The king is dead.

Long live the king.

On July 2, 2019 Canopy Growth (WEED.T) announced that its long-time co-CEO Bruce Linton will “step down” from all positions and responsibility at the company.

The strangely worded release advised shareholders that “Bruce Linton announced that Bruce will step down as co-CEO and Canopy Board member.”

Mark Zekulin has agreed to become the sole CEO as WEED tries to identify “a new leader to guide the company in its next phase of growth.”

The search will encompass both internal and external candidates.

“Creating Canopy Growth began with an abandoned chocolate factory and a vision,” stated Linton. “The Board decided today, and I agreed, my turn is over.”

The seeds of Linton’s demise were sowed last fall when Canopy accepted a $5.1 billion cash injection from Constellation (STZ.NYSE) the $38 billion beverage giant most famous for the watery (3.8% alcohol) Corona Extra, Corona Light, Corona Premier & Corona Familiar.

At the time, $5.1 billion gave the Mexican beer-maker a 37% stake in Canopy – along with WEED warrants that could result in Constellation becoming a majority owner.

Canopy now had the financial muscle to acquire smaller players.

But with great money, comes great oversight.

Canopy re-jigged its board of directors to include Constellation employees, like David Klein, Constellation’s CFO.

“We are also excited to embark upon our next phase of growth as global leader in the cannabis industry,” stated Canopy board member David Klein on the day that Linton was fired.

Did Klein lead the charge to fire Linton?

Only his hair dresser knows for sure.

But we’re going to hazard a wild guess.

Here’s the thing about CFOs.

There are always obsessed with numbers.

Asking a CFO not to think about numbers is like asking rapper Kanye West to stop saying crazy embarrassing shit.

It ain’t gunna happen.

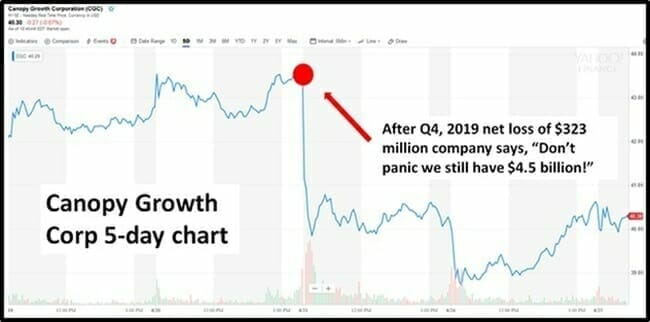

Canopy has a serious numbers problem.

Last week, Canopy’s Q4, 2019 results were released revealing a net loss of $323 million Canadian dollars. That’s $41 loss per second. $2,500 per minute. $150,000 per hour. $3.6 million dollars a day.

On the Q4, 2019 earnings call, Linton claimed that Canopy could have stayed a small profitable company, “But after the $4 billion injection from Constellation Brands, you need to use that capital to build scale, and we did.”

Shareholders were not consoled, and neither was Constellation’s CEO Bill Newlands who stated the next day that, “We were not pleased with Canopy’s recent reported year-end results.” Newlands also sits on the board at Canopy.

A couple of days later, Constellation posted net sales of US $2.1 billion for the three-month period ended May 31, 2019, reporting a loss for the quarter of US $245.4 million, after posting US $743.8 million profit a year prior.

Constellation said equity losses caused by its Canopy investment totaled US $106 million.

Last week we stated that “Canopy shareholders are lucky to have a CEO who comes across as an adult. That may seem like damning with faint praise – but it’s not a given. He also comes across as a decent human being. Again, not a given.”

If you sling French Fries, bang nails, serve food or type for a living, you probably won’t shed tears for the diligent, well-spoken Linton.

Yes, he did his job well.

But he was also in the right place at the right time.

“Linton has exercised the stock options he’s been sitting on for years, acquiring Canopy shares for as little as $2.95 per (it’s trading at $52.36 at the time of writing),” wrote Equity Guru’s Chris Parry, “amassing $17,965,750 in stock that cost him just $2,199,861.”

“That’s fair – the man has been integral in driving the share price of WEED.T upward, and options are granted in thanks for exactly such eventualities.” continued Parry.

“BUT…it’s worth noting those options were valid until 2022 and 2024. Why take them down now, if you think the share price is going to drive upward further still from where it is?

Maybe Linton is buying a waterfront mansion and a small harem of busty pool cleaners – we don’t know. It’s his right to cash in his chips whenever he feels the need, and certainly he’s still got more in hand – 64% of his previously available total, in fact, is still reportedly sitting in wait.”

“I think ‘stepping down’ might not be the right phrase,” Linton told CNBC about the Canopy divorce. “I was terminated.”

“When you bring in a big check and you change the board, there’s always some perceived risk,” added Linton, “But it would have been worse for the company if we didn’t do that.”

It must be galling to be shoved aside by the management of a company that makes such weak beer.

The king is dead.

Long live the king.

Full Disclosure: Equity Guru has no financial relationship with Canopy.