When performing due diligence on an investment prospect in the junior exploration arena, the one detail that requires your undivided attention – the one factor that can trump all other considerations combined – is the address.

“Is this mineral deposit located in a mining friendly jurisdiction?”

It’s difficult to overstate how important the answer is to that question. A twitchy government, one without a clear and fair set of values where foreign interests are concerned, can wreak all kinds of havoc on your investment.

And man oh man oh man, do I have stories – tales of the ‘once burned twice shy’ variety.

A few examples of what I’m getting at:

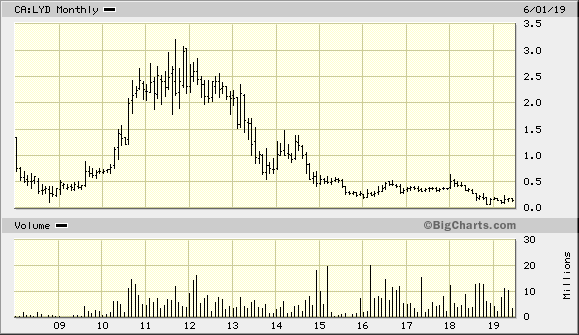

Nine years ago I began accumulating a position in Lydian International (LYD.V). The company’s Amulsar gold project in Armenia was a large oxidized, near surface, high-sulphidation gold deposit (a great body of ore, in other words).

Early exploration on the property was met with a succession of stellar drilling results. Every round of stepout assays seemed to surpass the last. The mineralization was so pervasive, gold was discovered in the subsurface layers of areas originally slated for mine infrastructure. Within a short time, Amulsar’s resource grew to greater than four million ounces in all categories.

Amulsar’s economics were robust, showing a pre-tax NPV (5% discount rate) in excess of $1.0 billion and an IRR of 38.1%. Capex was a very modest $269.6 million. This was going to be a cheap mine to build and operate.

The Armenian government appeared to be onside – permitting moved along at a comfortable pace.

All of the key people I followed in the sector – geologists, newsletter writers, analysts – appreared to appreciate Lydian’s prospects going forward.

One highly respected geologist I followed closely stated that out of the hundred gold deposits he considered, Amulsar was one of the few that were good enough to be shortlisted in his newsletter.

There was talk of an imminent takeover by any number of resource hungry producers after the company cleared the final permitting hurdles, which appeared to be only a matter of time.

Lydian had it all, or so it seemed.

Then in the summer of 2013, Murphy, of Murphy’s Law fame, paid Lydian and its loyal shareholders a little visit.

“… during a Government session on July 18, 2013, the Armenian Government passed a resolution (the “Resolution”) that modifies the area defined as the “catchment basin” to Lake Sevan, Armenia’s largest freshwater resource. The Resolution is yet to be promulgated and is then scheduled to come into force 10 days after its promulgation. According to the text of the Resolution, the borders of the catchment basin have been expanded to include the horizontal zone 3000 meters on each side of the “axis” to the Vorotan-Sevan tunnel. Based on the Company’s understanding of the Resolution, if projected to surface, the modified catchment basin includes the Company’s currently proposed location for its heap leach processing facility. Furthermore, the Resolution states that this part of the “catchment basin” is to be classified as the “Immediate Impact Zone” to Lake Sevan. This impacts the Company’s current mine layout plans as mineral processing activities are not permitted in this “Immediate Impact Zone.”

The message from the Armenian government for shareholders on record as of July 24, 2013: “Welcome to shitsville”.

In the end, Lydian was forced to relocate its heap leach processing facility and re-work its mine plan. Amulsar’s feasibilty study, which was 95% complete at the time of this crap news, was put on hold. EVERYTHING was put on hold. Amulsar’s economics, which showed all indications of exceeding the standard of the day, were negatively impacted by the new rule. Many early shareholders, those who were loyal to the company from the get, bailed. Key management stepped down.

The company picked up the pieces and is still a going concern, but it would never restore its former glory, not in the eyes of early shareholders anyway.

You might be thinking, “heap leaching requires cyanide – the good people of Armenia have a right to be protected from any such threat to their groundwater, no matter how rich the project,” and you’d be absolutely right.

But it immediately became evident that the only threat posed by Lydian’s planned heap leach processing facility to the region’s groundwater was if the laws of gravity were suddenly reversed causing water to flow uphill.

