Over the last few years, we’ve shivved a lot of terrible companies trying to pull a fast one on investors and, almost always, when we do, we face a few weeks of abuse from that company’s faithful.

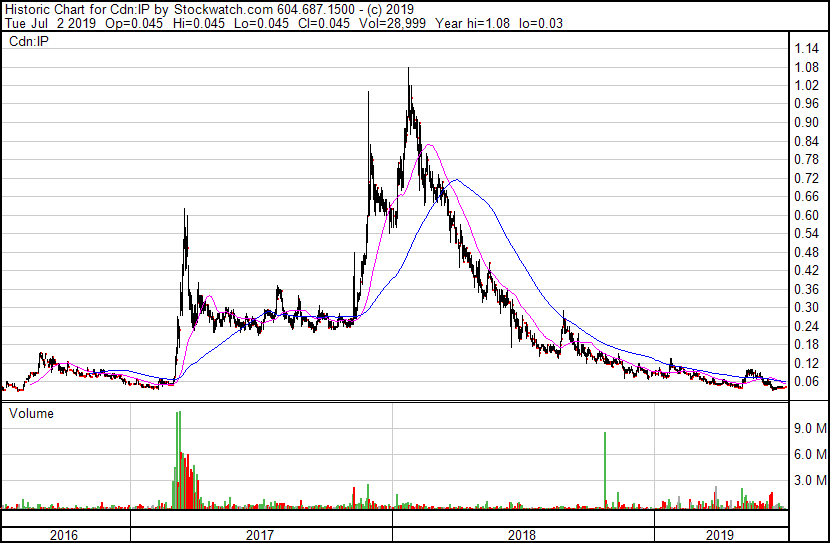

When we said Imagination Park (IP.C) was a bullshit fantasy playing on most people’s ignorance of the virtual reality scene, we heard no end of abuse in return, even as the execs of the company engaged in insider trading, announced deals that were never completed, and watched sadly as their boasts were cut down with the rusty broadsword of reality.

Ultimately, the share price called the winner of that fight. IP stock drifted ever lower and bagholders cut their losses while we wiped figurative blood from our knuckles.

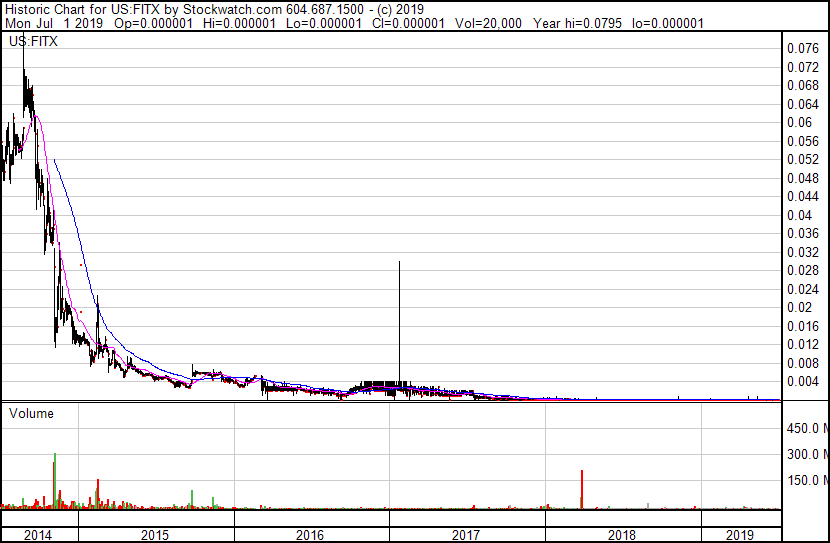

This also happened with CEN Biotech (FITX.OTC) back in the day, when they said they were going to be the biggest LP in the cannabis world, while the CEO was making up fake employees, signing his name on documents eight different ways, selling stock every morning while telling investors to buy more, and being told by the town they were supposed to be building in, ‘y’all can’t build here.’ Once again, the stock price called the winner, and it was us.

Namaste, same.

Wayland, same.

MedMen, same.

