76 million shares outstanding

- share price at the time of our coverage four months ago: $0.395

- current share price (08/07/19): $0.94

- four-month gain: +140%

A quote from our Treaty Creek JV coverage earlier this year:

This is turning into a big system (we love big systems here at Equity Guru). Worth noting: the mineralized intervals at Goldstorm increase in thickness to the northeast.

And as it turns out, southeast Goldstorm is looking pretty fat too.

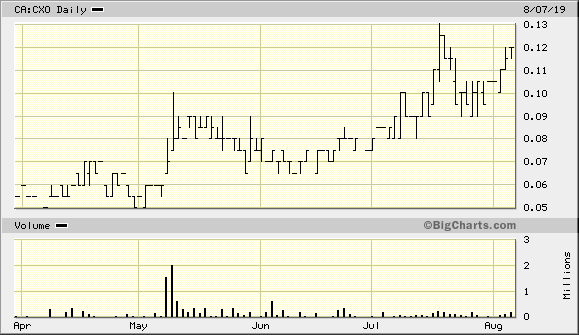

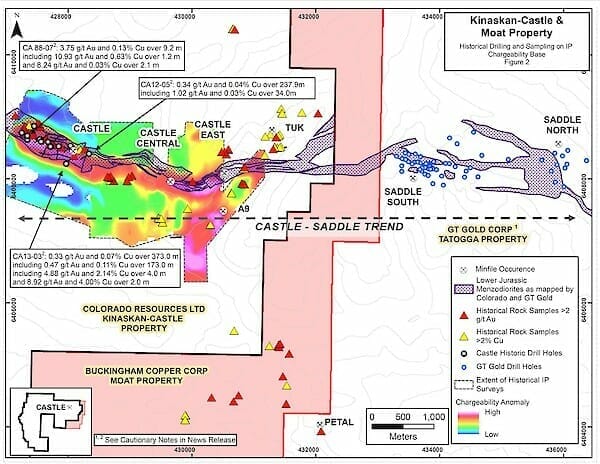

Colorado Resources (CXO.V)

- 125.14 million shares outstanding

- share price at the time of our coverage four months ago: $0.055

- current share price (08/07/19): $0.12

- four-month gain: +118%

- Six-month stock chart:

Shortly after our coverage four months back, the company added key ground to its Gldn-Tri land package by taking out Buckingham Copper.

From the company’s press release dated July 2:

“The planned exploration program, budgeted at $1.4 million including drilling, that has been designed for the Castle property is expected to commence in August. A phase-1 work program will include prospecting, geological mapping, and geochemical, magnetic and Induced Polarization (IP) surveys to in-fill a nearly two km-long, high-priority gap in data along the eastern Castle property boundary with GT Gold (map below).”

“A phase-2 program, scheduled for late summer, is expected to comprise drilling of up to 2,500 m on high priority targets already developed, including Castle East described below, and new targets from the phase-1 work.”

This is yet another highly prospective Gldn-Tri exploration play that will be watched closely this season.

Colorado has a current market of $15M.

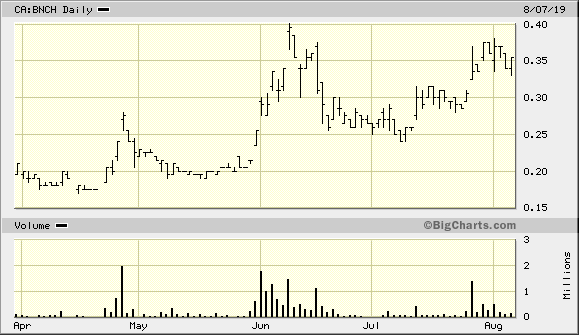

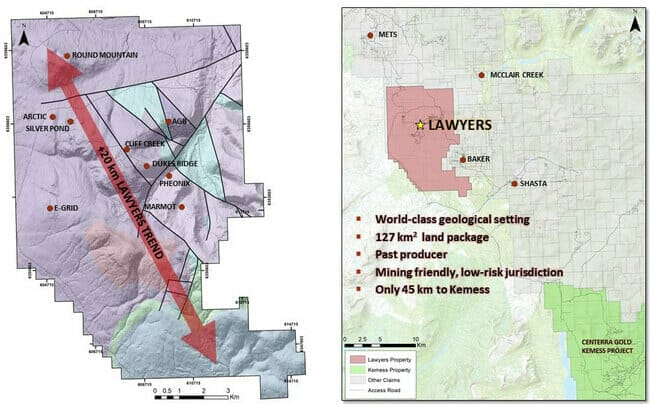

Benchmark Metals (BNCH.V)

