There’s a really important graphic in the investor presentation from the guys behind Stately, who were previously the guys behind HIKU/Tokyo Smoke, and before that were the guys behind DOJA, and before that were the guys who started the premium underwear line, Saxx.

DOJA wasn’t a big play. It was a nice little facility in a nice little city – Kelowna, BC. It was run by a trio of young guys with experience in the wine business, who made some dough in the undies business, and had a notion to do it all over again in cannabis.

Well boy howdy, did they.

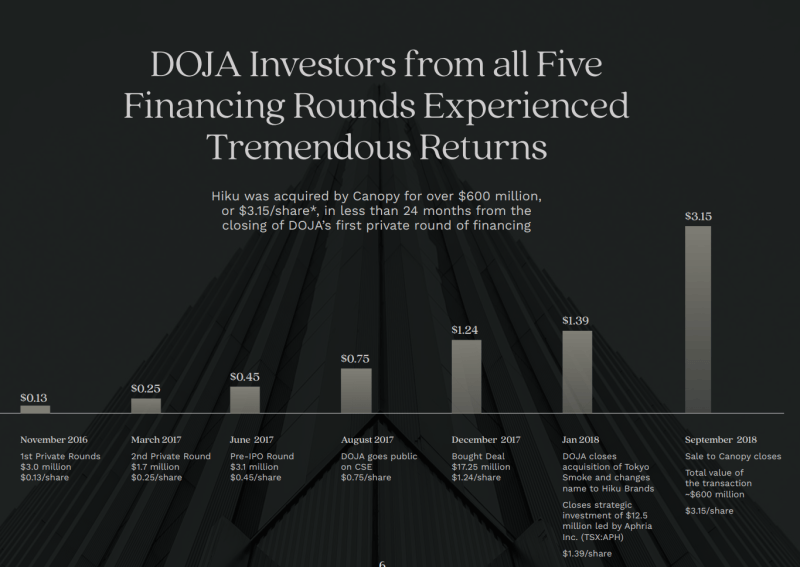

I got in on that $0.45 round in mid 2017. I think I cashed out around $2, because, much as I liked the plucky little branding play, I never saw the big exit coming and revenues were a way off.

DOJA, which would be rebranded as HIKU around the time it swallowed Tokyo Smoke, for a price nobody thought was sensible but which led Canopy Growth Corp (WEED.T) to come after it with a fat offer soon after, was always about branding.

It was a lifestyle brand before it had any actual product to brand, based purely on the Okanagan setting of its origins, the party set that CEO Trent Kitsch surrounded it with, a strong network of locals who had bet on Kitsch’s crew previously and won, and potential… always potential.

Canopy hasn’t exactly had success with the HIKU assets in the time since, and is known to be looking to offload some of what they bought. That’s no actual loss, however, because as much as the Kitsch crew cashed out at 30x their initial seed round, and 6x the $0.50 per share that they famously started personally buying up during a share slump, and 2.5x what the stock was at when it closed the Tokyo smoke acquisition – Canopy benefited from that deal with a premium increase in its own stock price when it came a-huntin’ for the cool kids.

Trent Kitsch is a walking Disney character; a lanky, happy, friendly dude who has time for everyone, and who you don’t mind seeing get stinking rich from his own hard work and hustle because he’s a damn nice guy.

Which is a good thing, because he’s at it again. They’re all at it again. Even the guys who helped raise the initial dough are part of the next venture.

Friends, relatives, enemies: HIKU is getting the band back together.

That’s right, the boys (and Kitsch’s missus, who should not be overlooked because she knows a thing or two about branding, having built the last batch) are back in town.

And what are they doing this time?

Well duh-doy, bois. They’re doing:

But they’re not doing it in Canada.

But they’re not doing it in Canada.

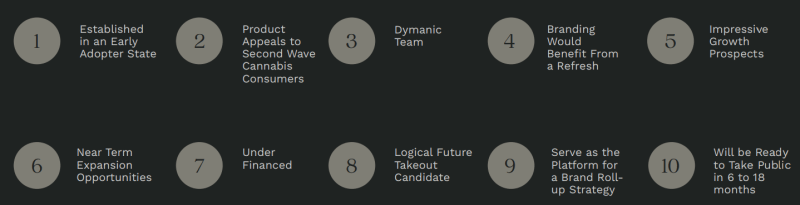

Kitsch has relocated to California to begin the process of finding the golden goose with which they can recreate past glory.