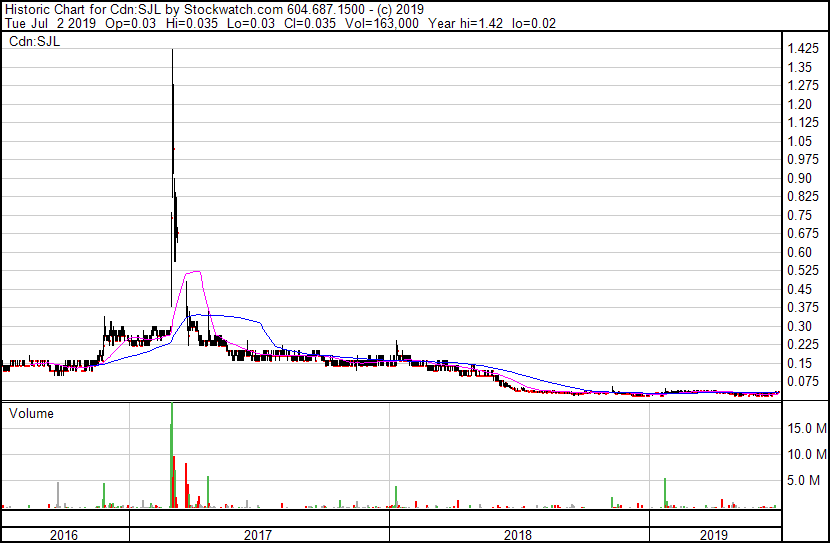

But one of the most beautiful carcasses we ever laid out was Saint Jean Carbon (SJL.V), which is somehow still lying twitching in the ditch we left it in two years back, face down in swamp muck, like Conky from the Trailer Park Boys, but still, miraculously, possessing something akin to a pulse.

Mr. Paul Ogilvie reports

SAINT JEAN CARBON ANNOUNCES FIVE SPIN OFF COMPANIES

Only five? Why not eighteen?

Over the next 12 to 18 months, Saint Jean Carbon Inc. will spin off five of the company’s internal technology projects to new companies that are fully independent of Saint Jean. Every shareholder will receive a one-for-one share in each of the new companies by way of dividend from the new companies. Each transaction will be subject to regulatory approval.

This strategy has been evolving within the company now for three years. The demand on the human resources is being pushed to a point where it makes sense to build a team for each company. Each team will consist of experts in their field that can provide the necessary guidance and growth plans.

It’s a spin-fest!

So what is it you guys are giving away, SJL?

1. High-speed graphene production and product development, specifically for polymers and epoxies that can be used in a multitude of industries worldwide. The opportunity here is for the new company to focus on the significant demands from the graphene markets and be a part of all the new technologies that are expected to roll out over the coming years.

ERMAGHERD, IT’S GRAPHENE! The wonder metal that nobody currently produces in any meaningful way! And Saint Jean is going to be part of all of it!

2. Cathode chemistry production for lithium-ion batteries, specifically for the high-end North American battery manufacturers of specialty batteries for a number of growing industries. The opportunity here is for the new company to not only provide today’s demands, but work on the forefront of all the new cathode chemistries being developed for the electrical vehicle industry.

Yes! Saint Jean’s side hustle will ‘provide today’s cathode demands’, because clearly nobody else in the world is already producing cathodes that are in every lithium ion battery currently sold. BIG OPPORTUNITY!

3. Salt water battery production. The plan to match energy density one to one with lithium-ion batteries is becoming closer to reality. The new company will work to finish developing batteries for stationary applications and mobile applications secondarily. The opportunity here is for the new company to solve the big environmental issue with lithium batteries by creating more economical and very environmentally friendly energy storage.

Of course! Solve the big environmental issues with lithium batteries WHILE supplying all the cathodes AND working alchemy with graphene. Such world leading! So science! Much dominant!

But there’s more!

4. Glucose monitoring with the use of graphene. The company will take the six-year-long project, finish the clinical trials and bring the product to market. The further opportunity is to allow the system to monitor all types of other applications, concrete stress and steel structure stress, to name a few. The opportunity here is for the new company to be able to apply the technology application to almost any product/material that needs to be monitored at the atomic level, basically recognizing structural disaster before it happens.

Because why stop at the impossible when you can do the impossible over and over again, in every industry, with every application? Also, unicorns!