- 42.23 million shares outstanding

- share price at the time of our coverage four months ago: $0.195

- current share price (08/07/19): $0.355

- four-month gain: +83%

- Six-month stock chart:

Since our coverage earlier this spring, the company has put out a number of press releases highlighting assays from historic drilling at its Lawyers Gold-Silver Project.

On April 26, Benchmark declared a goal to significantly increase the existing gold-silver resource at the Lawyers project. This is an ambitous crew. Spirits/expectations are high.

On July 19, the drills began turning at Lawyers.

On July 30 and August 2, the company reported updates on recent drilling.

Assays from multiple drill holes are pending.

Benchmark’s large following includes one Bob Moriarty.

The company has a 19.42M market cap.

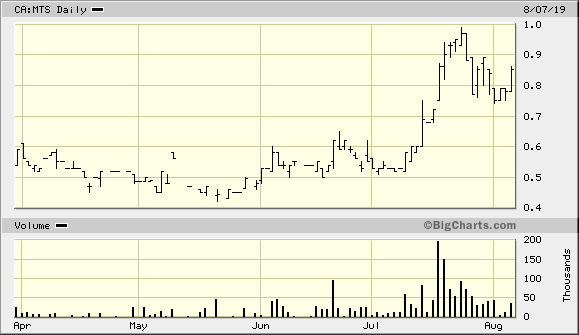

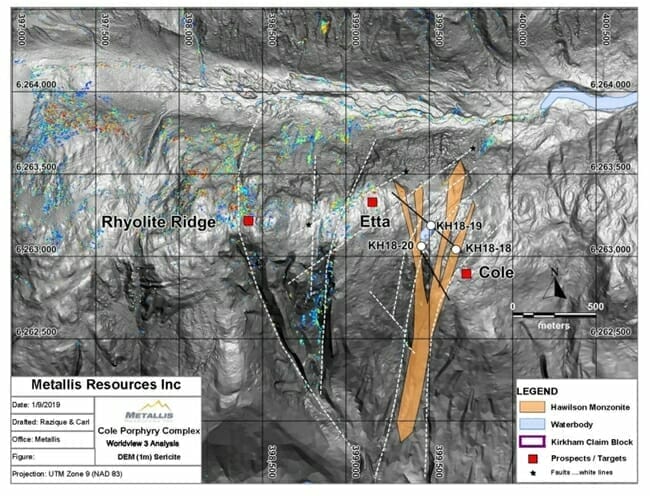

Metallis Resources (MTS.V)

- 32.99 million shares outstanding

- share price at the time of our coverage four months ago: $0.51

- current share price (08/07/19): $0.85

- four-month gain: +67%

- Six-month stock chart:

On July 9, Metallis announced the commencement of exploration at its 100%-owned Kirkham Property. This program will, in part, follow up on a 2018 high-grade gold discovery in drill hole KH18-19 which tagged 11.8 g/t Au over 7.7 meters (including 137 g/t over 0.6 meters).

Then, on August 2, the company dropped the following headline:

METALLIS OUTLINES NEW NICKEL AND GOLD TARGETS AT THUNDER NORTH AND THUNDER SOUTH

Drilling will commence later this month.

The company has a current market cap of $28.51M.

