When we put our hard-earned money to work in the markets, it’s tempting to bypass the whole ‘due diligence’ rigmarole and rely on the advice of “experts.”

Big mistake.

If this comes off as high brow, I apologize. But you need to educate yourself. Read. Take a few investment courses. Find a mentor who has survived a severe bear market or two, and prospered.

Develop market awareness. Learn to trust your own insights, your own instincts. It’s YOUR money, after all.

While I’m on a roll, I might as well lob a warning:

Beware of the resident “experts” on some of the more popular online investment forums, unless you already know and trust the individual. But even then, do not follow their stock picking recommendations blindly. Run your own due diligence, ask the hard questions, and don’t let them off the hook easy.

My mentors taught me to look for the fatal flaw, that one hidden snag that could derail the stock and drive it into the ground.

The folly of following blindly

This chart is a classic example of a stock with a long list of bagholders. It’s a stock that was guarded, defended and pumped relentlessly by resident experts over on a popular online forum.

The only thing these “experts” managed to accomplish was separating folks from their cash as nearly every shareholder who purchased this stock over the past 12 months is under H2O.

A couple of general rules to follow where geology and online forums are concerned:

Ignore pumpers, the riff-raff who won’t shut the fuck up about a stock they own. Their unbridled enthusiasm often betrays one or all of three things: 1) their ignorance 2) their lack of objectivity 3) their duplicitous intent. 2nd raters, the lot of em.

Seek advice from smart geo-types with solid backgrounds and good track records. The good ones will talk openly about their mistakes, their failures (no one gets it right every time, except the lying POS riff-raff).

Conversely, regard naysayers – you know, those loud and obnoxious bashers who condemn everyone and everything around them – with a healthy dose of skepticism. They pretend to be looking out for your best interests. More often than not, they have hidden agendas.

Bottom line: don’t trust any of these online experts, particularly those who hide behind a handle.

Rant over…

A candidate for your due diligence short list:

Max Resource Corp. (MXR.V)

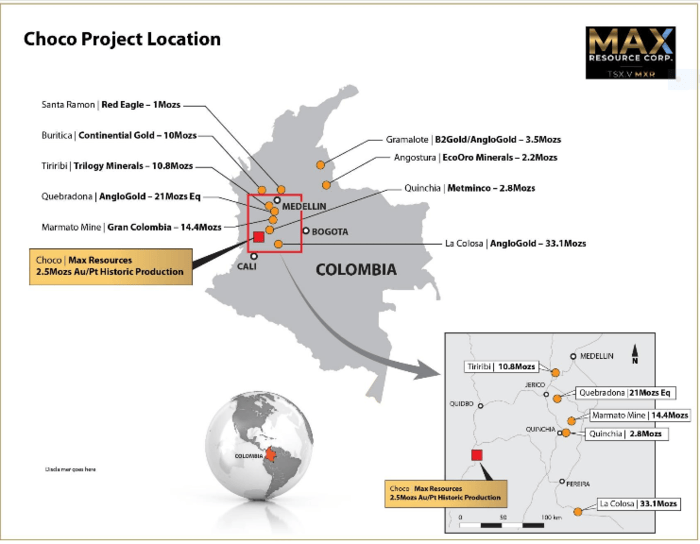

MAX’s flagship Choco project is located on a prolific gold belt in Colombia, roughly 100 kilometers southwest of the city of Medellin.

Via a series of transactions with Noble Metals Ltd, MAX controls 2,807 square kilometers of prospective gold-bearing terra firma.

This is a colossal land package.

MAX’s price of admission for all of this exposure: a cheque for $500K, the issuance of 26.6 million shares, and granting Noble “control person” status along with their 29.2% interest.

I’d be remiss in not stating that this deal was brought about by Noble’s William Hayden, who along with one Robert Friedland, brought Ivanhoe Mines (IVN.T) into this world. Hayden’s extensive involvement in Colombia – decades worth – led him to the Choco region.

A meeting between Brett Matich (MAX president and CEO) and Bill Hayden in 2018 led to the inking of the Choco deal we’re looking at today.

The Choco region

Roughly 1.5 million ounces of gold and 1.0 million ounces of platinum were produced at Choco between 1906 to 1990 at an average depth of 8 meters or less.

