We talked to the folks behind Livewell a lot, back in the day. Seemed a good deal, certainly a team that talked a good game. Even bought a little personally.

But there was always a coda attached. The projections and plans were big.

Here’s me, the first time I covered them.

Little Canopy” – that’s the two word slugline we came up with to describe Livewell Canada (LVWL.V), which hit the Canadian markets yesterday with a bang and ripped in early trading Friday, rewarding early private placement investors with a $0.95 to o$1.82 profit – so far. There’s a lot more to it than two words, obviously, but the numbers inherent in this deal are a little bit staggering.

In Quebec, which still has only one sales license, Livewell has a 1m sq. ft. hybrid greenhouse project with the first 100k due to be completed in Q4. They claim they can grow in this facility for less than $0.75 per gram, a claim I frankly don’t believe but will be really interested in seeing if they can hit, because it will be a gamechanger if it happens.

One of the big attractions for this deal was who had done due diligence on them before they went public, and had duly decided to climb aboard as part of the deal.

What’s up, Bruce.

Livewell already has a deal in place with Canopy Growth Corp (WEED.T) to supply 20% of their product to them for the next twenty years, and there’s $20m available to borrow from that outfit if Livewell execs should decide they need it. In the meantime, just for giggles, Canopy has taken a 10.55% stake in the company, which has already paid dividends [to them] by virtue of their great opening.

They did deals with Tilray (TLRY.Q) and things were going well. But there was also a little in the money, cheaply acquired stock to work through in those early months and, towards the end of 2018, as much of the weed market slushed downwards, LVWL did too at an accelerated pace.

That downturn would turn out to be okay for most companies in the sector, because the early months of 2019 were an upwardly shifting funhouse.

But Livewell never experienced that turnaround because, before the comeback occurred, they got an idea to buy some things and were duly halted, right as their competitors got hot.

December 3, 2018: Livewell Canada Inc. has signed a binding letter of agreement to acquire 100 per cent of Vitality CBD Natural Health Products Inc. and its wholly owned U.S. subsidiaries, which will result in a reverse takeover transaction by Vitality.

The transaction will enable the combined companies to become a new leader in the health and wellness market for cannabidiol (CBD) products from hemp and cannabis. Vitality, a cultivator and producer of hemp CBD, and Livewell, a cannabidiol researcher, developer, marketer and distributor, will combine their U.S. and Canadian operations to address the anticipated growing demand for CBD and other cannabinoid products in North American and international markets.

That idea, to become the first truly cross-border CBD company by making a fat hemp play, didn’t seem insane at the time. You couldn’t do it with cannabis proper, but hemp was more open to play, and the passage of the US farm bill even made it hot for a time.

Admittedly, Vitality was a bit of a black box, with scant detail about what they actually had beyond broad projections, but they had announced a partnership with Livewell months earlier, so it didn’t seem out of the ordinary for the two to join at the hip.

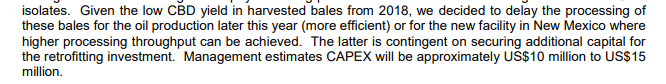

Vitality’s hemp cultivation, processing and sale activities are fully certified and compliant under U.S. state and federal laws, as per the Montana Farm Act. It also has cultivation operations in Alberta. In 2018, Vitality planted and harvested 20,000 acres of industrial hemp, purposely planted for CBD production (19,000 in Montana across 33 farms and 1,000 acres at one farm in Alberta).

Vitality is currently producing CBD isolate in its facility at Eureka, Mont., with existing capacity to reach 100 kg/day of CBD isolate in December, 2018. Vitality also acquired additional production capacity in Las Cruces, N.M., where it plans to retrofit the existing production/extraction equipment.

Looking back, LVWL did go to great lengths to avoid disclosing the valuation inherent in their deal in news releases relating to it, leaving it to investors to do the math.

That may have been a factor in 97% of shareholder votes being cast in favour of the deal..

Soon, there was another deal afoot:

LIVEWELL CANADA SIGNS DEFINITIVE AGREEMENT TO ACQUIRE ACENZIA

On Dec. 14, 2018, Livewell Canada Inc. signed the definitive agreement with Acenzia Inc., a leading developer and manufacturer of natural health products and supplements in Tecumseh, Ont., to acquire 100 per cent of Acenzia Inc.’s common shares, for a total purchase price of $20-million. Livewell previously announced the binding letter of intent to acquire Acenzia on Oct. 5, 2018.

This deal was far from crazy, or even expensive, but it was also ‘in the way’ of the bigger deal that had to play out.

Now you had LVWL in a trade halt until not one, but two deals were closed, involving four companies in total (the Vitality deal involved a shell called Mercal Capital that also needed to be roped in)… and as those negotiations played out over the ensuing eight months, LVWL remained frozen on the markets, while having to raise money where and how it could, and front that cash to Vitality to keep it afloat.