And they’re not looking to jump into the markets now. There’s a six- to 12-month timeline on concluding a deal with an asset, and taking that asset public.

Stately opted to bring in around 500 investors early, with $7 million raised at $0.20 per share, with a minimum order size of $10k. With that money, they’ll close an acquisition and go public in 2019/2020.

I had intended to write this article early enough for you guys to get in on it, but that $7m filled super fast. There will be more chances to climb in, however.

The intent is to find an asset that lends itself to a branding streamline, multi-state penetration, and will accrue in value while the US space nears ‘acquisition time’

NO ASSET? SO WHERE’S THE VALUE?

I hear you yelling at your computer. Yes, they have no asset as of now, other than their people and their knowledge, and the money they’re raised. That’s why it cost participants $0.20 per share.

The expectation is, when they close on an asset, that valuation will look CHEAP, so they opened the doors early to a large number of investors because their intent was to bring you, yes you, into their tent, rather than do the usual ‘Canaccord gets the cheap stuff, retail comes in last’ routine. To be sure, this mob can bring in way more than $7 million right now if they decided that was necessary, and from maybe a dozen investors instead of the 500 they’re looking for. Doing so would certainly mean a lot less stress.

But the idea here was to reward those who partied with HIKU back in the day; not the bigwigs, but the little guys who believed in Kitsch’s team and profited greatly from that faith a time or two already.

They’re not just bringing back the HIKU executives one more time, and the HIKU dealmakers one more time, but also the HIKU investors, who know the pedigree they’re working with and have already bought a ticket to this ride previously.

Full disclosure: I’m in.

I took part in the $7 milion private placement and am making no secret of it, because letting these guys be stewards of my money is a no-brainer.

If Kitsch, Barber and Foreman jumped out of a low flying plane with no parachutes, their fall would be broken by a human pyramid of bikini models that just happened to be practicing underneath the flight path. When they fart, dollar bills spray across the room. When you see a stunt in a car commercial and the fine print at the bottom of the screen says “closed course, do not attempt”, the finer print says “Unless you’re part of the HIKU crew, because those motherfuckers could pull this jump off while sliding into a parallel parking spot.”

You hear a lot of investors saying not to bet on the horse, but the jockey, and this is what they’re talking about. In the mining world, there are some teams that just always create wealth, and betting on their projects always brings a stronger likelihood of returns than going with randoms.

The cannabis industry is too young for their to be many of those go-to groups right now, but the HIKU kids are among the first to line up within it.

No, I’m not going to tell you those founders didn’t get in cheaper than I am; they did. They got their earlier shares for about 1/3 of the financing they just closed.

Last time they got in at $0.13, a 2nd round hit at $0.25, and a third at $0.45 before they went public. Nobody lost if they held to the end and that $3.15 exit.

Will that happen again? Well, they had an asset last time, they don’t here. But they also had less cash last time, and made mistakes that they learned from along the way, and the market was way less mature.

I’m betting on that jockey. They’ll be raising money again soon enough and, when they do, I’ll let you know.

— Chris Parry

FULL DISCLOSURE: I was a shareholder and marketing consultant on HIKU, and am a shareholder on this deal too.

If they’re not a public company, how would your audience be able to participate in a funding round?

>”for you guys to get in on it”

Curious investor

If you’re an accredited investor, private placement financings are open to you. Next time Stately has one, I’ll let you know.

Hi Chris,

What are the credentials needed to be an accredited investor. I would certainly be interested in getting in on this team. I invested early with Doja and like the team very much!

Generally, you need to be earning $200k or more, $300k or more with a spouse, or have access to $1m in liquid capital. Or be friends or family with the CEO.

Personally, I just lied on the forms until I qualified, but would never have qualified if i hadn’t lied on my forms…

” I just lied on the forms” is NOT something we hear every day from the CEO of a news organization. What beautiful fresh air!

Would love to have a chance to get in on the next pp if they have one too

I also would be interested in hearing about the next private placement.

Thanks very much Brad Deware