Cryptocurrency is a hard sell for most people.

The average person isn’t interested in things like censorship resistance, immutability, security, peer-to-peer services and other things that get blockchain enthusiasts off. Instead, Joe or Jane Citizen is interested in set-it-and-forget-it solutions so they can get back to living their best lives.

These people are either shocked to learn that the NSA uses their social media outlets to spy on them, or they naïvely don’t care, because they reason that they have nothing to hide.

This is your boomer mom who doesn’t see the value in Bitcoin.

She’s been turned off by all that talk of hash-rates and ASIC rigs and the various Bitcoins and altcoins and strange and abstruse nomenclature rattling around on those websites her millennial son spends all his time reading.

Maybe she read or watched something on the news about the Dread Pirate Roberts and how he funded his illegal empire using some untraceable cyber-currency straight out of a William Gibson novel, and it’s all too confusing and shady for her.

But if crypto is ever going to get mainstream acceptance then she’s the one it will need to win over, because women account for 70-80% of all consumer purchases, according to Forbes.

In order to win the hearts and minds of the largest consumer demographic, cryptocurrencies need an image upgrade. They will need to be demystified and made more user friendly, which is to say less shady, or at least get attached to a shady company that’s already acquired mainstream acceptance.

Maybe something like:

By the way, Facebook (FB.Q) is looking to launch its own cryptocurrency in 2020, under the Orwellian sounding name Globalcoin.

Think about that for a second. Does it fill you with existential terror? It should.

The pricetag on participation in advanced capitalism is your privacy, and this will make it so much worse.

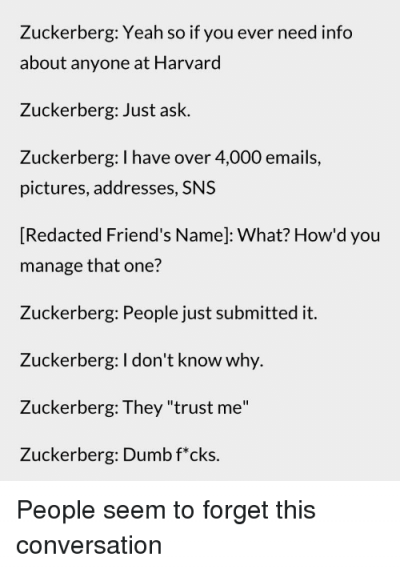

Here’s a friendly reminder of who we’re dealing with:

For years Zuckerberg preached the value of sharing more information, touting the idealistic notion of the creation of a world that would be more open and connected. And then centred his entire business model around bundling our information and selling it to advertisers.

That’s pretty benign compared to what else he’s been doing.

We’re only going to focus on the more recent events, but the history of Facebook is a history of violations of privacy, including everything from unethical, non-consensual experiments on thousands of facebook users to interference in the political process.

Like the time they got in bed with the data firm Strategic Communication Laboratories (SCL) and its subsidiary Cambridge Analytica, which provided the Donald Trump presidential campaign with digital voter outreach services and targeted political advertising.

The only reason Facebook suspended them was to get out in front of a story broken the next day by the New York Times and the Observer of London, which revealed that Cambridge Analytica had acquired data from 50 million American Facebook users using a third-party app to which they were attached.

But Zuck apologized as if that could make everything all better.

Except it did. Sort of. Especially if you consider that facebook still adds an average of 500,000 new users every day with six new profiles every second.

The takeaway from all of this is that the average person doesn’t give a shit about their privacy, and therefore there’s no bottom-line incentive for Zuckerberg to change his tune as long as his precious ad-revenue is rolling in.

So it behooves us to wonder what kind of bullshit Zuck’s got planned for us this time.

Here’s what we know

First Facebook is planning to peg GlobalCoin’s value to a basket of established currencies, (including the U.S. dollar, the euro and the Japanese yen,) to stabilize the value of the currency.

This is called a stablecoin, and in the short term, it’s not entirely a bad thing.

One of the biggest problems with Bitcoin (and its attendant altcoins) is its volatility. It’s presently trading at CAD$11,400.10, and there’s really no way to predict what it’s going to be worth five minutes from now. That makes it hard to use as a medium of exchange.

Who wants to order a pizza using Bitcoin when a year from now the amount you’ve used could be worth 10 times as much as it is today? A stablecoin fixes that problem.

Here are some more specifications:

- The initial launch will include around a dozen countries and Facebook could begin testing it by the end of the year.

- Facebook is planning a loyalty awards program that pays users fractions of a coin for viewing ads and interacting with content related to online shopping.

- Full currency exchange between Globalcoin and fiat currency.

- Globalcoin as medium for exchange between people, or for items on the internet and other outlets.

“Zuckerberg’s essay is a power grab disguised as an act of contrition. Read it carefully, and it’s impossible to escape the conclusion that if privacy is to be protected in any meaningful way, Facebook must be broken up,” said Konstantin Kakaes, for the MIT Technology Review.

We’re expected to trust that Zuckerberg has our best interests at heart. But trust is distinctively the wrong word to use, because Bitcoin (and cryptocurrency in general) was designed to eliminate the necessity of trust.

In Satoshi Nakamoto’s own words:

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

The upside

Believe it or not, this could be good for Bitcoin.

A Barclays Internet analyst said that the cryptocurrency could contribute up to $19 billion in additional revenue to Facebook by 2021.

Consider this scenario:

Facebook builds out a coin, and gets 20% adoption across its 2.7 billion subscribers. That’s 540 million people. Now if 10% of those people stumble onto Bitcoin during the early zealot phase of adopting a new technology, that spells out a potentially lucrative bounce for Bitcoin and all of its attendant altcoins.

It could even lead to the normalization that cryptocurrency deserves, but it’s still not enough to merit opening up an account and having your privacy (and whatever else) violated.

As part of his apology for the Cambridge Analytica scandal, Zuckerberg offered up this gem:

“We have a responsibility to protect your data, and if we can’t then we don’t deserve to serve you.”

Finally, something we can agree on.

—Joseph Morton