This kind of trade halt is never a good thing, even when it’s done to help complete the transition to a much bigger deal. The opportunity cost in having your stock stuck motionless for months weighs heavily on retail investors more than anyone else. Some people rely on the liquidity of the markets when they’re investing, that they can extract their cash quickly when it’s tax time, or Timmy needs new braces, or the wife found out about Felicity at the rub’n’tug and is calling a lawyer.

To be stuck in a deal that isn’t getting the benefit of a market upswing is infuriating. It’s even worse when that sector upswing turns the other way, and you have no way of escaping as everything drops 40% around you.

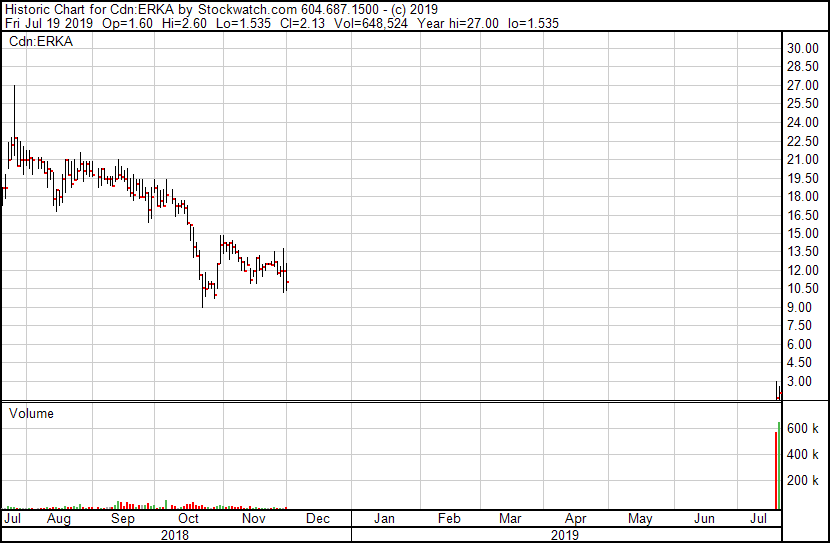

This week Livewell unhalted, at last, rebranding as Eureka 93 (ERKA.C) (a nod to the road its Montana facility is situated on), and rolling back the stock 15 to 1 so it could qualify for a NASDAQ listing based on a higher share price, which now appears to have been an insane folly.

That NASDAQ listing isn’t happening any time soon because, part of any measure used to qualify for a listing involves your stock being over $4.

It got as low as $1.52 yesterday. After a dead cat bounce today, the stock settled at $2.13.

Naturally enough, the market is furious.

LiveWell shareholders are down -90% today after the company started trading again as $ERKA. Canopy divested due to a dispute about the merger and @Eureka93Inc did a 15-1 split. Another company who totally fucked their shareholders. $LVWL $LXLLF $RIV https://t.co/wE2YZz27LM

— WeedStreet420 (@weedstreet420) July 18, 2019

I got fucked as a LIVEWELL shareholder , my shares got diluted , im down 90% since last traded value

— Wolf of Potstocks (@wolfofpotstocks) July 18, 2019

No press release or explanation from management this morning is a very bad move IMO#cannabisnewsDD #ManagementWakeUp

— ✍️ Cannabis News & Due Diligence ✍️ (@cannabisnewsDD) July 19, 2019

The Canopy agreement, that once gave this deal a seal of approval, is now toast. Canopy Growth Corp (WEED.T) and Canopy Rivers (RIV.V) weren’t please with the merger, according to company filings, and presumably didn’t like the valuation being tossed out there.

Others noticed too.

$ERKA valued a no revenue generating / non licensed / lease landed extraction company at $680 milllion ,why that valuation passed is beyond me ,original LiveWell shareholders have 10 million shares under $20 million in equity, they got hosed!

— MMJ Investing (@mmjinvesting) July 18, 2019

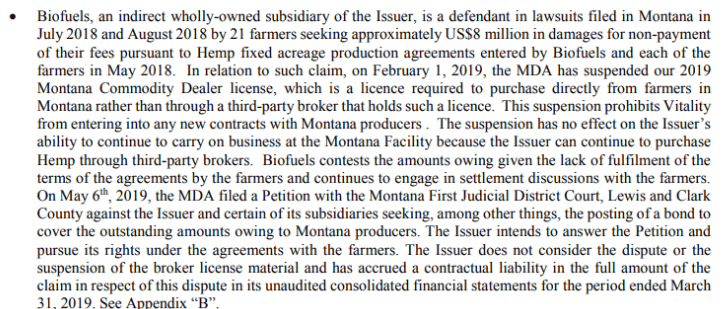

And then there was the lawsuit, where Vitality was being lawyered up against by Montana farmers pissed they (allegedly) haven’t been paid for hemp they grew for, and sold to the company.