5. Energy creation through the use of carbon graphene nanodots. The research and lab work over the last three years shows promise to greatly improve the photovoltaic value of solar energy throughput. Energy storage is important and creating clean green energy is even more important. The opportunity here is for the new company to be a part of the global goal to reduce carbon emissions by developing superefficient solar energy capture.

Of course. You’re already creating the global industry for graphene, building a new kind of rechargeable battery, dominating the existing market for cathodes for batteries, solving diabetes with wondermetals, now it’d be no big deal to solve solar while you’re at it.

6. Create a new kind of wind energy turbine that can be placed along the front of a car so, as it drives, it creates electricity that can later be added to the grid by simply plugging in your vehicle. This technology is unique to Saint Jean Carbon and was formulated with experiments performed by the CEO’s grandpa on his ’64 Oldsmobile, which was powered by Saint Jean’s proprietary potato clock technology.

Okay, that last one was a fake, but it had you going for a while there.

Clearly what we’re meant to take home with all of this is, Saint Jean Carbon has a rotating cast of uber-scientists in their corporate garage, performing the chemical wizardry of modern times, pumping out game changing technology at every turn, all of which will make shareholders wealthy beyond their wildest dreams.

Obvs.

Here’s the thing: Saint Jean Carbon has pulled this stunt before.

Let’s hit the time machine.

Saint Jean Carbon (SJL.V) soars over 400% on supposed Panasonic deal, but we call bullshit

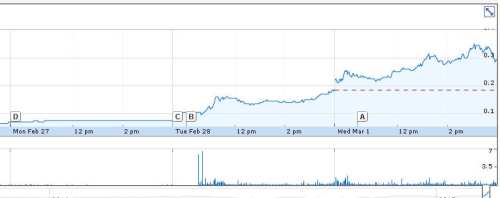

Booming Saint Jean Carbon (SJL.V), a self-described carbon science company with resource properties, has released news announcing the company had received its first order from Panasonic to supply graphite anode material to their manufacturing facility.

The company which had rode a steady $0.06 until the news broke, climbed overnight to $0.34 per share – a 466% jump.

That’s a big ass jump. But will it sustain?

We say no. Because maaaaybe the news is bullshit.

Company CEO, Paul Ogilvie, commented, “After more than two years of working on material specifications, sampling and re working, we could not be more pleased than to finally ship finished material to our customer. The order is part of an off-take agreement to supply multiple tonnes of anode material monthly for a number of years. We are hopeful that the electric car business continues to grow at this rate; as that will continue to push our demand and create more and more opportunities for us. We consider today as our greatest accomplishment; to be recognized and awarded with an order to supply one of the world’s best technology companies, is a tremendous accomplishment for the team.”

Sounds great, but try as we might, none of us in the Equity.Guru offices could find details of the deal. No totals of what had been sent, if it had been paid for, or what the actual timetable of the off-take agreement was, or even an approximate total of what the deal itself might bring.

Usually, when a deal like this is struck, the big player prevents the little guy from using their name, specifically to avoid situations where someone ‘passes off’ on the bigger player to do something like, oh, I don’t know, jack their share price?

True believers jumped all over us for daring to publish this the day after Saint Jean announced their ‘deal’. But the company didn’t object to it at all. There were no threats to sue, no strenuous denials, no accusations of us being part of a short attack… just silence.

It was almost like, maybe, we’d nailed it?

The next day, we found some interesting things in SJL filings.

When we looked back at documents SJL has put out [previously], we found a November news release from 2016, deceptively titled, “Saint Jean Carbon building a recycled high performance lithium-ion battery” (they’re not), that said the company would literally be supplying graphite for the anodes of two car batteries Panasonic is developing.

Not two models of battery, but two actual batteries, one with recycled car battery material and one without, so their ‘large partner’ can see if the recycled battery [Panasonic] are developing performs okay.

In short, SJL appears to be shipping a box of graphite. Not a container, not a crate. Make sure to sign the UPS slip, kids.

In addition, as SJL doesn’t currently produce graphite, it appears they’ll likely source their materials from a third party.

A day later, knockout punch.