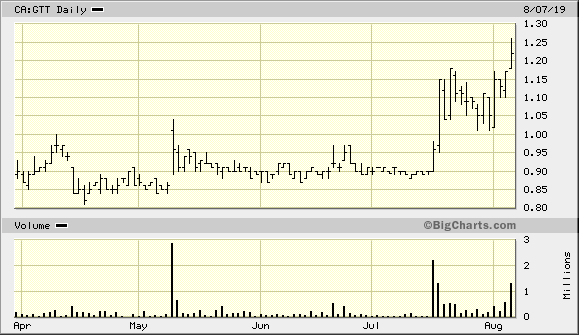

GT Gold (GTT.V)

- 112.93 million shares outstanding

- share price at the time of our coverage four months ago: $0.90

- current share price (08/07/19): $1.22

- four-month gain: +35%

- Six-month stock chart:

On May 9, GT Gold announced a substantial strategic investment by Newmont Goldcorp (NGT.T).

On June 13, the company announced the commencement of a first phase drilling campaign at its Saddle North Project.

On July 17 we had our first look at Saddle North assays via the following press release:

This first phase of drilling will consist of roughly 10,000 meters.

Once the 10,000 metres of drilling of Phase 1 is complete, Saddle North targets will be re-prioritized and drilling will focus on producing a preliminary resource for Saddle North. A number of additional targets peripheral to Saddle North will also be drilled. Any other new targets showing significant promise may also be tested in an anticipated Phase 2 drill program, scheduled to begin in early August.

A lot of news is expected to flow out of this project.

Aside from a resource estimate which is scheduled to be tabled later this year or early next, Saddle North (and South) has significant discovery potential.

The company has a market cap of roughly $127.5M.

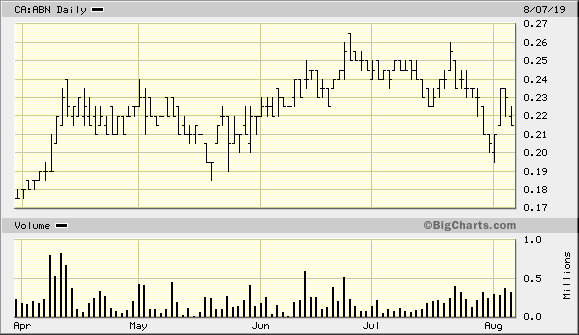

Aben Resources (ABN.V)

- 111.46 million shares outstanding

- share price at the time of our coverage four months ago: $0.175

- current share price (08/07/19): $0.215

- four-month gain: +23%

- Six-month stock chart:

Aben’s Forrest Kerr Project has been followed closely by the scribes here at equity.guru.

On May 23, the company announced an ambitious 2019 exploration campaign to follow up on last year’s impressive results:

- Early drilling will test the potential for a northward extension of the high-grade mineralized core at the North Boundary Zone;

- Early drilling will also test for the potential connectivity of the North Boundary Zone with the1991 high-grade Noranda hole approx. 200 meters to the south;

- Drilling will also further test the polymetalic occurance at the South Boundary Zone where broad intercepts of gold-silver-copper-zinc were incountered in 2018;

- Airborne mag survey to be conducted over entire Boundary Zone before drilling starts this year;

- New pad locations will allow Aben to further test with greater certainty and confidence locations that may have been drilled last year but were constrainded by the limited angles and pad locations and will be able to test many new targets based off the new geophysical survey as well as the existing geochemical survey with greater confidence.

On August 6, the company updated shareholders on progress at Forrest Kerr stating that ongoing drilling at the North Boundary zone continues to provide encouraging visual indicators of significant alteration immediately south of the known mineralization.

This is another project that is being watched closely.

With the sheer volume of high priority targets to test with the drill bit, the potential for discoveries of new, high-grade zones (and broader zones of mineralization) has to be considered excellent.

Assays are pending from multiple projects.

The company has a current market cap of roughly $25M.