Part of the benefit in doing a deal with Canopy in the first place, was that the bigger beast had agreed to help Livewell get their Canadian facility licensed through Health Canada. Now, ERKA will be handling that themselves.

It shouldn’t be the case, but the big LPs hold much sway in Health Canada circles. Aurora just licensed its sixth facility this past week, while many small guys with nice pedigrees have yet to move to one. With Canopy now unlikely to rest its sizable babymaker on the scale, that task is going to be harder.

And with the stock price of ERKA now down 90% from the last price of 2018, raising money to complete their mission is going to be a lot more expensive than it used to be.

MY TAKE: HOLY SHIT, LIVEWELL, DID YOU FUCK THIS STORY UP OR WHAT?

Too much stuff, for too high a valuation, done too quickly, with a trade halt that went too long and failed to read the room in any real way.

Uplisting to the NASDAQ? Come on, man, who goes that way when you’re pre-revenue?

The multi-deals going at once? Focus, guys. One at a time. Let a deal slide if you need to, but the more people you add to your bed, the higher chance you’re going to end up with something sizable stuck in an uncomfortable place.

In an effort to keep debt down, the combined companies have had to do deals with promissory notes, with debts shifting to stock, everything bar selling the lobby furniture, as it faced dilution of the share count at every turn.

In connection with the termination agreement, Surety agreed to convert existing [Vitality] indebtedness to Surety into an unsecured convertible note in the principal amount of $18.5-million (U.S.). This note is convertible by Surety into Eureka 93’s common shares at $9.44 per share. The Surety note accrues interest at 10 per cent per annum (payable monthly) and has a maturity date of March 31, 2021. The $18.5-million (U.S.) principal is repayable only at the maturity date; however, Eureka 93 may prepay the note at any time in whole or in part.

Natch:

At March 31, 2019, Eureka93 has cash of $4.9 million (December 31, 2018 – $1.2 million) and negative working capital of $19.0 million (December 31, 2018 – negative $17.0 million).

ERKA needs to raise money, and soon. Not just to actually do business, but to stay afloat.

From the most recent MD&A:

Raising that money now, at a price 90% down from eight months ago, will be the sort of heavy lifting one might associate with a truck and tractor pull.

Raising that money now, at a price 90% down from eight months ago, will be the sort of heavy lifting one might associate with a truck and tractor pull.

March 31 financials show a whopping loss of $0.59 per share.

With the addition of Vitality’s headcount and facility costs, management anticipates Eureka93’s quarterly OPEX will be approximately $6 million and subject to raising additional capital management expects further investment in headcount, facilities and information systems during 2019.

This is bad.

I mean, I don’t mind a company getting slaughtered on bad timing and some bad communication, that happens sometimes. I don’t even mind the overpricing of an acquisition, when execs get stars in their eyes – AS LONG AS I’M NOT IN THE DEAL AS IT CRASHES and can pick up some cheap on the other side. That’s often the silver lining on a situation like this, that the damage has been done and now you can get in for pennies on the dollar.

But there’s no silver lining here.

Let’s be clear here, this company is NOT jamming the executives’ pockets with share-based compensation, according tot he MD&A. They’re not running an absurd G&A budget, and their Acenzia pickup is actually bringing in revenue that should grow, albeit not enough to cover their quarterly losses any time soon.

This isn’t a case of a company fucking over shareholders as a deliberate act, it’s a company that didn’t run from the fire coming at them because it was feeling warm and toasty.

The rollback certainly made sense when you factor in the share price level needed to get a NASDAQ listing, but the decision to go forward with it didn’t consider the obvious – that after an 8-month trade halt, a lot of your smaller investors (and probably some big boys) are going to sell immediately, and that’s going to shred the stock.

A rollback, where (in this case) investors were given one share for every 15 they owned, in an effort to raise the dollar amount of the share price, will almost always puts pressure on a stock because it means every half cent uptick in price is a smaller percentage point than it would have been previously.

Investors like those low prices, where a march up can really run on every trade made.

Running a rollback in conjunction with a long trading halt? That’s madness. Unbridled optimism is the most generous way to describe it.

If ERKA had let the trade re-open happen without a rollback, and watched the share price drop from $0.80 to $0.50, then let the dust settle and brought in a little walking around money at that level, they could have made the NASDAQ listing a longer term plan that would happen on hitting milestones.

But they didn’t. They came in too hot. They figured they could just blow through.

The fundamentals are rough on this one, and got way rougher in the last 24 hours than I’m sure anyone at the company expected. It’s on them now to navigate a way clear, even if it means selling their local operation and doing one thing well, instead of three things poorly.