Saint Jean Carbon (SJL.V) CEO Paul Ogilvie saw his stock halted Thursday by the Venture Exchange, as he was forced to clarify an earlier news release that appeared to suggest an ‘off-take’ deal to supply graphite to Panasonic had been signed.

- Busted.

The Company has received a purchase order from Panasonic Corporation to supply graphite anode material to their manufacturing facility. While the size and value of the order is nominal, both on its own and in comparison to the anticipated monthly orders under the provisions of the proposed formal off-take agreement, the order is significant as it marks the first order for material that has been re-engineered by the Company.

- You catch that? Though the order is insignificant, it’s significant.

Although the off-take agreement has not been signed at this time, the supply of the re-engineered material pursuant to the order is based upon the procedures and timelines contained in the proposed off-take agreement.

- Translated: Yes, we know we told you ‘The order is part of an off-take agreement to supply multiple tonnes of anode material monthly for a number of years‘, but actually there’s no agreement yet because for an agreement to have occurred, BOTH SIDES WOULD HAVE TO SIGN IT.

The first order is anticipated to be delivered within 90 days from February 24th the date of the purchase order.

Translated: Yeah, we know we said earlier ‘we could not be more pleased than to finally ship finished material to our customer‘, but we were talking in a future sense, not an actual ‘product has been shipped to the customer’ sense.

The raw material is being re-engineered by the Company prior to its delivery; however, the supply is being out sourced as the Company’s properties are not currently in production.

- Yep, they’re not even using their own graphite, just like we alleged. It’s like they went to Bob’s Discount Graphite Yard in Etobicoke and filled the trunk, then put out a news release claiming they were SUPPLYING FUCKING PANASONIC.

We added a little extra at the end of this one that pontificated about the possibility insiders may have traded away stock while the pump was on.

Turns out:

UPDATE: Congrats to company insider Dick van Wyck, who dumped 900,000 shares at $0.21 and $0.22, the day SJL quadrupled.

It got worse a few weeks later:

At the time of the March 3 Press Release, the Company was proceeding on the basis that Panasonic and Saint Jean were working together to finalize the proposed offtake agreement. The Company was informed by regulatory authorities on March 8, 2017 that Panasonic had advised them that it was considering cancelling the Order and that Panasonic did not intend to enter into the Company’s proposed offtake agreement.

Oof.

On or about March 13, 2017, Panasonic advised the Company that it will not sign the Company’s proposed form of offtake agreement. When Panasonic reconfirmed its Order by email dated March 15, 2017, it also confirmed that in case of mass purchase of Anode Material from Saint Jean, Panasonic will do so under its own form of standard purchasing agreement. Even though Panasonic is proceeding with the [5kg] Order, there can be no assurance that Panasonic will proceed with a large purchase of Anode Material from the Company, nor that Panasonic will enter into any other type of commercial agreement or arrangement with Saint Jean.

CASE FUCKING CLOSED.

Except, not…

On March 6, 2017, Staff of the ASC received a copy of a document entitled “purchase order” issued by Panasonic Procurement Asia Pacific, Singapore (PPAP), to the Company, dated February 24, 2017 (the Purchase Order). 4 #5339843 v2

The Purchase Order:

(a) Claimed a value of $6.64 for a 5 kg quantity sample;

(b) Was for one specification, “Grade A Flakes”; and

(c) Was declared as having no commercial value

$6.64! That was the deal they did, for $6.64 of someone else’s graphite. I sure hope they covered the $8 of postage!

AND:

Following the Press Release (Feb 28), but before the Press Release (Mar 3), a number of suspicious trades occurred by “reporting insiders” and/or persons in a special relationship with “reporting insiders”, as that term is defined at section 1.1 of NI 55-104.

Leona M Callihoo-Pearson (Callihoo-Pearson), is the spouse of Director, Pearson. [..] On March 1, 2017, Callihoo-Pearson sold on the public market 150,000 common shares for $0.275, for total gross sale proceeds of $41,250 CDN.

Jo Ann Madill (J Madill) resides at the same address as Director, Madill. [..] On March 2, 2017, J Madill sold on the public market 200,000 common shares for $0.30, for total gross sale proceeds of $60,000 CDN.