For history buffs, historic gold and platinum production at Choco date back as far back as the 1600s when the conquistadors were on a rock kicking rampage up Colombia way.

This is elephant country. Deposits along this belt include:

- La Colosa – 33.1 million ounces of gold (Au)

- Quebradona – 21 million ounces of Au

- Marmato Mine – 14.4 millin ounces of Au

- Tiriribi – 10.8 million ounces of Au

- Buritica – 10 million ounces of Au

Okay, but why MAX?

Good question. MAX’s Choco project is what’s called a conglomerate play.

Choco is all about scale, and the potential for a substantial mineral endowment.

The word conglomerate should trigger the OMG (oh MINE gosh) synapses in your cerebral matter. THE largest gold producing region on the planet – the Witwatersrand Basin in South Africa – is a conglomerate setting.

Indulge me here for a bit – you need to know this:

Witwatersrand has produced some 2 billion ounces of gold in over a century of mining representing roughly 50% of all the gold ever mined on earth.

The Witwatersrand Basin was once a shallow sea that formed approximately 3 billion years ago.

Ancient river systems feeding into the basin eroded the higher ground in the region over a period of approx 260 million years depositing layers of quartz-pebble conglomerates, sandstones, and shales. Conglomerate settings are very distinctive and easy to spot.

Need more? A Witwatersrand history and geology lesson:

Is there another Witwatersrand, a Wits II, waiting to be discovered?

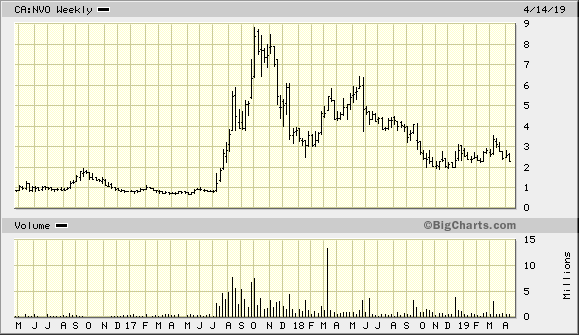

A couple of years back Novo Resources (NVO.V) lit up the junior exploration stage with their Purdy’s Reward/Comet project positioned along Australia’s Pilbara Craton, a possible Wits II.

During the initial excitement, Novo’s share price locked in multi-bagger gains tagging a market cap well north of $1.0B.

Personal note: I bear the emotional scars of having held a large quantity of Novo common in early 2017 only to dump the entire position two weeks before liftoff.

What’s the old adage? Be right, sit tight?

Keep in mind that Novo’s dizzying flight path took place during a rough patch for resource stocks. The vast majority of junior exploration companies – ExplorerCo’s – were doing the square root of dick (price wise).

A well-chosen ExplorerCo can emerge from the ruins, ignore the prevailing negative sentiment and, without any help from the gold price, go on to become a real show stopper.

Grade distribution issues have saddled Novo of late, but the story is far from over. 321Gold‘s Bob Moriarty is an authority on the subject. Searching his archives will give you far greater detail.

Should another Wits-type gold deposit suddenly emerge, say from the portfolio of a South American ExplorerCo, the price trajectory fireworks will likely blow some minds.

Back to MAX and Choco

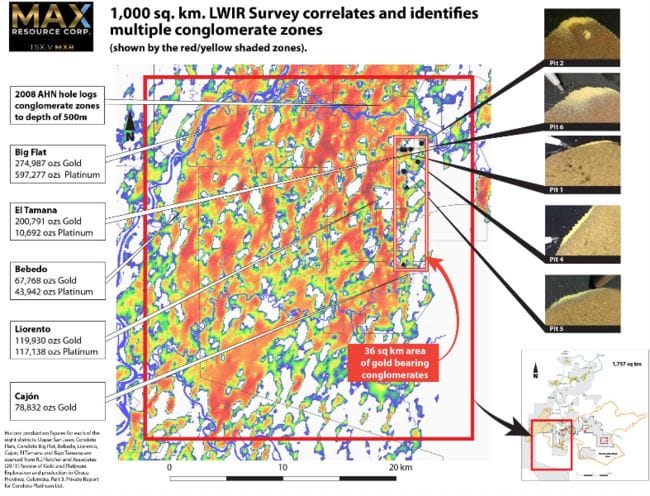

As mentioned further up the page, this colossal land package was host to roughly 1.5 million ounces of gold and 1.0 million ounces of platinum production. MAX’s ground completely encompasses this historically productive terrain. A map further on down the page pinpoints the locations of some of these historic producers.