The market held out hope that the Armenian government would spot the errors in its logic, but in the end, the stock itself was given a (real) lesson in gravity.

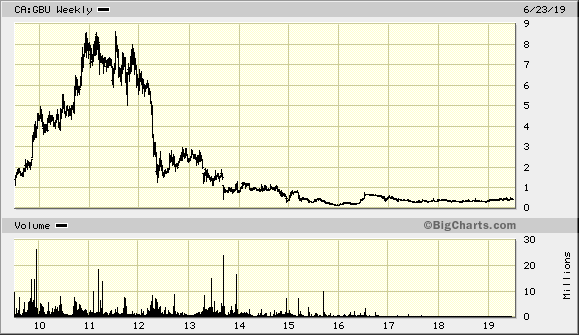

There are countless other examples I can site where jurisdictional risk killed fantastic, geologically abundant projects. Venezula is another heartbreaker.

Back in the mid-1990s, an area called Kilometer 88 in eastern part of the country was besieged by mining companies both big and small. It was a staking rush that rivalled some of the best in recent history. I chased over a half dozen Kilo-88 ExplorerCos shortly after the area made headlines. It was a traders dream – fast, furious and lucrative.

But in the end, after political idealists entered the fray, their sights set on Kilo 88’s subsurface riches, they kicked out the foreign companies, expropriated their projects and put the kibosh on what should have been a glorious, country-wide economic flourish.

Venezuela to Nationalize Country’s Largest Gold Mine Las Cristinas

What these mouth breathers failed to consider was that discovering a mine and operating a mine are two completely different things, requiring two completely different skillsets. Giving these cutting edge ExplorerCos the boot resulted in precious little gold production. It was a classic bullshit move by a corrupt government – a real lose-lose maneuver.

Romania is another recent example. The fate of Europe’s largest gold deposit has been in limbo for years after tens of thousands of people took to the street, protesting the develoment of ‘Rosia Montana’, prompting the Romanian government to dial back the permitting process.

This one is NOT an example of a twitchy government opportunistically looking to thieve a project held by a foreign entity.

Rosia Montana: Seeds of utopia in town almost lost to gold mining

This one is, however, a great example of why it’s important to examine every corner of the jurisdiction your company is operating in, before you lay your hard earned money down.

By the way, it’s not over for this company as arbitration talks could eventually lead to a nice settlement, but shareholders sure had their heads handed to them on this one.

An all too eager author asks ‘Do we have time for one more story, this time about a high-grade gold mine in the Asturias region of Spain?’

‘NO, get on with it man! snaps his editor.

A’ight…

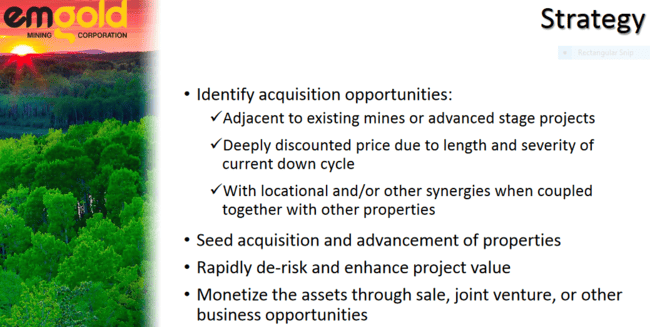

A Quebec and Nevada based ExplorerCo with a broad range of assets

EmGold Mining (EMR.V) has a portfolio of assets in two of the safest and most geologically prospective mining jurisdictions on the planet – Nevada and Quebec.

According to the Fraser Institute’s Annual Survey of Mining Companies, an investment attractiveness index that takes both mineral and policy perception into consideration, Nevada and Quebec are ranked numer one and number four respectively (Venezuela ranks dead last, the least attractive jurisdiction in the world for investment, just in case you’re wondering).

