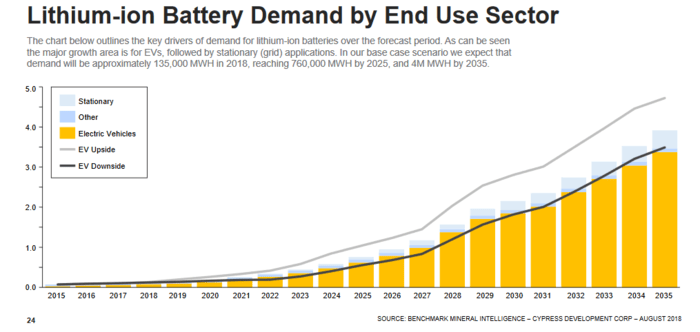

You might be wondering, “is the E-Mobility (Electro Mobility) supercycle for all things on wheels and water really on?”

The answer is a resounding yes, but there’s a catch. Chances are, matching lithium supply with demand is going to be a big problem as we enter the next decade.

When will the market clue in? I believe it’s beginning to now. The rate at which deals are closing is accelerating as the reality of a formidable supply crunch looms.

Just this month alone…

May 1st – Wesfarmers eyes lithium with A$776m cash bid for Kidman

May 15th – Galaxy Resource’s $22.5m buys bigger share of Alliance Mineral Assets Limited

And then today, as most Canadians ambled back to work after the long weekend, EV battery metals hoarder Ganfeng went long, again.

With its secured agreements to supply lithium to Volkswagen and Tesla, Ganfeng took aim at London listed Bacanora and its Mexican claystone deposit (more on this deposit type below).

May 20th – Ganfeng Lithium wants 30% of London-listed Bacanora

Sensing a theme here?

Do you own any lithium stocks, or are you currently on the sidelines wondering if the time is right?

U.S. lithium expert Joe Lowry expressed this concern to delegates at the Latin America Down Under mining conference in Perth recently:

“Overall, the industry faces a lack of financing and needs to inject more than US$12 billion within five years to have a chance of meeting demand. This requirement is exacerbated further by known and emerging failures in lithium start-ups which have demonstrated a lack of necessary skillsets – high profile failures that have discouraged sector investment.”

Interesting. Perhaps a better question might be: “Do you own any lithium stocks with projects sporting good economics, in mining friendly jurisdictions that are run by competent management teams?”

We have a couple of ideas, and no, it’s not just because we have a biz relationship with these two (I’d be all over them regardless)…

Cypress Development (CYP.V) boasts a world-class lithium-bearing claystone resource strategically located next to Albemarle’s Silver Peak mine, North America’s only lithium brine operation.

The Clayton Valley Lithium project resource:

- 3.835 million tonnes of LCE contained in 831 million tonnes of material at an average grade of 867 ppm lithium (Li) in the Indicated category

- 5.126 million tonnes of LCE contained in 1.12 billion tonnes at an average grade of 860 ppm Li in the Inferred category

Clayton Valley has its advantages over your typical Li salar production scenario. In a recent Guru offering, we stated:

“It’s important to note that unlike salt lake extraction (salars) lithium projects, where production levels are difficult to predict due to a host of variables (rain, snow, etc), Clayton Valley is a sedimentary hosted lithium deposit, which is easier to scale and production rates can be tabled with much greater predictability and confidence. This is a key differentiator.”

Located in the top mining destination on the planet, according to the Fraser Institute, Clayton Valley’s scoping study demonstrates compelling economics:

- A net present value of $1.45 billion at an 8% discount rate

- An after-tax IRR of 32.7%

- Average annual production of 24,042 tonnes of lithium carbonate over a 40-year mine life

- Capex of $482 million, pre-production, and an operating cost estimate averaging $3,983 per tonne of lithium carbonate

- An estimated 2.7 year payback period

One potential catalyst that could trigger a short term re-rating in the stock is a prefeasibility study (PFS) due out later this quarter.

Any number of scenarios could unfold here in the coming weeks/months as resource hungry predators look to secure supply in order to satiate the appetite of an e-mobility supercycle that continues to intensify.

Ganfeng taking down a 30% interest in Bacanora (May 20th news featured in the intro) should allay any doubts that these claystone Li deposits are the real deal.

Cypress has a $16.33M market cap based on its 74.25 million shares outstanding and recent $0.22 trading range.