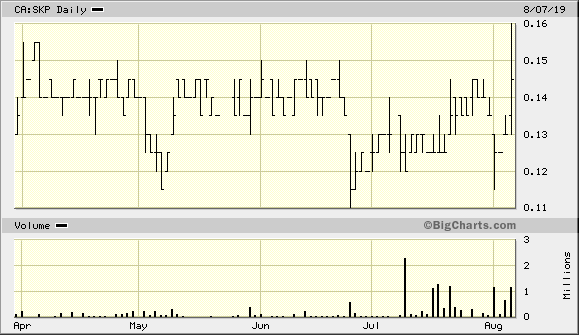

Strikepoint Gold (SKP.V)

- 74.09 million shares outstanding

- share price at the time of our coverage four months ago: $0.13

- current share price (08/07/19): $0.145

- four-month gain: +12%

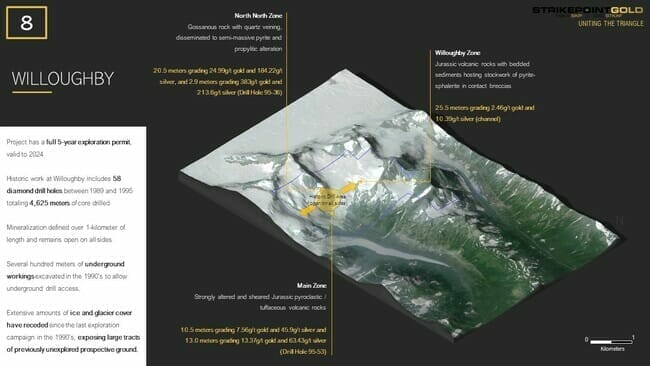

On July 31, Strikepoint announced the commencement of phase one drilling at their 100%-owned Willoughby Project located near Stewart BC.

A previous drilling campaign tagged the following high-grade hits at Willoughby:

- 53.21 g/t Au and 211.09 g/t Ag over 5.5 meters

- 113.68 g/t Au and 121.77 g/t Ag over 3.0 meters

- 20.08 g/t Au and 1,250.83 g/t Ag over 3.0 meters

- 352.22 g/t Au and 194.64 g/t Ag over 2.9 meters

- 120.30 g/t Au and 2,434.84 g/t Ag over 3.5 meters

Damn fine gunnery with the drill bit!

On August 7, the company announced that an expanded surface sample campaign of hand-trenching and channel sampling had commenced. This, due to the discovery of encouraging new exposures of sulphide mineralization, prospective alteration, and intrusive rock.

The news release went on to state:

StrikePoint is currently drilling the Property; at the time of this release, six holes for 800m completed at the high-grade North Zone. 194 core samples from the initial two drill holes have been shipped for ‘rush’ analysis, as well an initial batch of 47 surface samples.

It’s always an interesting development when a company slaps a ‘rush’ on assays. There are added lab costs associated with such a move. Obviously, the onsite geo liked the look of the core coming out of the ground.

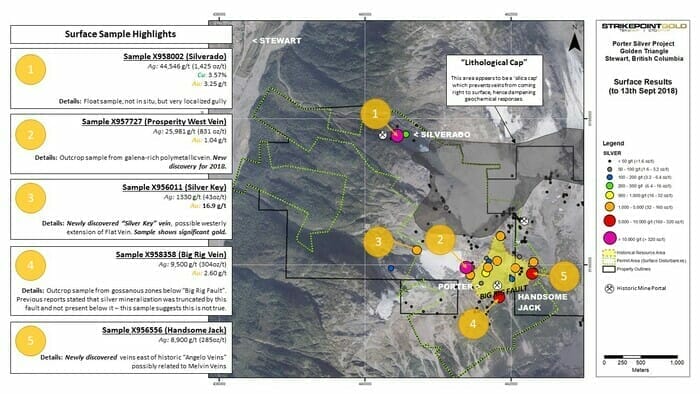

The company also has an uber high-grade silver project in the Triangle called Porter Idaho.

Strikepoint is definitely one to watch.