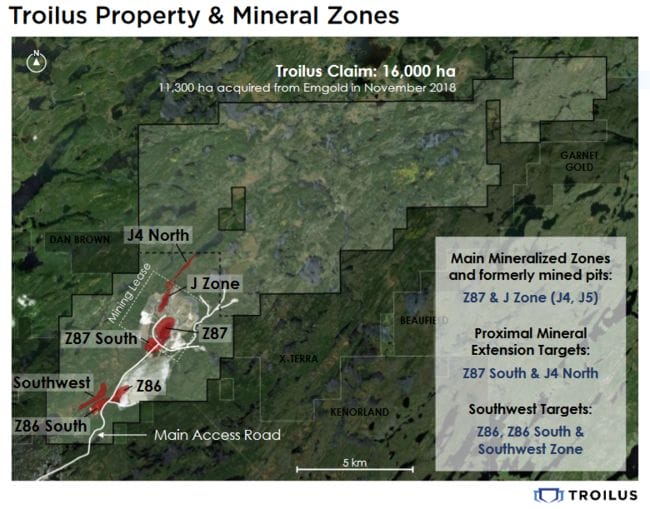

The very first thing that caught my eye when I was examining EmGold’s portfolio was its 3.75 million share position in Troilus Gold (TLG.V), an emerging gold producer in Quebec.

Through a series of rapid-fire transactions, EmGold acquired the Trolious North property from Chimata Gold (CAT.CN) and immediately turned around and sold it to TLG for $250K and the stack of common shares noted above.

This TLG stock position puts EmGold in an enviable position as the shares are currently worth, based on its recent trading range, roughly $3.2M. A junior ExplorerCo can buy a lot of exploration for that kind of money. An enviable position indeed.

Or, EmGold might view its position in TLG as a long-term strategic investment, one that stands to benefit from a market ‘re-rating’, as the company pushes towards production.

TLG is also aggressively growing its already sizeable resource base (5.09 million gold equivalent ounces in all categories), having launched a 40K meter drilling campaign earlier this year.

Either way, this 3.75 million Troilus stock position affords EmGold a lot of flexibility going forward.

Casa South Property, Quebec

The company’s business plan is nicely laid out in the following slide:

Casa South fits neatly into this strategy.

Casa South captures 10,061 hectares (100 square kilometers) of geologically prospective terra firma immediately south of Hecla Mining’s (HL.NYSE) Casa Berardi operation, a mine which produced over 2.0 million ounces of gold since commencing production in 1988 (the mine produced 162,744 ounces in 2018 – the current resource stands at 1.91 million ounces).

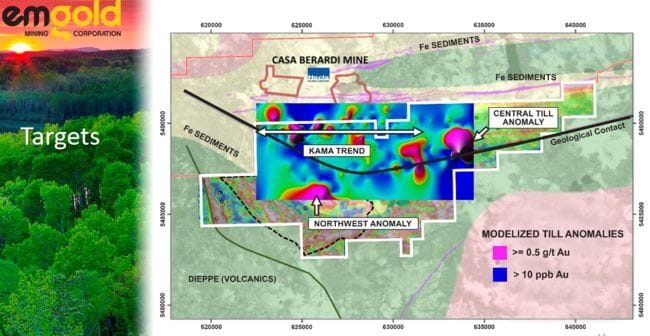

EmGold drilled 3,000 meters earlier this year to test the Kama Trend structure located just to the south of the property boundary with Hecla (above map).

The Kama Trend structure is a 7 km long by 2 km wide east-west gold bearing structure discovered in the 1980’s. It hosts numerous anomalous gold zones with historic assays above 300 ppb gold. The Kama Trend is a carbonatized andesite containing up to 7% arsenopyrite with variable amounts of pyrite.

Assays from this 3K meter drilling campaign are pending.

Casa Berardi represents a significant percentage of Hecla’s annual gold production. If EmGold is successful in delineating a meaningful resource at Casa South, Hecla could come-a-courting with a fat takeover offer.

Golden Arrow, Nevada

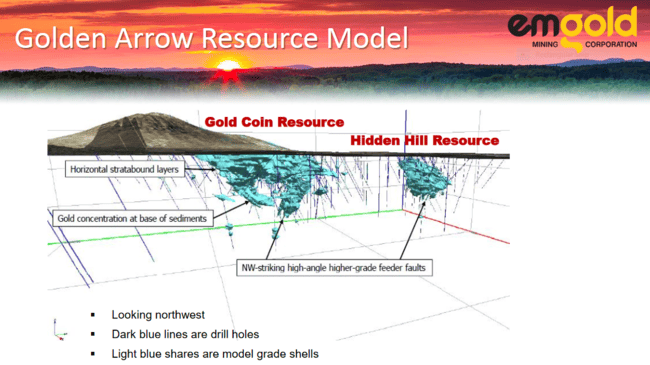

Golden Arrow is an advanced stage project consisting of some 7,050 acres in a region steeped in mining history.

