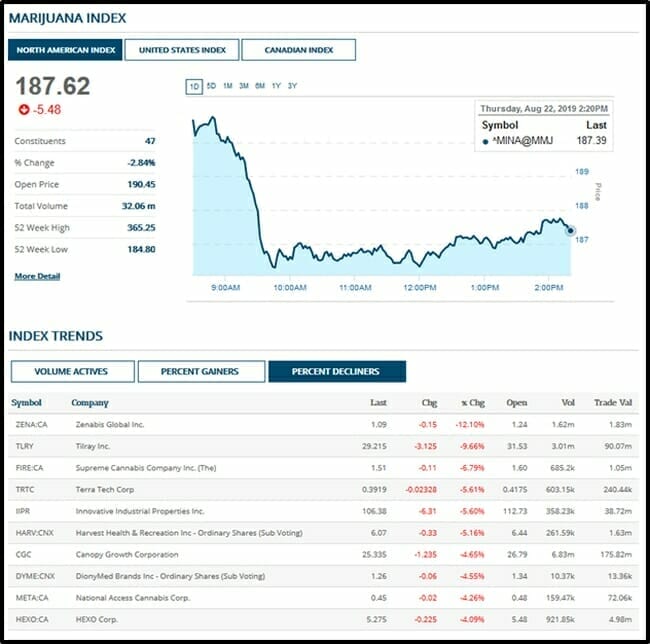

While the twitter-sphere frets about a looming U.S. recession – and the likelihood that the Fed is finally “out of bullets” – the Dow edged up 70 points, gold fell $6, the VIX (fear index) spiked 6% and cannabis stocks got hammered.

Aren’t weed companies “Sin Stocks”?

If everything is going to hell, won’t more people need to get stoned?

And won’t the people who are already stoned, need to get more stoned?

Yes & yes & yes.

But the promise of “more-people-getting-stoned” is no longer enough to keep retail investors in the cannabis space.

They need a daily fix of positive headlines like, “10 Marijuana Stocks Wall Street Thinks Will Double.”

“Perhaps it’s no coincidence that cannabis is green, because the green rush has generally treated investors well,” stated the Motley Fool article, “There are, obviously, huge growth forecasts attached to the industry, with investment bank Stifel calling for as much as $200 billion in annual sales in a decade.”

Editor’s note: If you’ve previously heard of “Investment Bank Stifel” – you are eligible to enter a draw for a 15% discount on an Equity Guru fridge magnet.

Recently, the weed headlines have turned gloomy.

“Aurora Cannabis Shareholders Aren’t Happy,” states Business Insider, “Aurora Cannabis is a Canadian-based marijuana grower. ACB stock trades on the NYSE. Like most other companies in this industry, the company has disappointed share holders. ACB shares have lost about 40% of their value since just this past March.”

“I would not own this stock,” the article continues, “but if I did, my biggest concern would be the large amount of goodwill and intangible assets that the company claims as part of its valuation.

“The reason why Aurora Cannabis has so much in goodwill and intangible assets is because they have made numerous acquisitions over the past few years. In my opinion, ACB probably overpaid for many of these acquisitions. Because of this I believe that the goodwill and intangible valuations are way too high. Eventually it will need to be revalued, which will in turn make the ACB stock price drop.”

Fair enough.

Of course, all cannabis companies are not created equal. And all cannabis sectors are not created equal

Marijuana companies focused on the United States face “massive and unsustainable” valuation discounts relative to their Canadian counterparts, according to a new report.

Companies operating states side, are trading at “about 13 times consensus estimates for their 2020 earnings before interest, taxes, depreciation and amortization (EBITDA.)”

That represents a 56% discount to the 30 X average for companies generating only Canadian, revenues.

“Today, US-listed Canadian cannabis play Tilray (TLRY.Q) was ‘pleased’ to show you their Q2 financials, according to an official company tweet,” wrote Equity Guru’s Chris Parry last week.

“Are they though?

Average net selling price per gram decreased to $4.61 (C$6.12) compared to $6.38 (C$8.36) in the prior year period.

Tilray, a $3.5 billion company, lost $35.1 million on the quarter. It brought in $48 million of revenues to do that.

The dumbest street slinger beats Tilray’s quarterly profit numbers, and that should be rare, not the norm, but we’re about to see a lot of companies pitch their tent right around Tilray’s numbers, and the battle won’t be for profit, but who can stem their losses best.”

Are the big cannabis companies over-valued?

Yes.

Are there too many little cannabis companies?

Yes.

But let’s not “throw the baby out with the bath water”.

This is not block-chain or 3-D printing.

THC and CBD are real products with surging global consumption and lot a feel-good stories attached to them.

In the last 5 months, Tilray (TLRY.Q), Canopy (WEED.T), Aurora (ACB.T), Cronos (CRON.T) and Aphria (APHA.NYSE) have shed about $22 billion in market cap.

That is a lot of bleeding.

Here’s the reality: most cannabis investors don’t know much about cannabis.

They saw the tide rising and they jumped on the boat.

Now that the tide is retreating, they are jumping off.

That is why the weed sector is getting hammered today.

Full Disclosure: Equity Guru has no financial relationship with the companies mentioned in this article.