On June 20th, E3 Metals (ETMC.V) announced it had engaged Integrated Sustainability – a leader in water management science and engineering – to help advance the company’s massive Leduc Reservoir lithium resource further along the development curve.

For those new to E3 Metals

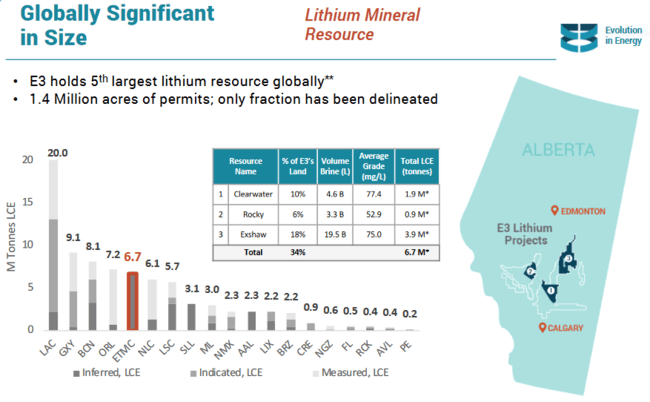

The company is sitting on top of one of the largest lithium resources on the planet, some 6.7 million tonnes of lithium carbonate equivalent (LCE) at an average grade of 75 milligrams per litre.

As per the map below, the Leduc Res is epic in (subsurface) scale.

Not your run-of-the-mill lithium resource

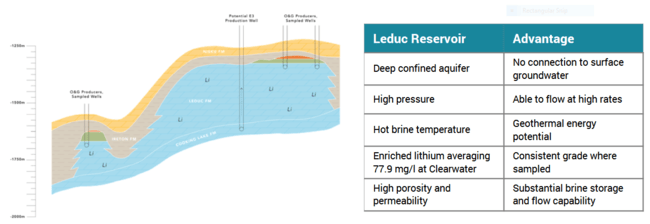

E3’s lithium resource occurs within the Leduc Reservoir’s subsurface petroleum brines, or petro-brines (dissolved lithium ions sloshing about in the formation H2O).

Occurring roughly 2,500 meters below the surface, the Leduc Formation is an extensively dolomitized ancient reef complex that spans hundreds of square kilometers in area and is over 200 metres thick.

The reservoir exhibits exceptional flow and production rates due to its favourable rock properties and pressure. These unique characteristics are well understood due to 70 years of historical oil and gas development in the area.

Of the billions of litres of fluid contained within the Leduc Formation, greater than 95% is lithium enriched brine. The remaining ~5% is hydrocarbons which have been mostly depleted.

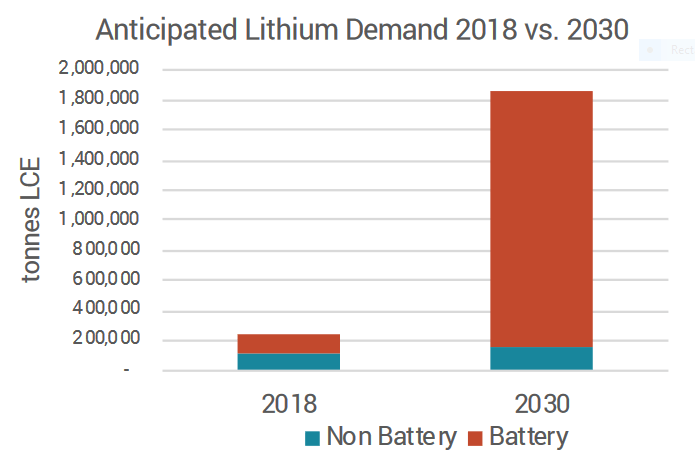

The potential to grow E3’s current 6.7 million tonne resource has to be considered excellent. And we are going to need all the lithium we can lay our hands on in the coming years.

Fueling this demand is the E-Mobility (Electro Mobility) breakout for all thing vehicular, with 76 lithium ion battery mega-factories currently in production, and another 45 in the works.

Back to the June 20 news

The company is developing this massive resource rapidly, without spending huge sums of cash, as would be expected. Government grants and a number of strategic partnerships have made this rapid cost-efficient growth possible.

These strategic partnerships include the University of Alberta, the National Resource Council of Canada, Alberta Innovates, and Green Centre Canada.

On this new strategic partner, the press release states:

Integrated Sustainability (IS) is a specialist water infrastructure delivery and operations company with extensive expertise in all aspects of mine and oilfield water management. They have accumulated a broad resume of knowledge through various water treatment, storage and disposal projects across multiple industries. IS has excellent working relationships with regulatory agencies throughout the Western provinces. These relationships help them to craft an effective approach to applications in order to minimize risk of re-work and ultimately expedite regulatory approval. IS specializes in the design, build, operation and transfer water infrastructure projects.

It’s this kind of relationship, the coming together of two entities with different but complimentary skillsets, that can really move the needle for a development company like E3.

The June 20 highlights:

- Brine production infrastructure study to be conducted on E3’s Clearwater Resource Area

- Analysis will include brine production and injection options in the permit area

This is another important step towards demonstrating the commercial viability of E3’s Production Flow Sheet.