E3 Metals (ETMC.V) is another Li developer looking at an alternate source of the battery metal.

The source: subsurface petroleum brines sloshing around in the prolific Leduc Reservoir of Central Alberta.

These lithium-rich brines come to the surface during oil and gas production. Treated as waste, they are reinjected back into the reservoir without hesitation.

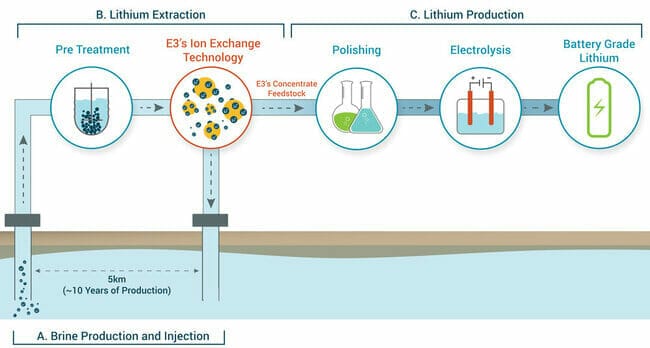

E3 management is thinking outside the box here (understatement). They’re working on a process – a proprietary ion exchange lithium extraction technology – to tap the potential of this massive Li resource.

How massive?

It’s one of the largest on Earth – some 6.7 million inferred tonnes of lithium carbonate equivalent (LCE) at an average grade of 75 milligrams per litre.

And this proprietary ion exchange lithium extraction process?

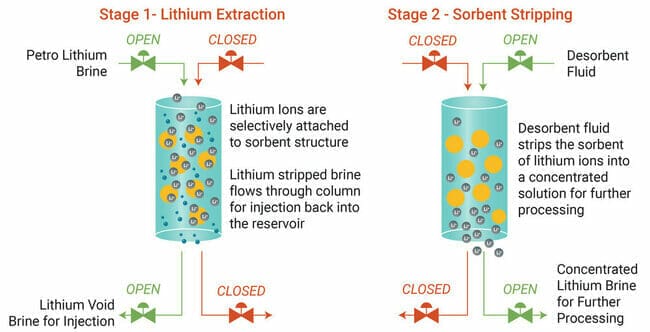

Step A involves the production of petro-lithium brine.

A network of wells would deliver the petro-brine to the surface for lithium extraction. The above image also depicts the re-injection of (lithium-void) brine back into the reservoir.

In this pre-treatment step, residual oil and H2S (hydrogen sulfide) are removed from the brine to improve the efficiency of the downstream extraction processes.

Step B depicts the ion-exchange extraction process which selectively extracts the lithium. This step will reduce the brine volume as well as concentrate the lithium.

Step C depicts the actual production of lithium (the polishing phase removes impurities and further reduces brine volume).

It might look and sound complex, but ion-exchange is a well-understood water treatment process, one that uses a sorbent for the exchange of similarly charged ions within the petro-brines.

The sorbent developed by E3 Metals and the University of Alberta has been designed to be highly selective for lithium, as opposed to other undesireable dissolved ions such as Ca, Mg, and Na.

The big question is: will it work on a commercial scale?

We don’t have that exact answer yet, but the company is making great strides – their proprietary concentration/extraction technology is evolving rapidly.

The short to medium term goal is to continue de-risking its proposed lithium production flowsheet and advance the project further along the development curve.

There is much to appreciate here:

Mar 4th Guru offering: e3 Metals (ETMC.V) registers significant breakthrough with its proprietary lithium extraction technology

If you like lithium, you’ll like E3. If you like new, innovative technologies, you’ll really like E3. Others sure as hell do…

Apr 4th news: E3 Metals Closes Oversubscribed Private Placement

E3 Metals has a $10.74M market cap based on its 24.97 million shares outstanding and recent $0.43 trading range.

Final thoughts

I like stocks with end games. I love the prospect of a resource hungry predator swooping in and devouring my company, offering a superior exit point for my shares.

Clearly, the lithium market is on the cusp of outgrowing supply. The two stocks featured above are, in my view, classic buy and hold candidates. “Be right – sit tight” might be the best advice I can offer here.

END

~ ~ Dirk Diggler

Feature image courtesy of FactsLegend.

Full disclosure: Cypress and E3 are Equity.Guru marketing clients. We own their stock.