Choco’s underlying hard rock – the conglomerate – was never exploited. Herein lies the opportunity.

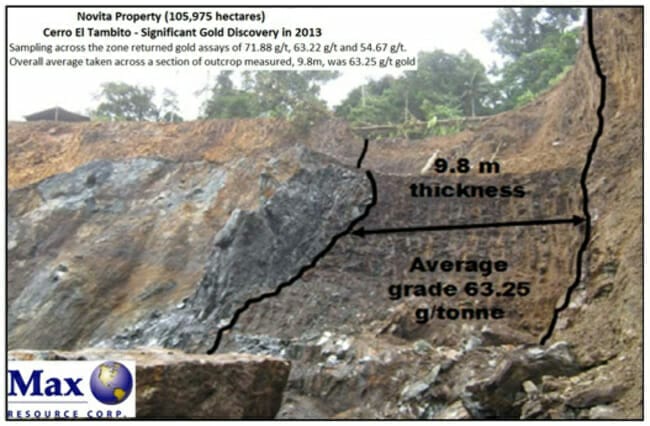

Aside from the historical production and vast areas of exposed conglomerates, a 2013 outcrop discovery (Cerro El Tambito) delivered assays averaging 63.25 g/t Au over 9.8 meters. Not too shabby!

In a conglomerate setting, these outcrops can offer a three-dimensional view of a deposit.

How does one even begin to explore 2,800 square kilometers of prospective terrain?

Smart exploration

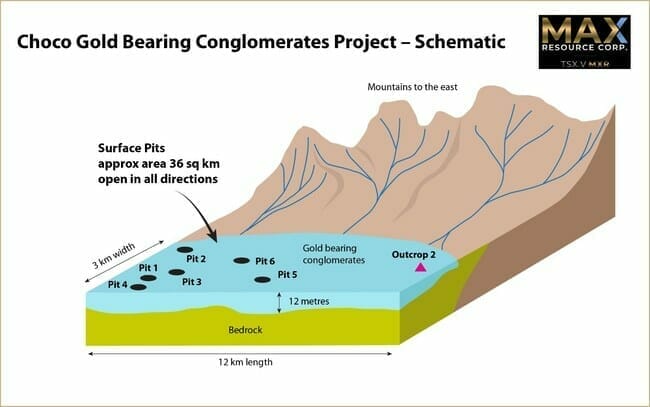

Systematically drilling off a project this size would require huge sums of capital. The smarter, more cost-effective solution – one that can provide invaluable information about a deposits lateral extent, continuity (grade distribution), and metallurgy – is a good old-fashioned bulk sampling program.

Management believes that enrichment at surface is indicative of what lies below.

The gold-bearing conglomerate in these test pits likely represents the face of an orebody where the mineralization continues at depth. This continuity potential is an alluring feature when you consider Choco’s sprawling (lateral) potential.