Dick van Wyck (van Wyck) is a self-reported insider of the Company vis-à-vis serving as a senior officer. [..] On March 1, 2017, van Wyck sold on the public market 600,000 common shares for $0.22, and 300,000 common shares for $0.21, for total gross sale proceeds of $195,000 CDN.

SJL plodded on, pumping out more news releases about amazing clocks they were making that would stay charged for 25 minutes.

Much technology!

Okay, so enough with the dark past of SJL. Let’s step back into the time machine and travel back to… THE FUTURE!

So Saint Jean Carbon, having put a few years between it and its insider trading history, it’s fraudulent claims history, and it’s stock manipulation history, now feels ready to march forward into the wild blue yonder as not one globally dominant technologically devastating genius company, but FIVE.

How’s that going to look for the main company when it spins out everything it has?

Well, currently the stock sits at… [stifles giggle]… $0.035 per share.

So, let me get this straight… currently, the company is worth $0.035 per share WITH ALL THE TECHNOLOGY AND ALCHEMY IN ONE PLACE. What happens when it spins everything out? SJL drops to $0.01 and spins out five companies at $0.005 each?

No, wait, you’re right… doing this math based on share price is silly because, maybe they have billions of shares out and a big market cap and they could just do a rollback and, nope, the market cap of the entire company is $2.2 million.

WHAT AN OPPORTUNITY!

All they have to do is find graphene, produce graphene, then build an entire graphene industry, while supplying the world’s lithium ion cathode market, building brand new solar battery technology, developing the salt water battery industry and supplanting lithium ion as a technology, and curing diabetes with graphene.

And when they do, maybe the stock will double to a $5 million company!

How could you not believe? To infinity and beyond!!

They’ll obviously need to raise some money to do this. Show me what you’e got, Ogilvie.

SAINT JEAN CARBON ANNOUNCES $400,000 PRIVATE PLACEMENT

Saint Jean Carbon Inc. intends to complete a non-brokered private placement financing of up to 11,428,571 units at a price of 3.5 cents per unit for gross proceeds of up to $400,000. Each unit will consist of one common share in the capital of the company and one common share purchase warrant. Each warrant will entitle the holder to acquire one additional common share in the capital of the company at an exercise price of five cents per warrant share for a period of 36 months from the date of issuance.

The company intends to use the proceeds of the offering to preserve the company’s existing operations and for general corporate and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative purposes. The company intends to close the offering as soon as practicable.

Christ. A raise below the usual limit of 5c per share, with the intention of keeping the lights on. Let’s see how that worked out for them..

One month later:

With reference to the previous press release dated March 19, 2019, Saint Jean Carbon Inc. has placed an aggregate of 4,277,500 units at a price of 3.5 cents per common unit for gross proceeds of $149,712.50

It took them a month to raise less than half of the tiny amount they actually wanted.

But hey, that second tranche may have been a beauty. Let’s get back in the time machine and go two months forward to see what treasure they eventually hauled in!

SAINT JEAN CARBON CLOSES BOOKS ON PRIVATE PLACEMENT

Saint Jean Carbon Inc. has closed its books with respect to the private placement announced on March 19, 2019.

The company raised a total of $159,687.50 by issuance of 4,562,500 units at a price of 3.5 cents per common unit.

Oh my god.. This is an absolute clusterfrance. Over four months, this mob, which is supposedly going to finance and spin out five companies, couldn’t raise the equivalent market value of a Halifax bachelor apartment.

And, of course, most of what they did raise is going to paying people they owe.

Outstanding payables $67,178.16 Outstanding payables of related parties for mgmt fees $15,138.40 Outstanding payables of related parties f/non-mgmt fees $2,835.00

CREATING BLINDINGLY AMAZING WORLD BEATING GRAPHENE TECH ISN’T CHEAP, YOU GOD FORSAKEN CYNICS.

If you’re buying into Saint Jean Carbon now, or at any time in the future, or the past, or some sideways dimension, just have a short think about what brought you to this time in your life.

It’s going to be okay. Together, we’ll get through this.

— Chris Parry

FULL DISCLOSURE: Once, about a decade ago, I did ether. It felt kind of like reading Saint Jean Carbon news releases.