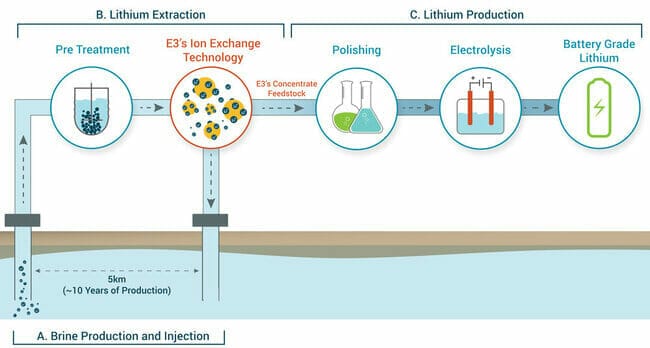

E3’s production flowsheet

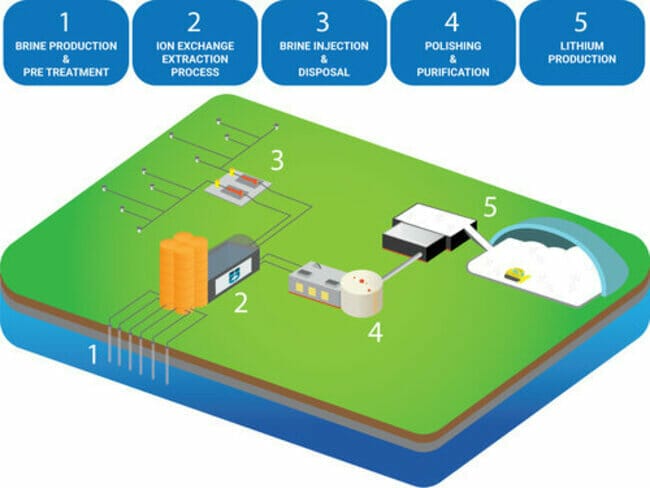

The first phase in the flow sheet involves the producion of subsurface brine, channeling it to the lithium processing facility and re-injecting the lithium-void brine back into the reservoir.

This production network will consist of a series of wells and pumps that take advantage of the significant production flow rates noted above.

This brine will then be transported, via underground pipelines, to the lithium production facility. It’s at this stage that E3 envisages deploying its proprietary ion-exchange lithium extraction technology to extract and concentrate the lithium.

E3 Metals’ own lithium extraction technology

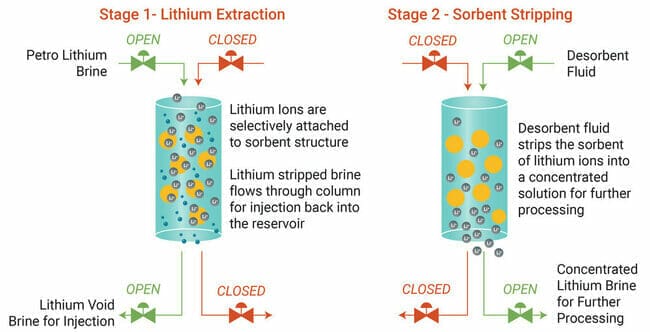

The ion-exchange process is one that is well-understood by the company and its strategic partners. It’s a water treatment process that uses a sorbent for the exchange of similarly charged ions within the petro-brines.

The sorbent developed by E3 Metals and the University of Alberta has been designed to be highly selective for lithium, as opposed to other undesirable dissolved ions such as Ca, Mg, and Na.

How it works

- Lithium enriched brine passes through the column

- The lithium, with few impurities, is attracted to the ion-exchange sorbent

- The sorbent becomes saturated with lithium

- The sorbent is then washed with desorbing fluid at a fraction of the production volume (up to 100x less) to liberate the lithium from the sorbent

- A concentrated lithium solution, with significantly fewer impurities, is the end result

The press release went on to say IS will work with Fluid Domains, E3’s resource specialist responsible for calculating the company’s Leduc Reservoir resource base.

IS and Fluid Domains will work together in determining the reservoir’s dynamics, the infrastructure required, and the ideal location for the brine production network.

Existing infrastructure – well sites, pipelines, processing facilities – are abundant throughout the region. This infrastructure will go a long way towards reducing costs and shrinking permitting timelines.

IS will report on a final configuration of E3’s proposed lithium brine production network. The report will include capital and operating costs to build and manage the planned facilities.

Once the brine is processed into a high purity concentrate, it could then be easily processed into battery-grade lithium hydroxide or lithium carbonate using existing conventional technologies.

Chris Doornbos, E3 Metals CEO:

“E3 Metals is very excited to be working with Integrated Sustainability and Fluid Domains on our Alberta Petro-Lithium Project. Both companies bring significant expertise from the oil and gas industry and are specialists in developing brine production networks in Alberta. E3 is very pleased to be advancing this work since it is a key component of the overall lithium production process.”

Bottom line

E3’s proprietary lithium extraction technology has already demonstrated it can produce a concentrate with a grade north of 5000 mg/L2.

With 99% of the impurities removed and recoveries averaging 90.3%, the process produces a concentrate feedstock that is likely to be processed directly by conventional lithium production technology to produce high purity lithium hydroxide (LiOH∙H2O).

The Company’s plans are to deliver a process facility of 10,000 tonnes lithium hydroxide by 2022 and continue expansion to an eventual 50,000 tonnes lithium hydroxide/year.

Greater insights into this rapidly developing lithium play can be accessed via following Equity.Guru offerings:

Lithium deals on the upswing – Cypress Development (CYP.V) and E3 Metals (ETMC.V)

E3 Metals (ETMC.V) takes a bow, successfully produces lithium hydroxide from Alberta brine

— Greg Nolan.

Full disclosure: E3 Metals is an Equity.Guru marketing client.