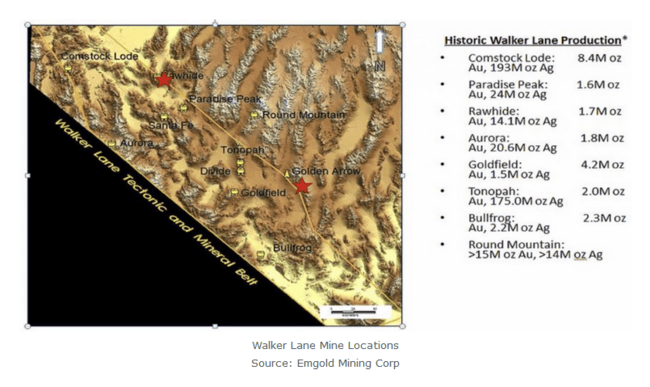

Located on the northeastern margin of the Walker Lane structural zone and the western margin of the Kawich volcanic caldera, Golden Arrow is embedded in a plethora geological formations (complex faulting, igneous intrusions, volcanism, hydrothermal mineralization, etc), all the result of the North American continent colliding with the Pacific tectonic plate.

Heat, pressure and time resulted in the formation of numerous mineral deposits in the region. The Walker Lane boasts past production and defined resources of some 30 million ounces of gold and 400 million ounces of silver.

Notable districts along the Walk(er) include the Comstock Lode, the historic Tonopah and Goldfield districts, and Round Mountain, one of the most prolific gold mines in the state.

Significantly, Golden Arrow has a measured and indicated resource of 296,500 ounces of gold and 4.0 million ounces of silver (plus a further 50,400 ounces of gold and 1.2M ounces of silver in the inferred category).

The company sees the potential for a modest, low cost open pit mining scenario at Golden Arrow. The project should see a drilling campaign later this year.

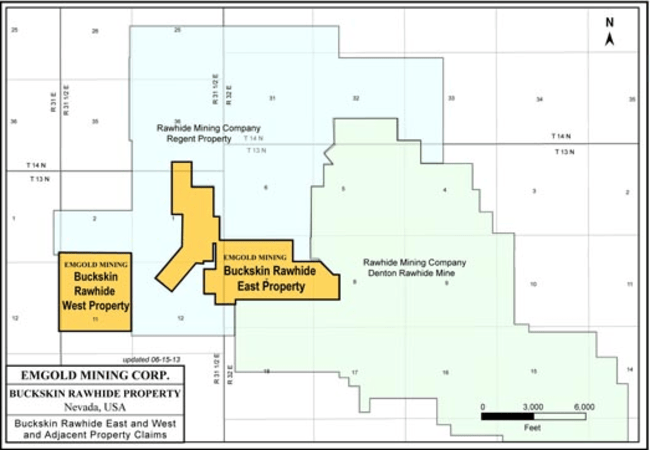

Buckskin Rawhide East, Nevada

The 835 acre Buckskin Rawhide East (BRE) project is located in the Rawhide Mining District along the northeastern portion of the Walker Lane structural zone.

The project is surrounded by Rawhide Mining’s (RMC) operating Denton-Rawhide mine and their adjacent Regent Property.

The BRE property shares similar geology to the Denton-Rawhide mine, which produced 1.7 million ounces of gold and 14.1 million ounces of silver in its day (from 1990 through 2014).

Here, EmGold inked a royalty type agreement with RMC. The terms are as follows (effective date June 1, 2013):

- A Lease Term of 20 years.

- Advance royalty payments of $10,000 per year, paid by RMC to Emgold, with the first payment due at signing and subsequent payments due on the anniversary of the Lease Agreement.

- During the Lease Term, RMC will make all underlying claim fees to keep the claims in good standing.

- RMC will conduct a minimum of US$250,000 in exploration activities by the end of Year 1.

