On July 31, E3 Metals (ETMC.V) announced that it has completed the design and assembly of a lab scale ion exchange flow system for lithium extraction.

Lithium is a key battery ingredient. Thanks to electric vehicles (EVs) and all things mobile, lithium demand is expected to double in the next 7 years.

One of the challenges of writing about resource extraction companies is that–for those of us without PhDs in geology–the stories tend to blend together.

“I walked around the conference floor of this year’s mining show annoyed that I was seeing nothing I haven’t seen before–indeed, nothing I wasn’t seeing at the next booth. And the next booth. And so on,” observed Chris Parry at a recent mining show.

“I saw young investors show up, clearly looking to learn about the mining business, and quickly leave as they were faced with shiny bald heads talking to shiny bald heads about inside baseball stuff, with no attention given to education or differentiation.”

E3 Metals does not have a differentiation problem. If it was playing golf, it might swing a club made of palladium. If it was traversing a lake, it might use a nuclear-powered hovercraft. If it was flirting, it might try this technique:

“E3 Metals is sitting on top of one of the largest lithium resources on the planet, some 6.7 million tonnes of lithium carbonate equivalent (LCE) at an average grade of 75 milligrams per litre,” wrote Equity Guru’s Greg Nolan on June 24, 2019.

The specific plan to extract that lithium is unique to E3 Metals. If the company succeeds, it will become legendary in tech circles, and early investors are likely to be richly rewarded. Although the company has been performing like a champ this year, it is still VERY early days (current market cap $13 million).

E3 Metals is figuring out how to recover lithium from oil and gas projects in Alberta. The beauty of this strategy is that the oil and gas companies have already done the drilling.

It’s like sweeping your driveway right after it’s been power-washed. The hard work has been done.

E3’s objective is to produce commercial-grade lithium from the Leduc reservoir formation. Alberta’s hydrocarbon reserves within the Devonian strata contain reservoirs ideal for lithium production, typically at depths of 1,500 to 3,500 metres.

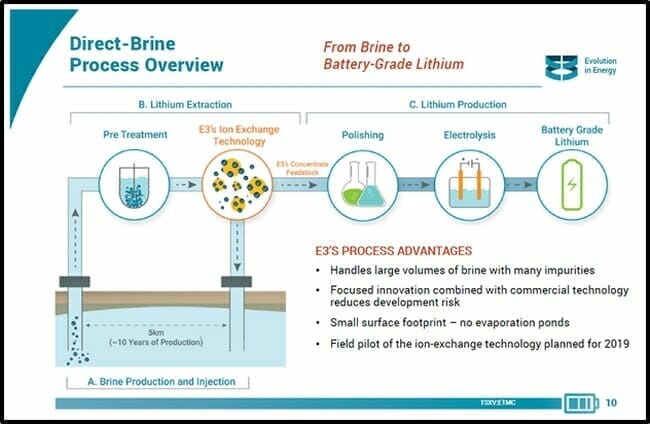

Getting the brine to the surface requires the same equipment, expertise and knowledge as the oil and gas industry. After that, it becomes a tech play.

The “lab scale ion exchange flow system” is next step towards building a bigger, more robust pilot project.

“Operation of the flow system will advance our proprietary Direct Lithium Extraction Ion Exchange Technology, under more commercially applicable continuous flow conditions,” stated E3 Metals in the July 31 release.

E3 Technology Review:

- Achieved lithium recoveries greater than 99%

- Recoveries averaging 90%

- Volume reductions up to 100 X

- Consistently removes 99% of critical metal impurities in batch sorbent tests

Continuous flow system testing will allow E3 to increase the speed and efficiency of extraction testing and analyze performance over multiple ion exchange cycles.

The system is designed to enhance process flow conditions to maximize recovery and stability. This will provide important insights to optimize the Ion Exchange Technology and support continued advancement in scaling towards a field pilot plant.

The extraction machine was built in collaboration with GreenCentre Canada and Kingston Process Metallurgy, with support from Alberta Innovates.

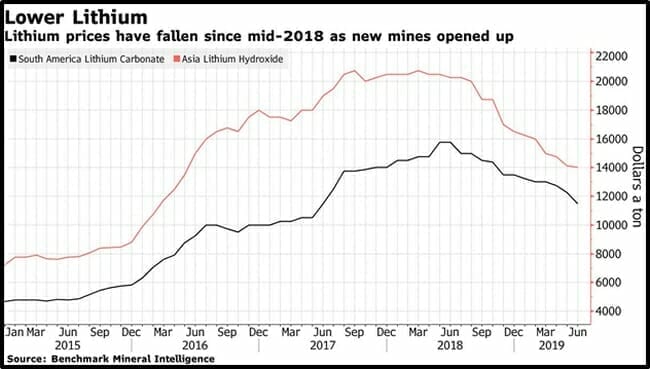

Between 2015 and 2018, prices for lithium spiked about 300% largely on the buzz around the rapid adoption of electric vehicles. Since then, six lithium mines have opened in Australia, while the price of lithium has dropped about 30%. Chile’s mining minister, Baldo Prokurica, recently announced that Chile is intending to double its production within four years.

It’s important to remember all lithium is not created equal. Lithium extractors produce lithium with diverse chemical properties, often meeting the needs of specific end users.

Last summer, Greg Nolan wrote: “ E3’s Leduc reservoir is too large to ignore.”

“I am very proud of our technical team at E3 Metals, GreenCentre and KPM for achieving this important milestone,” said E3’s President and CEO, Chris Doornbos. “This flow system will assist in improving technology performance and progress the Company in further refining our Ion Exchange process towards commercial viability.”

–Lukas Kane

Full Disclosure: E3 Metals is an Equity Guru marketing client.