NOTE: I’m certain CEO David Rendimonti, who I’ve talked to several times and seems a beyond decent guy, would have an alternate take on both the past situation, the current situation, and the future. And I intend to give him a chance to share that.

But not today.

The situation today has hurt a lot of shareholders whose only mistake was having faith in this business model, and they deserve to be heard, and to rage openly, and to have that voice not competed with by excuses, spin, or even an alternate viewpoint.

When your stock opens 90% down, you don’t want a CEO telling you that it’s going to be okay. You need to vent and rage and heal, so accept this article as our best attempt to give folks that voice, to explore the details honestly, and as a chance for the company to hit reset later on by telling us straight what happened here, what they got wrong, and how they’re going to make it better.

That’s for next week. For tonight, we drink.

— Chris Parry

FULL DISCLOSURE: Livewell was an Equity.Guru marketing client when it went public. There have been active discussions about that agreement being renewed upon their resumption of trading, as recently as today. We publish this article in accordance with our mandate that we speak honestly and openly about companies, even those that are, or may become, clients. We do that because the public deserves an honest look at how this situation came to be, and because we believe ERKA will agree mistakes were made, corrections are needed, and a clear plan needs to be shared and executed going forward.

Out of respect to both the company and investors, we are happy to provide a forum for both sides to have their say, gratis, regardless of commercial partnerships or otherwise, because what matters most are the little guys looking at a big hole where their money used to be.

Peace.

Thank you for this article

Looking forward to your grilling of the management as they have shown to be totally incompetent and shady. Some of them need to be in jail.

Will you be conducting an interview with the Eureka 93 CEO soon? They have remained eerily quite as the stock has plunged and continues to move down further. Investors want answers and their only Investor Relations guy has gone into hiding (apparently travelling). Will Equity Guru step it up and demand answers from the management? Canntrust seems very minor compared to the scheme these guys have plotted.

Hope so.

Looking forward very much, to this. The sooner it is done, the better it is for the current investors and also to bring to light anyone in management that needs to be booted out. Their latest press releases are nothing but fluff. It looks like they have not learnt anything or are very happy to have transferred the valuation over to insiders and so don’t really care about anything else that is happening to bring this company down.

There is a long list of unanswered questions, starting from

1. “what happened to the apparent $400 million in harvest hemp inventory that Vitality had from 2018”?

2. What was the valuation of Vitality based on?

3. Now we know that the reverse split clearly was not done to bring the price of the stock up, but rather to reduce the stake of existing investors to a negligible level. Who is taking responsibility for this mess and what have they done about it?

4. On what basis is the management getting such a high compensation when everything they have done to date has been a failure and they have not executed on any major milestones?

5. Where is the cultivation license?

6. What happened to the investment promised by the Quebec government?

7. All the shady insider dealings & supposed arms length “partnerships” most of which are barely legal but certainly immoral

8. What happened to the supply deal with the Brazilian company and the other U.S company which simply disappeared like vapour but the deal with the U.S company has now come back as some sort of partnership (again to enrich the insiders and their friends) – while the company needs to see sales not some fluff about partnerships?

9. Who/What is going to fund the Las Cruzes site? Investors have lost 90% and will likely end up having lost 98% by the time that funding round is done. Everyone in management should be fired and replaced with a new team. Same with the board.

10. Will management disclose the real faces behind the fictitious companies that have benefited to date from the 28 million in return for a 300K loan and other such crooked schemes? Is Owen Kenney the primary for that lending company?

The list is long, but I am sure answers to these would be a good start. Thank you for your great work, Chris. These guys have schemed to ruin the lives of many and need to be exposed. Now it is only the media that can do it.

And not to forget the Relief Effects deal, which gives the insiders a 10% cut off all Gross Revenue in perpetuity.

Digging through this a bit I see they license their technology from a company called Relief Effects Inc (REI)….what’s the origin of this technology? The only shareholders of REI are Livewell insiders and the founders of REI are Rendimonti and Leaker – do any of these people actually have a background in this stuff?

Please expose these crooks before we lose every cent of our investments. They need to be ousted as a bunch (management Board). They are all in it together to defraud the investors. There is no good news coming out of this.

Hi Chris,

When can we expect to see/hear your conversation with Eureka? Hoping it is not full of the same PR b.s from them and that Rendimonti is the one doing the talking.

Did the call today. Podcast soon.

The great manipulation by Rendimonti and co. Continues. Nothing from Chris yet. Possibly another piece supporting the managements’ new vision and growth strategy in the works? I am sure others will expose these crooks behind the scheme soon, if equity guru turns a blind eye.

Professional response: Wut? https://equitystaged.wpengine.com/2019/08/06/equity-guru-podcast-eureka-93-erka-c-provides-answers-dissolved-partnership-151-share-rollback/

Unprofessional response: Eat a dick, bruh.

Truly depressing.