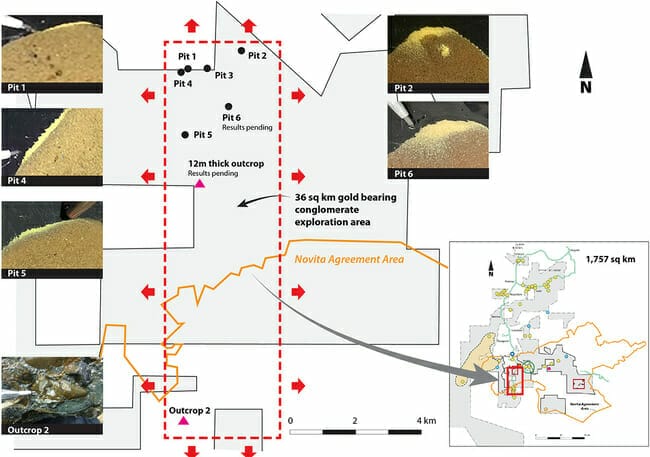

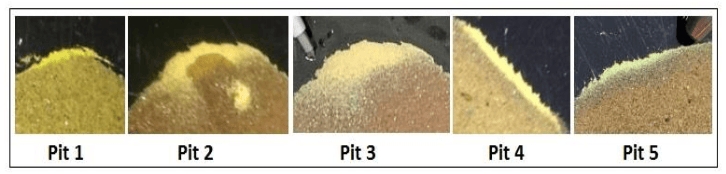

Earlier this year, MAX began a surface sampling program over an 8-square kilometer area excavating test pits measuring 2 meters by 2 meters by .3 meters deep. Of the 2,000 kilograms of conglomerate material extracted, 40 kilograms from each pit was sent away for assaying. A number of outcrop samples were also collected and sent off to the lab.

The company’s area of focus subsequently grew to 36 square kilometers.

What I find intriguing is that MAX launched this bulk sampling campaign without any real science backing it. They simply began outside the perimeter of their exploration camp and pushed outwards. The result?

Remarkably, free gold – gold that is not locked in or combined with other metals – was observed in concentrates from preliminary test samples from each of the 5 test pits.

Note the fineness of this gold. Novo’s gold at Pilbara is nuggety in nature – patchy – making its distribution uneven. Delineating a resource at Pilbara will be extremely challenging owing to this “nugget effect“.

Fine gold, like in the samples above, tends to be more evenly distributed throughout the host rock resulting in a more reliable resource.

MAX encountering free gold in these samples – gold that can be liberated by mere gravity – could lead to compelling economics should the company develop a mining scenario.

As mentioned earlier, a 40-kilogram sample was collected from each pit. The samples were sent off to a lab in Medellin where the conglomerate material was crushed to < 2mm, then gravity-separated to liberate the free gold. Assays from these pit samples are pending.

A rundown of the company’s sampling protocol is outlined in the following news release:

The above news item dropped in mid-February. The delay in releasing these results has ruffled more than a few feathers.

It would be a tremendous understatement to state that these assays are highly anticipated by the market. If you wade through the volumes of posts over on the MXR channel at Tommy Humphreys ceo.ca, past a deluge of protests relating to lab delays and broken promises, you’ll find several individuals with unique insights into to how all of this assaying drama might eventually play out.

Did I mention these test pit assay results are a highly anticipated item?

One ceo.ca regular, a placer miner by trade, reproduced the samples pictured in the above images using fine gold from his own mining operation, then ran the numbers according to his estimates re weight and volume. That’s due diligence at its finest.

Ceo.ca navigation hint: using the filtering mechanism at the top of the page helps cancel out the random noise.

Moving along…

After free gold was discovered in preliminary test samples from each of the five test pits, MAX then went on to throw some science at the project by way of a cloud stitching Long Wave InfraRed (LWIR) geophysical survey covering over 1,000 square kilometers of terrain.

Two things to note on the map below:

- The current 36 square kilometer area of focus relative to the 1000 square kilometer LWIR survey zone .

- The positive correlation, the areas that lit up relative to historic production and recent pit sampling.

According to the Feb. 27th news release:

“This survey sourced multiple bands through the gaps in the clouds over a 20-year period, stitching the imagery together.

LWIR analysis, through proprietary processing of Aster satellite data, has the ability to map or identify, through reflectance spectroscopy against a set of known standards, mineral distribution over extremely large areas covered by vegetation and shallow cover. The ground-penetrating nature of infrared radiation in the long wave bands allows viewing of mineral spectra in the first 30 to 60 centimetres of the earth’s surface through dense vegetation.”

CEO Matich:

The LWIR has yielded responses throughout the 1000 sq. km survey area similar to responses over the 36 sq. km area of our concentrated exploration efforts to date. The LWIR survey has also further increased our level of confidence in a possible link between overlying Choco Pacific production and underlying gold-bearing conglomerates.