The company has a current market cap of $15.15M

Scottie Resources (SCOT.V)

- 59.57 million shares outstanding

- share price at the time of our coverage four months ago: $0.16

- current share price (08/08/19): $0.175

- four-month loss: +10%

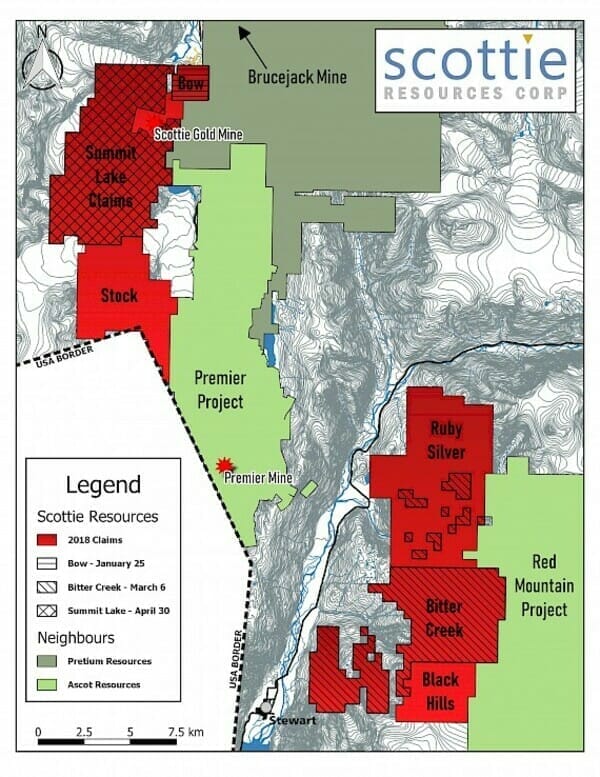

Scottie has an impressive portfolio of projects located in a highly prospective region within the Triangle (Scottie and Strikepoint are close neighbors).

Note the company’s proximity to the uber high-grade Brucejack Mine, the Premier Mine, and the town of Stewart itself.

On June 27, Scottie announced an early start to their 2019 field season at Bitter Creek, Ruby Silver, and its Black Hills properties (collectively referred to as the “Cambria Project”).

On June 27, Scottie announced an early start to their 2019 field season at Bitter Creek, Ruby Silver, and its Black Hills properties (collectively referred to as the “Cambria Project”).

On August 1, the company announced the commencement of an exploration program at its Summit Lake property, a project that surrounds the historic high-grade Scottie Gold Mine.

We’re waiting to hear more details regarding the company’s exploration plans this summer. If they do decide to mobilize a drill rig to one or more projects, things could get very interesting here.

Scottie has a very modest market cap of $9.4M.

The final few

The remaining picks from our early spring coverage have registered losses over the past four months. There’s no point in highlighting the price action, or lack thereof, with a chart. Having stated that, each one of these companies should be examined closely for the potential to capitalize on unwarranted weakness.

It’s possible that the market is ignoring the underlying fundamentals of these laggards. I wouldn’t write them off as things can turn on a dime in the exploration game.

Moving along…

Jaxon Mining (JAX.V)

- 100.48 million shares outstanding

- share price at the time of our coverage four months ago: $0.055

- current share price (08/07/19): $0.05

- four-month loss: (-10%)

Jaxon raised a modest amount of cash earlier this year and announced commencement of a field program on July 25.

Exploration will include:

- A soil sample program consisting of a systematic grid at 50m x 50m carpeting Primary Ridge and Red Springs copper porphyry target areas;

- Detailed geologic mapping of the prospect;

- Detailed alteration mapping of the prospect;

- Detailed rock sampling at the Razorback Cu porphyry target area and two high-grade sulfide mineralization veins areas (high-grade Sb-Ag area and East As-Ag-Au veins area);

- Selective channel sampling at tourmaline breccia and other areas as directed in-field;

- Determination of potential for new targets within the larger area.

No drilling is planned for 2019.