- RMC will conduct an additional minimum of US$250,000 in exploration activities by the end of Year 3, for a total of US$500,000 in exploration activities by the end of Year 3.

- RMC will have the option of earning a 100% interest in the Property by bringing it into commercial production.

- Upon bringing the property into commercial production, RMC will make “Bonus Payments” to Emgold.

- Bonus Payments will be US$15 per ounce of gold mined from the Buckskin Rawhide East Property when the price of gold ranges between US$1,200 per ounce and US$1,799 per ounce. If the price of gold exceeds US$1,800 per ounce, the Bonus Payment will increase to US$20 per ounce.

I like this deal. Emgold is essentially carried to production with a nice royalty attached to every ounce produced.

RMC completed a Environmental Assessment and Plan of Operations to expand their operations in 2018 which includes drilling on the Buckskin Rawhide East Property and potentially to develop satellite pits. Plans are to start a major drilling program in 2020. At a production rate of 40,000-50,000 oz. of Au per year at Rawhide Mine, if RMC is successful in developing satellite pits, the royalty could produce a pre-tax cash flow of US$600,000 to US$750,000 for Emgold at some point in the future, subject to exploration success and other factors.

New acquisitions along Walker Lane, Nevada

EmGold recently announced two acquisitions along the Walker Lane structural trend: Midora and New York Canyon. NY Canyon has a historic resource. Both projects are highly prospective for gold, silver and copper.

Mindora

Mindora is an epithermal, carbonate-hosted, structurally controlled deposit with a gold-silver zone overlying a porphyry system with molybdenum mineralization. The May 21 acquisition announcement states that there is also evidence of copper skarn and copper porphyry mineralization on the property.

The project is located 32 kilometers southeast of Hawthorne, Nevada.

Historical drilling on the property tagged 32 meters of 1.94 g/t gold and 121.78 g/t silver representing a 3.36 g/t gold-equivalent grade (true width of the intercept is unknown)

New York Canyon

This acquisition was announced only a few weeks back. NY Canyon is located in the Santa Fe Mining District, roughly 48 kilometers from Hawthorne, Nevada. This 607 hectare property is divided into two groups – the North and South Groups.

The North Group of claims are adjacent to the past producing Santa Fe Gold Mine operated by Victoria Gold (VIT.V).

Santa Fe Mine produced approximately 345,499 ounces of gold and 710,629 ounces of silver between 1989 and 1995.

The South Group of claims host the Longshot Ridge, Champion, and Copper Queen deposits. These exploration targets host copper skarn oxide, copper skarn sulfide, and copper sulfide porphyry mineralization.

Historic resources

Historic drilling on the Copper Queen prospect tagged a 311-meter interval of chalcopyrite and molybdenite mineralization grading 0.41% Cu, 0.012% Mo, 4.5 ppm Ag, and 0.1 ppm Au from 171 meters to 482 meters (true width unknown). That’s a FAT hit.

The Copper Queen deposit hosts a historic resource of 129 million tonnes grading 0.35% copper, 0.015% molybdenum, 0.1% Zn, and 0.1% Au (non 43-101 compliant).

The Longshot ridge deposit hosts a historic indicated and inferred resource of 14.8 million tonnes grading .43% copper and 2.6 million tonnes grading of 0.31% copper respectively (non 43-101 compliant).

The company inherited a massive drilling database for both projects (43,000 meters at NY Canyon and 13,000 meters at Mindora) along with geophysical info. The EmGold team is now busy scouring this treasure trove of data in order to delineate the region’s sweet spots. This will give them an edge as they prioritize exploration targets for upcoming field campaigns.

Mindora and NY Canyon are less than 20 kilometers apart. Important, cost-saving development synergies could emerge should sufficient economic mineralization be delineated at both projects.

Wrapping this one up

EmGold’s stock position in Troilus Gold is reason enough to give this one a close look.

The company’s broad range of assets located in mining friendly climes adds to the allure.

The company’s current market cap of roughly $6M, based on its 46.94 million shares outstanding and $0.13 trading range, is another plus. Keep in mind that their 3.75 million TLG shares alone are worth north of $3M.

Finally, the mining resumes of this crew stand out, clearly.

This one is worth a serious look.

– Greg Nolan

Full disclosure: EmGold is an Equity.Guru marketing client.