A more recent news drop

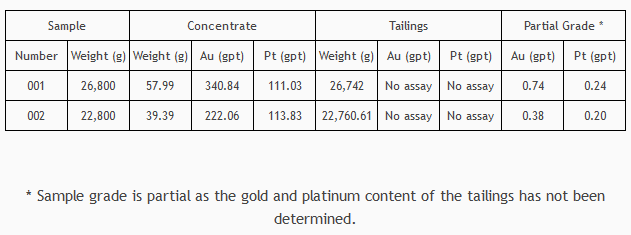

The market was hoping for the long-awaited test pit assays. Instead, what they got was assay results from material collected along surface demonstrating significant values for both gold and platinum.

These samples were taken from the same general area as the conglomerate test pits.

The gold and platinum are characterized as “coarse” when compared to the fine gold in the conglomerate.

Regarding the eagerly anticipated conglomerate test pit assays, this news release went on to state, very simply:

Test work is on-going on the conglomerate samples, with analytical procedure focused on optimal recovery of the fine gold.

CEO Matich:

“The assay results from Samples 001 and 002 are impressive and confirm the presence of noteworthy amounts of gold and platinum on our Choco project. We continue to enhance our analytical procedures to ensure optimal recovery of fine gold samples, and we look forward to continuing our exploration program within the 1,000 sq. km exploration zone and will now expand to the north.”

Platinum, right at surface?

South Africa currently produces 75% of the world’s platinum. Having been in production for decades, many of these SA mines are waaay deep, are waaaay expensive to run (deeper is costlier), and are getting waaaay extended in their life cycles. Choco, once ranked the world’s largest platinum producing region back in the 1920s, may have a very significant untapped resource sitting right at surface.

If you research the subject of surface platinum, you’ll discover just how rare this occurrence is. It’s waaay rare (sorry, couldn’t resist).

Regarding jurisdictional risk

Anyone thinking about positioning themselves in a Colombian exploration play needs to examine the risks.

Is there jurisdictional risk here? According to the Fraser Institute’s most recent annual survey of mining companies, a survey that ranks countries based on their ‘investment attractiveness’ on a scale of 0 to 100, Colombia ranked 62.58.

This number represents a marked improvement over its 2017 ranking of 56.10. For perspective, mining nirvana Nevada is ranked 92.99 while gut-wrenching-train-wreck Venezuela is ranked a 27.69.

On the pro side of the ledger:

Recently elected Iván Duque Márquez appears to be pro-mining and wants to open up his country to foreign investment.

It’s hoped that a new tax bill, one that includes a cut to corporate taxes, will attract more foreign investment giving exploration companies greater incentive to mobilize drill rigs to some of the country’s juicier regions.

Colombian mining group says tax bill will attract foreign investment

On the con side of the ledger:

In 2018, an attack on an exploration camp run by Continental Gold left three geologists dead and several others injured. The attack was blamed on a dissident group of ex-FARC members, a guerrilla movement that operated from 1964 until 2017.

This horrifying act of aggression caught media attention around the globe. The questions you need to ask yourself:

- Was this an isolated terrorist attack?

- Does the Colombian army have a handle on the problem – have they secured the area against further violence?

- Is MAX’s Choco project, some 190 kilometers to the south of where the violence occurred, in a relatively safer zone?

Ranked 62.5 by the Fraser Institute, Colombia isn’t considered “high risk”, but there is room for improvement.

Final thoughts

The more jaded speculators in the junior exploration arena – those sporting receding hair and gum lines, spare tires, and gimped hip flexors – will likely dismiss the possibility of another Wits-like orebody coming into play at this late stage of our species resource extraction cycle (cue The Matrix soundtrack).

But here’s the thing about the jungles of South America: there are still areas that remain untouched where no human footprints have branded the landscape. Stuff that has laid buried since forever can remain hidden indefinitely until curiosity pulls back the layers and probes the subsurface.

MAX might be onto something at Choco, perhaps something very big.

Going forward, the company plans to sample ground well outside their current area of focus using a variety of exploration tools. Areas to the north, where platinum grades are known to increase, are on MAX’s target list in the coming weeks/months.

With 65.13 million shares outstanding and a current market cap of $16.28M, based on its recent close of $0.25, MAX strikes me as a thought-provoking speculation.

Bring on those test pit assays.

END

~ ~ Dirk Diggler

Feature image courtesy of ProactiveInvestors.

Full disclosure: Equity Guru has no current marketing relationship with Max Resources. The author owns shares.