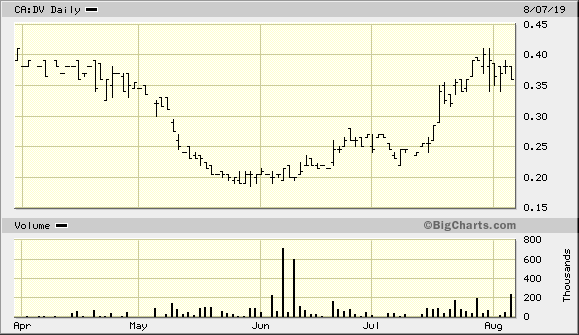

Dolly Varden Silver (DV.V)

- 57.37 million shares outstanding

- share price at the time of our coverage four months ago: $0.41

- current share price (08/07/19): $0.36

- four-month loss: (-12%)

- Six-month stock chart:

I’ve included a stock chart here on Dolly due to the unusual trading activity that has transpired over the past few months.

On May 8, the company dropped the following piece of news:

Resource and metallurgy highlights from this release include:

- Torbrit Deposit – Indicated Mineral Resource of 2,623,000 tonnes at 297 g/t Ag for 25.025 million ounces of silver.

- Torbrit Deposit – Inferred Mineral Resource of 1,185,000 tonnes at 278 g/t Ag for 10.588 million ounces of silver.

- Dolly Varden Deposit – Indicated Mineral Resource of 156,000 tonnes at 414 g/t Ag for 2.078 million ounces of silver.

- Dolly Varden Deposit – Inferred Mineral Resource of 86,000 tonnes at 272 g/t Ag for 0.754 million ounces of silver.

- Preliminary metallurgical silver recovery yielded 86.9% for the Torbrit and 85.6% for the Dolly Varden deposits from bottle roll cyanide leach testing over 96 hours.

- Total Indicated Mineral Resources for the four deposits on the Dolly Varden Property stand at 3,417,000 tonnes at 299.8 g/t Ag for 32.931 million ounces of silver.

- Total Inferred Mineral Resources for the four deposits on the Dolly Varden Property stand at 1,285,300 tonnes at 277.0 g/t Ag for 11,477 million ounces of silver.

Apparently, the market wasn’t impressed with the numbers. But it’s important to understand that management chose to go conservative when it tabled these numbers (conservative cut-off numbers were applied here).

It’s also important to keep in mind that the silver market was still in a funk when this news hit the wires.

Gary Cope, Dolly’s CEO:

“This update on the mineral resource estimates, based on a more comprehensive geological model, plus the positive metallurgical recovery numbers, are important steps in the advancement of the Dolly Varden project. The program’s metallurgical testing, yielding 86.9 % for Torbrit and 85.6 % for Dolly Varden, supports the historical results and demonstrates that the silver can be extracted from Dolly Varden styles of mineralization through conventional processes.”

This one is worth some additional due diligence. It might be well worth the time and effort.

It wasn’t that long ago that Hecla Mining (HL.NYSE) attempted to buy Dolly Varden for $0.69 per share.

Dolly Varden has a current market cap of roughly $27M.

Golden Ridge Resources (GLDN.V)

- 79.19 million shares outstanding

- share price at the time of our coverage four months ago: $0.13

- current share price (08/07/19): $0.115

- potential four month loss: (-12%)

On June 14, GLDN announced that crews had been mobilized and drilling had started at its 100% owned Hank Project.

On July 9, the company announced that it had expanded its property holdings by optioning the Ball Creek project from Evrim Resources (EVM.V).

On July 22, GLDN announced the first assay results from their 2019 drilling campaign at Hank.

Highlights:

- 0.28% Cu, 0.22g/t Au and 1.43 g/t Ag (0.44% CuEq1) over 380.5 metres, from 233.0 to 613.5 metres in hole HNK-WZ-19-01

- including, 0.35% Cu, 0.28 g/t Au and 1.71 g/t Ag (0.55% CuEq1) over 278.0m metres, from 257.0 to 535.0 metres

The market didn’t appear to appreciate this first round of assays. Additional results are pending.

We’ll leave it at that. There are three additional companies on our coverage list, but they haven’t produced much in the way of news this field season.

Closing thoughts

The next two to three months promises to generate a substantial volume of assay related newsflow out of the Triangle.

We stand to watch.

— Greg Nolan

Full disclosure: Equity.Guru does not have marketing arrangements with any of the companies featured above.